What has Meme coins brought to the current crypto market?

Reprinted from jinse

02/18/2025·2MAuthor: Alex O'Donnell, CoinTelegraph; Compiled by: Baishui, Golden Finance

Data shows that as the memecoin scandal continues to increase on the Internet and market sentiment plummeted, traders are increasingly preparing for the decline of Solana's native SOL (SOL) tokens.

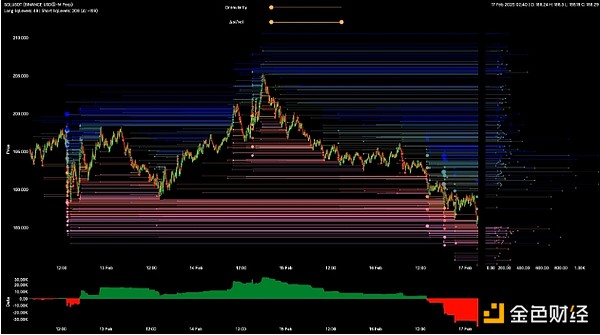

On February 17, the long-to-short SOL position ratio on cryptocurrency futures exchanges fell from 4 to 2.5, meaning the entire market tends to be bearish SOL.

“The market has decided to be angry with Solana,” Tyler Durden, anonymous cryptocurrency influencer, said in a February 17 post on X Platform.

Durden quoted data from Binance Perpetual Futures Trading Platform to indicate that Binance 's short-to-long position ratio has risen to 4:1, indicating that bearish bets are too much.

Perpetual futures, or “perps”, are derivatives that allow traders to buy and sell assets on a future date without an expiration date.

According to CoinGecko, SOL's price fell nearly 6% on the day as of this article.

Binance's short positions exceed the long positions. Source: Tyler Durden

Dissatisfied with Memecoin

The sudden rise of memecoin such as Bonk and Dogwifhat has attracted billions of dollars in funding for the Solana ecosystem.

According to CoinGecko, the market value of the two dog-themed memecoins exceeded $4 billion before the decline in December and January. A US exchange- traded fund issuer even proposed to create a BONK ETF.

According to a report by crypto research firm Messari, application revenue on Solana rose 213% in the fourth quarter of 2024, mainly due to memecoin speculation.

Now, insider sell-offs and huge losses from retail investors are undermining confidence in Solana’s memecoin ecosystem.

“The amount of junk coins now does seriously damage the SOL ecosystem,” Anonymous trader Runner XBT said in a February 16 X post.

LIBRA evaporated its market capitalization of $4.4 billion in a few hours. Source: Kobeissi Letter

On February 14, the cryptocurrency Libra (LIBRA), which appears to be backed by Argentine President Javier Milei, evaporated its market value within hours of its launch.

Mile initially promoted the token on X, but later deleted his post. He is now facing lawsuits in Argentina for allegedly misleading investors.

Since January, traders have lost about $2 billion in 800,000 wallets, the official memecoin (TRUMP) of U.S. President Donald Trump.

As of February 17, TRUMP's full dilution value had fallen about 75% from a high of more than $70 billion to around $17 billion, according to CoinGecko. About 80% of TRUMP supply is held by insiders.

Blockworks research analyst Westie said in a February 16 X article that the release of Trump’s Meme coin is “the most obvious example of insider gaming reaching its peak.”

According to DefiLlama, despite slowing memecoin transactions, Solana still outpaces Ethereum, the largest layer 1 network by total locked value.

panewslab

panewslab