What are the new opportunities for the encryption bull market under the Trump effect?

Reprinted from panewslab

01/24/2025·5MAt the end of 2024, the crypto market experienced an unprecedented rapid bull market. The price of Bitcoin quickly surged to more than 100,000 US dollars after Trump won the US election, thus starting the road to 100,000 Bitcoins. This wave of prices not only promoted the rise of Bitcoin, but also led to the prosperity of the entire crypto market. Data shows that the total market value of the global crypto market increased by approximately US$1.8 trillion in 2024, of which US$1 trillion of increase occurred after the election. However, this wave of market frenzy became even crazier because of Trump’s official inauguration in January 2025. The Trump team made a series of fierce operations, personally launching its MEME currency TRUMP, etc. In just 2 days, the market value of TRUMP exceeded 160 billion Dollar. The celebrity effect in the currency circle ranges from Musk to Trump. The sensitivity to information here is far greater than in other industries. NX.one Research Institute will conduct an in-depth analysis of the Trump effect and what investment points can be grasped in the Trump 2.0 era. .

Review: Trump’s US election win detonates Bitcoin

Let’s first review the first Trump effect. After Trump won the US election, the Bitcoin market was divided into three stages of breakthrough:

The first paragraph is that since Trump won the US election on November 5, the price of Bitcoin has started to rise rapidly. On November 10, the price of Bitcoin exceeded the US$80,000 mark. Just three days later, it exceeded US$90,000 on November 13. The market performance was extremely strong.

The second paragraph was on November 20. News came out from the Trump team that it was considering creating a new position in the White House dedicated to cryptocurrency policy. This would be the first time in the history of the White House to create such a position, reflecting the cryptocurrency industry. Influence over the new government is growing significantly. The day after the news came out, the price of Bitcoin climbed further, breaking through $98,000 in one fell swoop.

The third paragraph is on December 5, when Trump officially nominated Atkins, an official who is friendly to cryptocurrency, as the new chairman of the US Securities Regulatory Commission. According to people familiar with the matter, Atkins will focus on reducing regulatory restrictions on cryptocurrencies and easing penalties for related violations after taking office. After the news of this personnel appointment came out, the price of Bitcoin surged again, successfully breaking through the $100,000 mark.

NX.one Research Institute believes that Trump’s victory not only detonated Bitcoin, but also started a new bull market for the entire cryptocurrency. The total market value of the entire crypto market increased by 39.9% during the month, rising from US$2.48 trillion at the beginning of the month to US$3.47 trillion. Ethereum also performed well, rising 47.8% for the month, climbing from $2,511 to $3,711. In addition, the altcoin market has also ushered in a recovery, with XRP leading the market with a 362.3% increase, and MEME coins such as DOGE and SHIB also increased by 160.4% and 70.7% respectively.

While everything in the market was optimistic and advancing, the Federal Reserve lowered interest rates to 4.5%-4.75% on November 7, further promoting the rise of risk assets. At the same time, the resignation of SEC Chairman Gary Gensler triggered optimistic market expectations for an improvement in the regulatory environment. But there is no dispute that the core driving force of this bull market is the Trump effect.

Trump is officially inaugurated, and the family is fully involved in the

encryption industry

In January 2025, before Trump officially took office, he and his family members made a high-profile entry into the encryption industry, which triggered violent market fluctuations. First, Trump and Trump's wife Melania issued personal MEME coins.

Trump issues TRUMP token:

On January 18, Trump announced the launch of his personal MEME token TRUMP (OFFICIAL TRUMP) on social media, which was the first cryptocurrency issued by a US president in history. The TRUMP token issuance price was US$0.1824. Within 12 hours after its launch, the price increased by more than 15,000%. The price once reached US$82, and the market value exceeded US$82 billion.

The token is issued on the Solana blockchain and this decision is very critical. The NX.one Research Institute predicted in 2024 that a battle between the Ethereum chain and the Solana chain would inevitably occur this year. The issuance of TRUMP triggered a frenzy in the market, and a large number of investors poured into the Solana chain for transactions. Data shows that after the TRUMP token was launched, the transaction volume on the Solana chain increased by 1,200% in a short period of time, and multiple decentralized trading platforms (such as Jupiter, Raydium and Meteora) benefited from this. The price of Solana’s native token SOL exceeded US$290 on January 19, setting a record high, and Solana’s market value also exceeded US$159.2 billion.

In addition to strongly empowering the Solana chain, it also stimulates the Meme currency track. The successful issuance of TRUMP tokens has stimulated the broader market's interest in MEME coins, and other MEME coins have also risen. Subsequently, Trump’s wife Melania announced the issuance of MELANIA on January 19, and its market value quickly exceeded US$10 billion. BARRON, the Meme coin of Trump's youngest son's eponymous name, has also been launched. It has now been listed on mainstream exchanges like TRUMP and MELANIA, and its market value has soared to approximately US$400 million in less than 24 hours.

Trump’s two sons, Eric Trump and Donald Trump Jr., are also fully active in the crypto space, with Eric Trump campaigning for the TRUMP token on the X platform, calling it a “family move into an emerging business area.” In addition, the Trump family is deeply involved in the World Liberty Financial project. Donald Trump Jr. is not only the promoter of WLFI, but also revealed to be one of the leaders of the project and participated in the strategic decision-making of the project. In the following article, NX.one Research Institute will share the recent trends of WLFI.

It can be seen that the Trump family has fully participated in the encryption industry, and the bond between the two parties is constantly deepening. However, the celebrity effect in the currency circle also pays for it in waves, and the market's reaction cannot be 100% in line with the oligarchs' expectations. For example, when the issuance of TRUMP tokens triggered a frenzy in the market and a large amount of funds poured into the encryption market, the launch of MELANIA actually triggered a blood-sucking effect. The price of TRUMP tokens once plummeted 60%, showing that the market has no confidence in Trump. High sensitivity to family dynamics.

Crypto market volatility following Trump’s inauguration:

Although Trump expressed his support for cryptocurrency many times during the campaign, he did not mention cryptocurrency-related content in his inaugural speech when he officially took office on January 20. This surprise caused wild fluctuations in the crypto market:

On January 20, as market funds entered the market in preparation for the good news that may be released in the inauguration speech, the cryptocurrency market began a roller coaster ride. The price of Bitcoin once soared from US$99,600 to US$109,200, and then plummeted again. In early trading on the 21st, Bitcoin hit a low of $100,200. As of press time on the afternoon of the 21st, Bitcoin was fluctuating around $102,000, down 5.6% in 24 hours.

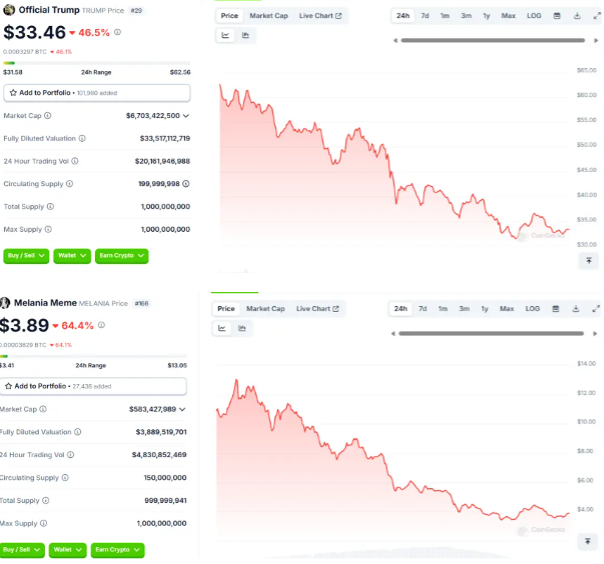

The fluctuations of the corresponding MEME currency were even more severe. The TRUMP currency fell by more than 46% within 24 hours, and its market value shrank to US$6.7 billion. MELANIA coin fell by 64% in 24 hours, with its market value shrinking to US$583 million. According to data from Coinglass, in the past 24 hours, more than 250,000 people have liquidated their cryptocurrency positions across the entire network, and the liquidation amount has exceeded US$750 million.

NX.one Research Institute believes that this phenomenon shows that the market is extremely sensitive to Trump’s words and deeds, and his policy expectations have a huge impact on the encryption market. The Trump effect cannot only affect endless increases. Once the market expectations are not met, , or did not meet market expectations, the price of tokens, especially MEME coins, was like a mirage beginning to collapse, with great risks.

Grasp the investment trends in the Trump 2.0 era

Although Trump did not mention cryptocurrency in his inauguration speech or signing an executive order, a series of recent actions by World Liberty Financial, a DeFi project supported by his family, proves that Trump attaches great importance to the cryptocurrency field. The following is a detailed analysis of WLFI’s recent actions:

- Adding positions on the first day of employment

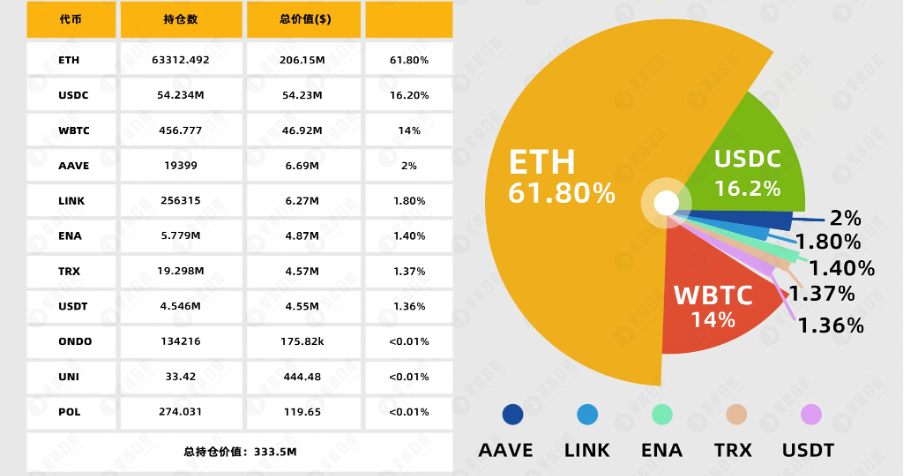

On January 20, the day Trump officially took office, WLFI announced that it had increased its holdings of WBTC worth US$32.81 million, ETH of US$37.47 million, TRX of US$4.7 million, and other cryptocurrencies, for a total increase of more than US$88 million. This move not only demonstrates WLFI’s long-term optimism for crypto assets, but also shows that it is actively deploying the global crypto financial market.

- The first investment in a Chinese project

In this increase in position, WLFI invested in TRX for the first time, with an amount of US$4.7 million. TRON was founded by Justin Sun and is one of the leading projects in the blockchain field. This investment not only marks the extension of WLFI's strategic layout to the Chinese blockchain community, but also opens up in-depth cooperation between the two parties in the field of encryption ecology.

- Partnership with Ethena Labs

On December 18, WLFI announced a cooperation with Ethena Labs and planned to implement sUSDe in DeFi cooperation. This collaboration will leverage Aave’s lending infrastructure to further enhance WLFI’s total value locked and attract more users.

- Other positions and market impact

From the list of WLFI's main holding tokens produced by ODAILY, we can see that among WLFI's holdings, ETH accounts for the highest proportion, reaching 61%. In addition, WLFI also holds tokens such as WBTC, AAVE, LINK, and ENA. These positions are viewed as potentially positive, giving the tokens in question the label of “Americanness.”

Conclusion

The Trump effect has brought new development opportunities to the encryption industry, but it has also caused high sensitivity and potential risks in the market. NX.one Research Institute believes that although Trump did not mention cryptocurrency in his inauguration speech, the market is still confident in his policy expectations. David Bailey, CEO of Bitcoin Magazine, said that cryptocurrency-related executive orders may be included in Trump’s first 200 executive orders after taking office. In addition, WLFI, which is supported by the Trump family, has recently shown its clear support for the cryptocurrency field through frequent positions additions and cooperation with all parties. These are signs that cryptocurrencies may still figure prominently in Trump’s future policy planning. Investors need to pay close attention to subsequent policy developments and further actions of WLFI to grasp the development trend of the encryption market.

chaincatcher

chaincatcher