Will Shadow Exchange with x(3,3) excitation model become a Sonic DeFi engine at 20 times in three weeks?

Reprinted from panewslab

02/21/2025·2MAuthor: Penny

Currently, one of the hottest sectors in the Sonic ecosystem is Shadow Exchange, whose native token $SHADOW has risen from around US$5M in one week to currently US$31.84M, an increase of more than 500%. There are currently 457 liquidity pools on Shadow Exchange, with 7-day trading volume of US$557 million and a single-day maximum trading volume of US$171 million.

During the period when other chains focus on the Meme market continues to attract attention from various emergencies, Sonic Labs focuses on the development of DeFi, and Sonic has announced a number of new measures to inspire DeFi projects in the ecosystem, which also makes Sonic chain TVL has risen by 500% in the past month. Sonic has achieved more than $500 million in TVL in just two months, with a total of $110 million in external funds on the chain, with Solana accounting for the majority, followed by Base and ETH. The DEX trading volume on Sonic also exceeded the $1 billion mark.

Shadow Exchange is a Sonic native centralized liquidity layer and exchange. In the high-speed, low-cost EVM-compatible Layer 1 ecosystem of Sonic Chain, Shadow Exchange, as one of its core transaction protocols, has improved the traditional ve(3,3) model to x(3,3) incentive model, attracting The eyes of a large number of investors.

Familiar (3,3), but there is an extra x

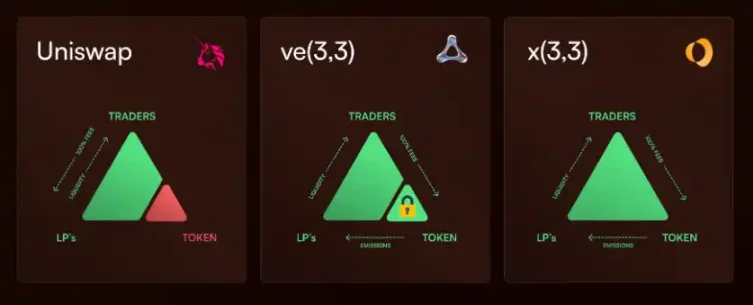

The history of decentralized finance has been marked by repeated attempts to solve the "DEX triad dilemma", namely how to coordinate incentive mechanisms between traders, liquidity providers and token holders. While Andre Cronje’s ve(3,3) model theoretically solves this problem by balancing incentives among all participants, long-term lockdown creates a high friction system that forces users to lock in tokens to participate in incentives fairly Model.

Uniswap focuses on a simple two-party system: traders and liquidity providers (LPs). ve(3,3) improve this by appropriately adjusting incentives with token holders’ interests, but it is unfair to obtain these incentives and is seriously biased towards the agreement.

And the x(3,3) model solves these problems and can exit at any time and can unlock the limits of locking through incentives. Users can participate in governance through pledge platform tokens and vote on the emission weight of the liquidity pool. Voters can receive fee sharing and additional "bribery rewards" to encourage long-term coin holders to participate in ecological construction in depth. The following figure clearly shows the entire Defi model process:

$SHADOW tokens are the most primitive tokens that can be exchanged freely with other currencies, $SHADOW can be exchanged 1:1 with xSHADOW tokens, xSHADOW tokens are the core of the entire model, xSHADOW stakers can vote to allocate the rewards directly to LP pairs, and can also receive 100% agreement fees, voting rewards and exit penalties through pledge.

In terms of user exit, Shadow implements a unique player-to-player (PvP) rebase mechanism where exit penalty flows to xSHADOW stakers. When a user exits his xSHADOW position early, 100% of the forfeited tokens will be based on their position The proportion flows to the existing xSHADOW stakers. In terms of token selection, you can claim SHADOW with better liquidity, enjoy the default APY, or non-liquid xSHADOW with 2x APY.

Users can convert xSHADOW to SHADOW at any time: convert immediately (50% fine) or convert during the vesting period chosen by the user (by ratio, for example, 3 months = 1:0.73). The longer the vesting period, the more favorable the conversion rate. A 1:1 conversion can be achieved after a full 6-month vesting period without any fines.

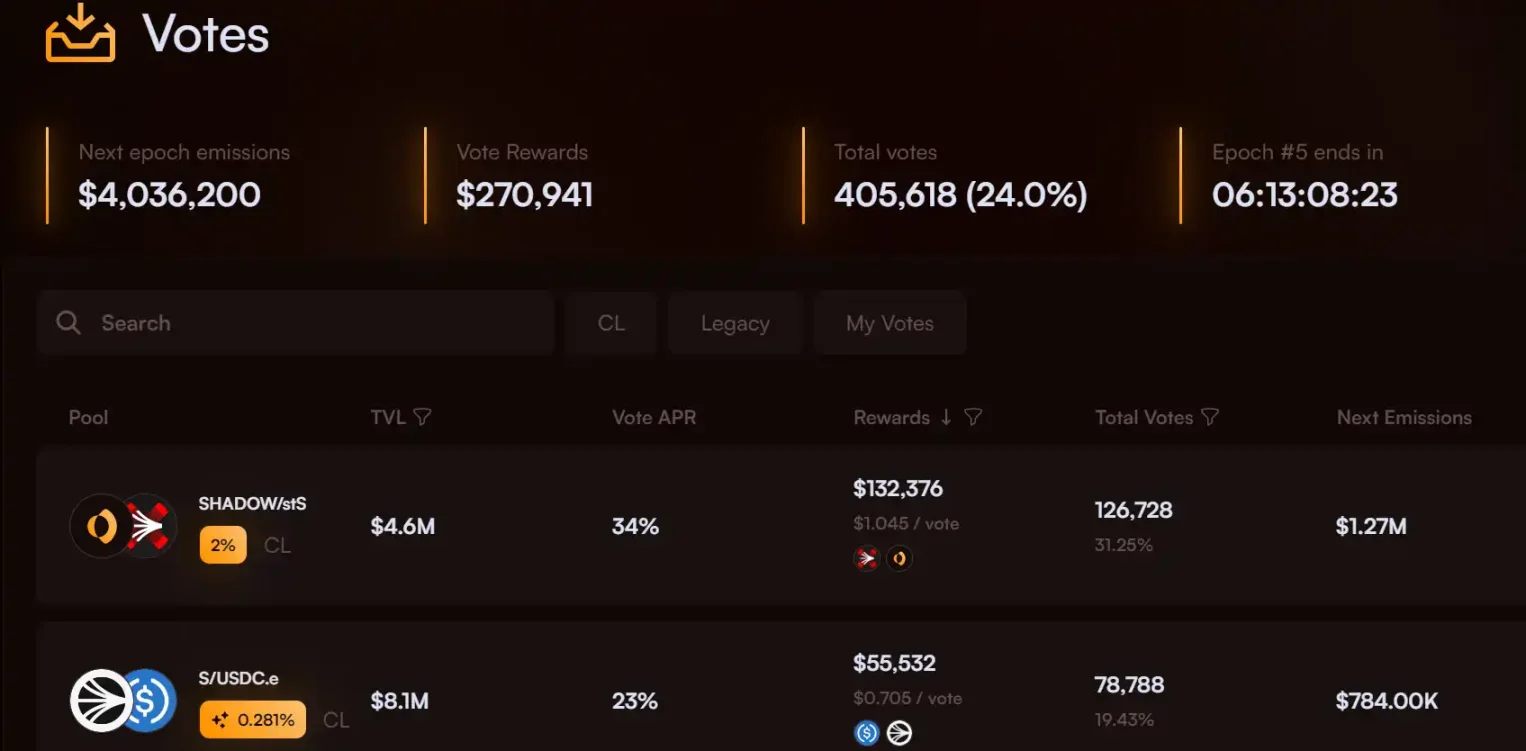

Voting incentives

xSHADOW holders receive rewards through active participation and voting. When the holder votes for liquidity through the scale, all expenses incurred by that liquidity will be shared proportionally, as well as the additional voting incentives provided by the agreement to attract participation. The main purpose of xSHADOW Tokens is to direct the issued token rewards to increase liquidity through voting, which part of the token rewards will be distributed as a percentage of the total percentage of the vote during the period. For example, 100,000 xSHADOW is distributed in a single period. If 10% of all votes are assigned to the SHADOW/USDC pair, the pair will receive 10,000 xSHADOW tokens that will be linearly allocated to the liquidity providers of the relevant LP pairs throughout the period.

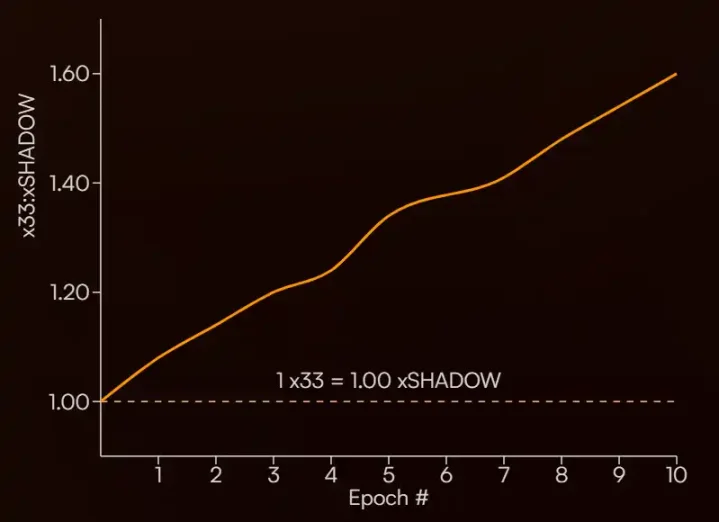

Liquidity pledge

Shadow is designed to eliminate friction in the ve(3,3) model, and managing voting positions is one of the largest sources of friction. After xSHADOW is liquid staking, $x33 can be cast, simplifying this process by automated voting and reward collection without interfering with the core mechanism of xSHADOW. The ratio of $x33:xSHADOW starts at 1.00:1.00, and this ratio will gradually tend toward $x33 as rewards accumulate from fees, voting incentives, and resets. After each cycle, rewards from fees and voting incentives are automatically sold to increase the $x33:xSHADOW ratio. Although $x33 provides instant liquidity, it still cannot avoid the exit penalty of xSHADOW. As a liquid pledged version of xSHADOW, the market price of $x33 will naturally reflect the instant exit fee structure and cannot be traded at a redemption value lower than xSHADOW.

Shadow adopts a unique player-to-player (PvP) approach, improving the traditional ve(3,3) anti-dilution model, aiming to protect xSHADOW holders from dilution, and motivate them to maintain their positions and participate in SHADOW. Continuous success. Stakers who stay in xSHADOW for longer earn more fees, voting incentives, users and emission exit rewards, and users can exit their positions at any time, ensuring that the rewards go to those who value it the most and continue to participate in it. This mechanism not only encourages avoiding premature exit, but also ensures that the remaining participants receive rewards for loyalty and active participation.

With the rapid growth of Sonic Chain TVL (13 times increased by 13 times to US$357 million from 2025 to date), and the endorsement of core developers such as Andre Cronje, Shadow Exchange is expected to rely on ecological potential energy to become a benchmark for the next generation of DeFi transaction protocols. Shadow Exchange is not only a technical test site for Sonic chain, but also a frontier for DeFi governance and liquidity innovation, providing a new paradigm for traders, liquidity providers and project parties.