What happened in the market when Bitcoin fell below $87,000?

Reprinted from jinse

02/25/2025·2MOn February 25, 2025, Bitcoin fell below $87,000, falling to its lowest level since mid-November last year.

What happened to the crypto market? Golden Finance Xiaozou has comprehensively summarized the reasons for the decline, and the possible reasons are as follows:

1. Many states in the United States have reservations about Bitcoin

reserve proposals

Before the decline, several U.S. states were reserved for Bitcoin reserve proposals.

"Although U.S. President Trump recently expressed support for Bitcoin, the three state-level Bitcoin reserve proposals in Montana, North Dakota and Wyoming have not been approved. Policymakers are trying to avoid it. Accused of using taxpayer funds for speculation and being reserved for state-level Bitcoin reserves highlights political risks. "Fournier added: "In the future, a national reserve strategy backed by bond issuance or partial sale of U.S. gold reserves may be more A feasible path to adoption. "

2. Global money supply declines

Some observers believe that Bitcoin’s weakness is consistent with a downward trend in global money supply at the beginning of the year .

"There appears to be a lag between the global money supply and the price of Bitcoin," said Andre Dragosch, head of European research at Biwise.

3. Macro uncertainty enforces the outflow of funds in the market

The continued adjustment of the cryptocurrency market is consistent with the capital outflow of cryptocurrency investment products.

-

The second consecutive week of capital outflows in digital asset investment products;

-

According to a report by CoinShares, the total outflow of funds was $508 million in the week ended February 21.

-

This shows that institutional investors have reduced their investment in digital assets.

-

Bitcoin has the largest outflow of funds, with a total amount of US$571 million.

-

Inflows so far this year fell from $7.4 billion two weeks ago to $6.6 billion last week.

James Butterfill, head of research at CoinShares, attributes this to uncertainty in trade tariffs, monetary policy and inflation. "We believe investors are keeping caution after the inauguration of the U.S. president and the uncertainty of trade tariffs, inflation and monetary policy that comes with it," he said.

4. **Crypto and US stocks fell simultaneously and liquidity is

exhausted**

Financial Newsletter The Kobeissi Letter comments on the X platform about the depletion of crypto liquidity as follows:

The cryptocurrency market's market value has shrunk by $325 billion since Friday morning. Today at 5 p.m. ET, the cryptocurrency market lost $100 billion in one hour, with no major news during the period. What happened to the cryptocurrency market?

In the past 24 hours alone, we have seen about $150 billion evaporate from the cryptocurrency market. The selling scope has expanded, and almost all crypto assets have fallen sharply. Even the meme currency market seems to have lost a considerable amount of liquidity.

So, what exactly happened?

It all seems to have started with Solana, which has fallen 22% since last Friday. During the meme coin craze, Solana shows extremely strong relative strength. However, as the meme coin craze subsided, Solana also began to weaken. For some time, Solana's selling has nothing to do with Bitcoin.

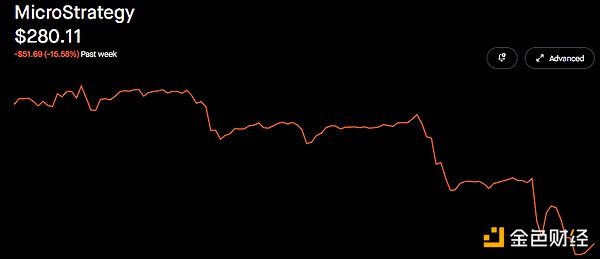

However, as the S&P 500 began to fall last Friday, Bitcoin also joined the decline. As shown in the figure below, the decline of the S&P 500 is accompanied by the acceleration of Bitcoin sell-off. Today, Bitcoin is losing its relative strength after falling below the $98,000 support level.

5. Hedge funds or close Bitcoin ETFs

BitMEX co-founder Arthur Hayes said on social media that many IBIT holders are hedge funds, and they earn higher returns than short-term U.S. Treasury bonds by long ETFs and short CME futures. If the price of BTC decreases, the basis (i.e. the gap between ETF prices and futures prices) narrows, then these funds will sell IBIT and cover CME futures. These funds are currently profitable, and considering the basis is close to U.S. Treasury yields, they will close positions during the U.S. trading session to cash in on profits.

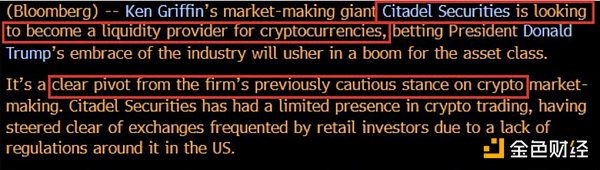

6. Citadel Securities enters the crypto market

Strangely, this happened a few hours after Citadel made a significant shift in its cryptocurrency stance .

Today, Bloomberg announced that $65 billion Citadel Securities is seeking to become a liquidity provider for bitcoin and cryptocurrencies. The market sees this as a "sell the news" event.

7. B ybit hacking incident hits market sentiment

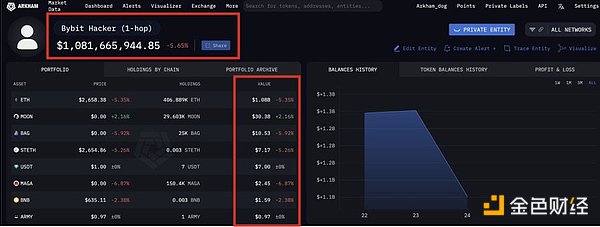

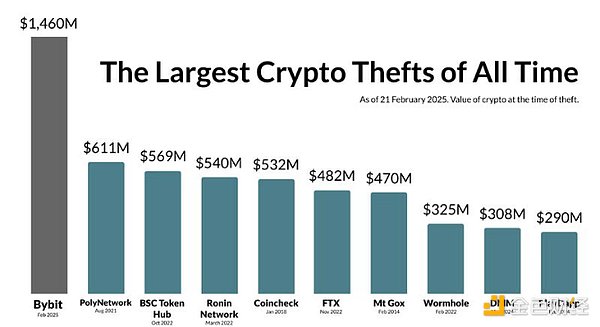

In addition, the Bybit hacking incident on February 21 also seemed to have hit market sentiment . Arkham Intelligence called the attack "the largest financial theft in history" after the $1 billion theft of Iraq's central bank in March 2003.

In fact, the Bybit hacker involves more than twice the second largest hacker in the history of cryptocurrency stolen funds. The largest cryptocurrency hacker attack was the stolen $611 million in August 2021.

The weakness of Ethereum has also put more pressure on the entire cryptocurrency market. Hacker attacks weaken market confidence.

The technical side seems to have lost momentum.

However, this does not mean that the cryptocurrency market will enter a long- term bear market. In this bull market, we have witnessed countless 10% corrections in Bitcoin. Technical callbacks are benign and healthy.

8. SBF returns to X platform

Most importantly, Sam Bankman-Fried returns to the X platform.

As cryptocurrency plummeted, SBF returned and said he "has deep sympathy for government employees." Meanwhile, DOGE and Elon Musk are preparing for more massive layoffs in the federal government.

Finally, risky assets such as Bitcoin are pulling back as volatility returns to the stock market.

We have seen historical levels of risk appetite in 2024 and continue until 2025.

The risk appetite pullback means less liquidity in the cryptocurrency market.

This must have happened before.

We all know that the cryptocurrency market needs liquidity to thrive. Overall, there is currently no specific factor driving cryptocurrencies to fall. On the contrary, it is the combined action of multiple factors that lead to the decline in liquidity.

Finally, we end the article with a sentence from Andre Dragosch: “The money supply has bottomed out recently, which means the price decline in Bitcoin may not last long.”

chaincatcher

chaincatcher

panewslab

panewslab