Weekly Preview | Initia will be launched on the main network and listed on Binance; US SEC holds its third roundtable for crypto policy, which will focus on hosting issues

Reprinted from panewslab

04/20/2025·1MNews trailer:

- Balance will launch TGE on April 21; Binance Alpha and Binance contracts and Gate.io will be launched on the same day Balance (EPT)

- US securities custody and settlement company DTCC launches tokenized collateral management platform "AppChain", which will be demonstrated on April 23

- Cross-chain protocol Hyperlane will issue $HYPER airdrop on April 22

- L1 blockchain Initia will be launched on the main network on April 24, and Binance will launch its INIT token at 11:00 (UTC+8) on the same day

- US SEC will hold its third roundtable for crypto policy on April 25 to focus on hosting issues

- Several Fed officials will make intensive speeches

April 21

Macroeconomics:

At 8:30 pm, 2025 FOMC voter and Chicago Fed Chairman Goulsby was interviewed by CNBC

Exchange:

Binance Alpha and Binance contracts will be launched on April 21 Balance (EPT)

Binance announced that it will open Balance (EPT) trading on the Binance Alpha platform at 20:00 on April 21, 2025 Beijing time, and launch the EPTUSDT perpetual contract at 21:00, up to 20 times the leverage. To celebrate the launch, all eligible Binance users will receive 3500 EPT token airdrops in their Alpha accounts, which will be completed by 20:10 on April 21, 2025. The empty investment space is limited to users who have made purchases through Binance Alpha using spot or fund accounts from 00:00 on April 11, 2025 to 23:59 on April 17, 2025.

In addition, Gate.io will launch Balance (EPT) spot transactions simultaneously

Coinbook, a Japanese crypto exchange that launched NIDT in 2023, has been acquired by BACKSEAT Co., Ltd. and will be renamed "BACKSEAT Code Account Exchange Co., Ltd." on April 21. The official website will also be moved to backseat-exchange.com. The new management will focus on promoting the development of Web3 and expanding blockchain business as its core strategy.

Coinbase applies to CFTC to launch XRP futures, expected to be launched on April 21

Coinbase Derivatives announced that it has submitted an application to the U.S. Commodity Futures Trading Commission (CFTC) to launch an XRP futures contract, which is officially expected to be launched on April 21, 2025.

Project News:

Balance announces EPT token economic model, TGE will be launched on April 21

The Balance Foundation announced its EPT token economic model, with the total supply of EPT tokens of 10 billion, which will be launched on the BNB chain and Ethereum double-chain on April 21, 2025 (UTC). In token allocation, airdrops and community incentives account for 15%, node rewards 25%, and ecological growth 23%. The airdrop targets include E-PAL users, early supporters, active community users and Pioneer badge NFT holders. EPT will be used to pay for AI services, governance, staking, incentives and other functions.

Latest Ethereum ACDE conference: Pectra client is expected to be released on April 21

The 209th Ethereum Execution Layer Core Developers Conference (ACDE) focuses on the upcoming Pectra and Fusaka upgrades. The Pectra client is expected to be released on April 21, adding the EIP-7702 delegation status to JSON-RPC. Fusaka, it is clearly stated that EIP-7823 (limiting MODEXP complexity), EIP-7825 (transaction gas limit) and EIP-7907 (contract code size measurement and limit increase); EIP-7762 and EIP-7918 will be adopted in the blob fee mechanism to balance resource utilization and market supply and demand.

Governance Voting:

Bitcoin staking protocol Babylon posted on X platform that the governance proposal to modify the parameters of Babylon Genesis chain has been officially launched. The proposal aims to adjust the unbinding fee for the second phase of pledge from 100 sats/vbyte to 30 sats/vbyte. The voting is now open, with the deadline being 7 a.m. UTC time on Monday, April 21.

April 22

Macroeconomics:

At 9 p.m., Vice Chairman of the Federal Reserve Jefferson delivered a speech at the Economic Liquidity Summit

At 9:30 pm, 2026 FOMC Tender Committee and Philadelphia Fed Chairman Huck delivered a speech at the Economic Mobility Summit

Policy Supervision:

The European Securities and Markets Authority (ESMA) initiated a public consultation on guidelines for evaluating the knowledge and competence of professionals providing crypto asset services under the Crypto Asset Market Regulation (MiCA). The consultation was released on February 17 and aims to standardize the qualifications and experience that individuals need to provide consulting or information to clients on digital assets.

The draft guidelines set clear standards for professional qualifications, work experience and continuing education for employees employed by cryptoasset service providers (CASPs). Under the proposal, individuals who provide investment advice on crypto assets must meet stricter capabilities requirements than those who provide basic information services. Market participants including CASPs, investors, financial institutions and industry associations were invited to provide feedback on the proposed criteria. ESMA will accept comments until April 22, 2025 and is expected to issue final guidelines in the third quarter of that year.

Exchange:

Kraken will launch BNB spot trading pair on April 22

Kraken Exchange will launch BNB trading soon, and BNB recharge service has been opened. The four major trading pairs of BNB/EUR, BNB/USD, BNB/USDC and BNB/USDT will officially open at 22:00 Beijing time on April 22.

Project News:

The cross-chain interoperability protocol Hyperlane will airdrop the token $HYPER on April 22, with 57% of the total supply allocated to community users, and the team, investors and foundations will be allocated 25%, 10.9% and 7.1% respectively. The community airdrop part will be fully unlocked, while the team and investor tokens will be locked for 12 months. Users must check the qualifications through the official portal before April 13.

Token unlock:

SPACE ID (ID) will unlock approximately 12.65 million tokens at 8 am on April 22, Beijing time, with a ratio of 2.94% to the current circulation and a value of approximately US$2.4 million.

April 23

Macroeconomics:

IMF President Georgieva pointed out that the "restart" of trade and the wave of protectionism driven by the United States are aggravating global uncertainty and may lead to a slowdown in economic growth, but the world will not fall into recession. She stressed that although some countries may face increased inflation, the overall economy is still resilient. The IMF will release its latest World Economic Outlook report on April 23 (next Tuesday).

At 2 a.m., 2026 FOMC voter and Minneapolis Fed Chairman Kashkali delivered a speech

Project News:

At 9:30 pm, 2025 FOMC voter, St. Louis Fed Chairman Mousalem and Fed Governor Waller delivered opening speeches at an event

The Argentina's lower house approved the establishment of a special committee to investigate the role of senior government officials in the issuance and collapse of the La Libertad Avanza project (i.e. Libra tokens). The committee consists of 24 lawmakers who will review testimony from all parties to confirm whether President Javier Milei, his sister Karina Milei and other government officials have been involved in the issuance of the token and its subsequent collapse. The committee will initiate an investigation on April 23 and must submit an investigation report within three months to clarify relevant responsibilities.

Mile announced the Libra token plan for the first time in February, claiming that it will be used to support small and medium-sized enterprises in Argentina. However, the price plummeted just a few hours after the token issuance, causing losses to tens of thousands of investors. The congressional investigation is one of the investigations carried out by multiple domestic and foreign agencies in the Libra token incident. Other agencies involved in the investigation include the Argentine court and the US Department of Justice, and all parties are committed to finding out the truth of the incident.

Google will implement MiCA crypto advertising rules in the EU starting April 23

Google will enforce cryptocurrency advertising regulations in Europe that comply with the Crypto Assets Market Ordinance (MiCA) from April 23, 2025.

The U.S. Custody Trust and Settlement Corporation (DTCC) announced the launch of a real-time monetized collateral management platform, which is an innovative platform called "AppChain" to be demonstrated at the DTCC "Major Collateral Experiment" event on April 23. The platform aims to improve the efficiency and liquidity of global collateral circulation, optimize capital utilization, and "build an open digital liquidity ecosystem for market participants to deploy digital applications." According to the technical architecture, AppChain is developed based on the Besu platform of LF Decentralized Trust, a subsidiary of the Linux Foundation.

DTCC pointed out that the increasingly complex market environment and cost pressures have made the demand for efficient and high-quality mortgage solutions increasingly urgent. Through collateral tokenization, the platform is committed to breaking the barriers of traditional "island-style" system and significantly improving the speed of cross-system collateral circulation.

Token unlock:

Murasaki (MURA) will unlock about 10 million tokens at 8 a.m. Beijing time on April 23, with a ratio of 1.00% to the current circulation and a value of about 4 million US dollars.

Karrat (KARRAT) will unlock approximately 21.25 million tokens at 8 am on April 23, Beijing time, with a ratio of 8.79% to the current circulation, worth about US$1.3 million.

Eigenlayer (EIGEN) will unlock approximately 1.29 million tokens at 3 a.m. Beijing time on April 23, with a ratio of 0.53% to the current circulation, worth approximately US$1.1 million.

April 24

Macroeconomics:

At 2 a.m., the Federal Reserve announced the Beige Book of Economic Conditions

Policy Supervision:

The Dubai Financial Services Authority (DFSA) announced that it would invite companies to apply to join its tokenized regulatory sandbox, with the application deadline being April 24, 2025. DFSA is an independent agency responsible for overseeing the Dubai International Financial Centre (DIFC). In a March 17 announcement, DFSA said the sandbox program is designed to attract companies that want to provide tokenized investment products and services. The sandbox provides a controlled environment for businesses to test tokenized financial solutions under the supervision of regulators.

DFSA made it clear that eligible services include tokenized stocks, bonds, Islamic bonds and collective investment fund units. Whether it is an existing enterprise that has obtained DFSA authorization and wants to expand its tokenization business, or a new applicant who qualifies for the application, you can submit an application. After submitting the application, the company will enter the evaluation process. Successfully selected businesses will receive structured testing opportunities in the sandbox and receive tailor-made regulatory guidance. DFSA stressed that only companies with strong business models and solid compliance capabilities will be selected. The sandbox program is part of DFSA's wider innovative testing license program, aiming to help businesses improve their financial products and prepare for full authorization.

Exchange:

According to the Coinbase International Exchange announcement, the platform will launch perpetual contract (PERP) transactions of four tokens: WCT, KERNEL, BABY and PROMPT from 17:30 on April 24, Beijing time, and are suitable for international websites and Coinbase Advanced.

Binance Launchpool launches Initia (INIT)

Binance announced the launch of its 68th Launchpool project - Initia (INIT). Users can lock BNB, FDUSD and USDC at 00:00 (UTC) on April 18, 2025 to obtain INIT airdrops, and the event lasts for 6 days. Binance will provide INIT/USDT, INIT/USDC, INIT/BNB, INIT/FDUSD and INIT/TRY trading pairs. The total supply of INIT is 1 billion pieces, of which 3% (30 million pieces) are used for Launchpool rewards. In addition, an additional 10 million INITs will be allocated in batches after they are on the spot, and another 20 million will be allocated 6 months after they are on the market. The initial circulation supply is 148,750,000 INITs.

It is reported that the Initia main network will be launched on April 24 . Binance will launch INIT at 11:00 (UTC+8) on the same day and open INIT/USDT, INIT/USDC, INIT/BNB, INIT/FDUSD and INIT/TRY trading pairs.

Binance has removed AMB, CLV, STMX and VITE, and will terminate withdrawal services on April 24

Binance announced that it will remove the shelves from 11:00 on February 24, 2025 (Beijing time) and stop trading the following spot trading pairs: AMB/USDT, CLV/BTC, CLV/USDT, STMX/TRY, STMX/USDT and VITE/USDT. All outstanding pending orders will be automatically revoked after the transaction is stopped. Starting from 11:00 on February 25, 2025 (Beijing time), the recharge of relevant tokens will no longer be recorded in the user account, and the withdrawal service will continue until 11:00 on April 24, 2025 (Beijing time).

Project News:

Dolomite will conduct TGE on April 24, airdropping 20% DOLO

Lending and lending protocol Dolomite announced that its DOLO token generation event (TGE) will be officially launched on April 24, and users can start receiving DOLO tokens on April 24. The total number of DOLO tokens is 1 billion, of which about 361 million will be circulated during TGE, including locked veDOLO. 20% of DOLO tokens will be distributed to platform users as airdrops, with the airdrop snapshot date being January 6, 2025, only the activities in Dolomite before the snapshot are considered. In addition to airdrops, Boyco depositors will receive a 3% DOLO token allocation.

April 25

Policy Supervision:

US SEC will hold its third roundtable for crypto policy on April 25 to focus on hosting issues

The Securities and Exchange Commission (SEC) released details of its third roundtable for cryptocurrency policy, with the April 25 meeting focusing on custody issues, with two panel discussions – one on brokerage proprietors and wallet custody, and another on investment advisors and investment firm custody. Members of the brokerage proprietor group include: Jason Allegrante of Fireblocks, Rachel Anderika of Anchorage Digital, Terrence Dempsey of Fidelity Investment, Mark Greenberg of crypto exchange Kraken, Veronica McGregor of Exodus, Brandon Russell of Etana Custody, Tammy Weinrib of Copper.co.

Exchange:

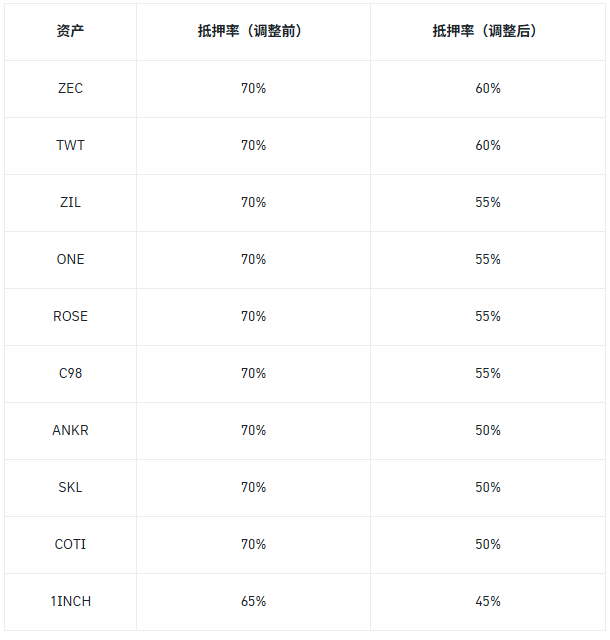

Binance will adjust the collateral rate of some assets in the unified account on April 25

Binance will adjust the mortgage rate of some assets in the unified account at 14:00 on April 25 (East Eighth District time). This update is completed within approximately one hour.

Bose Ethereum has been approved to participate in pledge activities from April 25

Bose Ethereum (03009), one of Hong Kong's first batch of virtual asset ETFs, and its US dollar counter (09009), have been approved to participate in staking activities from April 25. Lian Shaodong, chairman and CEO of Bose International, said that in the future, he will continue to leverage his advantages in investment and financial technology, further promote the integration of traditional finance and the third-generation Internet (Web 3), build a bridge between the on-chain and off-chain, and enrich market products.

Token unlock:

Venom (VENOM) will unlock approximately 59.26 million tokens at 4 pm Beijing time on April 25, with a ratio of 2.86% to the current circulation, worth approximately US$7.9 million.

AltLayer (ALT) will unlock approximately 240 million tokens at 6 pm Beijing time on April 25, with a ratio of 7.92% to the current circulation, worth approximately US$6.9 million.

April 26

None yet

April 27

Token unlock:

Undeads Games (UDS) will unlock approximately 21.94 million tokens at 8 a.m. Beijing time on April 27, with a ratio of 30.54% to the current circulation, worth approximately US$14.9 million.

Velo (VELO) will unlock approximately 182.8 million tokens at 8 am on April 27, Beijing time, with a ratio of 2.47% to the current circulation, worth about US$2.3 million.

The specific time is to be determined

Project News:

Sonic Labs: Public sales of .sonic domains are scheduled to start next week

Sonic Labs posted on the X platform that the .sonic domain name is ready, users can now check their emails, and waitlist users can now claim the domain name at Unstoppable Domains, and the public sales of the .sonic domain name are scheduled to start next week.