What will happen to the crypto market if Trump insists on removing Powell?

Reprinted from panewslab

04/29/2025·13DOriginal title: "If Trump fired Powell, what would happen to crypto?"

Organize & compile: Patti, ChainCatcher

In recent months, a specific pattern has been repeatedly staged: US President Donald Trump will take some measures that are objectively harmful to the U.S. economy, and the market will collapse. Seeing this, Trump would instead put pressure on Federal Reserve Chairman Powell to lower the federal funds rate—the interest rate the Federal Reserve lends to banks. However, Powell, who is tough, will flatly refuse and respond: "No."

Trump hopes to lower interest rates because this move is equivalent to injecting effective funds into the US economy, which can stimulate economic activity and boost markets. He believes that this can make himself appear to be awesome. Powell hopes to set interest rates by following rigorous economic standards to carefully balance the Federal Reserve's dual mission of promoting employment maximization and maintaining price stability.

In addition, Powell is committed to maintaining the independence of the Federal Reserve without political pressure, especially maintaining this independence in the eyes of the Federal Reserve. If the market believes that the independence of the US central bank has been lost, it may become more difficult to issue US Treasury bonds. At the fundamental level, this means that the United States will have to pay higher costs to borrow funds, which will lead to damage to its national strength - and the problem is particularly serious at the moment, as the United States has already suffered a huge debt of up to $30 trillion and needs to be refinancing regularly.

If the United States is forced to refinance at higher interest rates due to market losses in trust in the U.S. government, the interest cost will swallow up a larger proportion of GDP. In popular terms, the United States will be in trouble.

The above game continues to this day. Last week, Trump repeatedly hinted at the intention to fire Powell, and the market responded poorly. On Monday, Trump slammed Powell as a "complete loser" on social platform Truth Social, a move that triggered a market crash. In response, U.S. Treasury Secretary Scott Bescent has reportedly expressed concerns to Trump about the risk of firing Powell. It seems that Trump has compromised and said on Tuesday that he will not fire the Fed chairman.

However, this process is more like a deteriorating spiral, with many market observers waiting for the next crisis to break out. This can't help but raise a question: What consequences will it have if Trump really can't hold back his impulse and insist on removing Powell? In particular, what impact will this have on the cryptocurrency industry?

Challenge the authority of the Federal Reserve

It should be noted that the president should not have the right to fire the Federal Reserve Chairman at will. Article 10 of the Federal Reserve Act of 1913 stipulates: "Each Federal Reserve Director shall be in office for fourteen years, from the date of expiration of his predecessor term, unless the President removes him from office in advance on reasonable grounds."

This wording seems vague, but in the 1935 "Humphrey Executor v. United States", the Supreme Court ruled that the Constitution did not grant the president "unrestricted power of dismissal", so the president's power of dismissal is restricted by legal provisions.

This ruling established the concept of "independent institutions" that, although affiliated with administrative branches, have independent powers. Although this feature is seen by several institutions, including the Securities and Exchange Commission (SEC), Commodity Futures Trading Commission (CFTC), and Federal Trade Commission (FTC), the importance of the Federal Reserve is unparalleled.

Economists rarely pay attention to the issue of political control of central banks. Politicians often focus on the short term, and their decision-making cycles are usually in units of years or election cycles. This tendency makes them more inclined to implement short-term effective policies, and directly injecting funds into the economy is undoubtedly the purest short-termist method. However, fiscal and monetary policy is a fine art that often involves difficult policy choices.

A typical case is that Richard Nixon once put pressure on then-Federal Chairman Arthur Burns before the 1972 election to implement an expansionary monetary policy to increase his chances of re-election. Nixon did win the election with an overwhelming advantage, but what followed was a catastrophic "stagflation" - economic stagnation and inflation coexisted, hitting the US economy hard for ten years, and its impact still continues in some hollowed-out industries.

In sharp contrast, after experiencing the stagflation crisis, Paul Volker implemented a series of radical interest rate hikes between 1979 and 1987, triggering the "Valker shock" and leading to multiple painful rounds of economic recession. However, this policy ultimately managed to curb inflation, laying the foundation for economic prosperity in the 1990s, and achieving Bill Clinton's outstanding fiscal policy.

These choices are by no means something that politicians can do, and no politicians dare to do in the future. This is the crux of the problem—economists and crucial market participants, both firmly believe that the Fed must remain independent, otherwise the entire economic structure of American society will be at risk of collapse. This is by no means an alarmist

- politically controlled central banks such as Weimar Germany, Argentina during the Peronian period, and Venezuela, all encountered hyperinflation, causing the country to fall into a geopolitical recession of many generations, and even experienced tragic situations in which the people could not eat and feed on rats, which further encouraged the rise of dictators like Adolf Hitler.

If Trump wants to fire Powell, he first needs to overturn the precedent of the "Humphrey's Executor" case. Given the current composition of the Supreme Court, many legal scholars believe this is not impossible. However, once crossing this "Rubicon River" means that the president will have comprehensive legal powers to command all executive officials, including the Federal Reserve Chairman, at will. Most people believe this will lead to catastrophic consequences.

But no matter what the outcome is, it will be a test for cryptocurrency. The initial goal of the Bitcoin White Paper was to eliminate the intermediate links of "financial institutions as trusted third parties" in financial transactions. If the Federal Reserve falls and US monetary policy is separated from rational judgment, the "decentralization" concept advocated by cryptocurrencies in the early days will face severe tests.

Trump has recently triggered capital flight, and investors are seeking safe-haven assets. Traditionally, when a crisis breaks out, savvy investors convert risky assets into U.S. Treasury bonds, viewing them as risk-free assets. However, this concept may be outdated. At the worst time of the tariff crisis, the yield on the 10-year treasury bonds once approached 5%, and has not yet completely fallen back to its previous low. If Trump really destroys the Federal Reserve, the current capital outflow will be as small as a small amount, and funds may pour into the cryptocurrency field on a large scale.

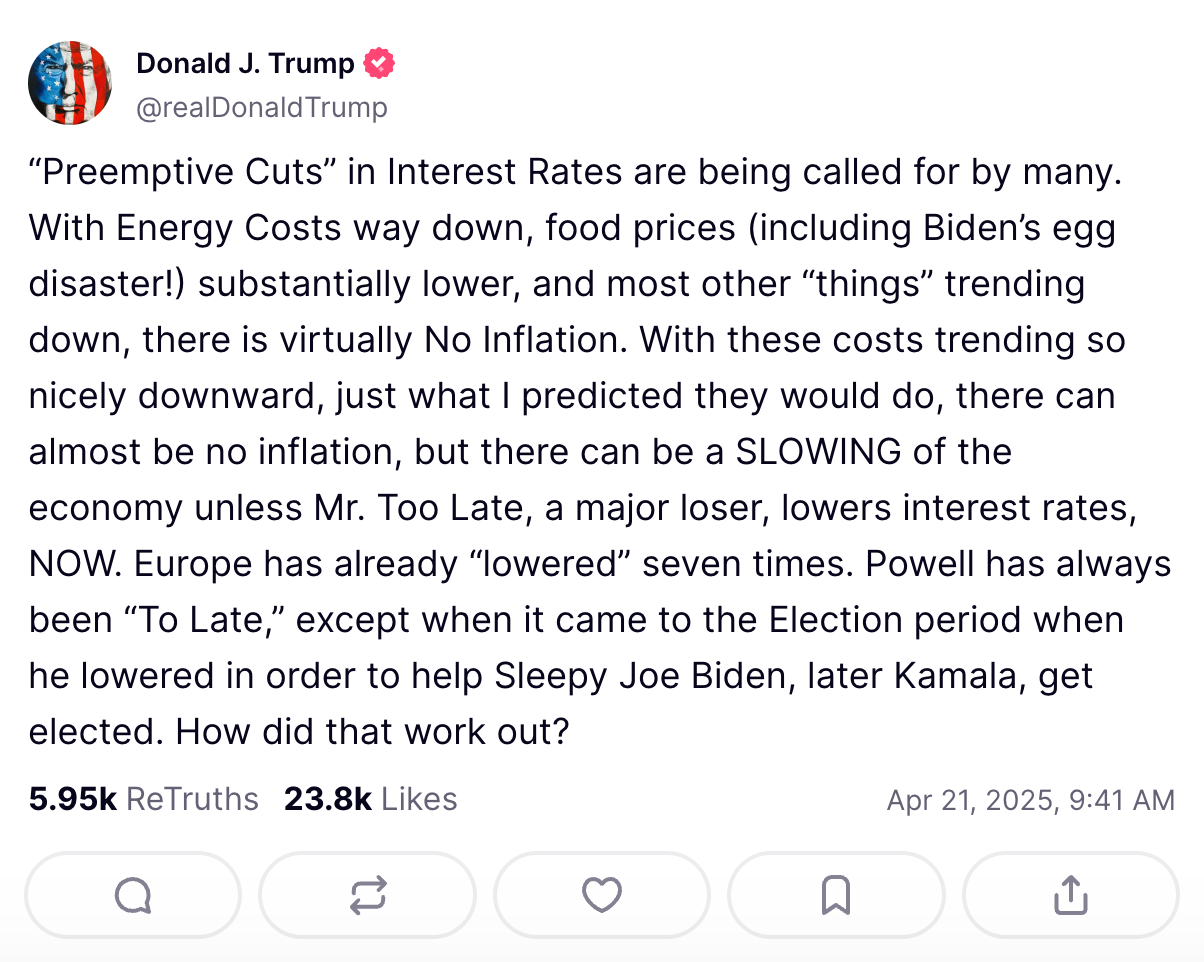

Note: Trump criticized Powell and directly criticized him as \"Mr. Slow\"

Historically, Bitcoin prices have been highly correlated with the Nasdaq Index (albeit with greater volatility). However, since the tariff crisis broke out, Bitcoin prices have miraculously begun to soar despite the continued sluggish price of U.S. securities. This has sparked some speculation: Are we witnessing the long-foreseeable "decoupling" phenomenon - crypto assets will fulfill their original mission, get rid of their association with centralized assets, and run independently?

We cannot assert whether this trend will continue, but if Trump does remove Powell, the answer will be revealed soon.

Just out of the oil pan, it fell into the sea of fire again

Of course, from a macro-historical perspective, global collapse is by no means entirely good for cryptocurrencies, and this crisis will also bring significant impacts to multiple fields. The first thing to bear is that stablecoins will face severe consequences almost immediately.

Two US dollar-denominated stablecoins—USDC and Tether’s USDT—have dominated the market over the past decade. Its issuers, Circle and Tether, are not only important systemic institutions, but also major buyers of U.S. Treasury bonds, which are the core components of their stablecoin reserve assets.

If the Fed falls into crisis, one of the most direct consequences is the sharp increase in the risk of US Treasury default. Economist Noah Smith once speculated that Trump may try to deal with the sovereign debt problem in the United States through "debt restructuring":

"I doubt Trump will take the means he used in the business world - when the debt cannot be paid, he will seek low-priced bailouts; if the bailouts are hopeless, he will declare bankruptcy directly."

In fact, Trump himself hinted at this possibility in February, claiming that he could reduce the size of his debt by some kind of "technical operation":

“There is a risk in U.S. Treasury bonds, which can be an interesting question… Perhaps many of these debts simply ‘do not count’. In other words, some of the debt can be fraudulent, so the actual debt size may be lower than we thought.”

If the United States defaults on sovereign debt, the value of Treasury reserves held by Circle and Tether will directly shrink, resulting in insufficient stablecoin collateral, which may trigger a run. Although the market may stabilize eventually, if things worsen, the collapse of mainstream stablecoins may be inevitable.

This shock will have a domino effect: smart contracts with stablecoins as collateral will be forced to liquidate positions, and panic will spread throughout the cryptocurrency market.

However, this technical consequence may be more "moderate" than the political cost caused by the Fed crisis. After all, Treasury bonds are not the only systemic risk asset for the cryptocurrency market. The US dollar's status as a global reserve currency has lasted for decades, and it has solid logical support behind it - the relative strength and stability of the US dollar make it the first choice for international trade settlement. However, if the credit of the US government that supports the US dollar is no longer stable, this pattern may undergo a fundamental change.

As more international trade is denominated in the euro or renminbi, regulators in the EU and China will gain greater authority to monitor fiat currency flows through cryptocurrency channels. A well-known cryptocurrency industry lawyer who did not want to be named said bluntly:

"I think China will fill some market gaps, and the EU will also occupy the majority of the remaining share. But whether it is the strict regulation of the Communist Party of China or the excessive intervention of the EU based on different goals, it is by no means good for the cryptocurrency industry. This situation is worrying."

Against this backdrop, market funds may turn to unsecured native crypto assets, but there is almost no precedent for such assets to be used in large-scale real-world transactions. More likely, the stablecoin crisis will put the cryptocurrency industry in an upward period into a long-term stagnation.

In the end, no one can predict whether Trump will fire Powell, and no one can even be sure whether he really has the right. Similarly, no one can predict what chain reaction their decisions will cause. But just as a butterfly flapping its wings in Argentina could lead to a tornado in which Lager was released, every "whisper" by Trump on the West Wing of the White House could permanently change the fate of the blockchain industry - or justify it or collapse it.

Whether we want to or not, this storm cannot be avoided.

We can only go on this unknown journey together.

jinse

jinse