Important information last night this morning (May 15-May 16)

Reprinted from panewslab

05/16/2025·21D

According to the Omni Labs announcement, the Omni Foundation announced that it would repurchase 6.77 million OMNI tokens (accounting for 6.77% of the total supply) from early investors at a discount, reducing the investor's holdings from 20.06% to 13.29%. The repurchase funds come from the foundation's $18.1 million seed and A round financing. The repurchased tokens will be transferred to the "community growth" pool, reducing the total holdings of investors, advisers and core contributors from 48.56% to 41.79%. This operation follows the established lock-up clause, refers to the community-first allocation model of projects such as Hyperliquid, and aims to optimize the token distribution structure. The current OMNI market price has a premium over the repurchase price.

According to Cryptoslate, cryptocurrency payment platform CoinPayments has reached a strategic cooperation with global business aviation dealer Jetcraft to provide digital asset payment services for private jet transactions. The cooperation is mainly aimed at the high net worth customer base, supports real-time settlement of multiple cryptocurrencies, and adopts security protocols that comply with anti-money laundering regulations. The CoinPayments payment system will directly connect to Jetcraft financial processes to realize the automatic exchange of fiat currency for cryptocurrencies. Jetcraft Chairman said the cooperation aims to meet the needs of customers in the technology field for innovative payment methods.

Saudi Central Bank discloses holding shares in Strategy and indirectly deploys Bitcoin assets

According to Ash Crypto, the Saudi Central Bank disclosed that it holds shares in Strategy (formerly MicroStrategy) and indirectly deploys Bitcoin assets.

According to Coinpost, Remixpoint, a listed company on the Tokyo Stock Exchange in Japan, announced an additional purchase of 500 million yen (about 32.83 BTC) of Bitcoin, with an average purchase unit price of 15.23 million yen/BTC. As of May 14, the company's total crypto assets held 11.1 billion yen, of which 648.82 BTC (valued at approximately 9.91 billion yen) were held, and mainstream tokens such as ETH, SOL, XRP, and DOGE.

Brazilian listed company Méliuz has purchased $28.4 million worth of Bitcoin

According to The Defiant, Brazilian listed company Méliuz has purchased $28.4 million worth of Bitcoin, becoming Brazil's first Bitcoin finance company. The decision to adopt the Bitcoin financial strategy has received overwhelming majority approval from the company’s shareholders. The move marks a significant progress in Brazilian companies' adoption of cryptocurrencies as financial assets.

Zhao Changpeng: MGX's US$2 billion investment in Binance has nothing to do with TRUMP tokens

Binance founder Zhao Changpeng forwarded a video of Trump being induced to ask questions. The video mentioned that "an UAE company reached a $2 billion transaction with TRUMP cryptocurrency", and Zhao Changpeng said this was a typical example of FUD, and the question was wrong, vague and misleading. He said that if MGX refers to the $2 billion investment in Binance, the transaction is completed with USD1 stablecoin and has nothing to do with the TRUMP token (Meme coin). It is reported that USD1 is a stablecoin launched by WLFI, a Trump son, and Trump, once said USD1 was selected as the official stablecoin invested by MGX in Binance.

U.S. lawmakers to finalize the vote on the stablecoin GENIUS bill on May 19

According to Coingape, U.S. Senate Majority Leader John Thune has officially submitted a motion to end the GENIUS Act, and a vote is scheduled to be held on May 19. This stablecoin regulatory bill requires that issuers with assets exceeding $10 billion are regulated by the Federal Reserve, and small institutions are regulated by the state; all stablecoins must be fully supported by assets such as US dollars or Treasury bonds. The latest bipartisan amendment plans to add three clauses: 1) stricter rules for technology companies to get involved in financial assets; 2) Strengthen consumer protection mechanisms; 3) Strengthen supervision of government officials (including Musk and others). The House of Representatives has previously passed a similar STABLE Act, requiring USDT and other stablecoin issuers to operate completely transparently. If the bill is passed, it will become the first federal legislative framework for stablecoins in the United States. Senate sources revealed that the amendment includes explicit prohibition on the abuse of FDIC insurance and strengthening bankruptcy protection clauses to win cross-party support. The results of this vote will directly affect the regulatory trend of the United States in the field of digital assets.

U.S. court dismisses SEC's settlement motion with Ripple on procedural errors

According to Cryptoslate, U.S. District Judge Analisa Torres dismissed the settlement motion jointly filed by the SEC and Ripple. The motion seeks the court to lift the injunction in the August 2024 judgment and approve the release of $50 million of the $125 million civil fine custody to the SEC, with the remaining funds being returned to Ripple. The judge found that the application did not comply with the procedural requirements set forth in Article 60 of the Federal Rules of Civil Procedure. Ripple's chief legal officer said it would re-submit a settlement application that complies with the rules. Legal experts analyzed that both parties need to explain and explain the reasons in detail according to the Rule 60 standard, including the decision basis for the SEC to abandon other allegations, and it is expected that the complete process will take another 3-5 weeks. The judge emphasized that this rejection is only aimed at procedural defects and does not involve substantive review of the content of the settlement.

According to The Defiant, the Russian Central Bank has named Bitcoin the best performing asset in Russia's financial markets in April 2025, with Bitcoin price rising 11.2% that month. The bank also stressed that Bitcoin has also topped the list year-to-date performance, with a return of 17.6%, surpassing stocks, bonds and gold. Although Bitcoin experienced a 18.6% short-term volatility decline between January and April 2025, Bitcoin has been recognized as the world's best-performing investment product since 2022, with a cumulative return of 121.3%. In the past year, Bitcoin has been recognized by the Russian Central Bank as the most profitable investment product with a return of 38%. Since 2022, Bitcoin’s cumulative return has reached 121.3%, significantly surpassing traditional assets such as gold, stocks and the S&P 500. This recognition comes at a time when institutions' interest in Bitcoin is rising unprecedentedly.

According to Bitcoin Magazine, the latest 13F document of Abu Dhabi sovereign wealth fund Mubadala shows that its BlackRock spot Bitcoin ETF (IBIT) position increased to 8.727 million shares, with a market value of US$408.5 million, an increase of 6% from the end of 2024. This investment coincides with the high-level interaction between the US and Afghan crypto policy. David Sacks, a AI and crypto adviser specially hired by President Trump, discussed opportunities for the integration of digital currency and artificial intelligence with UAE officials on March 20.

According to Bitcoinmagazine, cross-border consumer goods e-commerce group DDC Enterprise announced the launch of its Bitcoin reserve strategy, planning to hold a total of 5,000 BTC in 36 months. In a letter to shareholders, Norma Chu, founder and CEO, said that he would immediately purchase 100 BTC in the first period and set a short-term goal of increasing his holdings to 500 within 6 months. The company has formed a new advisory committee and fund management team with experience in crypto assets to be responsible for the implementation of the strategy. According to the 2024 financial report, DDC's annual revenue reached US$37.4 million, a year-on-year increase of 33%, and its gross profit margin increased to 28.4%. As of March 31, 2025, the company held approximately US$23.6 million in cash and short-term investments. Norma Chu emphasized that the characteristics of Bitcoin as an anti-inflation asset are highly consistent with the company's diversified reserve strategy.

eToro CEO says Buffett convinced him to reduce his focus on cryptocurrencies

According to The Block, eToro CEO Yoni Assia spoke to CNBC on Thursday about the company's listing and its past with cryptocurrencies. He said eToro had early access to cryptocurrencies and had purchased Bitcoin for US$50,000 as the company's treasury. It was the first regulated agency in Europe to launch cryptocurrency transactions. An early $50,000 cryptocurrency investment had added value to $50 million, but the board believes that non-core business requires a sale. Assia believes that cryptocurrencies have become a new type of capital market and are booming around the world. There are more than 130 cryptocurrencies trading outside the United States, but his enthusiasm for the capital market and stock market remains unabated. In fact, the meeting with "Stock God" Buffett changed his business focus. Buffett once said he would never hold cryptocurrency, and his former colleague Charlie Munger also criticized Bitcoin. Assia revealed that at one dinner, Buffett convinced him to focus more on stocks and less on cryptocurrencies. He said 25% of the company's revenue last year came from cryptocurrencies and 75% came from the stock market.

FTX will start allocating over $5 billion to creditors under the bankruptcy plan on May 30

According to The Block, FTX Trading Ltd., the parent company of the bankrupt cryptocurrency exchange FTX, will launch the second phase of the Chapter 11 restructuring plan on May 30, 2025, allocating more than $5 billion to creditors. The FTX bankruptcy management team announced Thursday that convenience and non-convenience creditors that meet pre-allocation requirements will receive their funds from Bitgo or Kraken within one to three working days from that date. Although the bankruptcy management team has "returned" customers at market lows for FTX's previous successful investment in startups such as Anthropic and tokens such as Solana, it has been criticized by some former customers. However, many cryptocurrency traders believe that these allocated funds may be positive for the token price if traders choose to reinvest.

Wisconsin sells BlackRock's Bitcoin ETF worth over $300 million

According to The Block, the latest 13F document disclosed by the Wisconsin Investment Commission shows that the agency has cleared the $321 million BlackRock spot Bitcoin ETF (IBIT). The commission no longer holds any share of IBIT in the fiscal quarter ended at the end of March, the documents show. The investment committee has not completely withdrawn from crypto-related investments, and documents show it still holds about $19 million worth of Coinbase shares. Previously, the institution had cleared its holdings of Grayscale Bitcoin Trust (GBTC). It is worth noting that BlackRock IBIT Fund has just set a record of 20 consecutive days of net inflows, with capital inflows exceeding US$5 billion.

BlackRock's sBUIDL launches "First Direct DeFi Protocol Integration" with Euler on Avalanche

According to The Block, BUIDL, a tokenized Treasury bond fund under BlackRock, announced the launch of "first direct DeFi protocol integration" with the Avalanche agreement with Euler. This cooperation is based on the sToken framework developed by Securities, allowing sBUIDL (combinable ERC-20 tokens for BUIDL) to expand on-chain application scenarios while maintaining redeemability. Through the integrated solution developed by Re7 Labs, users can now borrow sBUIDL as collateral to borrow USDC or AUSD on Euler, and receive AVAX rewards and basic returns from BUIDL funds. BUIDL is currently the world's largest tokenized Treasury bond fund, holding short-term Treasury bonds and repurchase agreements worth about $3 billion.

Sonic Assistant, head of strategy at Sonic Labs, said that the team had officially notified Wintermute 24 hours ago that it would not renew the cooperation agreement and end the five-year exclusive market-making cooperation between the two parties. Sonic will cooperate with new market makers who are more actively involved in DeFi ecology, community construction and team communication. Wintermute then sold about $857,000 S tokens, suspected of returning the previous $16 million loan inventory.

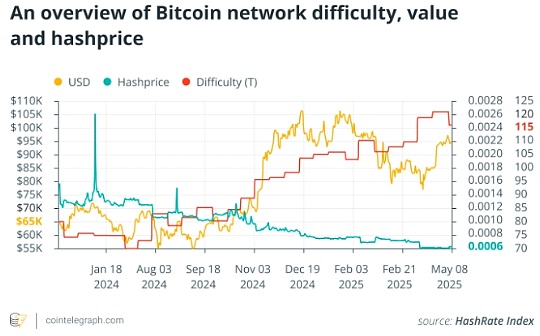

JPMorgan analysts said that as gold weakens and changes in capital flows, Bitcoin may continue to outperform gold in the second half of 2025. The institution pointed out that companies such as MicroStrategy continue to purchase Bitcoin, and many states in the United States have also included it in their strategic reserves. For example, New Hampshire allows up to 5% of its assets to allocate Bitcoin. In addition, the crypto derivatives market is mature and has clear supervision, which has also attracted institutional participation.

0x Acquisition of competitor Flood to expand DEX aggregator market share

According to CoinDesk, decentralized trading infrastructure company 0x announced the acquisition of aggregator rival Flood, its first acquisition since its inception in 2017. The transaction aims to improve transaction efficiency, optimize quotations and compete for market share on Ethereum and Solana with Flood’s self-developed aggregation software and development team. Currently, the total market value of aggregators is approximately US$2.3 billion, and the market competition is fierce.

Movement Labs has been revealed to privately promise consultants to allocate up to 10% tokens

According to CoinDesk, Trump's WLFi-backed cryptocurrency startup Movement Labs was revealed to have promised to allocate up to 10% of the total MOVE tokens to two "shadow advisers" in an undisclosed agreement, involving more than $50 million in profits. Among them, Zebec Protocol CEO Sam Thapaliya was assigned 7.5%, known as the "shadow co-founder", and has threatened to file a lawsuit. Another consultant, Vinit Parekh, was also allocated 2.5% and received high compensation based on the amount of financing. The incident intensified the company's internal strife. One of the founders, Rushi Manche, has been fired, and Coinbase also announced the removal of MOVE tokens.

Binance updates the Alpha points mechanism: valid for 15 days, expired and automatically cancelled

According to Binance announcement, starting from May 13, 2025, a new mechanism for Alpha points will be enabled. Users will need to consume points for participating in Alpha exclusive TGE or airdrop. Points are based on daily asset snapshots and the cumulative purchase volume of Alpha tokens, with an validity period of 15 days, and will be automatically invalidated after expiration. Only the main account and Binance Wallet (Keyless) transaction records are valid. Users can view activities through the "Alpha Events" page and decide whether to use points on their own. Related Reading: Binance Alpha Points Intensify, but the truth is not really good

The number of initial unemployment benefits in the United States to May 10 was 229,000, with an expected 229,000, and the previous value was revised from 228,000 to 229,000. The US PPI annual rate in April was 2.4%, down for the third consecutive month, the lowest since September last year. The monthly PPI rate in April was -0.5%, a new low since April 2020, far lower than the market expectations of 0.2%.

Binance launches BNSOL super staking phase 8 project Solayer (LAYER)

According to Binance announcement, Solayer (LAYER) has become the 8th project of BNSOL Super Stake. From 08:00 on May 16, 2025 to 07:59 on July 17, Beijing time, users who hold or pledge BNSOL and related DeFi assets can receive additional LAYER APR Boost airdrops, with a total of 1.6 million LAYERs distributed daily. LAYER is a hardware-accelerated blockchain based on Solana virtual machines, with a target processing speed of one million TPS. Users need to complete identity authentication through Binance and participate in the designated product.

Binance Wallet will launch the 17th issue of TGE tomorrow: Alaya AI (AGT)

According to Binance Wallet, the 17th issue of the exclusive TGE will be held from 15:00 to 17:00 Beijing time on May 16, 2025, and the Alaya AI (AGT) token will be launched on the PancakeSwap platform. Starting from this issue, users must use Alpha Points to participate. In addition, the official will launch an additional 200 million AGT tokens, details will be announced soon.

According to Tech in Asia, Franklin Templeton has been approved by the Monetary Authority of Singapore (MAS) to launch the Franklin OnChain USD short-term money market fund, Singapore's first tokenized fund for retail investors. The fund issues shares through its blockchain-integrated registered agent platform with a minimum investment of US$20, aiming to improve transparency, security and efficiency. The fund is backed by the Franklin Templeton Investment Variable Capital Corporation (VCC) structure.

jinse

jinse