Without compliance dividends, what is left with Coinbase?

Reprinted from chaincatcher

04/22/2025·27DAuthor: Fairy, ChainCatcher

Edited by: TB, ChainCatcher

In the moat built by regulatory advantages, Coinbase is the "golden signboard" in the field of compliance. But losing the halo of compliance, its "noble and indifference" is becoming increasingly dangerous.

The feedback from the community is ignored, the customer service is slow to respond, and the handling fees are high... These problems have made more and more users feel disappointed and dissatisfied. A question is becoming increasingly acute: Without the compliance dividend, what is left with Coinbase?

Where have individual users gone?

According to CryptoQuant, Coinbase's individual investor-dominated index is only 18.3%, far below Binance's 89.6% and Bitget's 50.1%. This index reflects the activity and influence of individual investors in exchanges relative to institutional investors. The higher the value, the greater the proportion of individual investors in the user group.

Behind this data, it reveals Coinbase's long-term strategic direction of focusing on compliance and institutionalization, and also shows that it is gradually drifting away from ordinary users, and the platform's attractiveness and stickiness to the mass market are declining. This has also been widely reflected by the community. Whether in the Chinese or English community, negative comments about Coinbase are increasing, and users' voices are increasing.

Source: CryptoQuant

Coinbase 's "Registration Metaphysics"

Some users reported that when two transactions are processed in the same block, the Coinbase system may only make one payment, and the other transaction will take several days to tug-of-war with the customer service before it can be restored. User @0x4848 said: "I said it was a bug, they said it was a feature, to protect the security of funds."

If this type of "in the name of security" problem does not have an efficient and transparent processing mechanism, it will become an overdrawn of user patience and trust.

Customer Service: Slowness is the norm

Coinbase’s customer service system has long become a “cause point concentration camp”. Many users reported that Coinbase's smart assistant was useless and could not really solve the problem.

Once manual customer service is selected, the nightmare of waiting really begins. The manual customer service authority is extremely low, and it is often only possible to "record problems and feedback upwards." According to user feedback, it takes at least 48 hours to receive a preliminary response, and a complete solution to a problem may even take a week or even longer.

In addition, some users said that their customer service communication mechanism was chaotic and inefficient. “They kept asking me for the same information via email, and I provided it, and they said they weren’t enough.” User @MattLGov said, “It’s absolutely terrible to deal with Coinbase customer service.”

Source: @0xPonga, @MattLGov

****There are scam hunting outside, and there are employees who cross the

line inside****

Coinbase users have frequently become targets of fraud. On-chain detective ZachXBT disclosed that the related cases alone caused a loss of up to $46 million in funding.

At the same time, data security issues have also been exposed within Coinbase. The Block co-founder Mike Dudas said on the X platform that he received an official email showing that an employee may have accessed some user account data in violation of regulations, including himself. "We have detected signs that an employee may have viewed a small number of customer account records in a way that does not comply with internal policies." (Related reading: A loss of $300 million a year, Coinbase users have been frequently cheated, and there is a "insider" leaking information behind it? )

The cold wind of " read can 't be replied

"

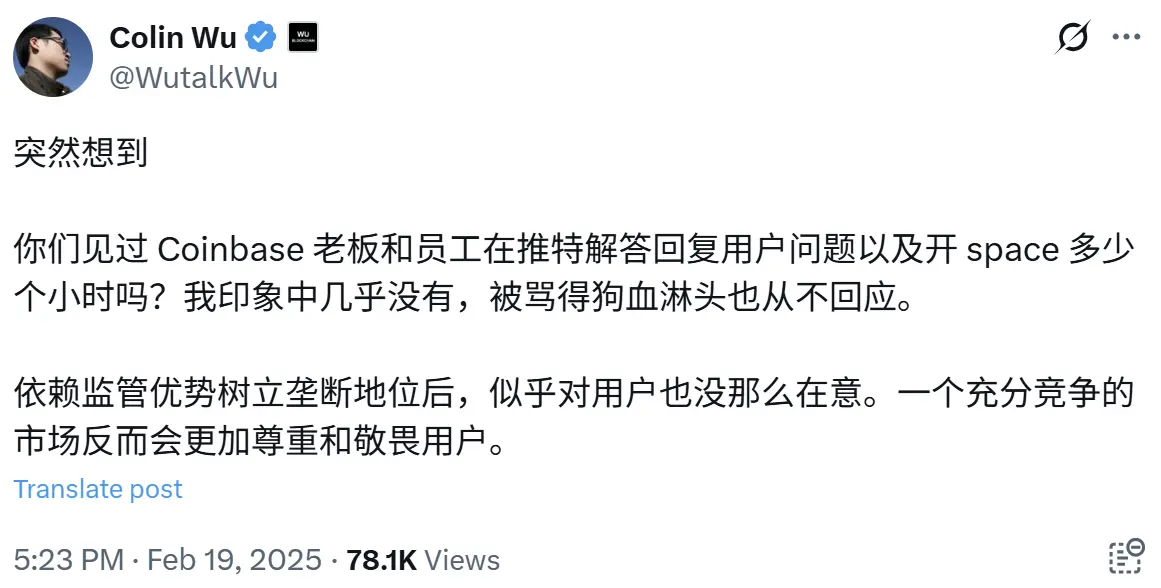

In terms of user communication, Coinbase has almost zero presence. It is not aimed at retail investors, nor has it established an effective user communication channel. Whether it is a CEO or an executive team, it rarely responds to user problems publicly on social platforms. Even when encountering a large number of complaints and doubts, it is rare to see them come forward to clarify or explain.

Behind this "silence", there may be cultural background and regulatory considerations, but the result is that users' voices are difficult to hear.

Source: @WutalkWu

" Noble " handling fee

User @hyperunit compiled the cost of purchasing 1 spot bitcoin on mainstream exchanges based on the initial fee level. The results showed that the cost of Coinbase was US$329.68, which was at a high level. In addition, community user @Tmzhao1 pointed out that if you want to obtain the same fee level as that of ordinary Binance users in Coinbase, users need to start from VIP 0, complete transaction volume of approximately US$250 million, and pay a cumulative handling fee of more than US$300,000.

Although Coinbase Pro (now Advanced Trade) offers lower handling fee options, its operating interface is relatively complex and is not familiar with or easy to use by many ordinary users.

Source: @hyperunit

Coinbase’s halo of compliance is undoubtedly the cornerstone of its firm place in the U.S. market. However, as it continues to increase its dependence on institutions, it seems to gradually fade the connection with ordinary users. On this road of pursuing compliance and security, Coinbase is quietly sacrificing user experience and giving up fine polishing of platform operations and services.

Behind this giant ship, scattered are the whispers and expectations of countless users, and their voices are gradually swallowed up in the cumbersome process and indifferent mechanism.

panewslab

panewslab