ACT plummeted and Wintermute left the market. Can retail investors get rid of the fate of being cut?

Reprinted from panewslab

04/03/2025·29DAuthor: Scof, ChainCatcher

Edited by: TB, ChainCatcher

On April 1, several low-market tokens crashed collectively on the Binance platform, with ACT falling by as much as 55%. This sudden decline has sparked widespread discussion in the community and has also brought deep contradictions hidden under the surface of the crypto market to the surface.

The truth on the chain behind the plunge?

The market first focused on market maker Wintermute. On-chain data shows that before and after the flash crash, Wintermute successively cleared out multiple altcoins, including ACT, DEXE, HIPPO, KAVA, etc. These tokens are the hardest hit areas of this round of decline.

Although the founder of Wintermute responded that the selling behavior was to arbitrage the price movements of the AMM pool, and the operation occurred after the sharp price fluctuations, it was not an active market smash. However, from the on-chain timing, the exit action of this batch of funds is highly coincidental with the plunge time point.

As the industry's leading market maker, Wintermute's basic profit model is to maintain liquidity and obtain price spread returns through high-frequency market making and cross-market arbitrage. In a normal market, it provides both the depth of buying and selling and maintains price stability. However, in extreme market conditions, its strategy may also turn into actively withdrawing liquidity or even clearing out positions and stopping profits due to risk control or profit maximization. This behavior may appear to be no different from "smashing the market".

Binance's risk control logic and strategy game

At the same time, Binance's contract adjustment has also become the core trigger point of this event. At 15:32 on April 1, Binance issued an announcement, deciding to lower the maximum holding limit of multiple U-standard contracts, including ACT, from 18:30 on the same day. Taking ACT as an example, the upper limit of holdings dropped from US$4.5 million to US$3.5 million. This means that all positions that exceed the new limit will be forced to reduce positions or close positions directly at the market price.

It is worth noting that this is the third time that ACT has adjusted the contract parameters in just four days.

On March 28, the upper limit of leverage dropped from 25 times to 10 times; on March 31, the maximum position dropped from US$9 million to US$4.5 million; and on April 1, it further dropped to US$3.5 million. Such high-frequency adjustments are unusual. Based on market data, it can be inferred that Binance may have noticed that unjianlian and unauthorized large players have accumulated huge positions in the ACT contract, and there is a risk of breaking positions when the market depth is insufficient.

This is also a common "bubble-squeezing" mechanism in contract risk control: by lowering the limit, guiding the clearance of risk positions to avoid large losses in insurance funds when the market fluctuates violently. Judging from subsequent data, the ACT contract holdings fell sharply by 75% during the adjustment effective period, and Binance Insurance Fund did lose about US$2 million.

However, this kind of risk prevention and control technical operation has rapidly evolved into a chain of trampling at the moment when Meme's ecology is extremely fragile.

The mist of responsibility in response to multiple parties

The project party ACT also spoke out after the incident, saying that the price movements were "completely uncontrolled" and promised to release a post-review report after the dust of the incident was settled.

As things have developed, many relevant parties are trying to "divide" their responsibilities, but the truth may be more than one. Binance emphasized that users sold $1.05 million in a short period of time, resulting in a plunge; Wintermute emphasized that it was an arbitrage rather than a smash; users accused the exchange of the exchange of adjustment rules for not sufficient communication in advance, and the project party maintained tactical and calm response.

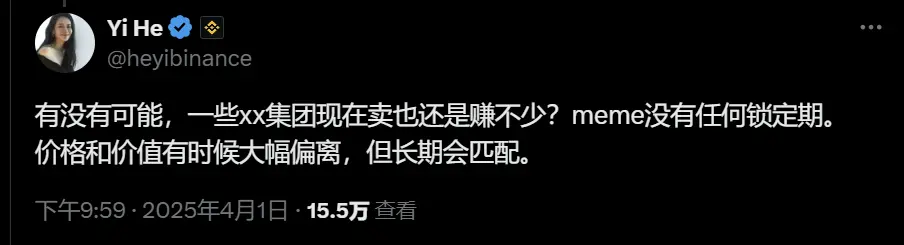

But no matter which side it is, the industry structural problems exposed by this emergencies are more worthy of attention. The most core contradiction in the crypto market is the opposition between the rapid failure of garbage assets and the damage to user interests. The large number of fast food assets such as Meme is essentially a stupid game driven by emotions. They lack fundamental support, but they enter mainstream trading platforms through currency listing, building momentum, and community operations.

In the era of bubbles, who is the sacrificed party?

As the head matchmaking platform, Binance is in the crack. On the one hand, it must ensure systematic security and prevent chain liquidation caused by low-liquid assets; on the other hand, it also carries users' trading freedom and asset confidence. In some extreme cases, its risk control behavior can trigger a price stampede, which in turn harms the interests of users. This trade-off under double pressure is exactly the "role paradox" facing the current platform.

The role of market makers is just as complicated. They are both providers of market liquidity and the first player to retreat when the market is fierce. When their strategy shifts, ordinary investors often get deeply trapped in it before they even notice it.

More realistically, when junk assets are cleaned up, there will always be people who profit from the chaos—whether it is to identify risk-retreat institutions in advance or strategic accounts that use volatility arbitrage. Removing bubbles and squeezing risks is a necessary stage in a healthy market, but when this mechanism lacks openness and transparency, it will trigger a crisis of trust.

Ultimately, this ACT incident is not only a plunge in assets, but also a mirror that reflects the deep institutional dilemma of the current crypto market.

In a rapidly evolving market, each role of the platform, project party, market maker, and user is not isolated. The stability of the system depends on the dynamic balance between all parties. If there is no sufficient mechanism to coordinate the tensions of "value" and "liquidity", "clearance" and "protection", any small-scale risk control operation may evolve into a systematic trust decline.

All of this will eventually be borne by every participant in the market.

chaincatcher

chaincatcher