Annual report on on-chain users: The number of new users per month reached a maximum of 19.4 million, and the Base chain contributed nearly 70% of the increase

Reprinted from panewslab

12/22/2024·5MAuthor: flipside

Compiled by: Deep Wave TechFlow

1.Introduction

On-chain user trends heading towards 2025

2024 is a turning year for Web3 user growth, with the number of new users and super users on major public chains hitting record highs. Public chains like Base redefine what exponential growth is, while Ethereum and its L2 solutions demonstrate how entrenched ecosystems can adapt to evolving user needs.

However, digging deeper into the data reveals that not all growth is of equal value – highlighting the importance of focusing not just on quantity but also on quality when evaluating on-chain activity.

To this end, this report is based on Flipside’s real-time data on on-chain crypto users in 2024. In addition to traditional performance indicators, it also evaluates this year’s cryptocurrency activity through more actionable multi-variable indicators to assess on-chain users in 2025. Health conditions offer new ways.

Brief summary

Behind the news of user growth lies a deeper challenge: how to build ecosystems that create meaningful, lasting engagement, rather than just fleeting speculation.

In short, most blockchains are still in their infancy when it comes to converting ordinary users into high-value contributors.

Get user status:

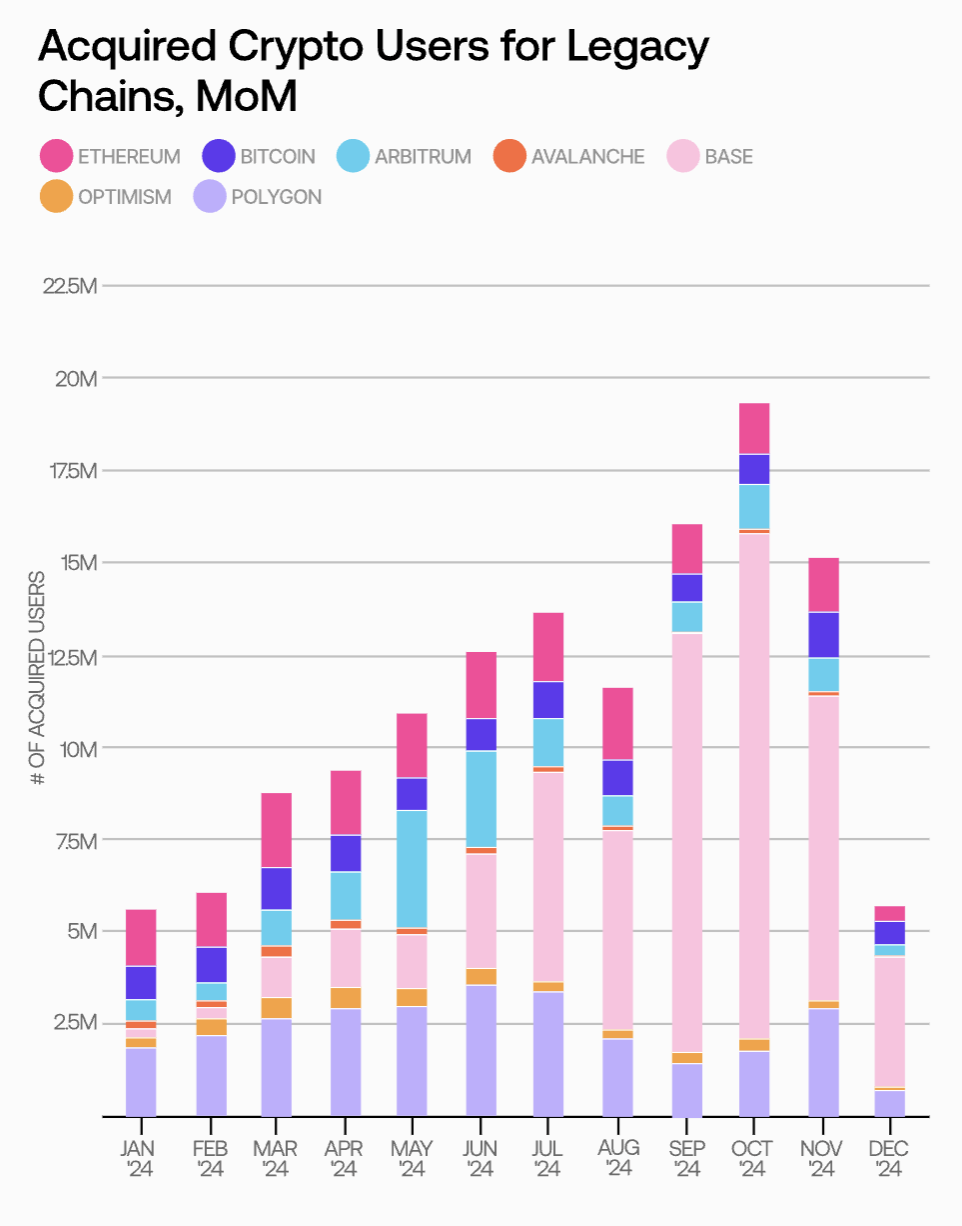

Base: Set a record of 19.4 million newly acquired users in October 2024, of which Base contributed 13.7 million users - almost 8 times that of the second-place Polygon.

BTC: The price of BTC hit an all-time high and exceeded US$100,000. The average number of Bitcoin users increased by only 935,900 per month, indicating widespread speculation among existing users rather than significant new user admissions.

ETH: The average monthly user acquisition reached 1.56 million, surpassing Arbitrum and Optimism. The month-on-month user growth in March reached 33.4%. It is worth noting that Arbitrum hit an outstanding peak of 3.3 million acquired users in a single month in May.

Super user situation:

Base: Attracted 15.1 million wallets that have executed 100+ DeFi transactions, 38.4% more than the second-ranked Ethereum’s 10.7 million super users.

ETH: 10.9 million DeFi-related super users exceed the combined number of Arbitrum and Optimism (6.2 million and 1.8 million respectively), highlighting Ethereum’s advantages in liquidity and convenience.

Polygon: Added 1.5 million new super users in 2024 and recorded 867.7 million super user transactions this year, highlighting its success in applications beyond DeFi.

DEX usage:

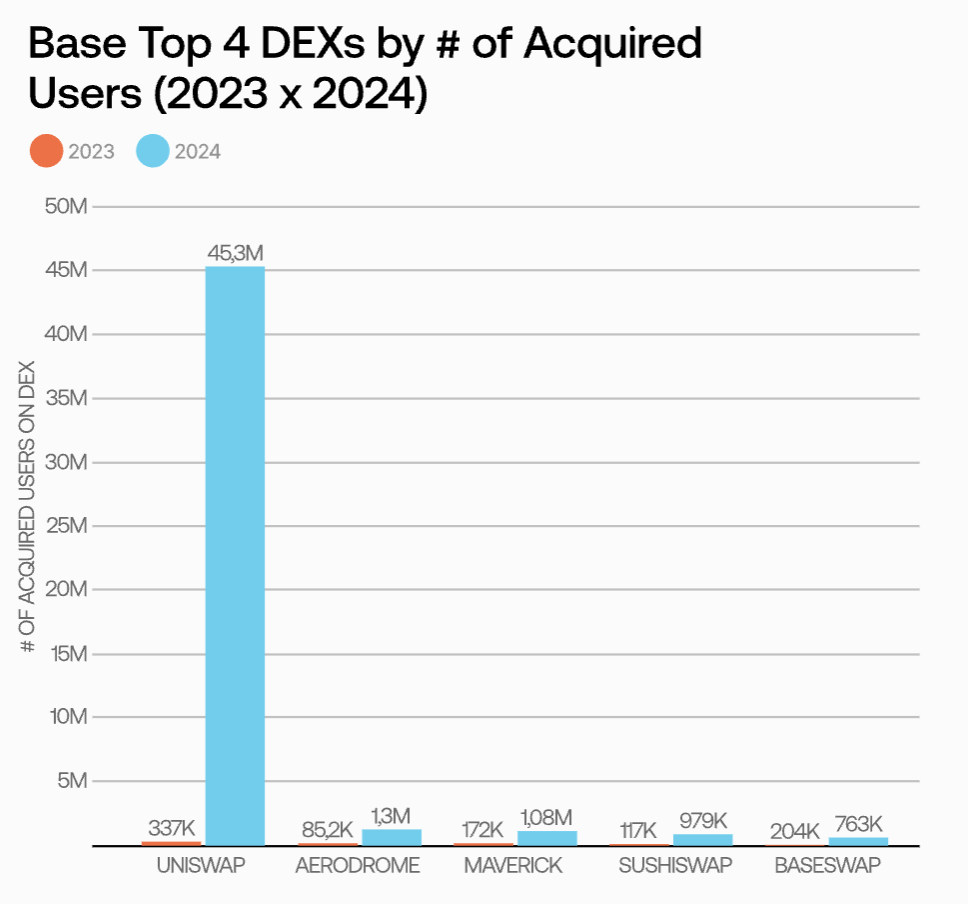

Uniswap: Expanded its dominance on major public chains, accounting for 91.3% of new user DEX activities on Base, and increasing its market share on Ethereum by 27.72% compared to 2023.

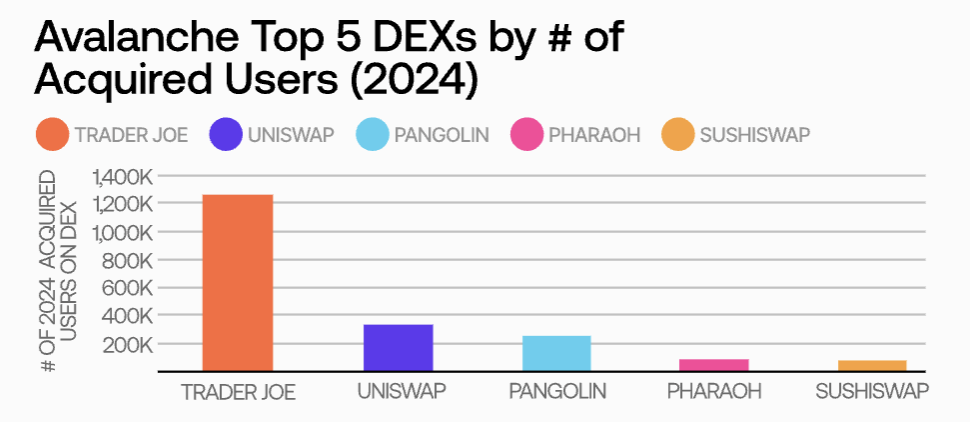

Despite Uniswap's growth, Trader Joe's maintained its lead on Avalanche, with a market share of 61.1%, a 6.1% increase from 2023.

Unlike 2023, in 2024 the top three DEX rankings by acquired users and super users are now consistent across all observed public chains.

2. Acquire new users

The number of newly acquired users reached a monthly peak of 19.4 million in October 2024.

This year's on-chain user growth was led by Base, which contributed 13.7 million newly acquired users in the month - almost 8 times that of second-ranked Polygon. Overall, it’s been an impressive year for the entire on-chain user growth industry. The number of acquired users will maintain a continuous upward trend throughout 2024, with only a slight correction in August.

Note: The definition of "acquired user" is a user who has conducted at least 2 transactions on a certain chain, with the second transaction occurring in 2024.

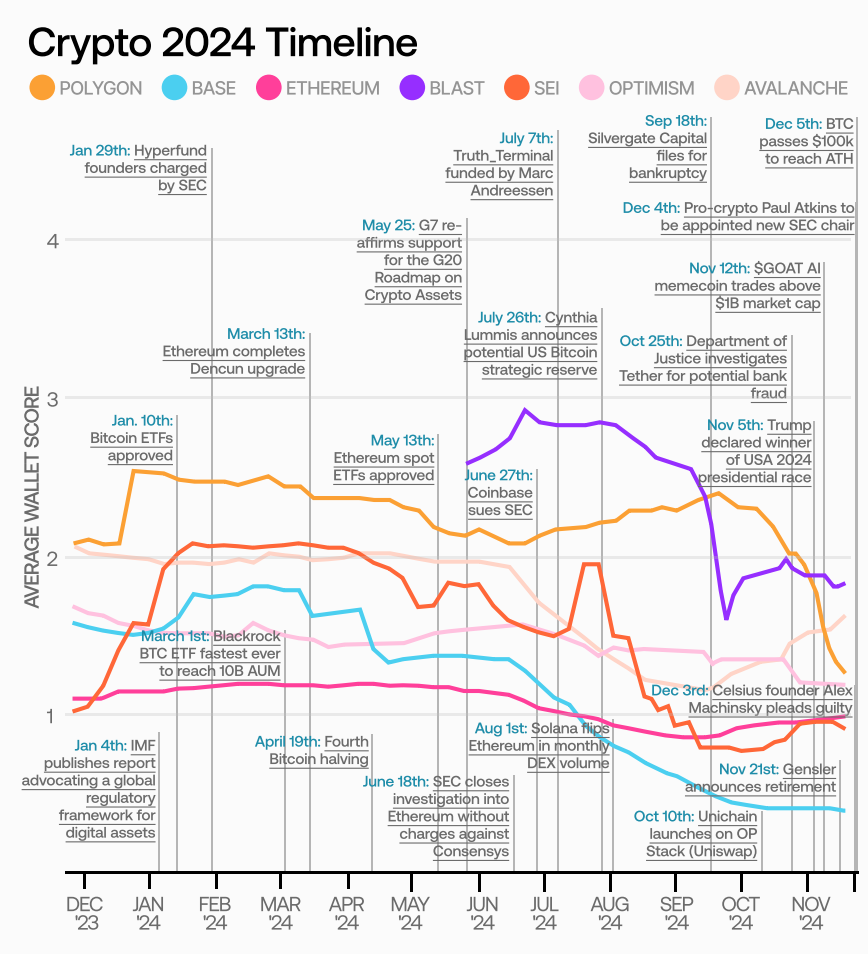

This continued growth may be influenced by increased institutional acceptance of cryptocurrencies, as reflected in the announcement of a series of BTC and ETH ETFs earlier this year.

Other exciting developments in the first half of 2024 may also be fueling this optimism, such as Grayscale’s listing of multiple new cryptocurrencies as “assets under consideration” and the September 2024 Federal Open Market Committee (FOMC) During the meeting, the Federal Reserve cut U.S. interest rates by 50 basis points - the first rate cut in four years.

Base’s incredible growth

Base got off to a slow start in 2024, but its monthly new user acquisitions have exploded 56x since January.

Base only had 244,700 acquired users in January, but experienced steady and significant growth throughout the year. By the time it reached its peak in November, the chain's monthly number of acquired users had increased 56 times compared to January, with an average of 4.7 million new acquired users per month during 2024.

The chain's performance has benefited greatly from Coinbase's large user base, which collectively controls approximately $130 billion in assets. Popular DeFi protocols like Aerodrome may also attract users from other EVM chains, while Base has successfully driven user interest through popular areas such as memecoin trading and on-chain AI (with new initiatives like Based Agents).

Bitcoin performance

Although BTC prices hit all-time highs, it has not attracted a large number of new users this year.

Bitcoin’s new user acquisitions remained relatively flat in 2024, despite significant appreciation in BTC value. Overall, Bitcoin’s average monthly user acquisition growth this year was 935,900, ranking third from the bottom among the seven traditional public chains observed in this report.

This suggests that Bitcoin’s price appreciation is primarily driven by enthusiasm and speculation among its existing user base, while BTC price growth has had mixed results in attracting new users.

In March 2024, BTC's first major price surge coincided with a 19.2% month-on-month increase in user acquisitions, but in November - when BTC reached the long-awaited $100,000 milestone amid ongoing price increases, user acquisitions actually declined month-on-month. 28.5%.

Performance of Ethereum and L2

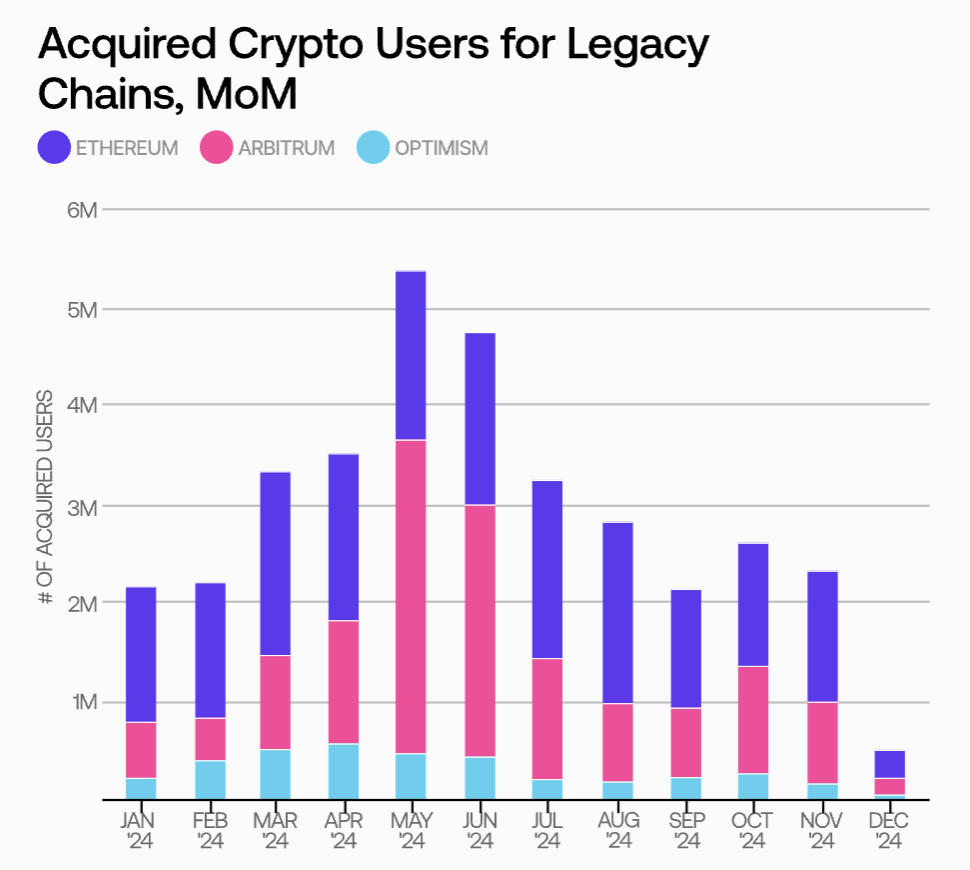

Ethereum is overall outpacing its legacy L2 in user acquisitions, but Arbitrum also saw impressive single-month growth.

Ethereum grew faster than its two leading L2 chains in 2024, acquiring an average of 1.56 million monthly users, compared with 1.2 million for Arbitrum and 348,800 for Optimism. Excluding December, Ethereum had only four months of month-on-month declines, and reached a monthly peak of 1.9 million new users in March - a month-on-month increase of 33.4%.

Both Arbitrum and Optimism started the year with considerable momentum, reaching peak 2024 user acquisition growth in April and May respectively, before user growth declined during the remainder of the year.

However, it is worth noting that Arbitrum’s 3.3 million acquired users in May exceeded any single-month peak for Ethereum in 2024. Against this backdrop, Arbitrum's user acquisition growth continued to outpace Optimism's throughout the year, driven by the success of its Arbitrum One program and the integration expansion of GameFi and SocialFi. With 169 builder grants approved in the first half of 2024, along with many behind-the-scenes developments, it remains to be seen whether the chain can regain its position as the world's leading EVM L2 chain.

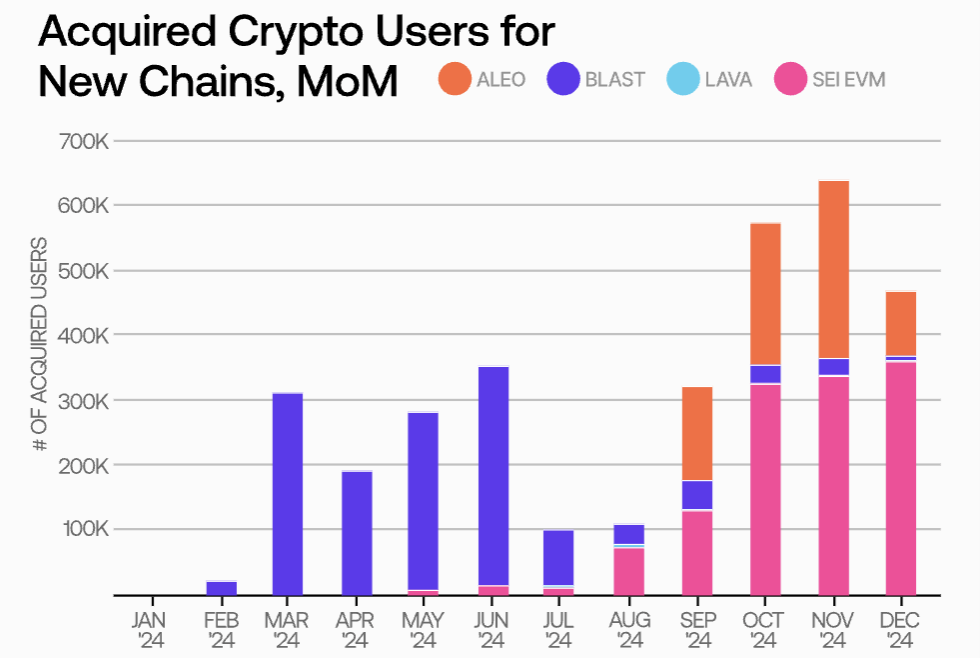

Performance of new public chains in 2024

Among the public chains launched in 2024, Aleo achieved the highest average user acquisition growth, while Blast set a single-month record before fading.

As for the newly launched public chains, Aleo had the highest growth in user acquisition during the month when the chain went online, reaching an average of 175,200 users per month, compared with 134,900 users for Blast and 90,700 users for Aleo. This can be attributed to Blast's sharp decline in user acquisition starting in July, as well as Sei's slow start - although its mainnet was launched several months ago, it did not reach a month-on-month peak of 324,500 users until October.

It's unclear whether these public chains will be able to regain momentum in 2025 - especially considering Base experienced a similar post-launch cooling off before surging in 2024. Among the four new public chains tracked, Lava’s performance has so far been overshadowed by its competitors, and although Blast achieved the highest monthly user acquisition growth among newly launched public chains in June, there is still a lot to catch up with.

3.Super user

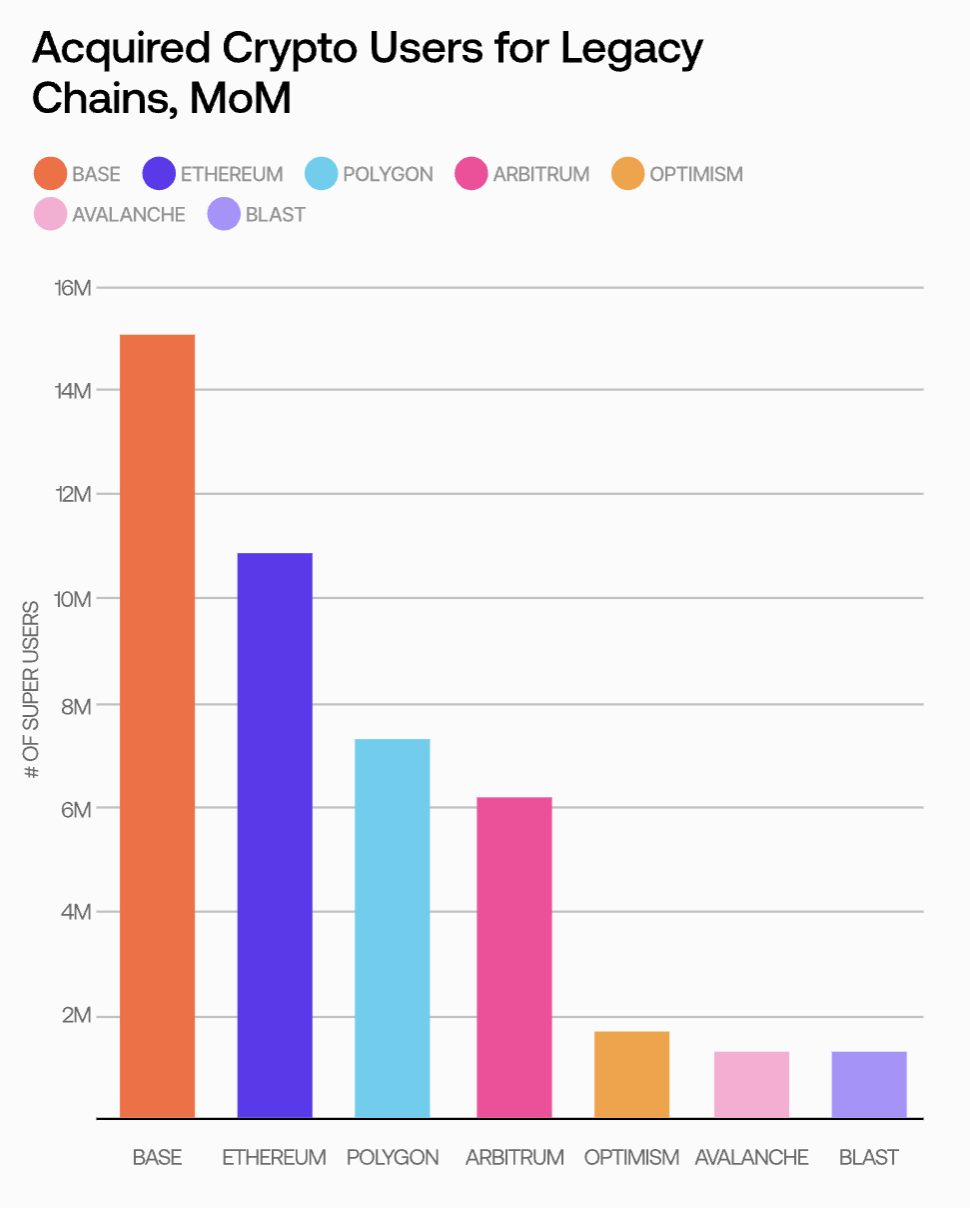

As of December 2024, Base has the largest number of DeFi-related super users, with 15.1 million wallets executing 100 or more transactions.

In addition to acquiring the most new users, Base also attracted the largest number of DeFi-related super users, with 38.4% more users executing 100 or more transactions than second-ranked Ethereum. This is followed by Ethereum with 10.7 million new super users and Polygon with 7 million.

Note: The definition of "super user" is a user who has performed at least 100 transactions on a certain chain, regardless of the creation time of the relevant wallet or the time when the last transaction occurred.

Given Base's explosive growth this year, its impressive number of power users may not come as a surprise. This success is likely due to Base surpassing many traditional public chains in many popular areas this year, including but not limited to meme coins and NFT transactions.

At the other end of the spectrum, Avalanche and Blast have similar numbers of super users this year, averaging around 1.3 million, while Optimism fared slightly better, with 1.7 million users making at least 100 DeFi transactions.

Highlights of Polygon

Polygon added the most new super users this year and continues to stand out in terms of non-DeFi related super user activity.

Polygon has attracted 1.5 million new power users so far in 2024—nearly double the number of second-placed Base.

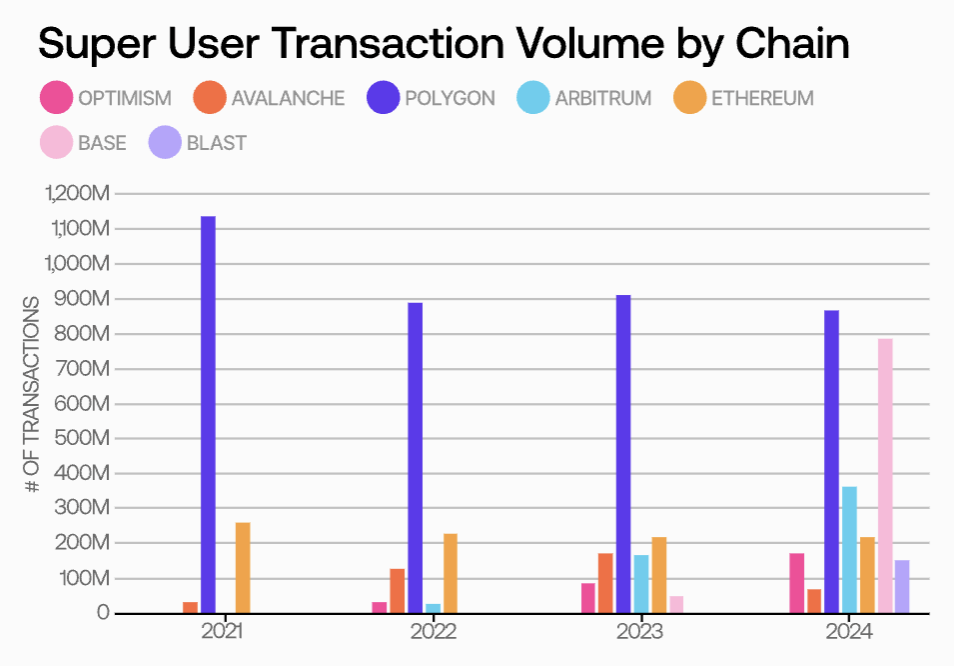

Polygon's super user activity also exceeds all other observed public chains, with average monthly super user transactions reaching 867.7 million this year. In addition to Base's impressive 786.3 million super user transactions, Arbitrum has also performed strongly in 2024 so far, reaching 365.3 million super user transactions.

Polygon's outperformance continues its long-standing lead in superuser activity dating back to 2021. In 2021, Polygon's transaction volume reached 1.14 billion, setting a record for super user activity among all blockchains and still holding it today.

However, although Polygon has the highest amount of super user activity among all blockchains, it ranks only third in the number of DeFi (decentralized finance) related super user wallets. This shows that Polygon has successfully attracted a large number of high-frequency trading users through GameFi (chain game finance) and other application scenarios, rather than relying solely on DeFi applications.

The number of super users of Ethereum in the DeFi field exceeds that of Arbitrum and Optimism combined.

As of 2024, Ethereum's super users in the DeFi field have reached 10.9 million, second only to Base. This number is much higher than Arbitrum (6.2 million) and Optimism (1.8 million) combined.

While EVM L2 (the Ethereum Virtual Machine compatible layer 2 network) generally has faster speeds and lower transaction costs, many users may still find bridging assets across chains too complex or risky, or prefer to use Ethereum Fangzhu.com, because it has deeper liquidity and a more mature market position.

However, Ethereum’s second-layer network needs to further explore ways to attract users, rather than just relying on its performance advantages over the Ethereum mainnet to attract on-chain activity.

4.DEX users

Uniswap continues to expand market share across major blockchains, further solidifying its position as a leader in decentralized exchanges (DEX).

Uniswap remains the undisputed number one among all observed chains, with the only exceptions being the Avalanche and Blast chains. Especially on the Base chain, Uniswap's user share soared from 36.8% to 91.3%. This achievement is particularly outstanding considering the exponential growth of Base chain users this year.

Similarly, Uniswap’s performance has improved on other major chains. Compared with 2023, its share of DEX activity on Ethereum increased by 27.72%, while on Polygon it increased by 12.57%. It is worth mentioning that Polygon’s DEX activities have always been relatively dispersed, and its user group’s trading behavior is more diverse than other leading chains.

Even regardless of Uniswap’s protocol upgrade, this phenomenon may reflect the “winner-takes-all” trend in the DeFi space, where larger platforms capture greater market share due to their deep liquidity and brand recognition.

On Avalanche, Trader Joe further consolidated its lead, while Uniswap also rose in the rankings.

Uniswap is currently the second most popular DEX on Avalanche, and in 2023, it did not even crack the top five. However, Trader Joe remains the most popular DEX on Avalanche, accounting for 61.1% of the market, and its market share has increased by approximately 6% since 2023.

As the first major DEX built natively on Avalanche, Trader Joe’s is committed to maintaining and expanding its market leadership. The Auto-Pools feature, launched in April this year, makes it easier for liquidity providers (LPs) to automatically adjust positions and compound returns. In addition, the platform also supports liquidity staking of a variety of Avalanche assets and actively expands to new chains such as Arbitrum and BNB Chain, verifying the feasibility of its unique Liquidity Book (LB) model.

Judging from the results, these efforts of Trader Joe’s provide a successful case for other platforms hoping to gain a foothold in the highly competitive DEX market.

The DEX preferences of super users and new users are converging, but the distribution of trading activity among super users is still more dispersed.

Unlike 2023, the top three DEXs used by super users and new users are currently consistent on every observed chain. This suggests that new users have become more adept at imitating the behavior of experienced traders, or that leading DEXs have found more efficient ways to optimize trading paths.

Despite this, the trading activities of super users are still distributed on more DEXs. Compared with new users, they are more familiar with a wider range of DeFi protocols and are willing to explore opportunities outside of mainstream platforms such as Uniswap in order to pursue higher returns. or unique trading conditions.

Looking ahead: Web3 opportunities and challenges in 2025

On-chain data shows that the number of Web3 users will continue to grow in 2024, and traditional blockchains and emerging competitors are also facing the challenge of how to stand out in the market and provide attractive application scenarios for new and old users. In addition, the increase in the price of native tokens on the chain has not significantly promoted diversified on-chain activities, and emerging DeFi protocols have also encountered considerable resistance when challenging existing giants.

Here are some key trends looking forward to 2025:

Base becomes the benchmark for ecological expansion

In 2024, Base has become a model for attracting and retaining new users with its explosive user growth, which provides a reference for other new blockchains hoping to make a mark. Base’s success in memecoin transactions and on-chain AI applications demonstrates that innovative use cases around popular areas will continue to drive user growth in 2025. However, how to translate these high-frequency trading activities into more sustained and diverse user engagement remains an important challenge.

The growth of Ethereum users brings new opportunities for L2 chains

Although Ethereum's second-layer network (L2) is generally more advantageous in terms of performance, Ethereum remains firmly at the core of the Web3 economy due to its large user base and liquidity. L2 chains like Optimism may further adjust their strategies to attract Ethereum’s growing number of regular users and direct them to their own on-chain ecosystems.

Differentiation or economies of scale are key to success

Uniswap’s growing market dominance shows that the DeFi market is showing a “winner-takes-all” trend. However, chains like Avalanche and Polygon have proven that it is possible to carve out a significant position in a specific market through targeted innovation. For example, Trader Joe's Auto-Pools feature simplifies operations for liquidity providers, while Polygon's GameFi project attracts a large number of gamers. Looking forward to 2025, protocols that can provide differentiated on-chain services that go beyond traditional DeFi functions will be more likely to attract market attention.

Transformation from user quantity to user quality

With the continuous influx of new users, blockchain ecosystem builders need to find ways to incentivize users to participate in more diverse activities, such as governance voting and staking, rather than just transactional behavior. As the number of wallets grows rapidly, those chains that prioritize user quality and focus on diverse participation will have an advantage in the healthy development of the long-term ecosystem.

5. Data-driven user quality insights

What are Flipside Scores?

As 2025 approaches, the Web3 industry is facing an important challenge: how to distinguish short-term activity from truly sustainable growth. While the surge in new users and transaction volume in 2024 brings optimism to the industry, the key question is whether these users will remain in the long term and contribute to the long-term development of the blockchain ecosystem. Flipside Scores are designed to solve this problem.

Flipside Scores quantify the quality of users' on-chain activities by integrating 15 performance indicators covering five categories. Unlike simple metrics based solely on transaction volume, this approach provides a comprehensive picture of the breadth and depth of user activity, revealing which ecosystems are performing well and where there is room for improvement.

User quality trends of different chains

Overall, with the surge in the number of wallets and on-chain transaction volume in 2024, the quality of users on each chain has declined. This phenomenon reflects the industry attracting a large number of new users who are currently less engaged but are expected to gradually explore the diverse use cases provided by Web3 in the future.

Here are some key findings:

- Base: One of the classic success stories in user growth in 2024. Although the chain has a low user quality score, this does not mean that Base performs poorly overall. On the contrary, this shows that its huge new user base is currently mainly concentrated in fewer on-chain activities, and Base still has huge room for improvement by guiding these users to participate in more diverse ecological activities in the future.

- ETH: There has been a significant decline in user quality ahead of the launch of multiple U.S. Securities and Exchange Commission (SEC)-approved ETH ETFs. This shows that although the entry of institutional funds can drive rapid growth in the number of wallets, without sufficient incentive mechanisms and convenient ways to participate (such as protocol governance), it may be difficult to increase the depth of users' on-chain activities.

- Blast: In the early days of its launch, it successfully attracted users to actively participate in multiple on-chain activities, demonstrating its strong ability to incentivize gamification activities. Although Blast's user growth slowed in the fourth quarter of 2024, remaining users remain active in multiple areas, indicating that the chain is poised to grow beyond its initial popularity and achieve long-term development.

jinse

jinse