Trading moment: 312 fifth anniversary, CPI is coming, Bitcoin's short-term trend may usher in a key battle

Reprinted from panewslab

03/12/2025·1M

1. Market Observation

Keywords: CPI, ETH, BTC

It's another 312 year. Looking back at the rise of Bitcoin from around $3,800 five years ago to $82,000 today, an increase of more than 20 times. In this wave, some people have made a lot of money and chose to leave, but only those who have faith still stick to it.

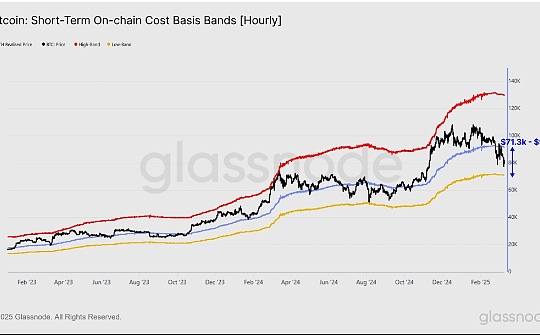

The recent volatility of the market has intensified, with Bitcoin rebounding above $80,000 after hitting $76,600 yesterday. Major institutions have different opinions on the future trend. 10X Research analyst Markus Thielen predicts in his latest trading report that Bitcoin may fall further to the $73,000 level, and stressed that the right time for "buying the bottom" has not yet reached. Geoff Kendrick, head of digital assets research at Standard Chartered Bank, analyzed that Bitcoin's recent price decline is mainly affected by the pressure of widespread risk assets, rather than the cryptocurrency's own problems. From the perspective of volatility adjustment, Bitcoin's performance is highly consistent with the combination of "seven major technology stocks plus Bitcoin". He further pointed out from a technical point of view that if Bitcoin falls below the key support level of $76,500, it may quickly fall to $69,000. Despite short-term pressure, he still maintains his target forecast of Bitcoin reaching $200,000 by the end of 2025. Regarding the market rebound, Kendrick believes that it will mainly rely on two key factors: the overall recovery of risk assets and the positive news of Bitcoin (such as sovereign purchases). He particularly emphasized that a clear tariff policy may or the Fed's rapid rate cut will promote market recovery. If the probability of interest rate cuts in the Federal Reserve meeting in May increases from the current 50% to 75%, it may trigger a rebound.

Meanwhile, Rohit Jain, managing director of CoinDCX Ventures, reminded investors that if the Fed maintains current interest rate levels as expected, Bitcoin may pull back to test the $70,000 support level. Presto Research analyst Min Jung believes that the recent price rebound is more like a technical correction after a sharp decline in the market and lacks substantial favorable support. Today's CPI release will be a major event for traders, as the entire market is focusing on inflation and how the Fed will respond. In the current market environment full of uncertainty, traders are advised to remain cautious, do a good job in risk management, and pay attention to breakthroughs or support situations in key price positions.

2. Key data (as of 13:00 HKT on March 12)

-

Bitcoin: $81,719.72 (-12.57%), daily spot trading volume is $46.4557 billion

-

Ethereum: $1,868.96 (-43.94% during the year), daily spot trading volume is $26.798 billion

-

Corruption Index: 34 (Fear)

-

Average GAS: BTC 2 sat/vB, ETH 1.00 Gwei

-

Market share: BTC 61.2%, ETH 8.6%

-

Upbit 24-hour trading volume ranking: XRP, BTC, ETH

-

24-hour BTC long-short ratio: 0.9643

-

Sector rises and falls: AI sector rises 3.44%, PayFi sector rises 2.42%

-

24-hour liquidation data: A total of 108,292 people worldwide were liquidated, with a total liquidation amount of US$380 million, and its BTC liquidation was US$186 million and ETH liquidation was US$72.1276 million.

3.ETF flow direction (EST as of March 11)

-

Bitcoin ETF: -$219.7 million

-

Ethereum ETF: -$9.75 million

4. Important date (Hong Kong time)

US President Trump meets with U.S. technology leaders, including CEOs of HP, Intel, IBM, and Qualcomm. (2:00 on March 11)

US President Trump signs executive order. The United States has not adjusted its annual CPI rate in February (20:30 on March 12)

- Actual: None/Previous value: 3% / Expected: 2.9%

US Seasonal Adjusted CPI Monthly Rate (20:30 on March 12)

- Actual: None/Previous value: 0.50% / Expected: 0.30%

The number of people who requested initial unemployment benefits in the United States to March 8 (10,000) (20:30 on March 13)

- Actual: None/Previous value: 22.1/Expected: None

5. Hot News

Senator Lummis resubmits Bitcoin bill to allow U.S. to reserve more than 1 million bitcoins

The ETF Store President: Franklin Templeton submits XRP spot ETF application

Metaplanet issues 2 billion yen zero-interest ordinary bonds to increase Bitcoin

SEC accepts Grayscale Hedera spot ETF application

USDC Treasury minted $250 million USDC on Solana in the early hours of the morning

OpenAI launches new tools for simplifying the development of AI Agents, Responses API and Agents SDK

SEC postpones approval for ADA, SOL, XRP and other encrypted spot ETFs

Tesla rebounded 3.7%, and Strategy and Coinbase stock prices both rebounded significantly

Coinbase will be launched on RedStone(RED)

Axelar Foundation discloses $30 million in sales of AXL tokens to expand interoperability protocols

GoPlus Security releases $4.34 million buyback plan and $2 million user compensation plan

chaincatcher

chaincatcher

jinse

jinse