Will Babylon give birth to the arrival of BTCFi Summer?

Reprinted from jinse

04/28/2025·14DAuthor: Haotian

How do you view the subsequent market impact of @babylonlabs_io after the main network is launched? There is no doubt that it will set off a wave of staking for the Bitcoin ecosystem just like Egenlayer to Ethereum, and will give birth to the arrival of BTCFi Summer.

So, how exactly does Babylon work? What is the difference between it and Eigenlayer? What are the potential highlights of the Babylon ecosystem? Where are Babylon’s weaknesses? Next, let me talk about my understanding:

Understand Babylon thoroughly

Simply put: Babylon has implemented a secure, cross-chain-free, and custodial- free Native Staking solution for a number of POS chains such as BTC layer2 by building complex UTXO script contracts on the Bitcoin main network. How to do it specifically?

Traditional solutions to achieve the effect of pledging assets of a POW chain to produce Yield, and rely on Third Party to provide asset custody, and then the 1:1 assets of Wrapped are circulated in the new POS chain. (For example: WBTC). The trust crisis caused by WBTC a while ago exposed the biggest shortcomings of this solution.

Babylon has built a system that uses Bitcoin chain for remote staking. It uses a scripting language to design Covenant to lock BTC on the main Bitcoin network, and then remotely manages and dispatches assets through the Babylon Chain built by the Cosmos SDK to realize subsequent functions:

-

The pledge, unbinding, withdrawal, etc. defined by the script contract must be operated by Validators on Babylon Chain strictly in accordance with the rules defined by the script (such as: EOTS signature scheme, final round multi-sign consensus, etc.), that is, the Babylon Chain's verifier node can safely and decentralize the assets remotely locked on the Bitcoin main network;

-

Babylon abstracts Validators' verification and coordination capabilities into a capability that can deliver security consensus to other POS chains, providing native security features to other modularly compatible POS chains in the form of "security as a service".

In this way, other POS chains will generate corresponding Yield returns to make the BTC assets pledged by Babylon generate returns. Theoretically, the greater the demand for this security service of POS chain, the greater the imagination space for Babylon staking to generate interest.

Babylon VS Eigenlayer

- The Babylon protocol is a connector that leads to the BTC mainnet and other POS chains. Its goal is to criticize the lack of Yied assets of BTC POW chain and the lack of decentralized BTC hosting services for other POS chains, so that BTC assets can access other POS chains in a Native way and generate expected returns. Therefore, Babylon's service objects are mainly assets with invincible consensus in the BTC universe, providing a technical framework and possibility for it to generate returns.

Eigenlayer packages the verification service capabilities of Ethereum Validators into products. On the one hand, Ethereum layer2 or other modular POS chains can connect to Ethereum's super Validators verification capabilities. On the other hand, the Yield benefits generated by these POS chains can amplify and enhance the original Ethereum nodes. Therefore, Eigenlayer's goal is to commoditize the output of Ethereum Validators' entity verification service capabilities to amplify the revenue capabilities of native Ethereum.

- Babylon's "Security as a Service" is no different from Eigenlayer's "AVS as a Service" from business logic, but the slight difference is that the requirements provided by Babylon are more rigid. If other POS chains are not connected to Babylon, they will be criticized for their "centralization" in hosting methods.

In contrast, Eigenlayer has amplified the leverage mechanism of Ethereum's original Staking income. Although it can stimulate the prosperity of the Restaking platform in the short term, there will be a game between the returns from exporting security consensus and the LRT points war. If the real commercialization income is not as good as the speed of the LRT platform's superimposed leverage, the Staking income effect will be backfired.

What are the follow-up highlights of Babylon ecosystem?

The launch of Babylon will definitely have a stimulating and catalytic effect on the long-sluggish BTC layer2 market, with two main effects:

-

It can allow many project parties that originally combined with CeFi to conduct a technical "upgrade" to eliminate the criticized centralization problem, and make the slogan of asset interest revenue easier to gain market trust.

-

It can bring direct commercial vitality to many BTC layer two-layer POS chains. On the one hand, BTC interest generation will accelerate the TVL accumulation speed of some POS chains, allowing the TVL points war to continue further. On the other hand, in addition to BTC interest generation, there will also be various gameplay such as LSD, LRT platform + DeFI combination interest generation.

The potential Babylon+ subsidy war on various platforms will also bring continuous popularity to the BTCFi track, which will be comparable to the Restaking craze brought by Eigenlayer.

@SolvProtocol, with the positioning of a decentralized Bitcoin reserve center, Solv has grasped the current situation of overly diversified BTC assets and quickly accumulated nearly 20,000 BTC. After Babylon is launched, SolvBTC.BBN will achieve expected growth;

@Bedrock_DeFi, incubated in the BNBChain ecosystem, supported by OKX Ventrues, as one of the leading projects of the Babylon ecosystem, the recent UniBTC's achievements and Babylon points are expected to have strong returns;

@LorenzoProtocol, introduced the concept of liquidity staking, where users can participate in pledge and receive rewards without locking in funds. Its principal and interest separation characteristics are similar to Pendle, and the combination of liquidity principal tokens LPT + income accumulation token YAT is eye-catching;

In addition, many platforms including @BSquaredNetwork, @Lombard_Finance, @ChakraChain, @BotanixLabs, etc. will show off their muscles one after another in this wave of Babylon ecological boom.

Babylon's "weakness"?

There is no doubt that the launch of Babylon has brought more positive impacts on the BTC ecosystem, but it is not impossible to find the "weakness".

Objectively speaking, the security consensus provided by Babylon depends on its Cosmos SDK chain, and is not directly controlled and dispatched by scripts on the BTC main chain, which is naturally limited to the scope of "asset management".

Therefore, relying on Babylon, many "Blast-like live-generating derivative projects" can be generated. It is difficult to grow Starkent and Arbitrum comprehensive chain projects for the BTC ecosystem.

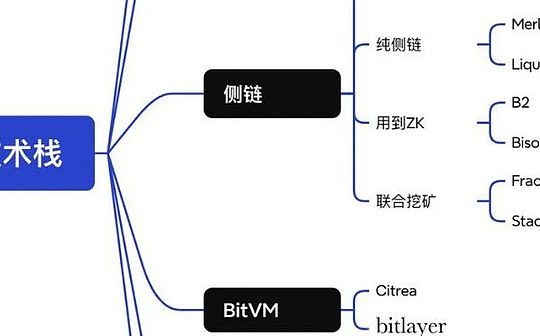

The logic is also relatively simple. If a BTC layer2 chain relies on Babylon to provide security consensus, it is equivalent to castrating the sovereignty of the layer2 chain, which is not conducive to the subsequent complex ecological construction. I have analyzed in a long article before that there are many more technical frameworks that can make up for this problem:

-

zkVM general protocol framework, @ProjectZKM utilizes zk's credible characteristics in cross-chain interoperability, and uses zk technology to build @GOATRollup, implements ZK Bridgeless cross-chain, Entangled Rollup Network interactive communication layer, etc., which is equivalent to using ZK technology to build a set of Cosmos IBC cross-chain communication components to help the BTC ecosystem prosper. This is a more general BTC underlying Native technology solution, which can be suitable for most sovereign BTC layer2 chain applications;

-

UTXO Stack structure framework, this BTC layer2 solution extended by the @NervosNetwork CKB team based on RGB++, allows BTC and its derivative assets to be circulated on the CKB chain through isomorphic binding, which is equivalent to reconstructing a BTC execution VM environment to support the subsequent programmable complex features required;

In addition, the MoveVM global state high-level language execution architecture provided by @RoochNetwork, as well as the @atomicalsxyz AVM virtual machine framework, etc., can all become the successors of the development of the BTC layer2 market.

If Babylon can provoke the first wave of BTCFi livelihood, and more projects with solid technical foundation and good innovation will take over the second wave, this is the prosperous scene of BTC layer2 that I am looking forward to.

In short, Babylon has no "weakness", but the BTC layer2 market cannot rely solely on Babylon. Please firmly believe that the BTC ecosystem must have its own Summer.