Will BTC fall to a 3-month low? Will macroeconomic uncertainty trigger a rebound in BTC?

Reprinted from jinse

02/26/2025·2MAuthor: Marcel Pechman, CoinTelegraph; Translated by: Tao Zhu, Golden Finance

Between February 24 and February 25, the price of BTC fell from $95,930 to $86,010, the lowest level since November 2024. The unexpected 10.7% decline triggered more than $760 million in leveraged long liquidation, raising concerns among traders about the strength of the $90,000 support level that has been maintained in the past three months.

To determine whether the bull market in Bitcoin is truly over, it is necessary to analyze the key factors behind the recent downturn. Some analysts pointed out that the net outflow of $516 million in spot Bitcoin Exchange-traded funds (ETFs) on February 24 was the main reason. However, this explanation ignores the fact that over the first four days, the total outflow reached $553 million, but Bitcoin remained above $95,500.

Investor concerns about global economic growth and Trump tariffs lead to

sell-offs

Investor concerns about global economic growth appear to be the main driver of the recent risk market sell-off , especially after U.S. President Donald Trump confirmed plans to impose tariffs on imported products from Canada and Mexico starting in March (after the move has already been Delayed for one month).

U.S. 10-year Treasury yield (left) and DXY index (right). Source: TradingView / Cointelegraph

The 10-year U.S. Treasury yield fell to its lowest level in three months, indicating strong demand for the safest assets. Meanwhile, the dollar weakened against a basket of global currencies, reflecting this, which fell to 106.30 on February 25, the lowest point in three months.

President Trump believes that the United States is “used by foreign countries” due to unfair trade policies, including the imposition of VAT on North American products. The market responded negatively to the statement, with Elias Haddad, senior strategist at Brown Brothers Harriman, warning that “the U.S. economy is showing red flags.”

"The new U.S. administration has not yet achieved our expectations for growth," said Mark Cardmore, a macroeconomic analyst at Bloomberg News, and warned that "U.S. policy may begin to cause real economic damage."

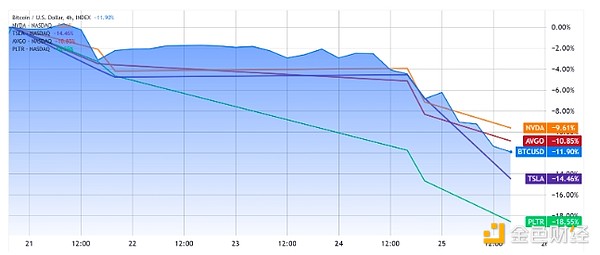

Declining confidence in the United States as the dominant economic force is often seen as a downside risk to global economic growth. Other major assets, including Nvidia (NVDA), Tesla (TSLA), Palantir (PLTR) and Broadcom (AVGO), have seen similar price drops since February 21.

Strong correlation shows that Bitcoin is still regarded as a risky asset, developing in parallel with the technology industry, which relies heavily on growth and usually does not provide dividends. However, specific events in the cryptocurrency market may lead to reduced exposure for Bitcoin traders.

OKX settlement case strengthens the view that BTC is a high-risk

investment tool

On February 24, OKX reached a settlement with the U.S. Department of Justice, agreeing to pay a $500 million fine, mainly from fees earned from institutional investors. The exchange advises individuals to provide false information to bypass regulatory procedures to facilitate more than $5 billion in suspicious transactions and criminal proceeds, the report shows.

Although it has no direct relationship with Bitcoin, this incident casts a shadow on the regulatory environment in the United States, including strategic cryptocurrency reserves. More importantly, nation-states and pension funds often have difficulty distinguishing Bitcoin from illegal financial activities involving digital assets (mainly stablecoins). Therefore, the OKX case reinforces people's perception that Bitcoin is a high-risk investment rather than a hedge tool.

There is little reason to believe that Bitcoin’s price will fall below $86,000 as governments work to curb potential recessions and push central banks to take stimulus measures. While the initial reaction may be to reduce exposure to risky assets, investors are also worried that the currency will be diluted as the currency base expands.

Therefore, Bitcoin’s tough monetary policy and censorship resistance may prevail. However, it is still uncertain how many days or weeks it will take to predict Bitcoin’s breakout of $95,000.

chaincatcher

chaincatcher

panewslab

panewslab