Why did Tether USDT market cap and trading volume drop?

Reprinted from jinse

01/06/2025·5MAuthor: Helen Partz, CoinTelegraph; Compiler: Bai Shui, Golden Finance

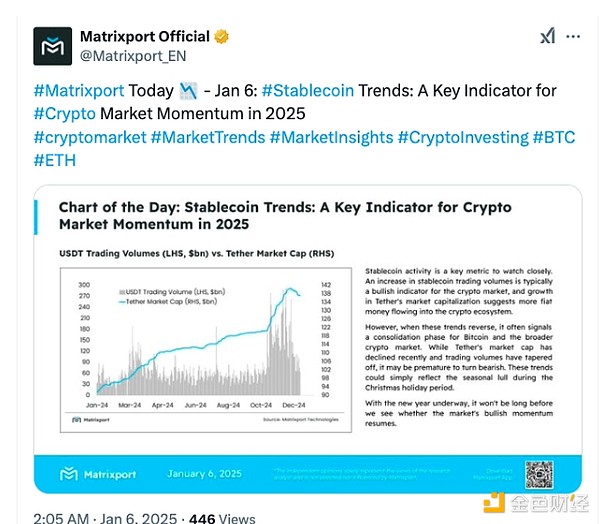

Crypto financial services platform Matrixport said that Tether USDT’s market capitalization and trading volume have fallen by billions of dollars recently, but this is not enough to indicate bearish signs in the market.

The market value of Tether’s USDT stablecoin has fallen by 2.8% since peaking at $141 billion on December 19, 2024, according to CoinGecko.

USDT trading has also fallen sharply in the past few weeks, with daily trading volume plummeting 64% from approximately $154 billion in mid-December to $55 billion on January 6, 2025.

However, Matrixport stated in an X post on January 6 that USDT’s downward trend may be the result of a holiday trading slowdown and should not be related to a bearish turn in the cryptocurrency market.

Matrixport predicts bullish momentum will resume soon

In the article, Matrixport mentioned that an increase in stablecoin trading volume is generally a bullish indicator for the cryptocurrency market, reflecting more fiat currencies flowing into the ecosystem.

“However, when these trends reverse, it often signals a consolidation phase for Bitcoin and the broader cryptocurrency market,” Matrixport reported.

Source: Matrixport

Matrixport wrote: “While Tether’s market capitalization has declined recently and trading volume has tapered off, it may be too early to be bearish.”

" These trends may simply reflect the seasonal downturn during the Christmas holiday period. We will soon see if the market's bullish momentum resumes as we head into the new year."

Matrixport isn't the only company highlighting the current holiday illiquidity.

On January 4, CryptoQuant analyst Axel Adler said that Bitcoin needs to accumulate more trading volume to generate strong bullish momentum, which may appear after the market recovers from the holidays.

Community slams FUD surrounding Tether and MiCA

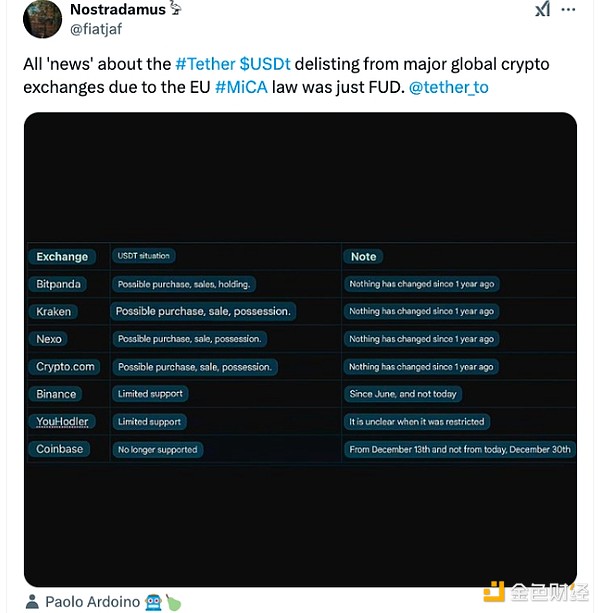

Matrixport’s comments about Tether come as the community reacts to earlier reports linking USDT’s market decline to the full implementation of the European Union’s Market Regulation in Crypto-Assets (MiCA).

While some online reports suggest that European cryptocurrency exchanges should delist Tether’s USDT by December 30, 2024, local regulators have yet to give such guidance.

The European Securities and Markets Authority (ESMA), the main watchdog for MiCA compliance, has repeatedly declined to comment on the status of USDT under MiCA, even after the December 30 deadline.

After Coinbase delisted USDT, USDT trading also continued across Europe, with exchanges such as Binance saying at the end of 2024 that they would continue to support USDT on the platform until further notice.

Source: Nostradamus

Many community members on X have slammed reports of USDT being delisted from major EU exchanges, calling such reports fear, uncertainty and doubt (FUD).

One industry observer wrote on X on January 6: “All the ‘news’ about Tether USDT being delisted from major global cryptocurrency exchanges due to the EU MiCA bill is just FUD.”

chaincatcher

chaincatcher

panewslab

panewslab