Aptos person in charge: Stablecoin regulation will become the next catalyst for the crypto industry

Reprinted from jinse

05/16/2025·21DAuthor: Christopher Tepedino, CoinTelegraph; Translated by: Deng Tong, Golden Finance

Ash Pampati, head of the Aptos Foundation ecosystem, said stablecoin regulation is the "next catalyst" for the cryptocurrency industry and could spark unprecedented "institutional investor interest."

In an interview at the Consensus 2025 conference in Toronto, Pampati said, “The world outside the United States […] has already tried [stablecoin]” and added that “the United States […] has come to the door.”

“I’m really thinking about what new use cases might emerge due to the borderless nature of stablecoins and the efficiency of on-board trading on the dollar,” he said. “Why go through so much trouble if you want to send money to friends in Nigeria?”

Stablecoins are often used for cross-border transfers because they are more convenient and cheaper than traditional financial methods such as wire transfers. They are also used to hedge fiat currencies, which in emerging markets can depreciate significantly in a short period of time.

According to a new Fireblocks survey, Latin America is ahead of other regions in the actual use of stablecoins, with 71% of respondents saying they use the technology for cross-border payments. The region contains many developing countries, with half of respondents saying they expect the transaction costs of stablecoins to be lower than traditional financial channels.

“I think institutional investors will show amazing interest…we really should rethink and build the B2B and B2C fintech space with full on-chain channels,” Pampati said.

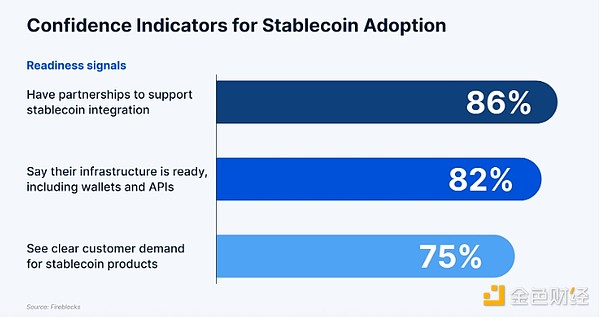

86% of companies are ready to adopt stablecoins

According to a Fireblocks survey, 86% of respondents said their company showed “infrastructure ready.” In other words, their company is ready to adopt stablecoins. Additionally, 75% of respondents said they saw clear demand for stablecoins from customers.

The confidence indicator used by stablecoins. Source: Fireblocks

However, regulation still plays an important role in determining the adoption rate of stablecoins. Surveys show that people 's confidence in stablecoins is rising, not only because of the technology itself, but also because of the lowering of regulatory barriers.

Institutions around the world are seeking to regulate stablecoins. Progress in this regard includes the EU's MiCA regulations, several UAE's bills, and even the GENIUS bill in the United States. The report shows that the bill has regained some bipartisan support after the failed vote on May 8.

chaincatcher

chaincatcher

panewslab

panewslab