When will the U.S. “Bitcoin Strategic Reserve” be launched? These points in time deserve special attention

Reprinted from panewslab

12/27/2024·5MAuthor | Mu Mu

Produced by | Vernacular Blockchain

Since Trump’s victory was “a foregone conclusion” in early November, the crypto market, especially Bitcoin, has entered into strong expectations of the “U.S. Bitcoin Strategic Reserve.” Obviously, the market will be highly focused on the implementation of this promise after Trump takes office in 2025. Some analysts bluntly say that this incident will break the Bitcoin bull-bear cycle. In other words, any "episode" in the future may cause the market to fluctuate. Violent turmoil. What we can do now is pay attention to its progress, estimate the possible landing time node in advance, and make corresponding preparations.

01. Latest progress

The matter of "Bitcoin Strategic Reserve" actually had related proposals and discussions before the US presidential election. Senator Cynthia Lummis proposed the "Bitcoin Strategic Reserve Act of 2024" as early as July 31, 2024. ), the bill proposes to purchase 200,000 Bitcoins per year, reaching 1 million within five years.

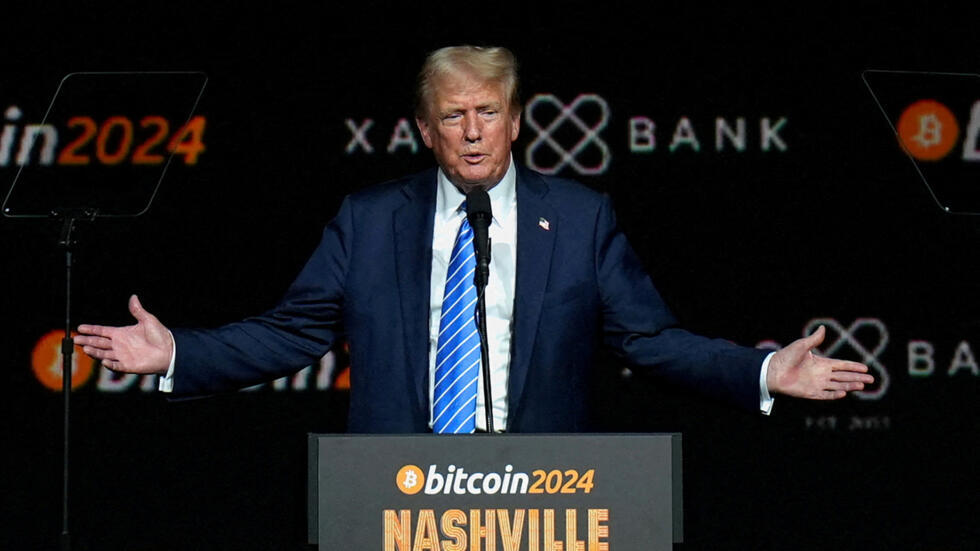

Subsequently, during the campaign, Trump promised to become the "cryptocurrency president" in his speech at the Bitcoin Conference in the crypto industry. The industry hopes that he will fulfill his promise and create a bitcoin inventory through executive orders to ensure that the industry can obtain banking services. , and create a cryptocurrency committee.

On December 17, 2024, the Bitcoin Policy Institute (BPI) (note, an unofficial organization, but a non-profit organization focusing on Bitcoin policy research, but it is still a decision-maker on Bitcoin-related issues One of the most important think tanks in the world) recently released a draft executive order in an attempt to provide reference for Trump’s “Bitcoin Strategic Reserve” executive order framework. This draft clearly states that it is recommended that 1%-5% of national debt assets be used to purchase Bitcoin to form long-term reserves. Led by the Treasury Department and coordinated by the Federal Reserve, reserves are gradually established.

On December 19, 2024, Federal Reserve Chairman Powell (who is expected to continue to fulfill his duties after Trump takes office) expressed a cautious view at a press conference. Powell said that the Federal Reserve has no intention to participate in any government plans to hoard Bitcoin. The issue falls within the purview of Congress, and the Fed is not seeking to change existing laws to allow the holding of Bitcoin.

Judging from the latest situation, despite the conservative views of the Chairman of the Federal Reserve, these will not affect Trump under favorable conditions such as Trump’s nomination of an encryption-friendly U.S. Treasury Secretary and the “Presidential Executive Order” quickly issued after taking office. The Trump team continues to promote plans to include Bitcoin in the U.S. strategic reserve.

02. Fastest landing time

Given that the "Bitcoin Strategic Reserve" is not a small issue, it is not something that the President of the United States can immediately implement as soon as his head is hot. Therefore, we will not see its implementation immediately. Judging from the current executive order or legislative process in the country If Trump wants to implement the Bitcoin strategic reserve, he will ask the Cryptocurrency Committee to conduct policy research and feasibility assessment immediately after taking office. After completion, he will formally propose a plan, which can then be carried out through two paths:

Path 1: Presidential executive order (as soon as the second half of 2025)

Directly issuing an executive order after Trump takes office is the fastest path because it can bypass resistance from conservatives and opponents such as the Federal Reserve and Congress. It also refers to the draft provided by the "Bitcoin Policy Institute" and instructs the U.S. Treasury Department to use The Exchange Stabilization Fund (ESF) allocates directly to Bitcoin.

However, although this method is quick and convenient, it also has side effects. Although the Ministry of Finance’s Exchange Stabilization Fund does not require congressional approval, it can be subject to congressional investigation and legislative restrictions. Executive orders can also be overturned and modified by the next president, so their durability and stability are not as good as legislation.

Path 2: Congressional legislation (as soon as the second half of 2026)

If a more stable legislative path is adopted, a longer process will be required. After the Cryptocurrency Committee conducts policy research and feasibility assessment, the bill needs to be submitted to Congress and submitted to the Senate Banking Committee for consideration, and then passed through the Senate, House of Representatives and the President. Only after signing and passing can the legislation be officially completed.

This process may go through various back-and-forths and is relatively complicated. After all, many conservative legislators will definitely raise objections and obstruct. Therefore, although a durable and stable bill can be obtained through this path, it will take a long time, at least in the future. It is possible to be implemented from the second half of 2026 to 2027.

According to recent news, the encryption industry is pushing Trump’s team to issue an executive order on his first day in office next month to launch his promised cryptocurrency policy reforms and help promote the mainstreaming of encryption. If the executive order is passed, it will eventually As soon as mid-2025, we may be able to see the implementation of the Bitcoin strategic reserve.

03. Several important time points

During the “process” of administrative orders or bills related to the Bitcoin strategic reserve, the following time points may have a significant impact on the market:

1) January 20, 2025, before and after Trump’s inauguration

Trump will officially take office on this day. Starting from this time, Trump will officially start "giving orders." This time point will mark the beginning of the new president's administration, and relevant policy trends may gradually emerge. Markets will be paying close attention to the inaugural address and the release of its early executive orders. Trump has invited many guests to this inauguration, which is expected to be quite lively, and financial markets will also pay close attention to it.

2) In mid-2025, the policy research stage will be completed

According to time estimates, the CryptoCommittee’s policy research will be completed and a feasibility report and draft on Bitcoin reserves will be completed as soon as the first half to the middle of 2025. Trump can then sign an executive order. Marking the official launch of the “Bitcoin Strategic Reserve”.

3) From the second half of 2025 to early 2026, implementation details and potential congressional pull

After the relevant executive orders are signed and the relevant framework is determined, the U.S. Treasury Department, the Federal Reserve and other relevant departments will begin to formulate specific implementation details, including Bitcoin procurement methods, reserve ratios, asset management rules, etc., and then begin formal implementation.

During this period, it should not be too smooth, and opposition members of Congress will join in the obstruction and repeatedly push back.

Finally, if everything goes well and the Bitcoin reserve strategy brings objective "benefits", further legislation may be promoted in the future, which will have a profound impact on the crypto market landscape.

04. Summary

The road to the "Bitcoin Strategic Reserve" seems to be full of twists and turns, and it is not something that can be implemented in a day or two. It will take half a year at the earliest. But no matter how you say it, Trump's "U.S. Bitcoin Strategic Reserve" brings While raising good expectations, it has also "set a good example" to drive central banks, financial institutions, and listed companies in various countries to research and explore the feasibility of Bitcoin reserves. Although there may still be many uncertainties in policy details and final implementation time, we still need to follow up and pay attention to key time nodes and make adjustments at any time.

chaincatcher

chaincatcher