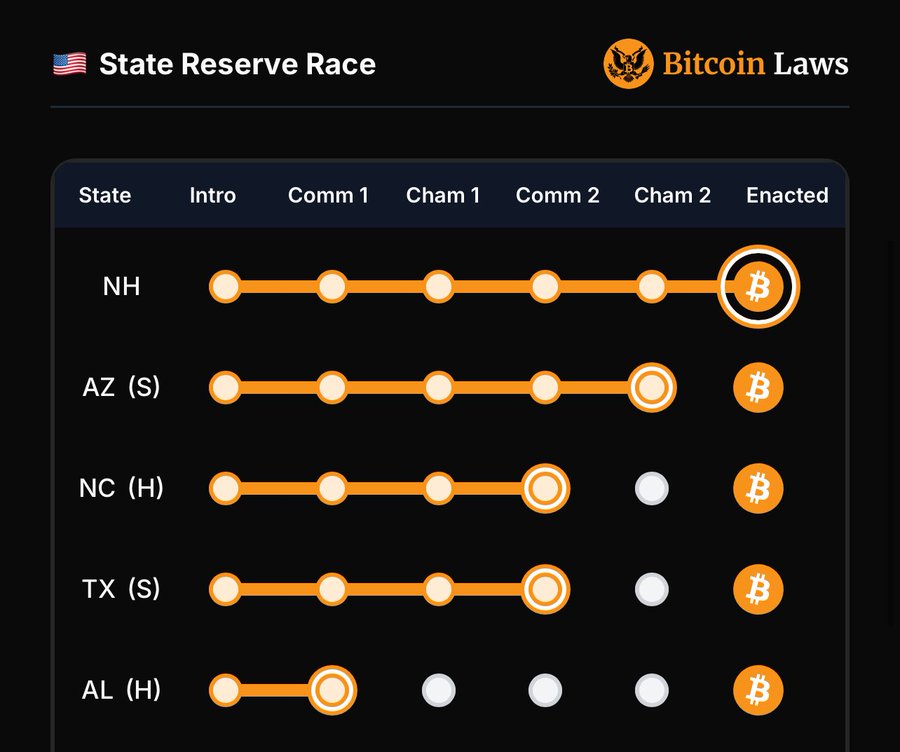

New Hampshire signs the first state Bitcoin reserve bill in the United States, more crypto legislation is ready to go, and may trigger a wave of states following suit

転載元: panewslab

05/07/2025·20h

Author: Weilin, PANews

New Hampshire, USA is the birthplace of the "Bretton Woods" agreement. In July 1944, representatives of 44 countries held a United Nations and allied monetary and financial conference at the Bretton Woods Park in New Hampshire, USA, and established a system of pegging and fixed exchange rate with the US dollar and gold, and established the US dollar as the global reserve currency.

After more than 80 years, on the evening of May 6, New Hampshire became the first state in the United States to include "digital gold" Bitcoin in its state fiscal reserves, establishing a legal status and policy framework for Bitcoin. New Hampshire Governor Kelly Ayotte formally signed the HB 302 Act, announcing that the state will establish a "strategic Bitcoin reserve" to allocate no more than 5% of the state's fiscal funds to hold precious metals, Bitcoin and other digital assets with a market capitalization of more than $500 billion (currently only Bitcoin meets the standards).

New Hampshire signs HB 302: The first state Bitcoin strategic reserve

bill in the United States is implemented

At the federal level, President Trump signed an executive order on March 6, 2025 to formally establish strategic Bitcoin reserves and other cryptocurrencies. Although state crypto support lawmakers have drafted state-level Bitcoin strategic reserve bills, they have encountered resistance in the near future.

But on May 6, the bill named HB 302 in New Hampshire made history. The New Hampshire Treasury Department holds about $3.6 billion in funding in its latest annual report, meaning the state can purchase up to $181 million in precious metals or bitcoins worth up to $181 million.

The bill was first proposed by Rep. Keith Ammon (the drafter of the bill), Calvin Beaulier, Mark Warden, Jason Osborne, as well as state Senators Daryl Abbas and Kevin Avard. Based on the version provided by advocacy group Satoshi Action, the bill has been simplified to make it easier to understand, accept and implement in the legislative process.

The New Hampshire Treasury Department is authorized under the framework of the bill to invest in Bitcoin and other digital assets with a market capitalization of more than $500 billion. At present, only Bitcoin can meet this market value threshold. According to the drafter of the bill, the core purpose of this policy is to provide the state fiscal system with a tool to hedge inflation and diversify its investment portfolio.

According to law, any Bitcoin or digital asset included in the reserve must be entrusted within the U.S. regulatory system, including a state-controlled multi-signature wallet, qualified custody agency, or U.S. listed trading products (ETPs). The move aims to provide taxpayers with the highest levels of security, long-term stability, financial responsibility and transparency.

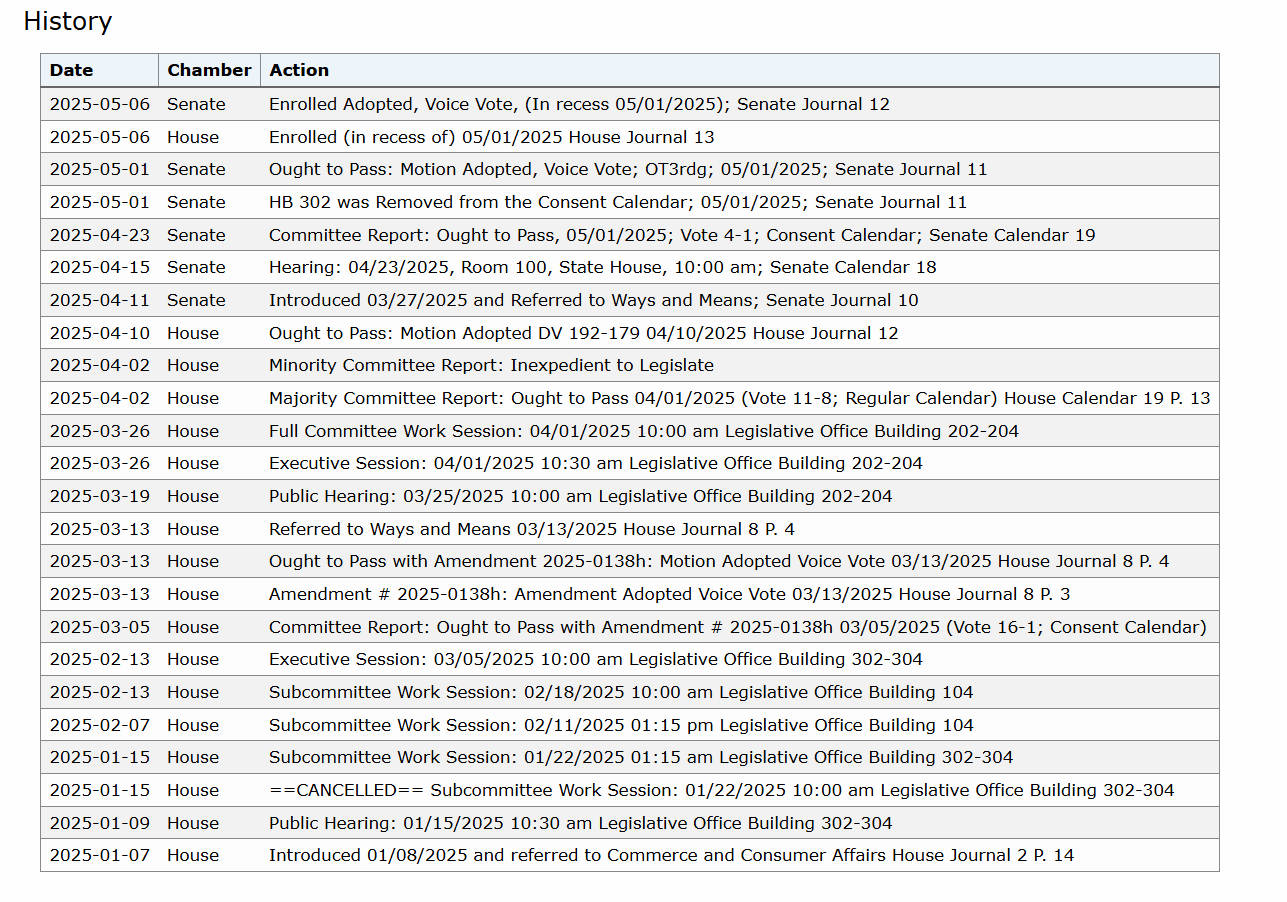

From concept to legislation: HB 302 passes process review

The HB 302 bill was introduced to the House of Representatives in January. In New Hampshire, a bill passes and first requires drafting. The draft can be proposed by 400 members of the General Court of New Hampshire or 24 senators. A state agency head, governor, citizen or interest group must find a member of parliament as the sponsor if it wishes to make legislative recommendations.

The bill is then submitted to the Legislature: the drafted bill is first handed over to the clerk of the Senate or House of Representatives - depending on the House where the proposer belongs. When the House passed a motion to consider the bill by number only, the bill was formally introduced.

After that, all bills submitted to the Committee must hold public hearings unless two-thirds of the attending members agree to the suspension of the rules. New Hampshire is one of the few states that require public hearings on all bills.

The next step is bill and committee review: the committee review is conducted in the executive session and requires the attendance of the majority of committee members to take action. The public can listen to the final voting process. The Committee submits a report to the clerk of the House, which may be concluded: "Ought to pass", "Ought to pass as amended", "Inexpedient to legislate", "Refer to interim study", or "Re-refer to Committee for consideration"

The bill is then considered in the House: After the committee report is published in the Parliamentary Calendar, the bill can be considered the next day. Major amendments proposed by the Commission must be listed in the calendar. All bills must be passed through the Senate and House of Representatives in a completely consistent text before they can be submitted to the governor for signature. After the bill is passed by both houses, it will be sent to the Committee on Enrolled Bills for registration and format review.

The bill is finally accepted or rejected. If the Legislative Council has not yet adjourned the meeting, the governor has 5 days to decide whether to sign the bill, reject the bill, or not to sign it.

Previously, on May 4, Arizona Gov. Katie Hobbs vetoed Senate Bill 1025 (SB 1025), which would have allowed public funds to be invested in virtual currencies, according to Arizona’s official website documents. In a veto statement, Hobbs said the Arizona retirement system is one of the most robust retirement systems in the United States, thanks to its robust and wise investment strategy. She stressed that state-minister's pension funds are not suitable for unproven investments such as trying virtual currencies.

On May 6, Florida House of Representatives Bill 487 and Senate Bill 550 were "delayed indefinitely and withdrawn from deliberation" on May 3. The two bills originally planned to allow state finance to invest up to 10% of some public funds in Bitcoin and establish state-level crypto reserves. However, the Florida Legislature did not pass relevant legislation before the end of its meeting on May 2 and has officially withdrawn from the state-level Bitcoin Reserves Act competition. Previously, similar bills also failed in South Dakota, Montana and other places.

May trigger national imitation, core promoter Keith still has two crypto

bills pending trial

HB 302 is not only a strategic breakthrough in local fiscal policy, but is also considered a new benchmark for digital asset policies in states across the United States. Dennis Porter, CEO and co-founder of Satoshi Action, celebrated this: “Satoshi Action drafted the model, which New Hampshire wrote into law, and now finance executives across the country can follow this roadmap. HB 302 proves that you can diversify your reserves while protecting taxpayer funds and safeguard the future of state finances – while embracing the safest currency network on the planet. New Hampshire not only passed a bill, it triggered a campaign.”

Satoshi Action, a nonprofit policy organization dedicated to promoting Bitcoin-friendly legislation, has participated in the drafting of the model for this bill. Nationwide, the organization has assisted in promoting the passage of six laws supporting Bitcoin and has led to the introduction of more than 20 Bitcoin reserve bills, continuing to promote solid and cross-party policy development in the digital asset field.

Behind the implementation of the HB 302 bill is a group of legislators who have long supported digital assets. Among them, Keith Ammon is the drafter of the bill. He represents Hillsburg's 40th constituency and always plays a facilitator role in the legislative process. He is also the chairman of the New Hampshire Blockchain Council and a member of the Business and Consumer Affairs Committee. In addition, state House Majority Leader Jason Osborne and member of the New Hampshire Blockchain Committee Ian Huyett also played a key role in the bill's consideration.

It is worth mentioning that HB 302 is just one of several crypto-friendly bills that Keith is advancing. Keith currently has two Bitcoin and blockchain-related bills underway, both of which have been passed by the House of Representatives and is now in the Senate deliberation stage:

Act HB310 proposes the establishment of a committee to study the possibility of creating a regulatory framework for stable tokens, tokenized real assets, and blockchain-based trusts in New Hampshire. Currently under consideration in the Senate; House Status: Passed/Accompany Amendment. The latest hearing was on April 29, 2025.

Keith said the privacy issues of stablecoins are crucial to him and plans to have in-depth discussions with relevant experts in Wyoming.

Act HB639 is a bill on the use of blockchain and digital currencies and its related disputes. The bill adds a new chapter called "Basic Laws of Blockchain" to the New Hampshire legal system, aiming to establish a new legal framework to protect the rights and interests of blockchain technology and its users. Currently under Senate deliberations, the House of Representatives has been adopted/adopted. The latest hearing was on April 29, 2025.

Half the content of the bill is based on the model provided by Satoshi Action, and the other half comes from the advice of other experts. The bill currently faces certain resistance in the Senate, and some environmentalists are concerned about the noise pollution and environmental impacts caused by crypto mining.

In general, with the official signing of HB 302, New Hampshire not only takes a key step in fiscal policy, but also opens up a new situation for the legalization of Bitcoin in public asset allocation. The implementation of this bill not only demonstrates the state's policy forward-looking nature in the field of digital finance, but also may become an important historical process inspiring other states to follow suit and may become an important historical process in the era of digital currency.

chaincatcher

chaincatcher