After BTC, traditional companies increase their holdings in SOL has become a new trend

Reprinted from panewslab

04/25/2025·14DHas MicroStrategy increased its holdings in BTC today?

This problem seems to have become an important weather vane for bullish sentiment in the crypto market. In 2020, this company ignited a craze for traditional companies to invest in cryptocurrencies and also set a benchmark for more traditional companies to cross-border embrace crypto assets.

However, the current weather vane may need to add a Solana.

The recent trend is that traditional companies have also begun to increase their holdings in SOL in various ways.

From real estate, consumer goods and then to investment funds, more and more companies in different industries have begun to gradually include "SOL reserves" in their investment considerations.

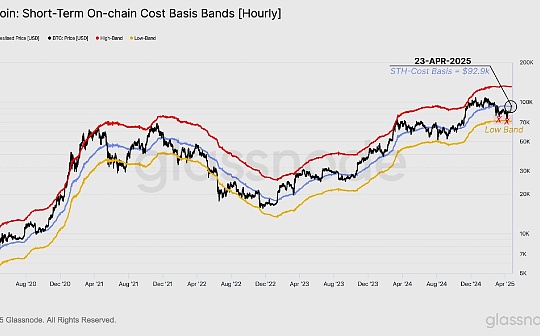

Since the sharp drop after TRUMP issued coins, the price of SOL has fallen to around US$95; and has rebounded to US$150; historically, this is not the first time that SOL has shown price resilience.

After experiencing ups and downs, SOL may become the next "bitcoin" pursued by traditional companies. These companies that are the first to take the lead are also actively transforming and making arrangements in the rising earnings expectations.

Janover Inc.: Crypto Team Reinvents Real Estate FinTech

Janover Inc. is a Nasdaq-listed fintech company (stock code: JNVR) based in Boca Raton, Florida, focusing on commercial real estate loan matching. Founded in 2018, Janover connects borrowers (such as real estate developers, property owners, small business owners) and lenders to provide financing solutions for multi-family residential and commercial properties through an AI-powered online platform.

The company's business was previously affected by a downturn in the real estate market, but small business loan revenues grew for two consecutive years. In July 2023, Janover raised $5.65 million through an IPO, with a cash reserve of $5.1 million at the end of the year and a staff of only 26 people. He is positioned as a small but innovation-driven FinTech enterprise.

In April 2025, Janover announced a bold asset allocation strategy, increasing its holdings of 163,651.7 Solana (SOL), worth approximately US$21.2 million, becoming a typical case of cross-border crypto markets in traditional industries.

This is actually not the first time the company has purchased SOL.

After this transaction, coupled with some previous purchases, Janover's total SOL position reached 317,273, worth approximately US$48.2 million (including pledge rewards).

On April 4, the company's board of directors approved the inclusion of SOL in the corporate treasury, and the transaction was completed through market purchases on April 15. Janover plans to pledge these tokens to obtain 5-7% annualized income, and consider operating Solana network verification nodes to participate in ecological construction.

The funding source for this move is its cash reserves and US$42 million convertible bonds raised from crypto-industry institutions such as Pantera Capital and Kraken on April 7.

Behind this incident, there are more connections with the crypto industry.

News released on Janover Inc.'s official website shows that a team of former Kraken members has acquired a majority stake in the company. As part of this transaction, the company name and stock code will be changed in the future. The new name will be "DeFi Development Corporation".

The company's board of directors has passed financial decisions, and the main holdings of financial reserves on the balance sheet will be allocated to digital assets, first of which is Solana (SOL). The company will explore the acquisition of Solana validators and plans to acquire and pledge SOL through them. The Verifier business seeks to acquire external equity and utilizes corresponding revenue to acquire more SOLs.

"I am very much looking forward to the deal creating value for shareholders and promoting future growth for the company. I have spent a lot of time learning about every aspect of the DeFi ecosystem and finding myself highly in line with the vision of the new leadership." So rather than saying that the company embraced encryption, it is better to say that people in the crypto industry have acquired the company and cleared the threshold for increasing their holdings in SOL.

SOL Global: Pioneer of Crypto Investment

SOL Global Investments Corp. is a Toronto-based Canadian investment company focused on tapping the potential of cryptocurrencies, blockchain and emerging technologies. Since its inception in 2017, the Canadian Stock Exchange-listed company (code: SOL) is known for its bold alternative investment strategy, with an asset management of approximately C$150 million, covering medical technology and digital assets.

In 2025, SOL Global further focused on Solana (SOL), consolidated its pioneering position in the crypto market by increasing its holdings of 40,350 SOLs (worth approximately US$8.7 million), and became a benchmark for traditional investment companies to embrace the Solana ecosystem.

In January 2025, SOL Global announced the raising of funds through a targeted additional issuance of US$18 million, of which US$10 million will be used directly to purchase SOL, and the remaining funds will be invested in DeFi and NFT projects of the Solana ecosystem. As of March, about 60% of the 40,350 SOLs held by the company were pledged, locked on the Solana network to obtain 6.26% annualized income.

The latest news shows that SOL Global currently holds about 260,000 SOL.

"We are determined to be Solana Super Company, providing public market investors with a direct access to Solana's transformation opportunities," said Paul Kania, CEO of the company.

SOL Global’s Solana layout is much more than coin hoarding. The company's portfolio includes star projects of Solana Eco, such as decentralized exchange Serum and NFT platform Magic Eden, showing its ambition to deeply participate in ecological construction.

SOL Global also plans to launch a Solana-based investment fund by the end of 2025 to further amplify its influence. Unlike traditional investment companies, SOL Global's crypto genes (most of the teams come from the blockchain field) have made it easy to get along with the Solana boom.

SOL Strategies: Veterans changed their name, but their original

intentions remain unchanged

Sol Strategies Inc., formerly known as Cypherpunk Holdings, is a holding company listed on the Canadian Stock Exchange (code: HODL), which has been deeply involved in cryptocurrency investment since 2018. This investment veteran, founded in 1995, focused on privacy technologies (such as Tor and VPN) in the early stage. After 2018, it turned to digital assets such as Bitcoin and Ethereum, with an asset management scale of approximately CAD 60 million.

In September 2024, led by former Valkyrie Funds CEO Leah Wald, the company completed a dramatic transformation: renamed Sol Strategies, focusing on Solana (SOL), becoming a pioneer case of crypto investment inclining towards the Solana ecosystem.

In February 2025, Sol Strategies announced its holdings of 189,968 SOLs, worth approximately US$40.89 million, becoming one of the largest Solana investment entities in the open market.

The company accumulates SOL through batch purchases from October 2024 to January 2025, and the funds come from existing crypto assets portfolios (including partial clearance of Bitcoin) and a CAD 25 million private placement completed in November 2024.

So far, public data shows that the company holds about 260,000 SOLs

Sol Strategies not only hoards coins, but also operates multiple Solana network verification nodes and participates in the consensus mechanism, with an estimated annualized return of 6-8%. "Solana represents high growth opportunities and is a logical extension of our strategy. We offer a more proactive approach to engagement than ETFs," said CEO Leah Wald.

Upexi Inc.: Crypto adventure for consumer goods businesses

Upexi Inc. (Nasdaq:UPXI) is a Nevada-based consumer goods company focusing on data-driven brand development and distribution covering areas such as health care products, pet supplies and children’s toys.

The company was founded in 2018. Upexi quickly expanded through acquisitions and self-built brands. Its revenue reached US$83 million in 2024, a year-on-year increase of 54%, occupying a place in e-commerce and Amazon platforms. After listing on Nasdaq in 2023, the company has a market value of approximately US$120 million and has about 150 employees. It is positioned as a medium-sized consumer product player.

In 2025, the company, which had nothing to do with cryptocurrencies, also invested nearly $100 million to increase its stake in Solana (SOL), becoming an unexpected star in the traditional industry's cross-border crypto market.

On April 21, 2025, Upexi announced that it would make $94.7 million to purchase SOL through a private equity financing of US$100 million and establish a Solana corporate treasury. The specific holdings have not been disclosed. The financing was led by crypto trading giant GSR Markets, showing professional institutions’ confidence in Upexi’s strategy.

Upexi said that SOL investment will be completed through batch market purchases, with the first batch expected to start in May 2025, and the company also plans to pledge part of SOL to obtain 5-7% annualized returns. "This strategy will bring long-term value to shareholders, seize the growth opportunities of the crypto market while maintaining the core competitiveness of the consumer goods business," CEO Allan Marshall said in the announcement.

Upexi's cross-border stems from management's optimism about crypto assets. At the end of 2024, the company hired a former Coinbase financial advisor to join the board, accelerating the development of the crypto strategy. Upexi's consumer goods business relies on e-commerce fluctuations, and SOL Treasury is seen as an innovative attempt to hedge traditional market risks.

WonderFi: Solana layout of digital asset platform

WonderFi Technologies Inc. is a leading operator of digital asset platforms in Canada based in Vancouver and is committed to providing cryptocurrency trading, custody and investment services to retail and institutional clients.

Founded in 2019, WonderFi quickly grew into a key player in the North American crypto market through the acquisition of Coinsquare (one of Canada's largest crypto exchanges) and CoinSmart. In 2024, its assets under management exceeded CAD 1 billion and its registered users exceeded 1 million.

The company is listed on the Canadian Stock Exchange (code: WNDR), with a market value of approximately CAD$280 million and an employee of approximately 200 people. In 2024, WonderFi will focus on Solana (SOL), consolidating its leading position in the crypto industry through increased holdings and ecological integration, and becoming an important driving force for Solana's mainstreaming.

As of February 2024, WonderFi held 61,720 SOLs worth approximately US$8.4 million (based on the SOL price at that time US$136) and plans to pledge all tokens to obtain an annualized return of 5-7%.

On January 16, 2025, the company further acquired Solana ecological tool developer Blade Labs to obtain its verification node technology and developer resources, with an investment of approximately CAD 15 million. WonderFi launches SOL staking service through the Coinsquare platform, allowing users to directly participate in the Solana network, which contributed $8.8 million in staking asset revenue by the end of 2024.

WonderFi’s Solana layout stems from its strategic insight into the crypto-native ecosystem. The acquisition of Blade Labs not only strengthens WonderFi's technical capabilities, but also makes it an active validator for the Solana network, with verification revenue expected to reach $2 million in 2025.

Different methods, same purpose

The five companies have different ways to increase their holdings in SOL in 2025, with varying reasons ranging from asset diversification to DeFi potential, but their purpose is actually similar:

Seize the growth opportunities of the crypto market and maximize shareholder value.

The implicit logic here is that companies believe that SOL still has room for growth, after all, no one is willing to trade at a loss.

As Bitcoin gradually becomes a consensus recognized by the outside world, the increase in revenue that can be brought about by holding Bitcoin is actually gradually diluted; for smaller or more radical traditional companies, holding SOL is more like an alpha strategy, while holding BTC becomes Beta.

Compared to Degens in the trenches, the choice of holding SOL is of course conservative; but compared to traditional businesses that make more hard-earned money, this choice may have relatively higher odds.

I believe that more and more market participants will vote with their feet to gain the opportunity to share the growth benefits of the crypto market.

chaincatcher

chaincatcher

jinse

jinse