A review of the Santa Claus market in history: Will it happen again this year?

Reprinted from panewslab

12/18/2024·6MAuthor: Lim Yu Qian

Translation: vernacular blockchain

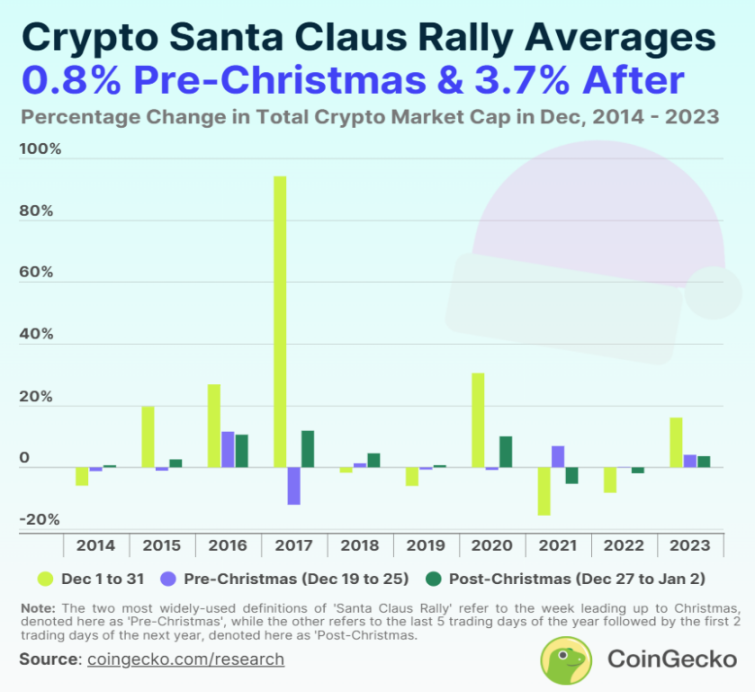

From 2014 to 2023, the crypto market experienced post-Christmas “Santa Claus runs” eight times in 10 years, with the total crypto market capitalization increasing by 0.69 in the week from December 27 to January 2. % to 11.87%. This phenomenon draws on the definition of Yale Hirsch, who is considered to be the originator of the term "Santa Claus Quote", which originally refers to the market performance of the last five trading days of each year and the first two trading days of the following year.

On the other hand, the number of “Santa Claus runs” in the crypto market during the week before Christmas is less frequent, having only occurred five times in the past 10 years. Similar to post-Christmas moves, these pre-Christmas gains ranged from 0.15% to 11.56%.

1. How does the “Santa Claus Quote” perform in the crypto market?

Among the years without a “Santa Claus market”, the crypto market experienced the largest correction before Christmas in 2017, falling by 12.12%. This drop was the result of the price collapse following the ICO craze that year. In addition, the crypto market correction before Christmas was smaller, only between 0.74% and 1.25%. Meanwhile, post-Christmas market corrections in 2021 and 2022 are 5.30% and 1.90% respectively.

It is worth noting that only three of the past 10 years have seen a “Santa Claus market” in the crypto market around Christmas. These three years are:

- In 2016, the total market value of the crypto market increased by 11.56% before Christmas and by 10.56% after Christmas;

- In 2018, although the market was in adjustment throughout the year, modest gains of 1.31% and 4.53% were recorded before and after Christmas;

- In 2023, in the context of bear market recovery, the crypto market rose by 4.05% before Christmas and by 3.64% after Christmas.

In contrast, the performance of the total crypto market capitalization throughout December was more extreme. In five of the past 10 years, the overall December market has grown by 16.08% to 94.19%. In the case of another 5-year correction, the market decline in December ranged from 1.73% to 15.56%.

Generally speaking, the "Santa Claus market" in the crypto market is not a stable phenomenon, and its performance varies significantly and is difficult to predict.

2. Will Bitcoin rise during Christmas?

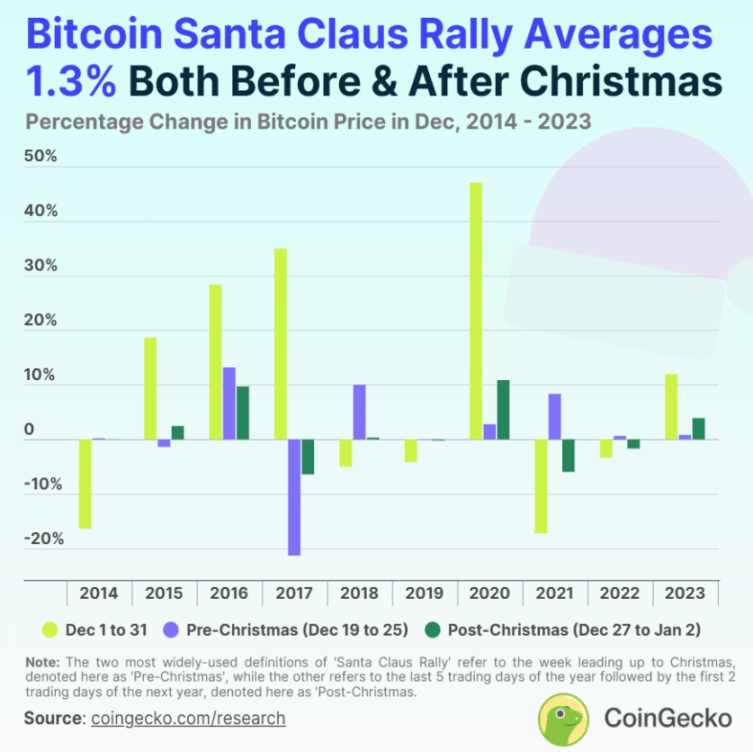

Over the past 10 years, Bitcoin has experienced a “Santa Claus run” seven times in the week before Christmas and five times in the week after Christmas. Specifically, Bitcoin’s pre-Christmas gains ranged from 0.20% to 13.19%, while post-Christmas gains ranged from 0.33% to 10.86%. This is consistent with the broader crypto market “Santa Claus” performance.

Bitcoin’s biggest “Santa Claus run” occurred in the week before Christmas in 2016, when the price of Bitcoin rose by 13.19% and broke through the $1,000 mark.

Bitcoin's biggest decline occurred in 2017, not the "Santa Claus market." At that time, Bitcoin prices fell by 21.30% before Christmas. In addition, Bitcoin also experienced smaller declines before Christmas in 2015 and 2019, of 1.37% and 0.11% respectively. After Christmas, Bitcoin’s price fell between -0.04% and -6.42%.

In other words, if a speculator participated in Bitcoin's "Santa Claus run" every year from 2014 to 2023, buying and selling in the week before Christmas, his average return would be 1.32%; and after Christmas Performing the same operation for a week, the average return is 1.29%. In contrast, if speculators chose to participate in Bitcoin price fluctuations throughout December, their average return would be 9.48%, which is at least 7 times the "Santa Claus market" return.

However, similar to the “Santa Claus run” in the crypto market, Bitcoin’s “Santa Claus run” effect also exhibits inconsistent characteristics.

3. The “Santa Claus Effect” in the crypto market over the past 10 years

The following is the “Santa Claus Effect” data based on the daily percentage change in the total market capitalization of the crypto market:

Bitcoin’s “Santa Claus Effect” data over the years is based on the daily percentage change in Bitcoin’s price within each specific time period:

4. Summary: Methodology

This study is based on data from CoinGecko and examines the percentage change in the total daily cryptocurrency market capitalization over the past ten years (i.e., December 1, 2014 to January 2, 2024). The research draws on the two most commonly used definitions of the "Santa Claus Effect" or "Santa Claus Quotation" from Investopedia:

Pre-Christmas period: refers to the week before Christmas, that is, December 19th to 25th.

Late Christmas period: refers to the last five trading days of the year plus the first two trading days of the following year.

This research is for illustrative and informational purposes only, not financial advice. Always do your own research and exercise caution before investing in any cryptocurrency or financial asset.

jinse

jinse

chaincatcher

chaincatcher