AI boom leads US VCs to record the largest investment in three years

Reprinted from jinse

03/10/2025·2MAuthor: George Hammond, Financial Times; Translated by: Baishui, Golden Finance

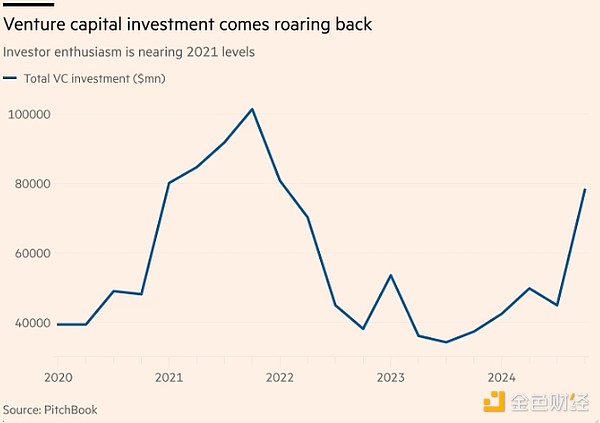

U.S. startups have raised more money than they have since 2021 due to investors’ optimism about artificial intelligence, but the venture capital market has already skewed to fund a handful of large private tech companies.

According to PitchBook, more than $30 billion has been invested in emerging groups this quarter. Another $50 billion in financing is underway as venture capitalists work on a series of major deals involving OpenAI, Safe Superintelligence and defense technology startup Anduril.

The craze for artificial intelligence has prompted investors to invest at the fastest pace since the market peak in 2021, during which time, $358 billion poured into tech groups, leaving many companies with unrealistic valuations.

But venture capital groups believe that this investment cycle will be different. “Artificial intelligence is a transformative force that can make these companies better,” said Hemant Taneja, CEO of General Catalyst, one of Silicon Valley’s largest venture capital firms.

“The way to think about this is ‘Can these businesses reasonably grow 10 times from their current levels? ’ The answer to all of them is yes, so they are priced at reasonable prices,” he added.

U.S. financing jumped to about $80 billion in the last quarter of 2024, PitchBook data shows. This is the best fourth quarter since 2021. But Kyle Stanford, head of research at PitchBook, said that just six large transactions (involved OpenAI, xAI, Databricks, etc.) accounted for 40% of the total.

“It’s a very elite group of companies that dominate venture capital,” he added.

The investment levels will be similar in the first quarter of this year based on transactions already completed and those expected to be completed in the coming weeks – which will make it the best first quarter to raise funds since 2022.

In the past two weeks alone, fintech companies Stripe and Ramp have announced funding rounds with valuations of $91.5 billion and $13 billion, respectively, while artificial intelligence startups Anthropic and Shield AI have signed $61.5 billion and $5.3 billion in deals, respectively.

Venture capital firms are also making a series of large-scale investments. OpenAI is in talks with SoftBank to raise $40 billion at a valuation of $260 billion, which will be the largest funding round ever, surpassing the $10 billion investment in Databricks late last year.

Anduril, founded by Palmer Luckey, is negotiating to raise at least $2 billion at a valuation of more than $30 billion, more than double the valuation in a round of funding last summer, according to two people familiar with the matter.

These more mature companies have annual revenues of hundreds of millions or billions of dollars and are growing rapidly. General Catalyst's Taneja, who has invested in Anduril, Anthropic, Ramp and Stripe, said that makes them relatively safe options.

“The road to making money in AI is very vague, and a lot of capital ends up focusing on industry leaders with customer bases and large markets,” he said.

But the enthusiasm for artificial intelligence has also driven the growth of young companies that have no revenue or even products.

Safe Superintelligence, founded last year by OpenAI co-founder and former chief scientist Ilya Sutskever, raised $1 billion in 2024 at a valuation of $5 billion and is currently in talks to raise new capital at a valuation of $30 billion or more, according to two people directly familiar with the deal.

The ongoing huge financing marks a significant divergence from traditional venture capitalism, which aims at emerging companies and is dominated by a “power law” where the best startups in the portfolio will compensate for the losses of the remaining companies that failed.

“We have always believed that the 50x return of [the venture fund] will come from seed investments they exited at the time of their IPO,” said PitchBook’s Stanford.

In an untested experiment, this logic is now applied to more mature companies that are orders of magnitude larger and more mature, which Stanford calls “pseudo-VC firms.”

These include Josh Kushner's Thrive Capital, General Catalyst and Lightspeed Venture Partners, all of which have invested in several major rounds in recent weeks. All three companies are registered investment advisors, which enables them to invest in a wider range of asset classes and hold these companies once they go public.

Stanford said the three companies also raised more than $5 billion in funding each, giving them “are sufficient size to invest in startups worth $1 billion and hold for 15 years until they are worth $50 billion, investing in a variety of ways in the process.”

Sebastian Malabi, author of the book Law of Power, believes that even the most expensive startups can expand 10 times, and this belief “has made fund managers flock to big-name companies with enthusiasm and say 'Who cares how much I paid? I'm a genius and can enter the industry.'”

Malabi warned that while a mature company is less likely to go bankrupt, it is less likely to increase its valuation by ten times or a hundred times. “The effective habits of the Bank in early stage investment need to be adjusted as it enters a larger round of financing.”

Stanford said the large round of financing discussed today represents “a completely different venture capital style than I have ever experienced.”

The peak period of venture capital in 2021 was characterized by rising financing scale and valuation: According to PitchBook, there were about 854 transactions of $100 million or more that year. This year, total investment is close to 2021 levels, but the market is becoming increasingly unbalanced.

“If you’re OpenAI or Anduril (a well-known brand with high growth), then your positioning is very favorable. Money is right next to you… If you’re on the other side, like most companies, money isn’t there,” Stanford said.

“Maybe it will end up reaching the 80 billion [that raised this quarter], but $40 billion of that is just a round…even the outliers in 2021 are trivial compared to that.”

chaincatcher

chaincatcher

panewslab

panewslab