A 60% plunge in one day, and many troops were harvested, revealing the trading techniques of AUCTION giant whale

Reprinted from panewslab

03/24/2025·1MAuthor: Fairy, ChainCatcher

A hidden and efficient trading game was staged on the weekend.

In just a few weeks, an unknown entity acquired more than 20% of the total supply of AUCTION, driving a surge in trading volume, increasing holdings, and continuing to rise in CVD. Everything seems to be a strong market dominated by bulls. However, behind this, the "banker" is shipping accurately without hesitation.

The token price has emerged from the "Christmas Tree" market, which seems to be rising steadily, but in fact it has hidden murderous intent. What kind of trading layout is this? How can "bankmakers" complete large-scale shipments in a situation where "seemingly bulls dominate"? This article will deeply analyze the truth about this trading layout.

AUCTION Market dynamics: Giant whale trading trajectory emerges

AUCTION is Bounce Brand’s governance token, a decentralized auction platform that integrates liquidity mining, decentralized governance and pledge mechanisms.

Last night, Bounce Brand issued a statement clarifying that the team did not participate in AUCTION price manipulation and disclosed a series of market trends:

Over the past few weeks, an unknown entity has acquired over 20% of the total AUCTION supply.

AUCTION trading volume rose sharply on major exchanges, with AUCTION futures trading pairs on Binance becoming the third largest trading pair after BTC and ETH. AUCTION spot trading volume on Upbit surpassed BTC for many consecutive days.

Upbit's AUCTION trading price showed a significant premium, and a large number of AUCTIONs were withdrawn from mainstream exchanges for arbitrage trading.

In addition, there is also a significant imbalance in market liquidity, showing a series of unhealthy conditions:

Binance hot wallet holdings have plummeted, and currently only less than 10% of AUCTION's total supply.

The annualized lending rate is more than 80%, and the capital fee rate remains at -2% over multiple cycles.

Major exchanges adjust position restrictions and risk control measures for AUCTION perpetual contracts.

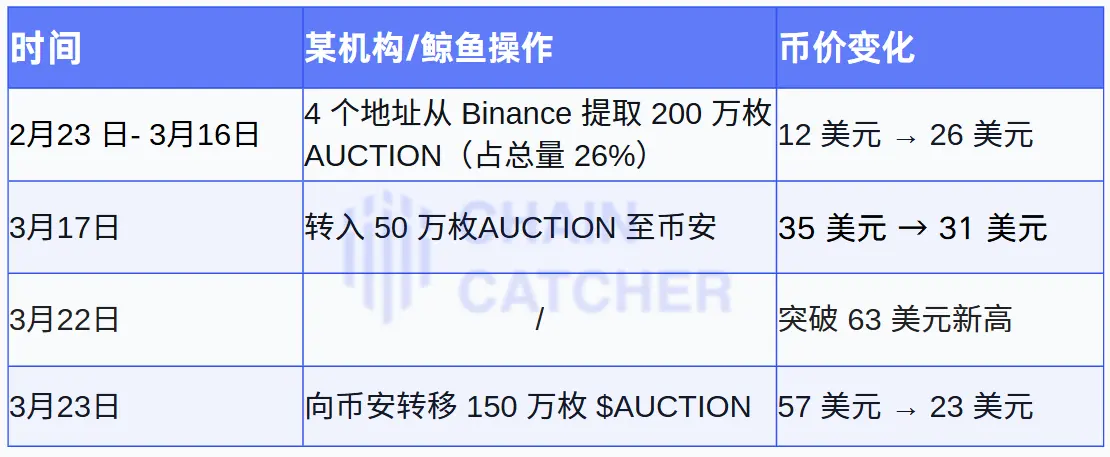

Based on the monitoring data of Embers, we have compiled the recent key operation trajectories and changes in the currency price of AUCTION giant whale:

Judging from the series of capital mobilizations of Jujie and market abnormalities, the price trend of AUCTION is not a simple capital promotion, and there is a more complex trading layout behind it.

Hidden shipment technique: "passive selling orders" trading strategy

During the AUCTION plunge, market data showed a seemingly contradictory signal: CVD (incremental volume of cumulative trading volume) continued to rise, capital rates continued to rise, and position volume also increased. According to conventional logic, when CVD rises and positions increase, it usually means that a large number of active buy orders are pouring in in the market, and the price should rise. However, the price of AUCTION has been falling all the way, showing a clear market divergence.

According to the analysis of encrypted KOL Biupa-TZC, AUCTION's "banker" adopted an extremely hidden "passive selling order" shipment strategy and completed large-scale shipments in a market that seems to be dominated by bulls.

1. Put a huge amount of passive selling orders

The "market maker" keeps placing super large passive selling orders near the market price, allowing the active buying order to hit the transaction.

Since spot stocks are mainly controlled by "market makers", there are almost no active selling orders in the market. The calculation method of CVD is to minus the volume of active buying orders minus the volume of active selling orders. In the absence of active selling orders, CVD continues to rise, but the price is always under pressure.

2. Create the illusion of "stable price"

"Statemakers" avoid actively smashing the market, but instead make the market seem to be buying, creating the illusion that the market is rising.

As CVD continues to rise and holdings are also increasing, retail investors mistakenly believe that funds are actively pouring in, so they may take the initiative to go long or buy at the bottom.

3. Gradually absorb market buying and complete shipment

The "bank dealer" will eat up the active buying orders one by one by one by continuously placing new passive selling orders.

Whenever active buying hits passive selling orders, a short-term liquidity vacuum appears in the market, and the "market maker" will adjust the selling orders downward again, causing the price to gradually fall.

Due to the large trading volume, these sell orders are not just selling at the price, but ultimately causing the AUCTION price to plummet.

The trading game ends, and the market alarm bell rings

Behind this surge in AUCTION is the carefully planned capital allocation and trading layout by the "market maker". Although Bounce Brand has provided liquidity support on several exchanges to stabilize market liquidity and locked in about 1.5 million AUCTIONs, this incident still exposed the hidden risks and complexities in the crypto market.

For ordinary investors, this is a profound lesson: in the face of high volatility assets, blind signal trading will only become a bargaining chip for "market makers". Only by staying alert and deeply analyzing market trends can we be invincible in the changing trading market.

jinse

jinse