What are the restrictions on the issuance of RWA in Mainland assets in Hong Kong?

Reprinted from panewslab

05/17/2025·23DRecently, Sa Jie's team has received a lot of RWA project consultations, and the underlying assets are also very strange, including those who make agricultural products, those who make real estate, those who make precious metals, and even some pure concept projects that sound very psychedelic...

In fact, the Sa Jie team has made it clear in previous articles that under the premise that my country's September 4 announcement and September 24 notice are still valid, except for the strict review of the Hong Kong Ensemble sandbox and the RWA projects issued under supervision have certain "criminal risk resistance", other types of RWA are very dangerous (especially RWA projects issued to residents in mainland my country).

Therefore, today, the Sajie team will use this article to directly explain which mainland assets can be used in the Hong Kong sandbox and which assets cannot be used, so that partners can conduct business more efficiently and save a consultation fee.

01 Basic knowledge: restrictions and judgment criteria for RWA in

mainland assets

First of all, it is clear that the assets of "body" located in mainland my country and mainly operated by mainland residents can be RWA, and several previous successful RWA projects have proved this.

However, there are indeed restrictions on the issuance of RWA in mainland my country in Shahe, Hong Kong. According to the practical experience of Sajie's team, the following three types of assets cannot be used as RWA:

1. Assets that do not comply with the laws of Hong Kong in our country;

2. Assets that do not comply with the laws of mainland my country;

3. Assets that are not suitable for issuance in Hong Kong at this stage.

Mainland assets issue RWA in Hong Kong must comply with the "dual

compliance principle"

In fact, this logic is easy to understand. The assets are in the mainland, but tokenized assets are actually sold and operated in Hong Kong. The entire financing chain spans the mainland and Hong Kong, so it naturally needs to comply with the "dual compliance principle" - the underlying assets are both compliant in the mainland and in Hong Kong.

1. Hong Kong norms

Given that Hong Kong is mainly responsible for asset tokenization and financial operation in RWA projects, in terms of Hong Kong regulations, we need to pay attention to the requirements of financial supervision-related laws and regulations on underlying assets when issuing financial products, such as the Securities and Futures Ordinance, Banking Ordinance, Insurance Ordinance, and Combat Money Laundering and Terrorist Fund Raising Ordinance.

The Sa Jie team has previously said that at present, Hong Kong, my country has not issued relatively clear normative legal documents in the issuance and supervision of RWA, and is still in the exploration stage. Therefore, the current RWA project still has a "one project, one discussion" situation during the review of sandbox supervision. However, the absence of relatively clear normative legal documents does not mean that everyone has to cross the river by feeling the stones, grasp the consistent regulatory principles of financial assets in Hong Kong, and refer to specific issuance rules similar to financial products, which can greatly improve the success rate.

In principle, Hong Kong has always adopted the "substantive regulatory principle" (or "perspective supervision") for financial assets, which means that whether to comply depends on the essence of the asset rather than the shell. It is not feasible to cover up the illegal core with a compliant appearance. In terms of specific specifications, judgments need to be made based on the regulatory rules applicable to physical assets corresponding to RWA. For example, if the underlying asset is a bond, the audit regulations for the underlying asset are applicable to the Hong Kong Securities and Futures Ordinance and related normative documents.

2. Mainland standards

Because tokenized underlying assets are in the mainland, it is necessary to focus on the legitimacy of the underlying assets themselves and the legitimacy of their operating methods, which needs to be viewed in two aspects.

In terms of the legality of underlying assets themselves, according to my country's Civil Code, relevant judicial interpretations and judicial practice experience, objects can be divided into three types based on whether they can be circulated and what scope they can be circulated as standards:

- Circulation

- Restricted circulation

- Prohibited circulation

Circulating objects refer to objects that are allowed to be freely circulated between civil subjects by law; restricted circulating objects refer to objects that have certain restrictions on the scope and degree of circulation; prohibited circulating objects refer to objects that are expressly prohibited by law from circulation and transfer. According to one person, the Sajie team believes that the items used for RWA should be "circulating objects" or "restricted circulation objects" that flow with permission.

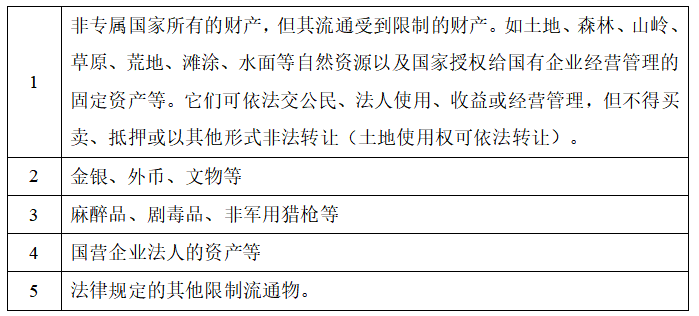

In practice, "restricted circulation" generally includes:

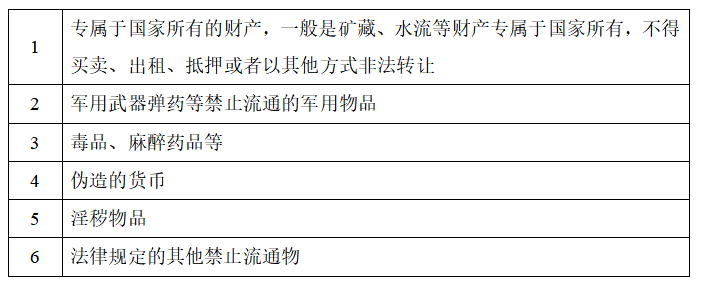

"Prohibited circulating substances" generally include:

In terms of legal operation mode, because Hong Kong in my country has cash flow requirements for the underlying assets of RWA projects (currently all commercial projects with practical application scenarios), the underlying assets also need to comply with the provisions of my country's laws at the operation level: stay away from the red line and obtain administrative licenses required for operation.

Assets that are not suitable for issuance in Hong Kong at this stage

This type of assets itself has complied with the requirements of the "dual compliance principle", but it is not suitable to be issued in Hong Kong at this stage.

On the one hand, the RWA in Hong Kong is still in the sandbox experiment stage. Therefore, the selection of underlying assets is more cautious and it is clearly stated that the recommended underlying assets are assets with "high-tech" and "clean and green" attributes. Therefore, Sa Jie's team believes that if you want to issue RWA projects in Hong Kong at this stage, the underlying assets must account for at least one of the two above-mentioned requirements, such as carbon emission rights, which are not physical but closely linked to the green economy.

On the other hand, some assets that want to revitalize through RWA and cannot generate better cash flow should not be used to do RWA in the Hong Kong sandbox, as the probability of passing is low. For example, no matter how many real estates with low economic value "empower" them through emerging concepts, they cannot change the reality that the market value of the assets themselves is gradually decreasing. The possibility of such assets issuing RWA is very low.

02 These specific mainland assets basically cannot do RWA...

After understanding the principles and standards for judging whether underlying assets can issue RWA, we will conduct a concentrated answer to the assets that have more recent consultations or need to be discussed separately to save everyone's consultation fees.

Jewelry and Arts RWA

Jewelry and Art Circle RWA is a category with a large number of consultations. It is also the most difficult to give clear legal opinions for consulting such RWA projects. This is mainly because there are many varieties of jewelry and art Circle, water depth, and various special restrictions are scattered in laws and regulations, judicial interpretations, administrative regulations, departmental regulations and national standards. If there are extraordinary categories, a large amount of legal identification work is generally required to give opinions. Overall, jewelry and art Circle is not recommended as the underlying asset of RWA at this stage.

If the partners' assets are in the following situations, you can veto it with one vote:

1. Gem products with gambling nature. In layman's terms, it is impossible to judge the quality of the outer surface. It is necessary to cut it to know the internal quality of the raw materials and the raw stones, such as jadeite raw stones, unskinned turquoise raw stones, and pearls without opening clams;

2. Processed jewelry and jade, such as B-grade jade, C-grade jade, etc.;

3. The state prohibits the sale of biological products (organic gemstones), such as ivory, helmet hornbill products, tridacna, queen shells, corals, rhino horns, tortoiseshell, coba resin, sea willow, amber pillow, amber powder, chensand, etc.;

4. Low-quality or treated jade or imitation products, such as sodium feldspar jade, Guatemalan jade, burnt red jade, etc.;

5. Primordial metals such as pure gold and sterling silver have special laws to restrict circulation and prohibit circulation.

Intellectual Property RWA

Intellectual property rights, such as copyright, trademark, patent, etc., have actually appeared in the overseas crypto asset circle, and many film and television projects have even achieved short, flat and fast financing through tokenization. At present, we have not seen successful cases in the Hong Kong RWA project, but the Sa Jie team believes that intellectual property is not an underlying RWA asset that cannot be explored. For specific projects, if the intellectual achievement does have great commercial value, after the regulatory standards are clear, you can boldly try to "pass through the barrier".

RWA

"Can Sunshine Qingti do RWA?" Not long ago, a friend came to consult with the Sa Jie team with RWA promotional materials for a similar grape project in a domestic company. We do not evaluate specific projects, but only look at the RWA projects in agriculture and agricultural products in an abstract way, if the project meets the standards for scientific and technological ethics review, it has high scientific and technological content and scientific research value and has good commercial value. After the regulatory standards are clarified, you can also boldly try to "pass through the barriers".

Pure concept RWA

Friends must figure it out: RWA is not crowdfunding. For such projects, the Sajie team generally gives a direct veto.

03 at the end

One thing to say: For the underlying assets that are neither in the mainland nor in Hong Kong, can we do RWA in Hong Kong? The Sajie team believes that there is currently no provision on where assets must be located to apply for the Hong Kong RWA. From the perspective of Hong Kong's "international financial center", where the underlying assets themselves should not be a condition that hinders RWA. Truthfulness, credibility, compliance, and investment value are the hard indicators.

jinse

jinse

chaincatcher

chaincatcher