Why does CZ like Kyrgyzstan so much? A quick look at the country's crypto assets tax and regulatory system

Reprinted from panewslab

05/12/2025·20D1 Introduction

Since the Kyrgyz State Investment Agency signed a memorandum of understanding with Binance co-founder Zhao Changpeng (CZ), in early April, preparing to cooperate on crypto assets and blockchain technology, the Kyrgyz government has frequently interacted with CZ. On May 5, CZ posted the local license plate of "888BNB" on social media and wrote to praise it. In the same period as this news, the Kyrgyz president released a tweet meeting with CZ and invited CZ to join the National Crypto Commission, while CZ suggested that Kyrgyzstan include BNB and BTC in the national cryptocurrency reserves. So, why does CZ like Kyrgyzstan so much? What are the characteristics of the country's tax and regulatory system involving crypto assets? This article will reveal the answer to you.

1.1 Country profile

The Kyrgyz Republic (English: Kyrgyz Republic, referred to as "Kyrgyz Republic") is located in northeastern Central Asia, at the junction of central Asia, Western Europe and East Asia, and the capital is Bishkek. The Mandarin of Kyrgyzstan is Kyrgyz, and the official language is Russian. The currency is Kyrgyzstan Som (referred to as "Som"). Kyrgyzstan has made significant progress in the field of crypto assets in recent years. It has actively formulated crypto asset regulations to support the development of digital technology and blockchain ecosystem. It is a leader in the development of digital asset supervision and market size in Central Asia and a core area of the crypto industry.

1.2 Qualitativeness of crypto assets

According to the definition of the Kyrgyzstan Virtual Assets Law, virtual assets are a set of data in electronic digital form, with value, a means of digital expression of value and a means of proof of property or non-property rights, created, stored and circulated using distributed ledger technology or similar technologies, rather than monetary units (currency), means of payment and securities. Crypto assets are a type of virtual assets.

2 Tax Policy

2.1 Overview of the tax system

The legal system of Kyrgyzstan was developed within the framework of the laws of the former Soviet Republic and, in many ways, has similarities with the legal systems of the Russian Federation and other former Soviet Republics. Overall, its legal system can be divided into four levels: constitutional laws, codes, laws and regulations. After Kyrgyzstan's independence, its legal system has been further revised and improved, and a series of laws covering various fields have been promulgated, including the new Constitution, Civil Law, Foreign Trade Law, Tax Law, and Investment Law.

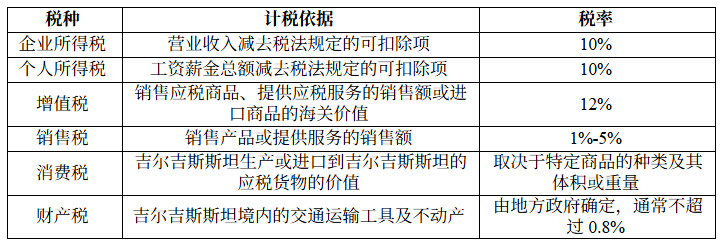

Specifically in terms of taxation, the Kyrgyzstan tax authorities manage taxpayers in accordance with the tax collection and management procedures in the Kyrgyzstan Tax Code (hereinafter referred to as the Tax Code). Taxpayers shall also comply with the requirements of the Tax Code and fulfill their own tax obligations in accordance with the law. The taxes in Kyrgyzstan are mainly composed of income tax, circulation tax and other small taxes, including central taxes such as corporate income tax, personal income tax, value-added tax, sales tax, consumption tax, underground resource use tax, as well as local taxes such as property tax and land tax. In addition, the Tax Code also introduces a variety of tax systems, including a simplified tax system based on a single tax type, digital currency mining tax, e-commerce tax, entertainment tax, special business license tax, special trade zone operating tax, special tax system for free economic zones and special tax system for high-tech parks.

Corporate income tax: 1) Resident enterprises. A legal entity and self-employed person established and registered in accordance with the laws of Kyrgyzstan is a resident entity (including resident enterprises and non-enterprise units, institutions and organizations, etc.). A partnership is a transparent entity in Kyrgyzstan's law. The profits obtained from the partnership are regarded as the profits of the participants of the enterprise, and the partnership itself does not need to pay corporate income tax. The scope of collection is the corporate income tax paid for the total annual income it has obtained worldwide. Special Economic Zones usually provide preferential policies to reduce corporate tax burden and implement a free monetary management system. However, a special incentive fee will be charged based on the location of the company, at 0.1% to 2% of the revenue. Kyrgyzstan exempts resident enterprises in innovative technology parks that meet the conditions from corporate income tax. 2) Non-resident enterprises. Enterprises established in accordance with foreign laws and non-resident individuals who need to register as self-employed persons in Kyrgyzstan are tax-free non-resident enterprises in Kyrgyzstan. Specifically, non-resident enterprises with permanent institutions in Kyrgyzstan, and non-resident enterprises with permanent institutions in Kyrgyzstan, which have income from Kyrgyzstan. The scope of collection is the income derived from Kyrgyzstan.

Personal income tax: 1) Resident taxpayer. Any individual who lives in Kyrgyzstan for 183 days for any consecutive 12 months is a resident taxpayer of Kyrgyzstan. Individuals who perform official duties for Kyrgyzstan abroad are also considered taxpayers of Kyrgyzstan residents. Foreign citizens who have Kyrgyz nationality and who have obtained permanent residence or returned overseas Chinese certificates among Kyrgyzstan’s resident taxpayers should pay personal income tax in Kyrgyzstan for the income they have obtained from the world. If an individual who meets the criteria for judging a resident taxpayer does not have Kyrgyz nationality and does not obtain permanent residence or a certificate of return, he or she will only pay personal income tax on his or her income from Kyrgyzstan. Self-employed individuals do not need to pay personal income tax, but should pay corporate income tax. 2) Non-resident taxpayer. Individuals who have lived in Kyrgyzstan for less than 183 days for any consecutive 12 months are non-resident taxpayers in Kyrgyzstan. Non-resident taxpayers should pay personal income tax on their income derived from Kyrgyzstan.

VAT: Taxpayers include enterprises and individuals who sell taxable goods and provide taxable services in Kyrgyzstan; enterprises that import taxable goods; foreign companies that provide labor, services and services in Kyrgyzstan and provide services in electronic form (including e-commerce services to individual residents of Kyrgyzstan). According to the tax law, in addition to enjoying preferential VAT policies, VAT is required to pay VAT sales and taxable goods and services in Kyrgyzstan. At the same time, imported taxable goods also require value-added tax, and the tax calculation basis is the customs tax-paid price of imported goods. There is no VAT required for selling crypto property.

Simplified tax based on single tax: From January 2024, the income cap of 30 million Som has been cancelled. Except for a few industry entities that still cannot apply for the simplified tax system based on single tax, taxpayers of any self-employed and enterprise (except for foreign companies that do not have permanent institutions in Kyrgyzstan) can apply for the application. The basis for tax calculation of a single tax is usually sales income, and there are special provisions on the basis for taxpayers engaged in special business types.

Special tax system tax preferentially: 1) Special tax system in free economic zones. Taxpayers registered in the Free Economic Zone shall apply to the special tax system of the Free Economic Zone. Except for some special circumstances, taxpayers who apply the special tax system of the free economic zone are exempted from the tax obligation of all taxes and only need to fulfill their obligation to pay social security payments. The special tax system in the free economic zone does not add new tax obligations, so the tax system itself does not involve tax declaration and payment. 2) Special tax system for high-tech parks. Taxpayers registered in high-tech parks are subject to the special tax system for high-tech parks. Taxpayers in high-tech parks are exempt from tax obligations for corporate income tax, sales tax and value-added tax, but tax obligations for other tax types still need to be fulfilled in accordance with general regulations. The special tax system in high-tech parks also does not add new tax obligations, so the tax system itself does not involve tax declaration and payment.

Overall, in order to better promote economic development, Kyrgyzstan has continuously simplified the tax system in tax management, optimized the tax structure, and introduced digital tools to establish a more efficient and fair tax system and improve tax transparency and compliance.

2.2 Crypto Tax Policy and Latest Updates

According to the government decree issued on August 1, 2020, Kyrgyzstan has implemented a special tax system for entities that conduct business in the crypto assets field and imposed crypto mining tax. The Tax Code stipulates that companies and individuals who use software and hardware to perform calculation operations mining activities should pay crypto mining tax instead of income tax. The taxpayer shall submit an application as a mining tax taxpayer to the tax authority at the place of tax registration. The tax base of the crypto mining tax should be the accrued amount of electricity consumed during the mining process, including value-added tax and business tax, with a tax rate of 15%.

The excess income amount of the sale of crypto assets exceeds its purchase cost, and the value of crypto assets obtained free of charge, are all part of the taxpayer's annual total income and income tax is required to be paid according to regulations. Among them, the country defines the sale of crypto assets as: converting crypto assets into their own or foreign currencies. The exchange of one crypto asset with another is not considered for sale. The applicable income tax rate is 10%.

VAT is not imposed on sale of crypto assets in Kyrgyzstan. However, when selling goods, engineering and services that are exempt from VAT, the trade activities and production departments pay 2% sales tax, and the rest are charged 3% sales tax. According to the provisions of Islamic Finance, when selling stocks, organizational interests, currency, crypto assets, fixed assets, and goods, the tax base is the sale proceeds minus the acquisition cost.

It is worth noting that on October 15, 2024, the Financial Market Supervision Bureau of the Ministry of Economy and Commerce of Kyrgyzstan announced the commencement of the legislative supervision and solicitation of suggestions from relevant parties on the "Resolution on Amending the Resolution of the Government of the Kyrgyz Republic No. 159 of April 15, 2019" and soliciting suggestions from relevant parties. The aim is to ensure the country's non-tax revenue by increasing the national tax rates for non-bank financial enterprises (such as crypto asset exchange operators, insurance institutions, professional participants in securities markets, pawn shops and organizations engaged in crypto asset mining). In particular, financial stability is improved by imposing higher taxes on high-risk industry participants such as crypto assets, insurance companies and securities.

3 Crypto Asset Supervision News

3.1 Crypto Asset Supervision Policy

In 2022, Kyrgyzstan passed the Virtual Assets Act, laying the regulatory foundation for the creation, issuance, storage and circulation of crypto assets. Promoting the booming development of Kyrgyzstan's crypto asset industry, it stands out among Central Asian countries with its positive attitude towards crypto assets and blockchain. The Virtual Assets Law clearly defines the crypto asset service provider (VASPs) license system, which is uniformly supervised by the State Financial Market Supervision Service Bureau. This allows service providers to easily enter the market and regulators to better regulate. As of January 31, 2025, the Financial Regulatory Bureau has issued 144 operating licenses for crypto asset service providers. Of the total number of licenses issued, 8 licenses were issued to crypto asset trading operators, and the remaining 138 licenses were issued to crypto asset exchange operators.

On January 10, 2025, in order to improve the efficiency of crypto asset service providers, the resolution of the Kyrgyz Republic Ministers' Meeting of the Kyrgyz Republic's cabinet on December 31, 2024 was passed. The main changes include: 1. Increase requirements for crypto asset transaction operators. It includes requirements for customer identity identification and verification, announcement of exchange rules, verification of the reputation of benefiting owners, etc.; prohibit transactions through unlicensed operators and use more confidential crypto asset wallets; and requires 2,000,000 calculation indicators for the minimum authorized capital of operators trading crypto assets. 2. Activities requirements of crypto asset exchange operators. Requirements for verifying the reputation of benefiting owners, conducting annual audits and notifying authorized institutions; prohibiting the use of prepaid cards of foreign financial institutions and transfer of crypto assets to addresses in online casinos and decentralized systems; the minimum authorized capital for crypto asset exchange operators is set to 1,000,000 calculation indicators. 3. The regulatory regulations on the issuance of crypto assets have changed. The possibility of issuing crypto assets through private placement is ruled out; the possibility of nominating the issuer of crypto assets in foreign currency has been determined.

Since the Virtual Assets Act 2022 has established a clear legal framework for crypto activities, Kyrgyzstan has also demonstrated its active preparation and open attitude towards the crypto industry by promoting the inclusion of crypto banking technology into its banking system, digital payments and financial regulations. In October 2024, the Kyrgyz Ministry of Economic Affairs initiated and submitted a bill to the Parliament on the establishment of crypto banks in Kyrgyzstan. The bill proposes to amend the current crypto asset legislation, requiring crypto banks to provide one or more banking services related to crypto assets for legal entities registered in Kyrgyzstan under a license issued by the Kyrgyzstan Banking and Banking Activity Law. After obtaining a license, crypto banks have the right to carry out any type of digital asset-related activities stipulated in this Act without obtaining an additional license. Crypto banks do not need a separate license to conduct banking. Creating a crypto bank will ensure user rights are protected, thereby reducing the risk of fraud and unauthorized access to funds. Crypto banks will also become the implementation platform for new financial technologies such as smart contracts and DeFi, helping to modernize the financial system.

It is worth noting that in February 2025, the Financial Market Supervision Bureau of the Ministry of Economy and Commerce of Kyrgyzstan announced the commencement of legal supervision of crypto asset service provider activities and the collection of suggestions from relevant parties. The overall approach to regulating the crypto asset market is to ensure transparency, security and protection of market participants. The proposed regulations will involve amending and revising norms of regulatory conduct to adapt the legal framework to the development trends of the crypto asset market and to create a clearer and more stable legal environment for participants in the crypto asset market. And promote crypto asset service providers to establish internal controls. This heralds Kyrgyzstan will introduce stricter regulatory policies to further improve transparency in crypto asset transactions. The introduction of proposed regulations will also help combat terrorist financing and money laundering and improve their operational efficiency.

3.2 Latest news in the local crypto industry

The Kyrgyz Ministry of Finance has created the first national crypto asset exchange Coin National Exchange, which is the first country in Central Asia to establish a national crypto asset exchange. The exchange officially entered the Ministry of Justice Registration on December 30, 2024, and its main business is financial market management. The Kyrgyz Stock Exchange, BTS Exchange, EVDE General Exchange and many crypto asset exchanges currently fall into this category. According to a Ministry of Finance document, 100 million KGS is allocated from the Republic's budget as the initial authorized capital for Coin National Exchange.

To continue to consolidate its position as a regional crypto-center, Kyrgyzstan actively supports the development of stablecoins. In April 2025, Kyrgyz company Old Vector issued a stablecoin A7A5 pegged to the Russian ruble, which remained 1:1 pegged to the Russian ruble. The A7A5 was issued in accordance with newly approved encryption regulations in Kyrgyzstan and supported by the government. According to the official white paper, the project reserve report is updated weekly, and independent companies conduct external audits quarterly to ensure adequate accountability and trust. A7A5 generates income from interest income and automatically distributes 50% of the income to all token holders when they receive bank deposit funds every day, and holders can receive these distributions without performing any.

In terms of stablecoins and CBDC, Kyrgyzstan has previously launched the stablecoin Gold Dollar (USDKG), which is pegged to gold and the US dollar. Unlike other stablecoins, USDKG is a 1:1 dollar-anchored, gold-backed stablecoin, and the country's finance ministry's role is limited to providing gold reserves. The rest of the development, auditing and maintenance are done by private companies and individuals. This move may better promote the normative transparency of crypto ecosystems, modernize infrastructure, promote cross-border trade, and attract international investment. In addition, in mid-April this year, the Kyrgyz president also signed a bill to give the "Digital Somme" legal status, and if Kyrgyzstan ultimately decides to issue CBDC, then the Digital Somme will become the country's legal currency.

4 Summary and Outlook

Kyrgyzstan actively promotes the development of the crypto industry, focuses on optimizing tax policies for crypto assets, a clear tax system and competitive tax rates, which not only enhances Kyrgyzstan's attractiveness in the global crypto asset market, but also creates stable and favorable operating conditions for investors and market participants. At the same time, both the previous regulatory reforms and frequent interactions with CZ show Kyrgyzstan's friendly attitude towards crypto assets. We believe that in the context of rapid growth of the global crypto asset industry, Kyrgyzstan's relevant tax and regulatory systems will help it create competitive advantages in the crypto asset field, especially with the development of crypto banks, national exchanges and stablecoins in the country, Kyrgyzstan's crypto assets will further integrate with the traditional financial system to promote the development of innovative infrastructure in the country and even the Central Asian region and the booming industry in the overall industry.