April Chain Game Report: Daily active users fell to annual lows, and financing amount fell by 69% month-on-month

Reprinted from panewslab

05/17/2025·23DAuthor: Dappradar

Compiled by: Felix, PANews (this article has been deleted and modified)

In April, the development trend of blockchain games was mixed. User activity declined, capital investment slowed down, and market attention turned to AI and real-world assets. But under the surface, real progress is happening: new infrastructure is coming online, large publishers are increasing their investment, and high-quality games are also approaching release.

This report will explore the current trends that shape the development of blockchain games, the quietly achieved results, the changing narratives, and the significance of all this to the future.

Key points:

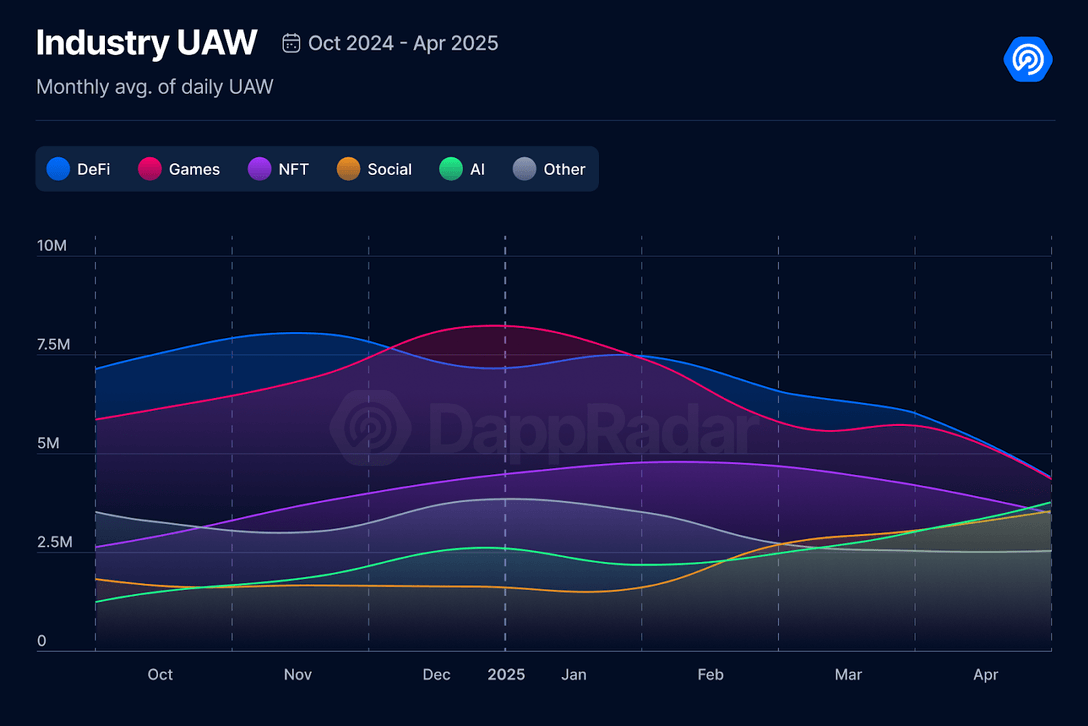

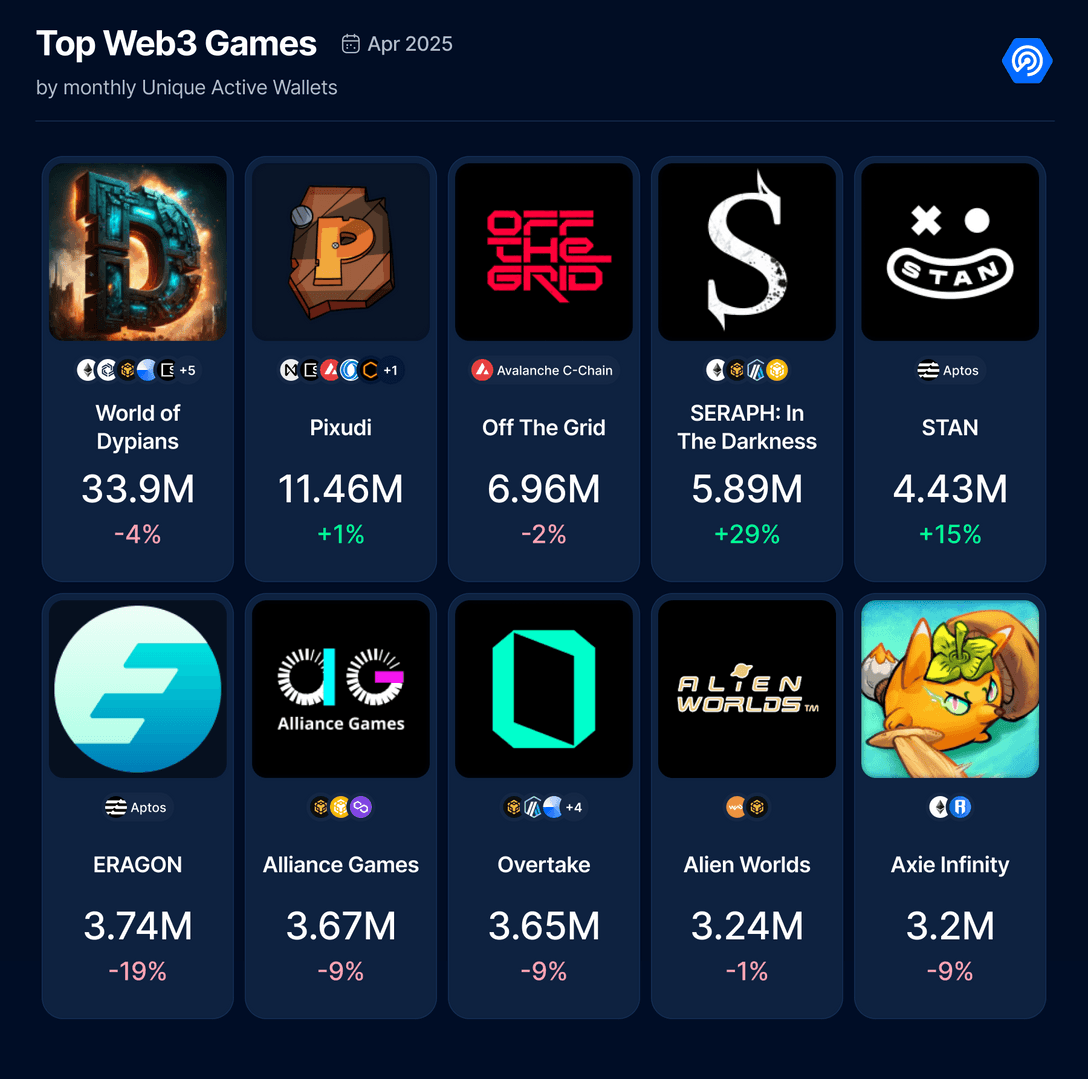

- User activity fell 10% in April, with the number of daily independent active wallets (dUAWs) falling to 4.8 million, the lowest point so far in 2025.

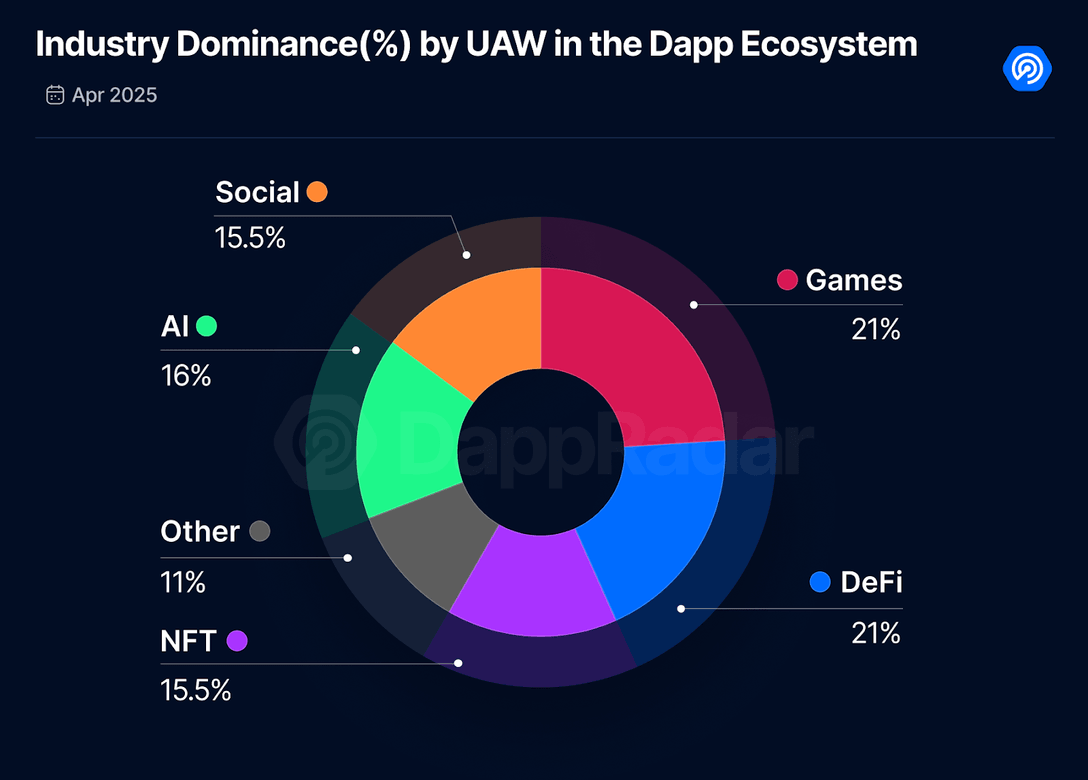

- The dominance of gaming in the dapp industry has also declined, currently on par with DeFi, both at 21%, while AI is on the rise with a market share of 16%.

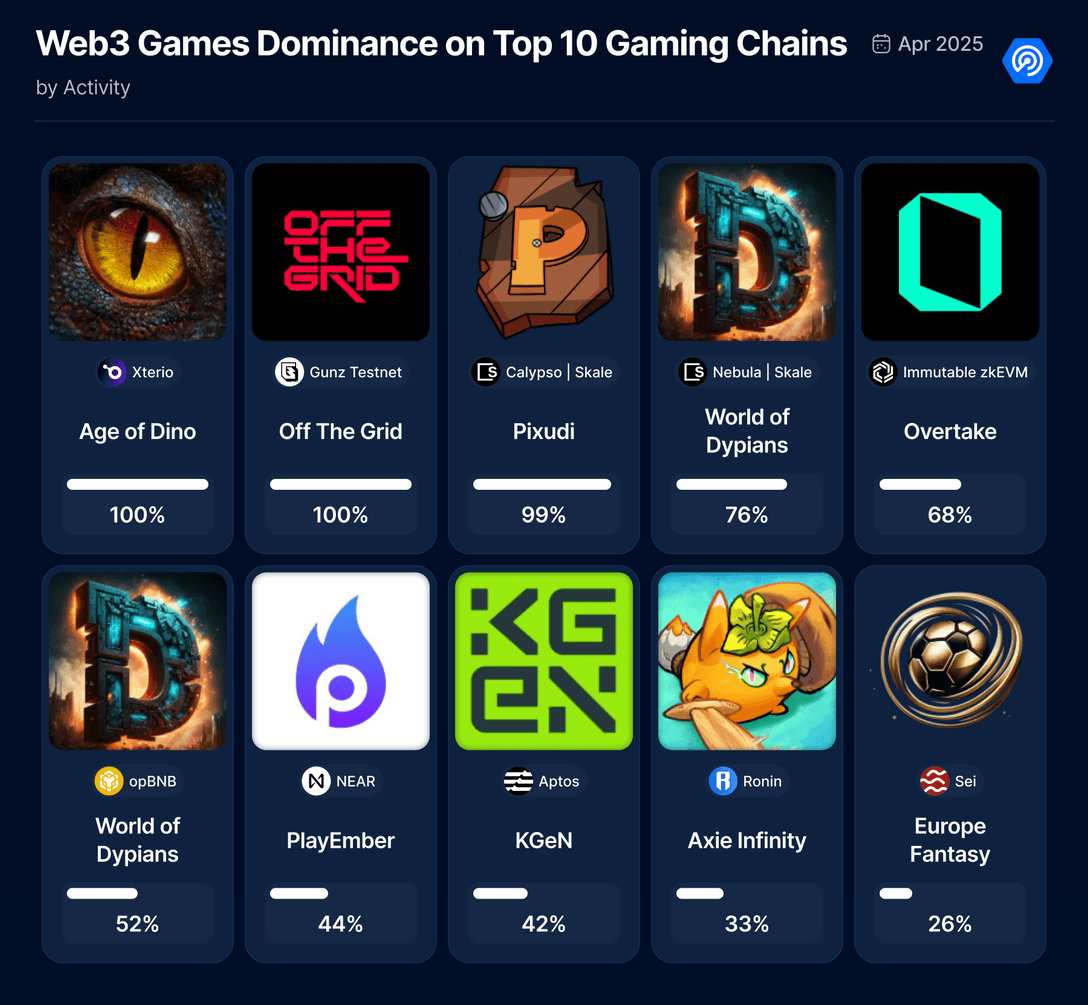

- Key games still dominate the blockchain level: Pixudi accounts for 99% of Calypso, Off The Grid accounts for 100% of GUNZ, and World of Dypians accounts for 76% of Nebula.

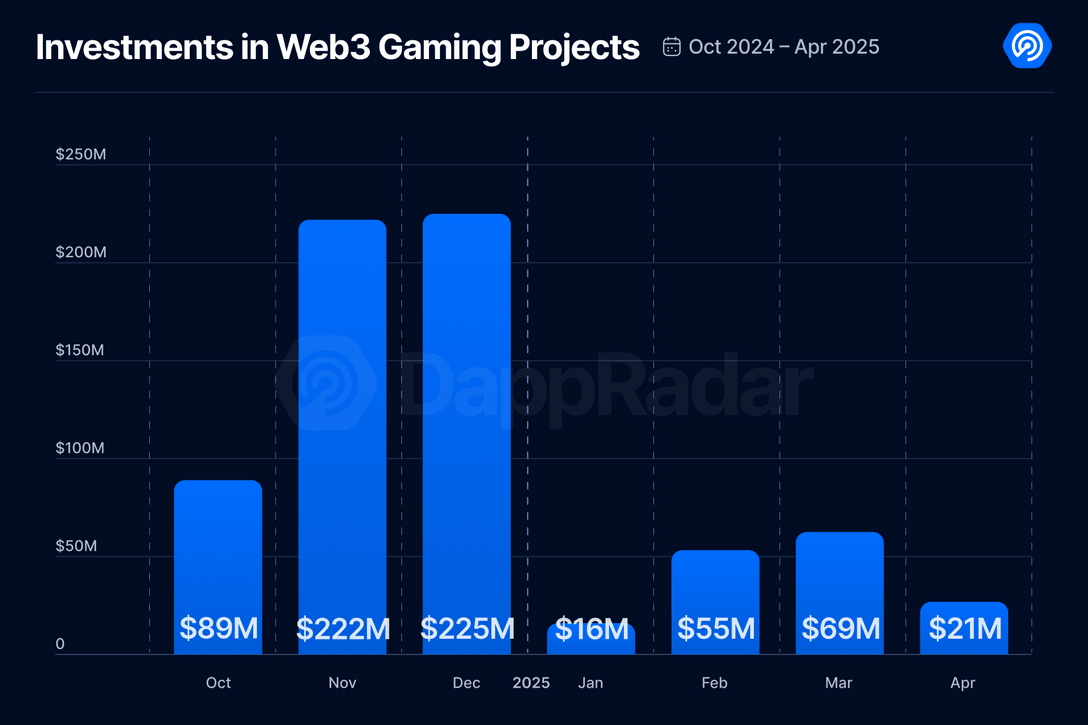

- Despite the poor market environment, the chain game sector still raised US$21 million, down 69% from March.

- Arbitrum Gaming Ventures set aside its first $10 million fund to support projects such as Wildcard, XAI and Proof of Play.

1. Overview

It is safe to say that blockchain games will continue to develop. It remains one of the most promising areas to bring Web3 to the mainstream. But it’s clear that users’ attention is shifting from gaming to real-world assets and AI-powered projects.

The data also confirms this. In April, the number of daily active standalone wallets (dUAWs) for Chain Games was 4.8 million, down 10% from the previous month. The dominance of gaming in the dapp industry is also declining. While it used to be the leading category, DeFi has been back in the spotlight thanks to the memecoin wave. Today, AI is catching up quickly, accounting for 16% of the share, while gaming and DeFi each account for 21%.

But development has not slowed down, the team is still building, and funds continue to flow into this area. It no longer relies so much on the speculative "playing while earning" mechanism, but is driven more by users who are interested in gameplay, asset ownership and community.

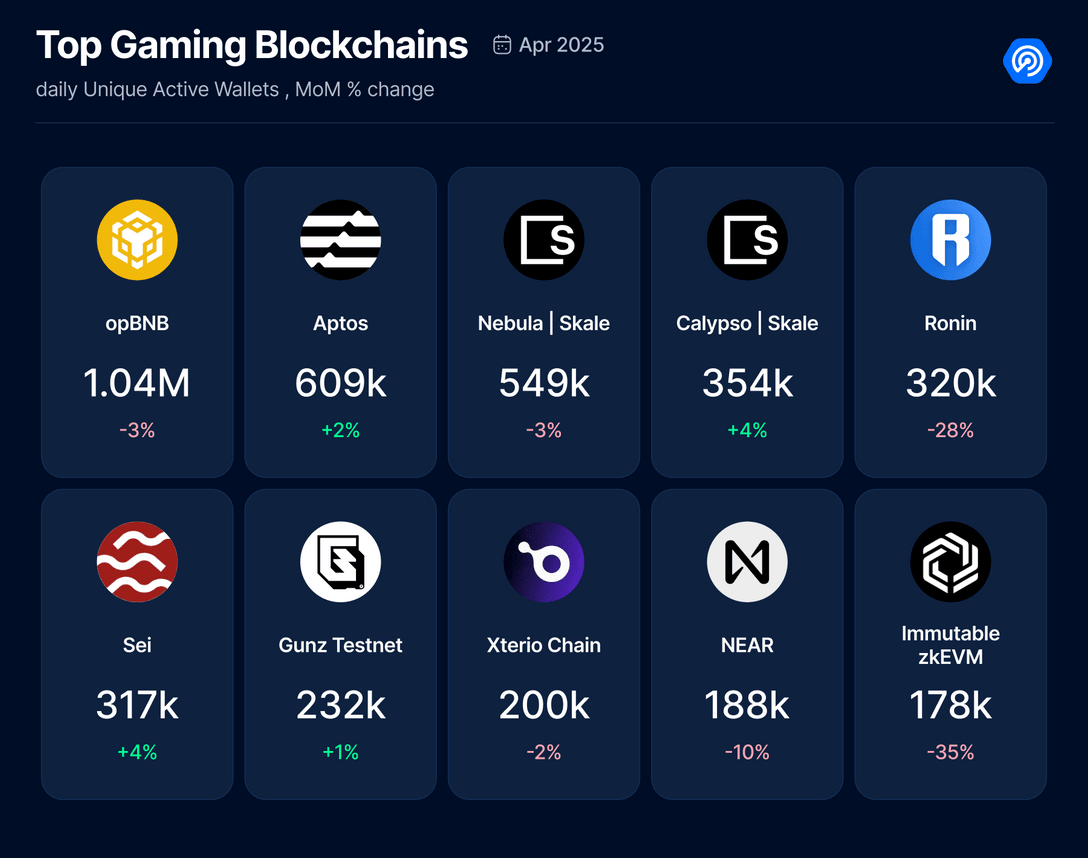

The familiar name dominates the top game chain list, and opBNB is again at the top of the list. In order to dig deeper, we analyzed the activity of game DApps on each chain and found some rules.

- World of Dypians accounts for 52% of activeness on opBNB and up to 76% on Nebula (SKALE).

- On Ronin, although Axie Infinity is the number one game, it accounts for only 33%, indicating that Ronin is actively ridding from the single identity of "Axie Chain".

- Off The Grid is 100% active on the GUNZ test network created specifically for it, and Age of Dino is 100% active on Xterio.

These data reveal a deeper problem: some chains are obviously built around flagship games, while chains like Ronin are evolving into an ecosystem of multiple games. As competition intensifies, it is worth paying attention to which chains can successfully develop into a broader comprehensive gaming center, while which chains are still limited to a single IP.

2. April game leader

Every month, we will focus on the top ten games by activity. There are not many surprises in April, but some of the most active projects are continuing to make progress.

" Off the Grid " ——GUNZ mainnet is now online

Off the Grid (OTG), a cyberpunk-style battle royale game launched by Gunzilla Games, made significant progress in April. Around April 17, the team activated its customized GUNZ blockchain on Avalanche and launched the mainnet node to build the core infrastructure for the in-game economic system.

OTG is still in its early stages of testing, but the launch of its mainnet shows that it is getting closer to full release. It is worth noting that this is the first Web3 game to be played on PS5 and Xbox One Series. Gunzilla's ecosystem model includes node rewards and earnings repurchases through GUN tokens, and there are growing speculations about its possible full release in the next few months.

" Axie Infinity " - The season continues

Axie Infinity attracted players to participate in the Ronin network in April by launching multiple competitions:

- Axie Classic Season 9 (continued until the end of May) – Total Prize Pool 35,000 AXS

- The 13th season preliminaries of Origins start on April 22

- The 12th season playoffs have also ended

Sky Mavis is turning resources to the upcoming massively multiplayer online role-playing game Atia's Legacy. As part of this transformation, the experimental center "Project T" has been closed. Players seem to have a strong interest in this Axie MMO game, with pre-registered users reaching 2.5 million as of mid-March.

" Seraph " - Season 3 officially launched

The dark fantasy action role-playing game Seraph opens its third season on April 27, bringing new dungeons, gear and free season passes. This update also introduces:

- Stall License (Shop run by players)

- On-chain asset income system, convert in-game achievements into token rewards

The focus remains on sustainable P2E mechanisms that reward players' efforts and time, not just token trading

Comprehensive game updates

Star Atlas launches two new PvP modes:

- Gunfighting Game - A Deathmatch Mode that Kills Upgradeable Weapons

- Regional competition - Team-based map control gameplay

The Sandbox continues the five-season Alpha with new UGC games like SABOTAJ and brand experiences like “Jurassic World”. The season will last through May 12 and offers a $1 million bonus pool including SAND, NFT and LAND rewards.

Cambria delayed its second season of The Paymasters, which was scheduled to be launched on April 7, a massively multiplayer online role-playing game (MMORPG) inspired by RuneScape runs on Blast and Ronin, with its "risk-benefit" mode requiring players to collateralize assets for high-return dungeon challenges. Developers promise 24 hours notice before the start of the new season.

Gods Unchained announced a major backend migration: migration from Immutable X to zkEVM, enabling smart contracts and enabling wider interoperability. The Token Bridge is expected to open at the end of May, when players will automatically complete the migration.

3. Ecosystem development and cooperation

April witnessed a series of developments and cooperation in the ecosystem, reflecting that Web3 games have entered a more mature stage. From testing new models for large publishers to opening up chain infrastructure, the field continues to develop in a strategic way.

Traditional publishers in Web3

Mainstream gaming companies are still trying blockchain technology – some of which have achieved even greater success.

Sega officially launched "KAI: Battle of Three Kingdoms", adding NFT and the "play while earning" mechanism to well-known IPs.

Meanwhile, Square Enix announced that it will close the Symbiogenesis project in July 2025 due to poor performance (NFT trading volume was only about 125 ETH and the floor price was nearly zero in April).

Square Enix will still remain in the Web3 realm, but this result shows that simply porting NFTs to the game is not enough. Sega's collaboratively driven strategy contrasts with Square Enix's solo fights, highlighting a key experience: a native Web3 experience is crucial.

In April this year, Ubisoft announced a partnership with Immutable. The two parties will work together to launch the exchange card game "Might & Magic franchise", bringing the "Might and Magic" series into the blockchain field. The game is scheduled to be launched by the end of this year.

Netmarble x Immutable

Netmarble has issued a major ecosystem announcement through its Web3 division, Marblex. The South Korean giant plans to launch seven blockchain games on the Immutable platform in 2025, including Tokyo Beast, a game that combines esports and NFT mechanisms.

Immutable's zkEVM will support these games, and both parties seem to be confident in the cooperation, believing that this cooperation can bring blockchain games to a wider audience. Marblex also replaced its new mascot "Goby" and the slogan "Fun First", which marked its further advance into Web3.

Ronin opens to third-party developers

Ronin was once the stand-alone game chain of Axie Infinity and is now officially open to third-party developers. April's results are remarkable:

- Originally expanded to Ronin on Arbitrum to benefit from a lower fee and a game-first ecosystem

- Realms of Alurya abandons the Treasure ecosystem and migrates to Ronin

- Community Gaming launches forecast market dapp on Ronin (FORKAST)

With more games added, Ronin is moving from an Axie-only chain to a wider ecosystem. However, this also brings some trouble as the developers of "Wonderland: Monster World" have moved their game to another chain and are suspected of defaulting.

Arbitrum and exclusive links

Through its Orbit plan, Arbitrum is enabling custom gaming subnets. An example of the attention gained in April was Studio Chain – built in partnership with the Karrat and Arbitrum Foundation.

The chain's flagship work is My Pet Hooligan, a battle royale game with in-game assets trading over $78 million. Currently, the game is fully migrating its tokens (KARRAT) and gameplay to Studio Chain. This heralds a broader trend: developers are turning to app-specific chains to customize game performance and in-game economy.

4. Investment fell 69% , but " smart "

capital poured into infrastructure

Investment activity in the Chain Games and Metaverse sectors almost stagnated in April, but there are still some reasons for caution optimism. The total amount raised this month was only $21 million, down 69% from March. The macroeconomic situation is not favorable, and the continued uncertainty has affected investor sentiment.

However, despite the low overall figures, previously announced ecosystem funds have begun to achieve results. The most prominent of these is Arbitrum’s $200 million ARB gaming fund, which has officially renamed Arbitrum Gaming Ventures, and announced its first investments in early May after completing its back-end work in April.

The first $10 million in funding was allocated to five projects:

- Wildcard: A Web2 card game from Steam, now turned to Arbitrum;

- Proof of Play: Blockchain service provided by Pirate Nation developers;

- XAI Network: One of the leading gaming Layer-3 chains built on Arbitrum;

- Hyve Labs: a multi-platform game distribution platform;

- T-Rex: Game application chain;

Rather than investing in a brand new independent team, Arbitrum bets on established studios and experienced founders to ensure the growth of the ecosystem.

It is worth noting that as of now, 66% of all funds have been spent on infrastructure construction in 2025. It can be seen that with the continuous entry of traditional game companies and the significant investment in the ecosystem, people's long-term confidence in Web3 games has not weakened, but has become more mature.

Investors are now more focused on sustainable models, player engagement and actual retention rates than just token speculation. This shows that the market is clearly in reset mode. Funds are harder to obtain, but this is not necessarily a bad thing. Some weaker projects are being eliminated and funds are pouring towards developers who lay the foundation for the next generation of blockchain games.

5. May Outlook

May will see major updates, Alpha beta releases and content updates, which may shake the Web3 gaming space.

" MapleStory N "

Nexon's "MapleStory N" was officially launched on May 15, and the game is built on Avalanche's "Henesys" subnet. This is a blockchain game from well-known traditional IPs, with strong early data performance:

- During the test period, the number of wallets registered reached 1 million

- More than 31.5 million transactions have been processed

" Treeverse "

The first season of Treeverse is in progress, with daily tasks and rankings, as well as in-game/NFT rewards.

" Gigaverse "

Gigaverse has launched two features designed to improve player retention and growth:

" Illuvium "

In May, Illuvium: Zero may be officially released. The ILV tokens performed strongly, and the team is pushing for the official release with all their might be announced soon.

6. Summary

April is not a record month for blockchain gaming, but it doesn’t matter, the industry is re-aligning. The speculation boom is cooling down, but developers are not stopping. The game continues to be launched. The ecosystem continues to expand and the infrastructure is becoming more mature.

The decline in user activity (10% drop in dUAW) and lower investment ($21 million raised only) reflect the current risk appetite in the market. But at the same time, it also witnessed the first deployment of the Arbitrum $200 million fund, the new studio joining Immutable, and Ronin opening up to external developers. This is not an explosive growth, but a basic work.

Large publishers are still emerging, but what is really making progress are those who work with the Web3 native team. Furthermore, there has been a clear shift in priorities, from unsustainable token models to gameplay, interoperability and actual user retention.

Related reading: Take a look at the ten web3 games worth paying attention to in May

jinse

jinse