Will Bitcoin, “tamed” by Wall Street, eventually turn into another U.S. stock?

Reprinted from panewslab

12/28/2024·4MOriginal|Odaily Planet Daily

Author|jk

The price fluctuations of Bitcoin have long been showing two completely different trends from those of traditional financial markets. There are two completely different narratives behind this: As a risk asset, when market sentiment is high and risk appetite increases, Bitcoin often performs differently from U.S. stocks. convergence, showing a higher positive correlation. This is primarily due to increased participation from institutional investors, making it similar to other riskier asset flow patterns. However, when market panic or risk events break out, Bitcoin will be regarded as a safe-haven asset, decoupled from the trend of U.S. stocks, and even negatively correlated, especially when investors lose confidence in the traditional financial system.

These two narratives complicate Bitcoin’s role as both a risk asset and a possible safe-haven asset. Which one will it be? Especially at this point in time when Trump is about to take office?

Price Correlation: More “safe” than U.S. Treasuries

According to TradingView, over the past decade, Bitcoin has had a correlation of 0.17 with the S &P 500, which is lower than other alternative assets. For example, the correlation between the S&P Goldman Sachs Commodity Index and the S&P 500 was 0.42 during the same period. While Bitcoin’s correlation with the stock market has historically been low, this correlation has increased in recent years. Over the past five years, its correlation has risen to 0.41.

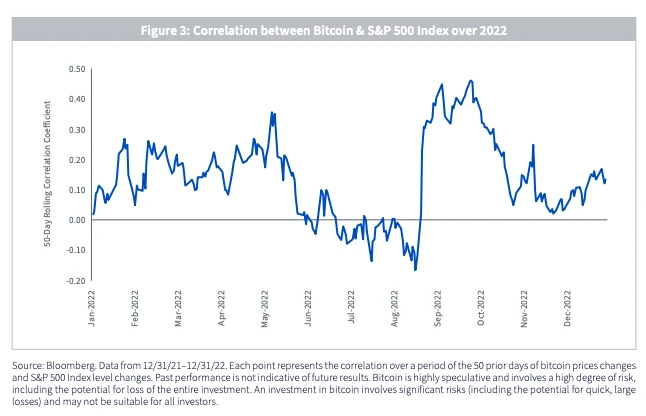

However, the strong volatility of Bitcoin makes the correlation data less reliable: the relationship between Bitcoin and the S &P 500 showed a negative correlation of -0.76 on November 11, 2023 (before and after the FTX incident). But by January 2024, it reached a positive correlation of 0.57.

In comparison, the S&P 500 has been relatively stable, with annual returns of about 9% to 10%, and serves as a benchmark for the U.S. economy. Although the S&P 500's overall return may be lower than Bitcoin's, it is more stable and less volatile.

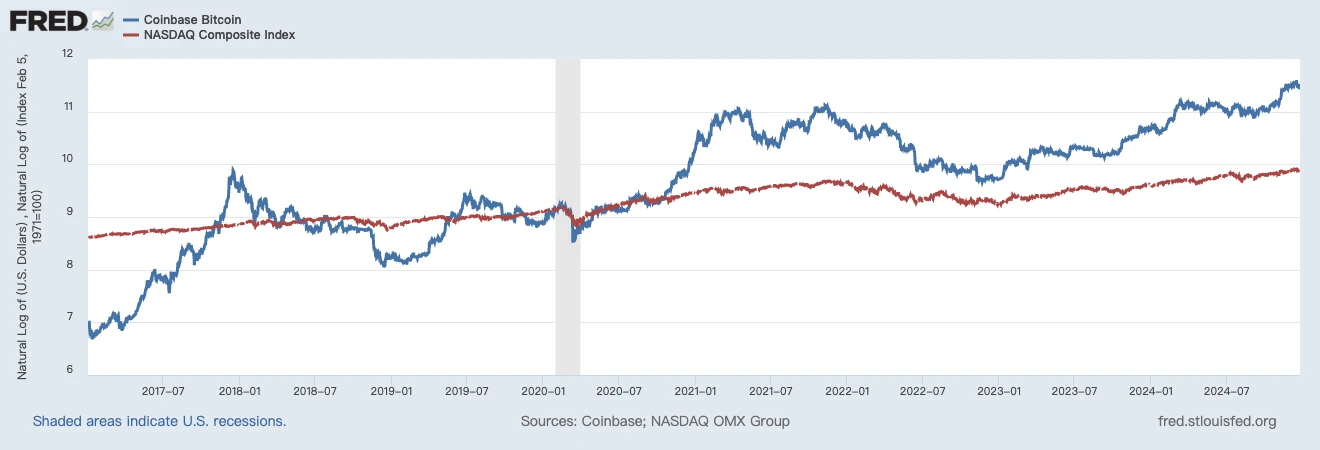

Logarithmic comparison of Bitcoin and Nasdaq. Source: FRED

It can be seen that when macro hot events occur, the two usually have a strong correlation : for example, during the market recovery after the new crown epidemic in 2020, both showed a significant upward trend. This may reflect increased investor demand for risk assets in the context of loose monetary policy.

However, in other time periods (such as 2022), the trends of Bitcoin and Nasdaq are quite different, showing a weakening of the correlation, especially in time periods that are only targeted at black swan events occurring in the crypto market. The currency will experience a unilateral plunge.

Of course, in terms of cyclical returns, Bitcoin can completely beat the Nasdaq. However, purely from the perspective of price correlation data, the correlation between the two is indeed increasing.

A report released by WisdomTree also mentioned a similar view. The report's view is that although the correlation between Bitcoin and U.S. stocks is not high in absolute terms, this correlation has been lower than the correlation between the S &P 500 Index and U.S. Treasury bonds in the near future. Return correlation.

Trillions of dollars of assets worldwide benchmark the S&P 500 or attempt to track its performance, making it one of the most closely watched indices in the world. If you can find an asset that has a relatively stable -1.0 (perfectly inverse) correlation between its returns and the S &P 500, that asset will be highly sought after. This characteristic means that when the S&P 500 index performs negatively, this asset has the potential to provide positive returns, exhibiting hedging properties.

While stocks are generally viewed as risky assets, U.S. Treasuries are considered by many to be closer to a "risk-free" asset. The U.S. government can meet its debt obligations by printing money, although the market value of U.S. Treasuries, especially those with longer maturities, can still fluctuate. An important discussion point in 2024 is that the correlation coefficient between the S &P 500 Index and US Treasuries is approaching 1.0 (positive correlation 1.0). This means that both asset classes may rise or fall simultaneously during the same time period.

Assets rising or falling at the same time is exactly the opposite of the original purpose of hedging. This phenomenon is similar to 2022, when stocks and bonds recorded negative returns at the same time, which went against many investors' expectations for risk diversification.

Bitcoin does not currently exhibit a strong ability to hedge against S &P 500 returns. From the data point of view, the correlation between Bitcoin and the S&P 500 Index is not significant. However, Bitcoin’s recent return correlation with the S&P 500 has been lower than the S&P 500’s return correlation with U.S. Treasuries. If this trend continues, Bitcoin will attract the attention of more asset allocators and investors and gradually become a more attractive investment tool over time.

From this perspective, compared with the risk-free asset U.S. Treasury bonds, Bitcoin only needs to be a safe haven asset that "runs faster than U.S. Treasury bonds". Investors will naturally choose Bitcoin as part of their investment portfolio. of an item.

The chart shows the 50-day rolling correlation between Bitcoin price and the S&P 500 in 2022. On average, the correlation is around 0.1, with highs above 0.4 and lows below -0.1. Source: WisdomTree

Institutional holdings: ETFs account for an increasing share

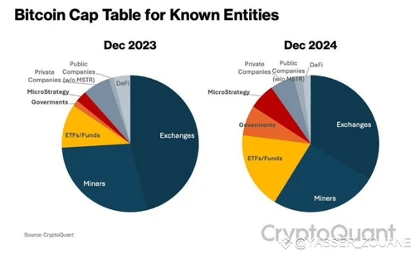

The role of institutional investors in the Bitcoin market is increasingly important. So far, the distribution of Bitcoin positions shows a significant increase in the influence of institutions on its market. This concentration trend may further promote the correlation between Bitcoin and US stock trends. The following is a specific analysis:

According to data, 19.9 million Bitcoins have been mined so far, with a total supply of 21 million, so the remaining 1.1 million have not yet been mined.

Among the mined Bitcoins, the holdings of the top 1,000 dormant addresses for more than 5 years account for 9.15%, equivalent to approximately 1.82 million coins. This portion of Bitcoin usually does not enter the circulating market, actually reducing the active supply of the market.

In addition, according to Coingecko data, the top 20 listed companies including Microstrategy accounted for 2.63% of the total Bitcoin holdings, which is about 520,000 coins. Microstrategy alone holds 2.12% of the total number of Bitcoins (about 440,000 coins).

On the other hand, according to data from The Block, as of the time of writing this article, institutional holdings of all ETFs currently reach 1.17 million.

-

If it is assumed that the number of Bitcoins in dormant addresses, the unmined quantity, and the holdings of listed companies remain unchanged, then the theoretical circulation in the market = 1990 - 182 - 52 = 17.56 million

-

Institutional holdings proportion: 6.67%

It can be seen that ETF institutions currently control 6.67% of Bitcoin circulation, and this proportion may further increase in the future as more institutions get involved. From the same period last year to this year, we can find that the share from exchanges has been significantly compressed, while the share from ETFs has further increased.

Bitcoin holdings proportion. Source: CryptoQuant

Similar to U.S. stocks, when institutional investors gradually increase their share of market positions, investment decision-making behaviors (such as increasing or decreasing holdings) will play a more critical role in price fluctuations. This market concentration phenomenon can easily cause Bitcoin price trends to be significantly affected by U.S. stock market sentiment, especially the flow of investment funds driven by macroeconomic events.

"Americanization" process

The impact of U.S. policy on the Bitcoin market is increasingly significant. As for this issue, there are more unknowns at present: according to Trump’s current acting style, if encryption-friendly people occupy important decision-making positions at key policy nodes in the future, such as promoting a looser regulatory environment or approving more and Bitcoin-related financial products, the adoption rate of Bitcoin is bound to further increase. This deepening of adoption will not only solidify Bitcoin’s status as a mainstream asset, but may also further narrow the correlation between Bitcoin and U.S. stocks, two assets that reflect the direction of the U.S. economy.

To sum up, the correlation with U.S. stocks is gradually increasing. The main reasons include the common reaction of prices to macro events, the significant impact of institutional positions on the market, and the potential impact of U.S. policy trends on the market. From this perspective, we can indeed use the trend of US stocks in the future to judge more trends for Bitcoin.

chaincatcher

chaincatcher

jinse

jinse