Asset management firm GraniteShares files for cryptocurrency-related leveraged ETF to track companies like MicroStrategy and Robinhood

Reprinted from panewslab

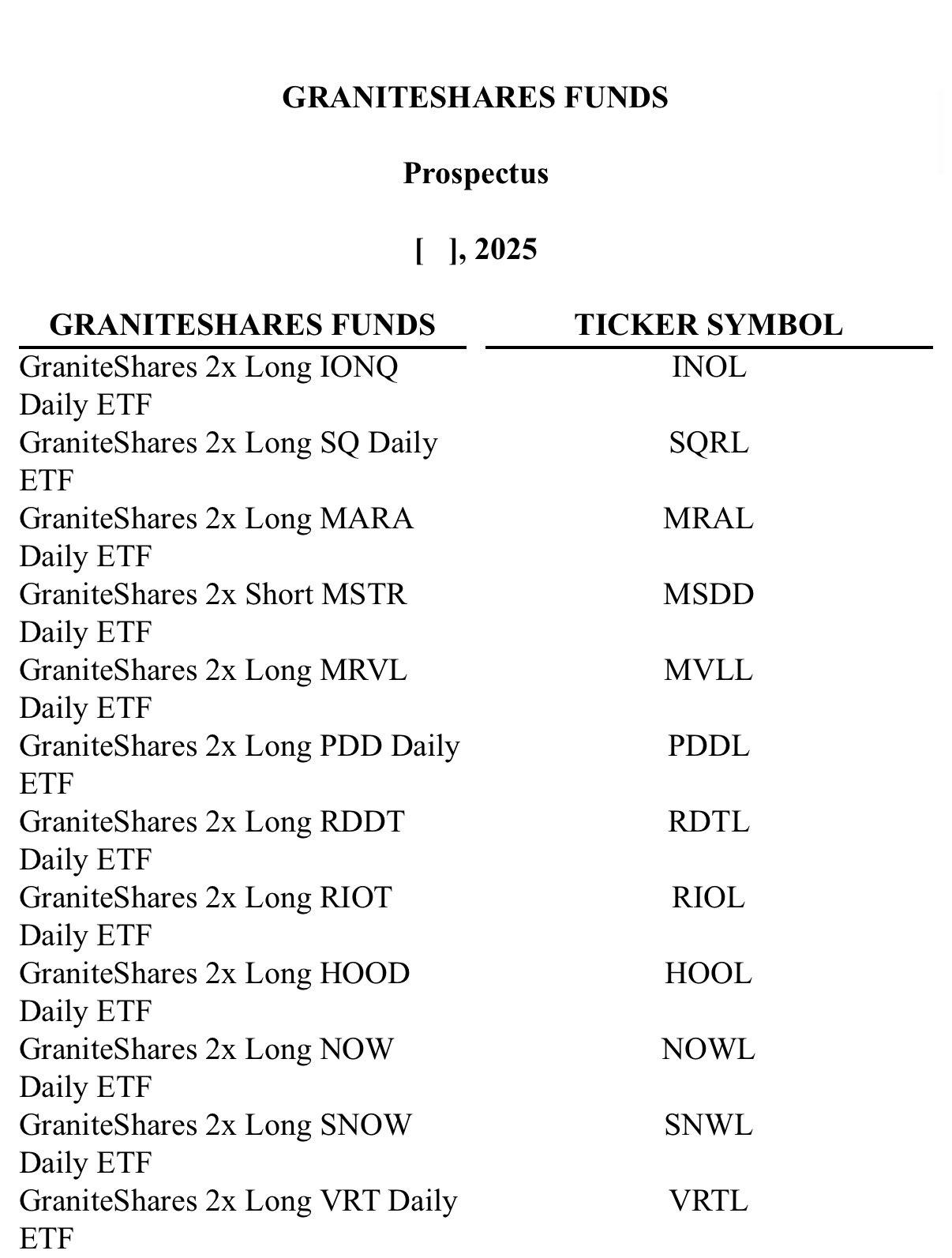

12/22/2024·5MPANews reported on December 22 that according to Crypto.news, GraniteShares, a New York-based asset management company with over $10 billion in AUM, applied for a new leveraged ETF to track companies such as Riot Platforms, Marathon Digital, MicroStrategy and Robinhood. These funds will be both long and short. A 2x long ETF will generate twice the daily return of the corresponding stock.

Other companies have launched other types of cryptocurrency-focused ETFs. In addition to leveraged funds, YieldMax has also launched covered call ETFs on a number of cryptocurrency companies. The company launched Coin Option Income, MARA Option Income and MSTR Option Income ETFs. These ETFs use a covered call strategy to provide investors with monthly income. In a covered call, the fund invests in a stock, sells the call option, and collects a premium, which is distributed to investors each month.

jinse

jinse