Who are the eight crypto companies that announced their expansion in the US market?

Reprinted from jinse

05/12/2025·25DAuthor: Aaron Wood, CoinTelegraph; Compilation: White Water, Golden Finance

Cryptocurrency service platform Nexo announced plans to return to the U.S. market on Monday, the eighth large cryptocurrency company to announce such plans since U.S. President Donald Trump took office early this year.

Companies such as Circle, Binance and OKX all hope to clarify regulatory policies in 2025 to herald their expansion in the United States. Bills such as the Stability Act and the GENIUS Act are being advanced in Congress and, if implemented, will lay the foundation for the rapid success of Nexo.

Trump and his family are actively involved in some of these expansion plans. Nexo's recent statement was backed by Donald Trump Jr., who said: "We see opportunities in the financial industry and want to make sure it is brought back to the United States."

Due to conflicts of interest and blatant token marketing practices in the Trump family, it remains to be seen whether these upcoming regulations can fully protect ordinary investors. In any case, these eight companies have made a lot of money in the United States this year.

Binance.US resumes US dollar services; CZ seeks pardon

Less than a month after Trump took office as president, Binance.US officially resumed its US dollar deposit and withdrawal services.

The service was suspended on June 13, 2023 as the U.S. Commodity Futures Trading Commission (CFTC) filed a civil law enforcement lawsuit accusing Binance of intentional evasion of U.S. law and illegal operation in the United States. Binance later settled for $2.7 billion; then CEO Zhao Changpeng paid $150 million.

Shortly after the suspension of US dollar deposits and withdrawals, the Securities and Exchange Commission (SEC) filed a lawsuit against Binance and its then-CEO Zhao Changpeng. The agency claimed that Zhao Changpeng and Binance were "suspected of extensive fraud, conflicts of interest, inadequate information disclosure and intentional evasion of the law."

In November 2023, Binance and Zhao Changpeng reached a settlement with the U.S. Department of Justice, including admitting federal charges, including violating anti-money laundering laws, and imposing a $4.3 billion fine, removing Zhao Changpeng as CEO, and imprisonment.

Zhao Changpeng has sought pardon from President Trump, who has previously pardoned several cryptocurrency executives.

eToro applies for U.S. IPO after 2024 law enforcement action

Online trading platform eToro publicly submitted its registration statement for its initial public offering (IPO) in the Nasdaq Global Selected Market under the stock code "ETOR". The IPO is expected to take place in the second quarter of 2025, depending on the market conditions. eToro seeks a valuation of $4 billion and plans to raise $500 million by issuing 10 million Class A shares.

The trading platform had some disputes with the U.S. Securities and Exchange Commission (SEC) in 2024, when the agency claimed that eToro “operated an unregistered broker and unregistered clearing agency on its trading platform that facilitated the purchase and sale of certain crypto assets as securities.”

As a result, eToro paid the fine and agreed to reduce its cryptocurrency products for U.S. customers to Bitcoin, Bitcoin Cash and Ethereum.

The move shows that investors' future confidence in the U.S. retail cryptocurrency trading platforms is growing as U.S. jurisdictions readjust their cryptocurrency definition rules and relax restrictions, making it harder for such platforms to access banking services.

OKX re-launched in the United States months after a $500 million

settlement

OKX, the world's leading cryptocurrency exchange, announced that it will return to the U.S. market in April 2025. The company is implementing a phased promotion plan throughout the year and has set up a new regional headquarters in San Jose, California. The company also appointed Roshan Robert, who recently left Barclays Bank, as its head of operations in the United States.

Just a few months ago, the company announced a settlement with the U.S. Department of Justice (DOJ). U.S. attorneys accused the platform of "deliberate violation of anti-money laundering laws and evading the enforcement of necessary policies to prevent criminals from abusing our financial system" for more than seven years.

OKX paid a huge fine of $500 million, admitted to operating the remittance business without a license and agreed to hire an external compliance consultant. "There are no allegations of any customer injury in the settlement, no charges against any company employees, and no government- appointed ombudsman," OKX said in a statement.

Robert told Fortune that the company is strengthening its compliance and risk management infrastructure to prepare for a business restart.

He also pointed out that the improvement of the regulatory environment is also a driving factor in the restart of the business. “The rulemaking takes some time, but we can see a viable path,” he said.

Nexo returns to the U.S. after stalemate with regulators

The global digital asset wealth platform Nexo announced its return to the U.S. market at an event in Sofia, Bulgaria on April 28, 2025. According to industry media reports, U.S. customers will be able to use Nexo's asset-backed credit lines, cryptocurrency savings accounts and advanced trading options.

Nexo exited the U.S. market in 2022 after 18-month negotiations with federal regulators reached a deadlock. Earlier, regulators in eight states accused Nexo of failing to register its Earn Interest Product.

Nexo co-founder Antoni Trenchev attributed the company’s rejuvenation to President Trump’s friendly attitude towards cryptocurrency: “The United States is back – so is Nexo.”

“Nexo is returning to the United States – stronger, smarter, and more determined to win,” he added.

Circle moved to New York before IPO

Circle, the issuer of the stablecoin USDC (USDC), will move its global headquarters from Boston to New York City in early 2025. The relocation to Building 1 of the World Trade Center is in line with Circle's initial public offering (IPO) program and reflects its commitment to integrating into traditional financial markets.

Circle applied for an IPO on April 1 and plans to list on the New York Stock Exchange. JPMorgan Chase and Citigroup serve as lead underwriters. The company seeks a $5 billion valuation.

“Our new headquarters near the top floor of the World Trade Center Building One symbolizes the trust, security and stability we have built as a future provider of financial critical infrastructure,” said Jeremy Allaire, CEO of Circle.

Circle initially planned to go public through a blank check company in 2022, but the deal failed. At the time, the deal valued Circle at $9 billion.

Crypto.com launches stock and ETF trading

Crypto.com plans to expand its U.S. services in 2025, including launching stock and ETF trading.

As part of its 2025 roadmap, the company will launch these services in phases, including a significant expansion of banking, cryptocurrency, stock and credit card services for U.S. customers.

The plan demonstrates the company's broader strategy to combine cryptocurrencies with traditional finance, a recurring theme for many cryptocurrencies and financial companies operating in the United States.

Travis McGhee, managing director and head of global capital markets at Crypto.com, said the company is allowing customers to “combine (stock and ETF trading) capabilities with cryptocurrency trading as well as cryptocurrency derivatives trading.”

McGhee added that “there are many favorable factors” driving the industry forward, including “the government is considering establishing a regulatory framework.”

“This bodes well for a strong market and a bright future for cryptocurrencies.”

a16z Return to the United States after Britain

Anderson Horowitz (a16z) announced that it would close its UK branch and turn its focus to the US market.

Anthony Albanese, chief operating officer of the cryptocurrency division of Anderson Horowitz, said in a Jan. 24 X post that the company will close its UK branch despite its “passionateness in the construction and application of cryptocurrencies”.

According to Sifted, the British government spent five years persuading a16z to move to London, but the company left 18 months after opening an office in London.

a16z set up an office in London in 2023, citing the regulatory environment during former President Joe Biden’s administration was too unfriendly to the blockchain industry. Albanese said the cryptocurrency industry ushered in "strong momentum" with the inauguration of President Trump.

Other factors that prompted the a16z relocation include slow progress in the UK cryptocurrency sector and the Labor government's focus on shifting from digital assets, TechCrunch reported.

Coinbase acquires Deribit to enter the derivatives market

US cryptocurrency exchange Coinbase acquired cryptocurrency derivatives platform Deribit on May 8 for $2.9 billion.

According to a blog post by Coinbase, the merger makes Coinbase the largest cryptocurrency derivatives platform.

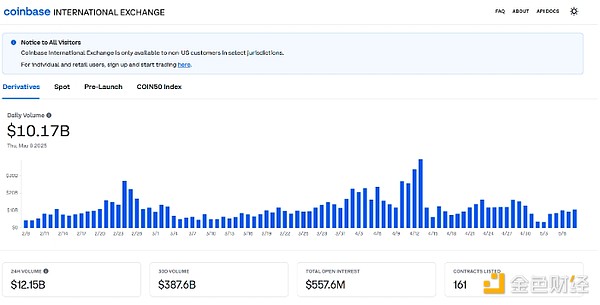

The deal comes as major cryptocurrency exchanges such as Coinbase, Kraken and Robinhood compete to capture the growing global cryptocurrency derivatives market. On the day of the announcement, Coinbase's international derivatives exchange trading volume reached US$10 billion.

chaincatcher

chaincatcher

panewslab

panewslab