Why did Bitcoin price fall after Trump reaches a Sino-US tariff agreement

Reprinted from jinse

05/13/2025·1MAuthor: Marcel Pechman, CoinTelegraph; Translated by: Deng Tong, Golden Finance

summary:

-

Investors turned to stock markets after China and the United States reached an agreement that could end the current trade war, and Bitcoin lagged behind.

-

The macroeconomic environment is shifting from gold investment to stock markets.

On May 12, the price of Bitcoin reached $105,720, a high in more than three months, but then failed to maintain its upward momentum. It is worth noting that the price of Bitcoin fell to $102,000, and the previous tariff conflict between China and the United States eased. This confuses traders why Bitcoin reacts negatively to seemingly positive progress.

The 90-day truce agreement lowered import tariffs, and U.S. Treasury Secretary Scott Bescent pointed out that the agreement could be extended as long as the two sides make sincere efforts and engage in constructive dialogue. According to Yahoo Finance, the topics discussed include "currency manipulation", "steel price dumping" and semiconductor export restrictions.

Bitcoin/USD (orange) vs. S&P 500 futures (red) and gold (blue). Source: TradingView / Cointelegraph

Part of the reason Bitcoin’s lack of momentum in recent days is that it has risen 24% over the past 30 days, while S &P 500 futures rose 7% over the same period and gold prices remained flat. Investors believe that further differentiation between Bitcoin and traditional markets is unlikely, especially given that its 30-day correlation with the stock market is still as high as 83%.

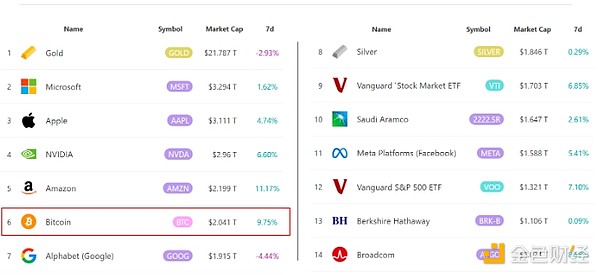

In addition, Bitcoin's market value has now surpassed Silver and Google, becoming the sixth largest tradable asset in the world.

The world's largest tradable asset: USD. Source: 8marketcap

News that Strategy acquired 13,390 more BTC between May 5 and May 11 has also raised concerns among investors. With BlackRock and Strategy holding 1.19 million BTC, accounting for about 6% of the circulating supply, some traders are concerned that Michael Saylor's company is primarily responsible for the support of Bitcoin prices.

Critics such as Peter Schiff predict that Strategy's rising average purchase price could eventually lead to losses and force the company to sell some of its holdings to cover the cost of borrowing. However, this seems unlikely to happen, as the company has doubled its capital increase limit, which includes $21 billion in stock and $21 billion in debt.

Macroeconomic events are good for stock markets rather than gold, Bitcoin

price stagnates

While traders often focus on Bitcoin-specific events, the most likely reason for Bitcoin’s weakening around $105,000 is the broader macroeconomic situation. Although the suspension of tariffs directly benefits the stock market, the impact on scarce assets such as Bitcoin is slightly negative. For example, gold prices fell 3.4% on May 12 as demand for safe-haven assets fell.

Gold/USD (left) vs USD Index (right). Source: TradingView / Cointelegraph

Gold usually has an inverse relationship with the US dollar index (DXY), which climbed to its highest level in 30 days on May 12. Although U.S. gross domestic product (GDP) fell 0.3% in the first quarter and sales of homes for sale increased by 6.1% month-on-month in March, a stronger dollar showed increased investor confidence.

When the price of Bitcoin approaches $105,000, investors lack confidence, at least in part because of the reduced demand for scarce assets, as investors see the stock market as a more direct beneficiary of the Sino-US trade deal. Lower import tariffs mean higher business revenues and may increase profit margins.

Given that the U.S. spot Bitcoin exchange-traded fund (ETF) flowed in an astonishing $2 billion between May 1 and May 9, the probability of Bitcoin price falling below $100,000 is still low. After a 24% increase in the month, stable demand for Bitcoin shows that institutional investors adoption rather than retail investors’ “fear of missing out” (FOMO), which is a very positive signal for Bitcoin prices.

panewslab

panewslab