Wanzi Exploration of Web3 Payment: Web3 Reform of Consumer Cross-border Payment

Reprinted from panewslab

03/31/2025·1MWritten by: Will Awang

Consumers’ cross-border payment habits are constantly changing: People are trying multiple payment methods, but are still looking for better options. As VISA Ryan McInerney said: “There has been a bigger change in payment methods in the past 5 years than in the past 50 years.”

Today, with the continuous development of blockchain technology and digital currency, behind the deeper changes in payment methods is actually the changes in accounting methods - blockchain, an open and transparent global public ledger.

The changes in human accounting methods have only happened three times in thousands of years. Each time has profoundly shaped the economic form and social structure, and each breakthrough reflects the coordinated evolution of technology and civilization.

- Single bookkeeping during the Sumerian period allowed mankind to break through the restrictions on oral communication for the first time, promoting early trade and the formation of states;

- Double accounting has a driving force for the business revolution of the Renaissance, promoting the emergence of banks and multinational corporations and the establishment of commercial credit;

- Distributed accounting, driven by Bitcoin in 2009, led to changes in decentralized finance, trust mechanisms, and the rise of digital currencies.

This far-reaching change will not happen overnight, but is constantly evolving, and has also contributed to Web3 payment based on blockchain and digital currency. This new payment method is constantly deepening into all aspects of the real society.

Therefore, this article uses the recent consumer cross-border payment survey report released by VISA and proposes solutions to the main scenarios of current cross-border payment for consumers through cases on the market. Finally, let’s see where the future of Web3 payment will lie.

The full text is 15,000 words, the following Enjoy:

1. The growing cross-border payment market

The cross-border payment market is experiencing explosive growth driven by the surge in cross-border e-commerce, cross-border travel and cross-border remittances. Consumers are paying more frequently across borders than ever before, and Bank of England expects that payments related to it will reach $250 trillion by 2027.

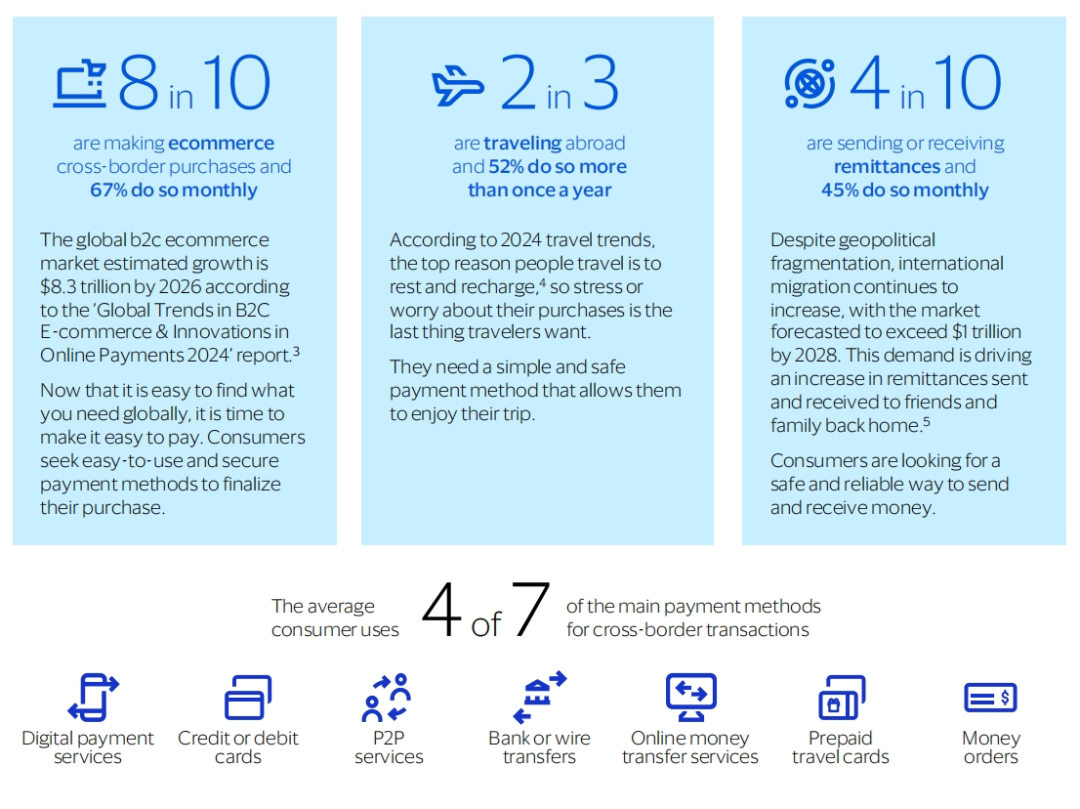

Consumers around the world are accepting cross-border payments, and today consumers spend more on cross-border transactions than ever before, but what is really interesting is its frequency (Frequency). 30% of people buy overseas through cross-border e-commerce every week, 45% send and receive remittances every month, and 66% travel abroad every year.

Often, people develop habits that make routine decisions easier and more efficient, but in the field of cross-border payments, this habit has not yet been developed. They use 4 of 7 different payment methods on average, and only 16% of consumers will always use the default payment method.

At present, there seems to be no payment method that can fully meet consumers' demand for cross-border payments, although nearly 80% of consumers are still using traditional banks for cross-border payments. But it’s very clear for consumers to be that they need a secure and trustworthy cross-border payment provider.

Between June 2023 and June 2024, a total of 771 million people conducted cross-border transactions. VISA's research shows that this growth is driven by three transaction categories: e-commerce, travel and remittance.

1.1 Main scenarios and methods

A. Cross-border e-commerce

Eighty percent of consumers choose to shop through cross-border e-commerce, and 67% of them spend cross-border every month. According to the "2024 B2C E-commerce and Online Payment Innovation Global Trends", by 2026, the global B2C e-commerce market size is expected to exceed US$8.3 trillion. Nowadays, it is no longer difficult to find the products you like worldwide, but the convenient payment experience still needs to be improved. Consumers are eager to obtain simple, easy-to-use, safe and reliable payment methods to successfully complete every cross-border shopping.

B. Cross-border travel

Two out of every three people have cross-border travel experience, and 52% of them travel more than once a year. According to the travel trends in 2024, the biggest purpose of people travel is to relax and relieve stress. Therefore, the last thing travelers want to encounter is the stress or concerns when shopping. They need a simple and secure payment method to be able to enjoy the trip with all their hearts.

C. Cross-border remittance

Four out of every ten people use cross-border remittance services, of which 45% perform remittance operations every month. Despite the complex geopolitical situation, the number of international immigration continues to grow, and the cross-border remittance market is expected to exceed US$1 trillion by 2028. This trend has also driven the increasing demand for people to send money to their relatives and friends in China. Consumers urgently need a safe and reliable method of cross-border remittance.

(Unlock the opportunity in cross-border payments, VISA)

Among the following seven cross-border payment methods, each consumer will use four on average:

- Electronic payment method;

- Credit or debit card;

- P2P transfer;

- Bank remittance

- Online transfer;

- Prepaid traveler's check/card;

- cash.

1.2 Why is it the right time to provide cross-border services to

consumers

The cross-border trading market is huge and growing. This is a critical stage in the development of cross-border transactions. More and more consumers make cross-border payments frequently, but traditionally, these transactions tend to be slow, costly and lack transparency. However, all this can be completely changed.

Consumers currently use multiple payment methods. Every consumer is trying a variety of different payment solutions and actively looking for the best way for them. But they have not found an ideal solution yet. They desire more choices and want guidance to help them make informed decisions. As consumers begin to develop habits that may accompany their lives, now is a critical moment that affects their choices.

Consumers need stable payment habits and reliable partners. Market competition will intensify as banks and fintech companies realize the potential to become the preferred cross-border payment method for consumers. This is not only an opportunity to attract new customers through new services, but also an opportunity to retain existing customers’ cross-border consumption through one-stop solutions. But at the same time, there is also the risk of other competitors taking the lead.

The foundation of trust cannot be ignored. Trust, security and reliability are crucial in cross-border transactions, especially when transaction amounts are often large. Consumers are very sensitive to these factors and expect banks and fintech companies to provide a safe and reliable payment environment. Winning the trust of customers is the key to building long-term partnerships.

2. Main scenarios and models of cross-border payments for consumers

The following will explore in-depth scenarios and processes of cross-border e-commerce, cross-border travel and cross-border remittance payment transactions, as well as the core issues encountered in cross-border payments.

2.1 Cross-border e-commerce

In the past year, about 589 million people around the world have participated in cross-border e-commerce transactions. Among them, 72% of transactions purchased physical goods through mainstream online retailers such as Amazon and eBay, and 44% of transactions purchased digital products. Despite the rise of the social media market, only 30% of consumers shop through these platforms, which may be related to concerns about data breaches.

(Unlock the opportunity in cross-border payments, VISA)

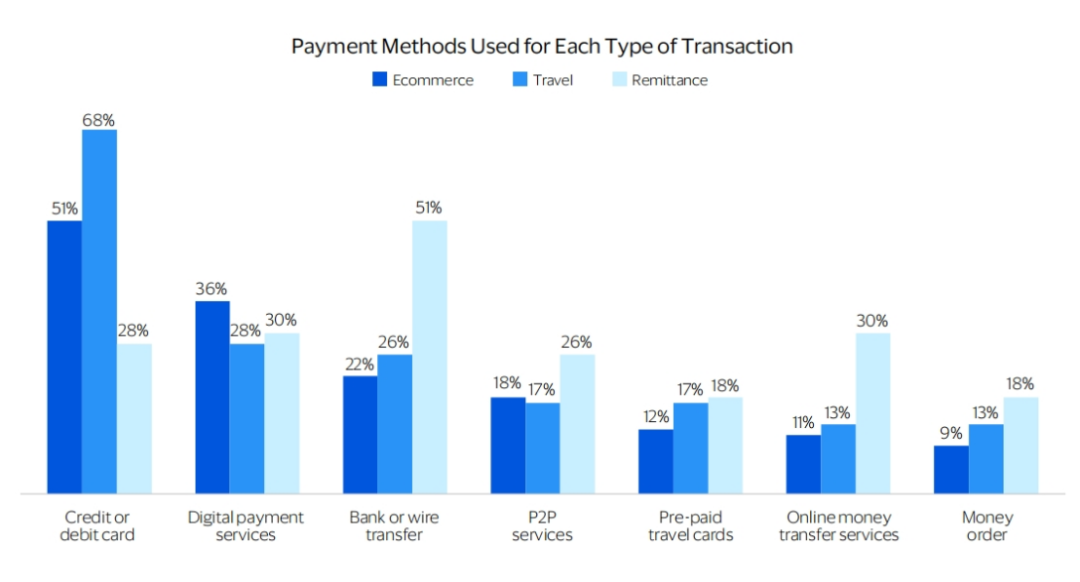

In terms of cross-border shopping payment methods, most consumers will choose credit card, debit card or digital APP payment services (such as Paypal, Apple Pay). However, financial institutions may be surprised to find that only 51% of consumers use credit or debit cards. This means that there is still a market space for other payment methods, such as 36% of consumers choose digital APP payment services, and some consumers use wire transfer or P2P services.

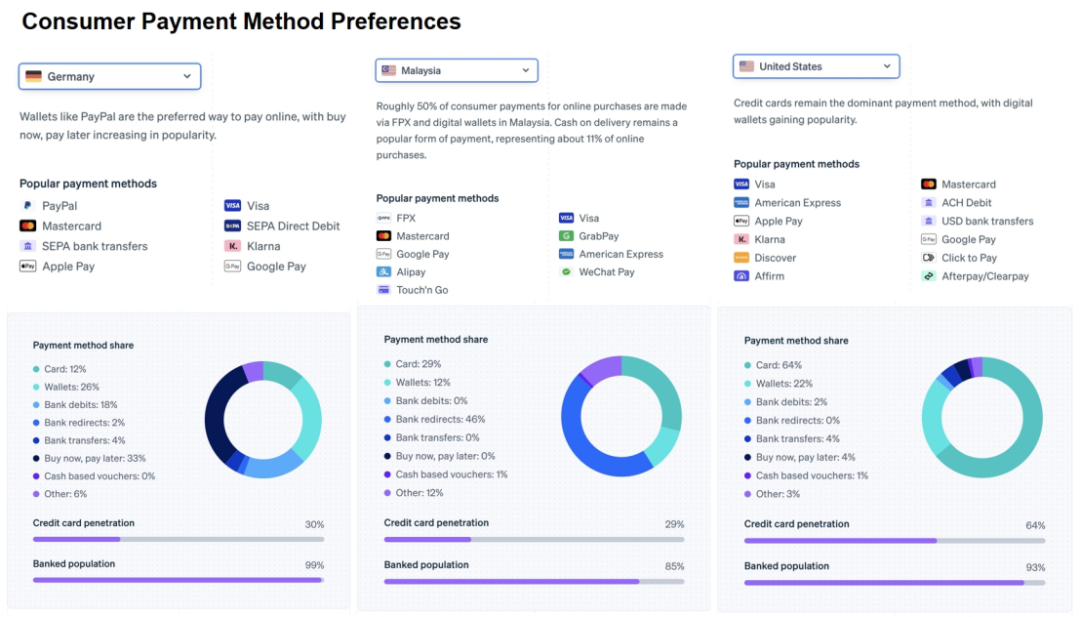

However, there are still significant differences in consumption habits in different countries:

Germany: Consumers are least willing to use credit or debit cards (only 32%), and prefer digital APP payment services (49%) and bank transfers or wire transfers (35%). This may be because consumers value the security and ease of use of payments more, as highlighted in the 2022 Western Europe Online Payment Methods Report.

Philippines: Consumers prefer digital APP payment method (49%), which may be related to the lack of access to traditional banking systems in 48.2% of local consumers.

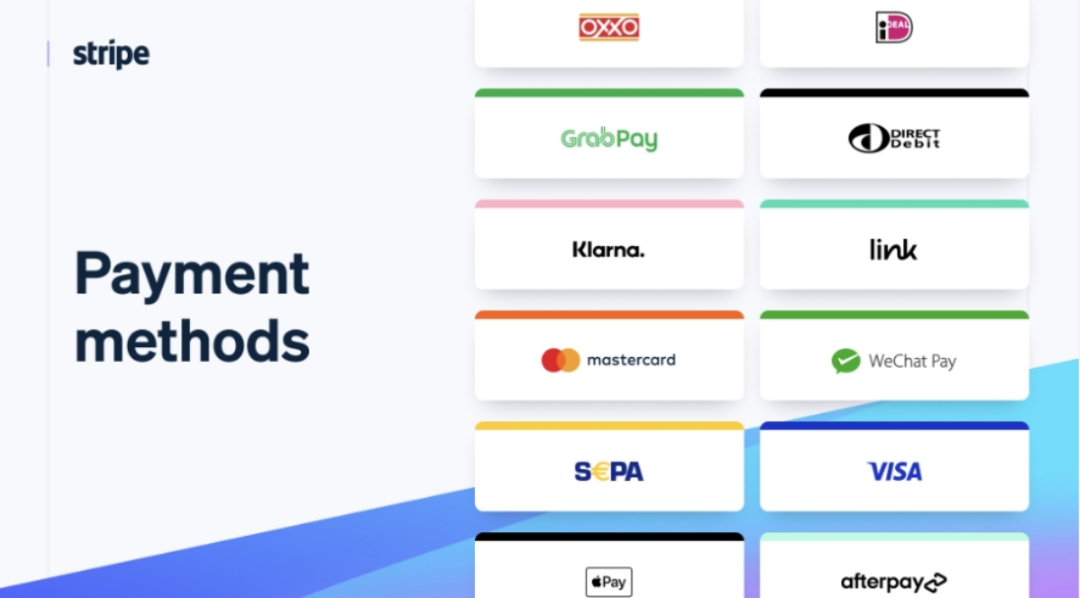

(Convert more customers with the most relevant payment methods, Stripe)

The above picture shows us comparing the payment habits of consumers in Germany, Malaysia and the United States through Stripe's Payment Method dashboard. These data show that the choice of payment methods varies by region and consumer demand, and financial institutions and e-commerce platforms need to provide diversified payment solutions based on local market characteristics.

The payment scenarios of cross-border e-commerce will be more likely to make consumer payments in their own country through the payment gateway of overseas e-commerce platforms. The payment gateway will inevitably link many payment methods, such as the preferred credit or debit card (organized through the card network), such as Paypal, Apple Pay (payment through the digital app), such as bank transfer (through the bank SWIFT network), etc.

(Convert more customers with the most relevant payment methods, Stripe)

2.2 Cross-border travel

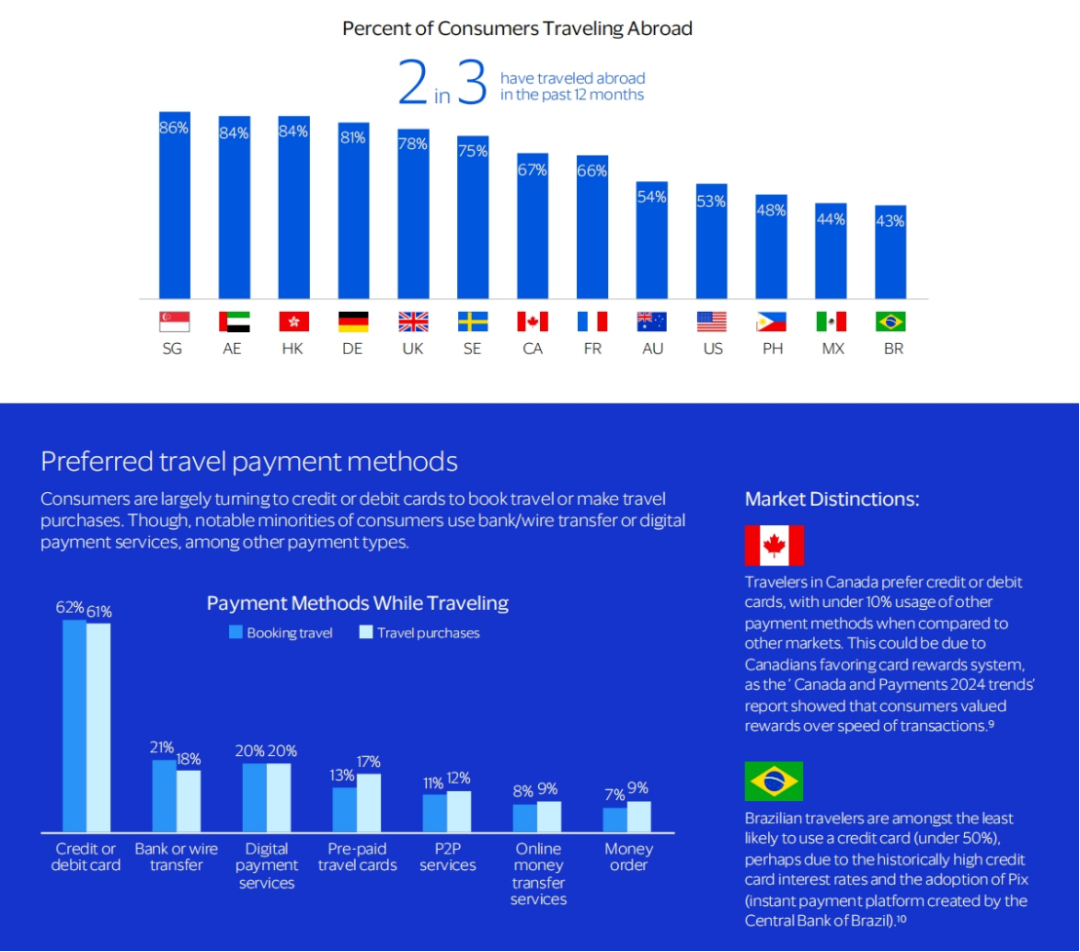

Two-thirds of consumers surveyed have traveled abroad in the past year, with 62% saying they booked a trip with a credit or debit card, making it the most popular payment method. This preference is not only reflected in their actual consumption abroad when booking a trip, but also in their actual consumption. The payment method used by most respondents during their trip was the same as when they booked their trip. This may be because credit cards are widely accepted and offer conveniences such as instant currency conversion and fraud protection.

Even though geopolitical factors continue to be prominent at the moment, cross-border travel remains a norm, especially in Singapore (86%) and the UAE (84%), where consumers travel abroad have the highest proportion. Of the 13 markets surveyed, nearly 50% of respondents in each country have traveled abroad in the past year.

(Unlock the opportunity in cross-border payments, VISA)

When it comes to travel payment methods, most consumers choose credit or debit cards to book a trip or pay for travel expenses. However, a small number of consumers also use other payment methods such as bank transfer, wire transfer or digital APP payment services.

Canadian travelers are particularly favoured with credit or debit cards, with less than 10% of other payment methods compared to other markets. This may be because Canadians value credit card reward systems more, and according to the Canadian Payment 2024 Trends report, consumers value reward points more than transaction speed.

By contrast, Brazilian tourists are least likely to use credit cards (less than 50%), which may be related to Brazil's historically higher credit card rates, but also affected by widespread adoption of PIX, an instant payment platform created by the Brazilian Central Bank.

(Understanding Cross-Border Payments: Process, Challenges, and Solutions)

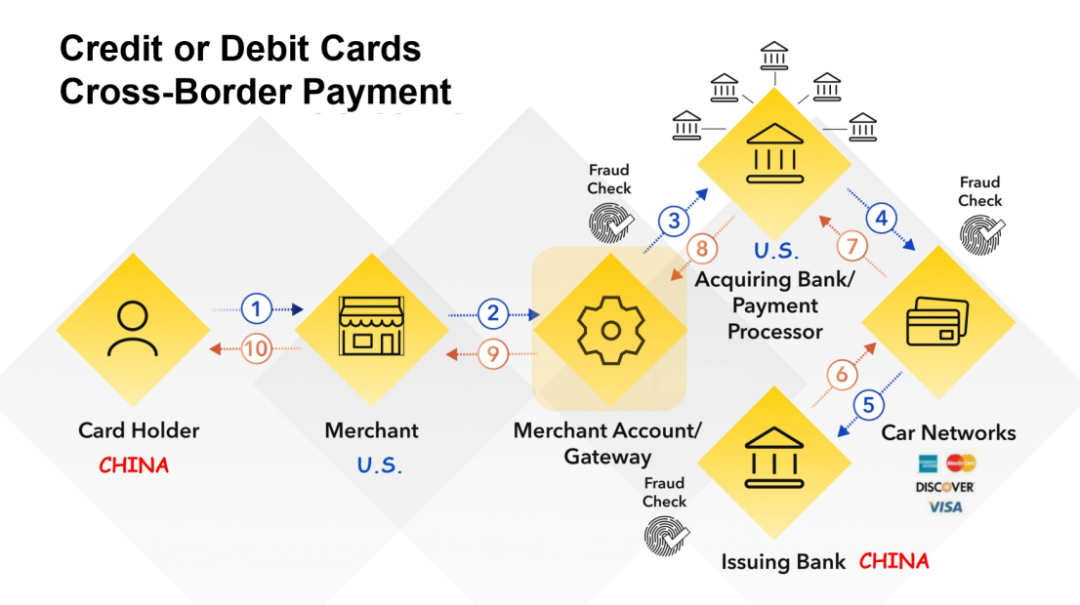

Payment scenarios will be more: consumers use their own debit or credit cards, online and overseas merchants to swipe their cards to spend, or scan the code through digital APP payment platform. The above picture shows the process of paying for debit or credit card swiping.

2.3 Cross-border remittances

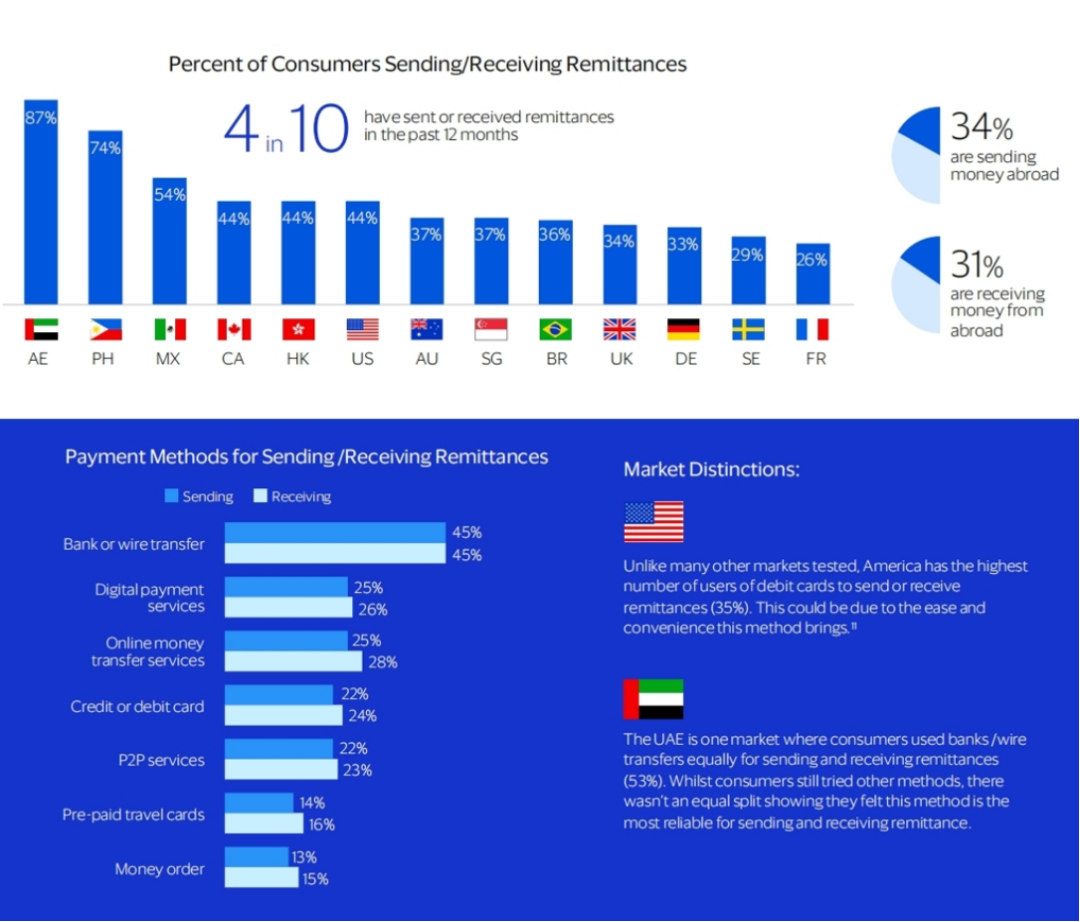

In the past 12 months, 40% of respondents have sent or received remittances, with bank transfers or wire transfers being the most common payment method. It is not surprising that in countries with large immigrant labor force such as the UAE and the Philippines, the highest proportion of remittances is 87% and 74% respectively. Remittances are an important source of funding for millions of workers and families around the world, and remittancers want to get the most cost-effective payment services in every transaction.

(Unlock the opportunity in cross-border payments, VISA)

In 2023, total remittances to low- and middle-income countries increased by 3.8% to $669 billion. In the Asia-Pacific region, China, India and Singapore are markets with frequent remittance activities. A significant trend is that digital app payment is becoming increasingly popular among remittancers due to its security and ease of use, and has gradually become the main way to send and receive remittances. Compared with traditional remittance methods, digital app payments are considered to have higher security.

Compared with the payment methods of digital apps, there are significant differences in the payment methods of cross-border remittances. Although banks or wire transfers are longer and often more expensive, they are still the most commonly used remittance methods.

Unlike other markets, the United States has the highest proportion of users using cross-border remittances (35%). This may be due to the convenience and ease of use of debit card payment methods. In the UAE, consumers use bank or wire transfers in a comparable proportion (53%) when remitting money across borders. Although consumers have tried other payment methods, banking or wire transfer is the most reliable way to transfer money across borders.

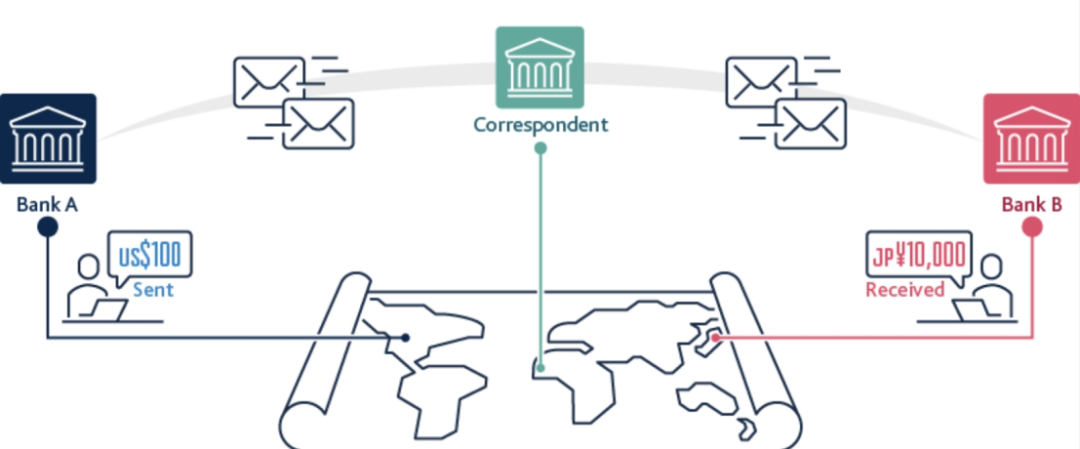

(Cross-border payments, Bank of England)

The above is a flowchart of cross-border remittances through the banking network. If large banks in developed countries have settlement accounts with each other, the transaction process will be relatively simple. However, not every bank has a direct relationship, so sometimes they need to trade through an intermediary, the “agent bank”. If there is no direct relationship between Bank A and Bank B, the agency bank will provide them with an account.

For small currencies/return countries, the agency bank model (intermediaries make the difference) will greatly erode their profits and bring huge burdens to consumers. According to statistics from international banks, the average cost of remittances accounts for 6.62% of the remittance amount worldwide.

Research shows that consumers expect cross-border payments to be as convenient and smooth as daily payments, and financial institutions must work hard to meet this demand of their customers. Customers hope that cross-border payments can be fast, transparent and efficient, with instant arrival, avoiding multi-day settlement waiting, especially for small transactions.

3. Characteristics and pain points of cross-border payment

3.1 Cross-border payments are becoming more common and frequent

According to VISA's research, cross-border payments are very common among many consumers in various regions. However, what may surprise many people is how frequently these cross-border purchases occur. Despite the differences between different types of goods and different markets, overall, a considerable number of consumers make cross-border payments monthly, weekly, and even more frequently.

(Unlock the opportunity in cross-border payments, VISA)

Most digital natives (i.e., the generations who grew up in a digital environment) – Gen Z (84%) and Millennials (83%) have traded across borders in the past month, which is already a pretty big number. So, what about the baby boomers and older groups? In fact, 68% said they have traded cross-border in the past month and they are catching up – in addition to buying goods and services, they may also send money to their families abroad, pay tuition fees or buy property.

3.2 The payment method is not fixed and the habit has not yet been

developed.

Cross-border payments are becoming increasingly common and frequent, and it is crucial to understand how they handle these transactions. VISA research shows that consumers have not yet formed clear preferences in terms of payment methods for cross-border consumption and services. This is the window period for fintech companies to use cross-border payment services.

Currently, consumers still use a variety of different applications and payment methods when conducting cross-border transactions. In terms of cross-border e-commerce and cross-border travel, more than 50% of consumers use credit or debit cards to make payments through traditional banks, which is obviously the most commonly used payment method, but is not the only option. Similarly, digital app payment services are also very popular, but other payment methods also account for a considerable proportion of the remaining consumption.

When remitting money across borders, consumers choose more diverse payment types. Bank transfer or wire transfer payment services are the most widely used methods, but many consumers also use digital online transfer services, credit or debit cards, and P2P services.

(Unlock the opportunity in cross-border payments, VISA)

3.3 Consumers desire more choices

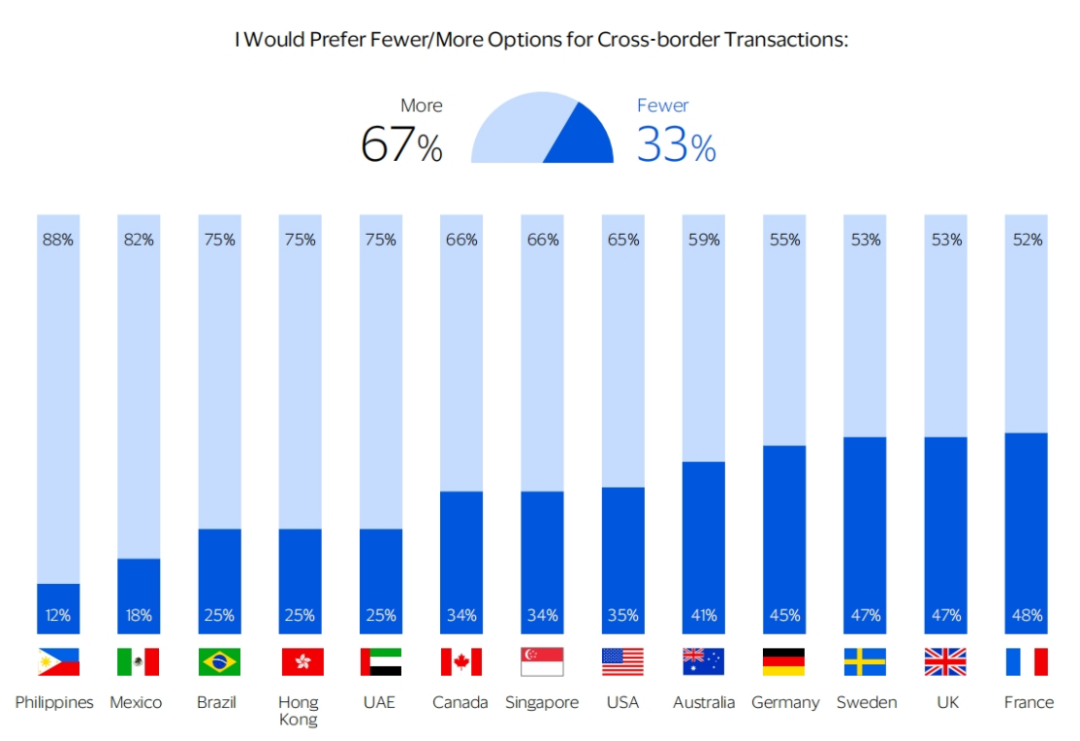

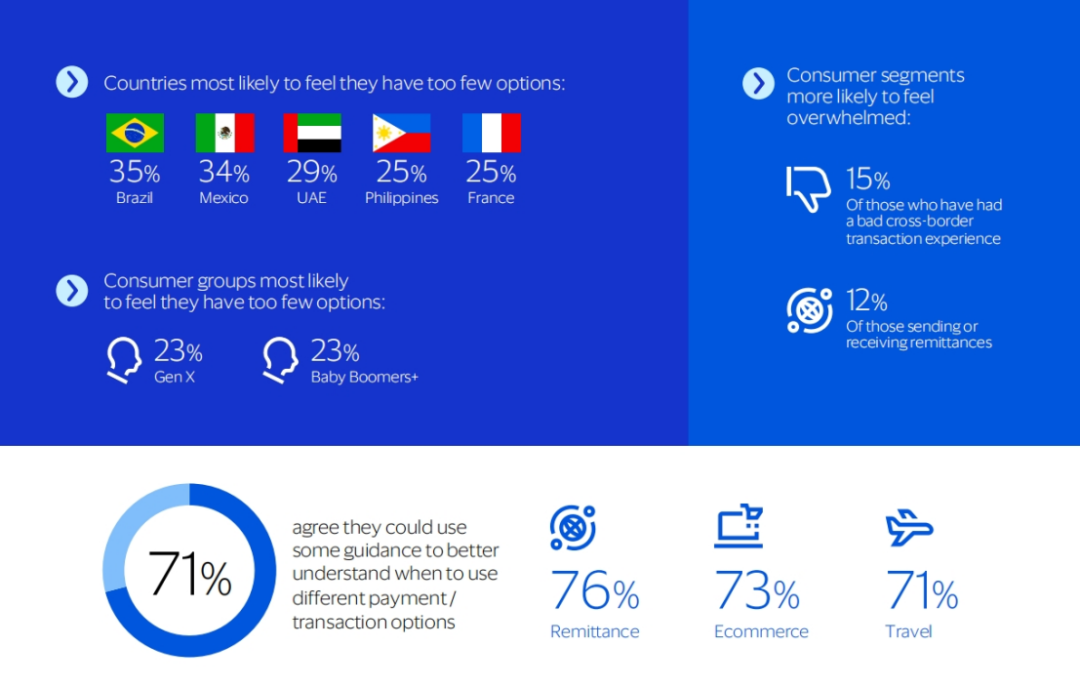

VISA's research shows that in various regions, most consumers want more options when it comes to cross-border payments. A considerable number of consumers are not satisfied with the currently available cross-border transaction methods, and one in five consumers said they currently do not have enough payment methods to choose from in cross-border transactions. By contrast, one in twelve consumers believe there are too many options for cross-border transactions.

Consumers who remittance cross-border pay particular attention to having more options (76%). This demand is particularly important among consumers in the Philippines (88%) and Mexico (82%), who are also major labor countries and have low local banks.

It should be noted that even in countries like Sweden (53%), the United Kingdom (53%) and France (52%), which already have rich payment options, consumers say they want to have more options, which shows that the cross-border payment market is still very problematic.

(Unlock the opportunity in cross-border payments, VISA)

More options mean more intense competition, especially for banks and fintech companies. At the same time, this also means that the payment transaction experience is not satisfactory, and consumers will not hesitate to turn to other service providers if they feel dissatisfied or need more choices.

Therefore, this leads to consumers switching among multiple service providers. In key markets of cross-border payments, such as Sweden, Singapore and the UAE, about half of consumers involved in cross-border payments are currently more inclined to deposit funds in multiple accounts to gain flexibility in transferring funds. This flexibility provides the impetus for banks and fintech companies, who must work harder to retain and attract customers by focusing on consumer behavior, attitudes and needs, prompting them to implement the most suitable digital app payment method for cross-border transactions.

But so many choices, as well as the complex rate structure, consumers often feel overwhelmed. So when 71% of consumers say they want more guidance to better understand when and how to use different payment options, it is clearly a clear call for banks and fintech companies: there is a lack of guidance from trusted sources in the market. What they need is security, ease of use, clear guidance, and stable payment habits.

(Unlock the opportunity in cross-border payments, VISA)

Two-thirds of respondents said they like to maintain their daily habits and stick to it once they find the right payment method (66%). Meanwhile, three-fifths of respondents said they would be cautious in using tools (61%) in cross-border transactions.

These financial behaviors are gradually forming habits as people conduct cross-border transactions more frequently. Consumers want easy-to-use services and clear guidance, and many are looking for other payment options. This is exactly where fintech companies are based.

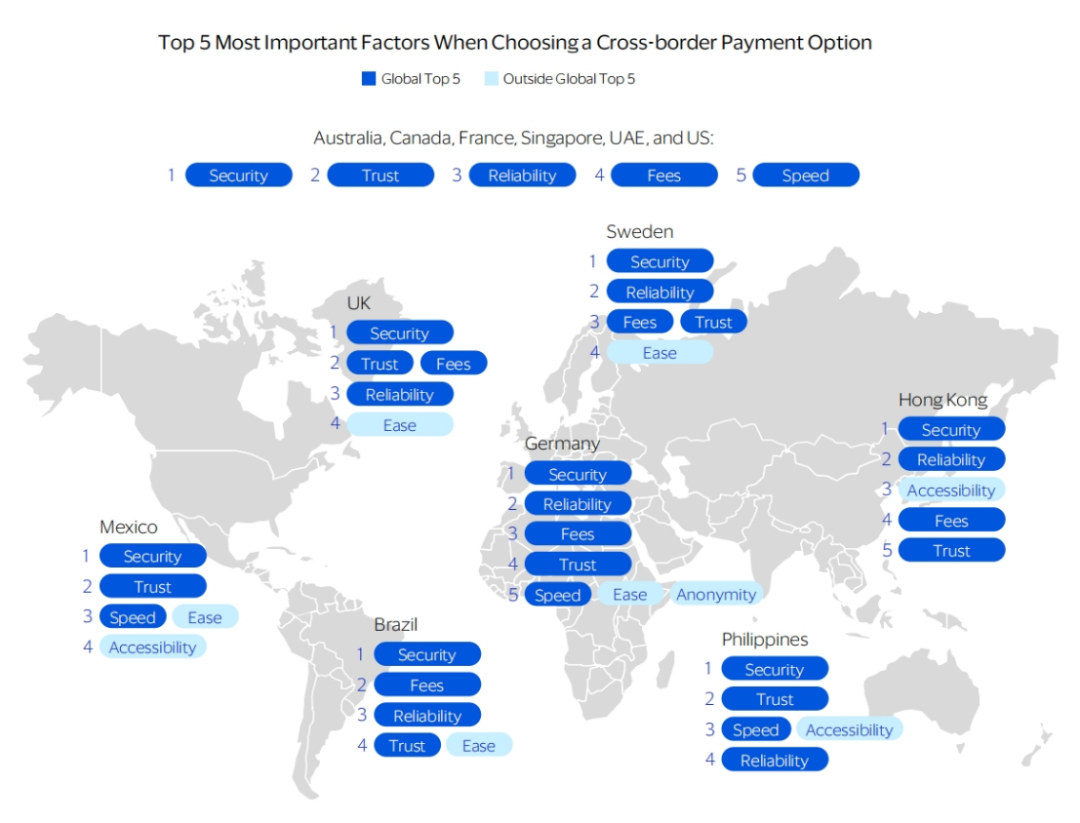

3.4 Security is a requirement, not an option

For banks and fintech companies, consumer trust in the security of payments is crucial. Security is always the top priority when choosing a cross-border payment solution in each region surveyed by the VISA. When VISA further analyzes the four most important factors in choosing cross-border payment methods, consumers value security (63%), trust (51%), reliability (49%) and expense (49%) the most.

Of all types of cross-border transactions, security has always been the primary focus for consumers in all regions and those involved in tourism (63%), e-commerce (62%) and remittance (59%) transactions.

When analyzing the choice of cross-border payment methods, in addition to the first three considerations, there are some differences between different markets. For example, for consumers in Mexico, Brazil, the Philippines, Hong Kong, the United Kingdom, Germany and Sweden, the availability and ease of use of payment methods are very important. In Germany, anonymity is one of the top five factors consumers consider, while in Brazil, consumers say that fees are second only to security and are the second most important consideration when choosing cross-border payment methods.

(Unlock the opportunity in cross-border payments, VISA)

Negative events that consumers experience, witness or hear about in person may be one of the reasons why security is so common and important. Negative experiences cover a wide range of areas, including delays, fraud or fraud, loss or stolen funds, transaction errors, fee problems, bank card problems, complex processes, unreliable services or technical failures. These experiences have profound and serious consequences for the parties involved.

One in five consumers (21%) have had unpleasant experiences when conducting cross-border transactions. In addition, consumers who remittance across borders are more likely to report negative experiences (31%). These groups may be extra cautious about fraud in cross-border transactions.

An UAE consumer described his experience: "…I am sending money to my brother. He urgently needed the money, but payment was delayed for a week and he almost lost his home." Others reported being repeatedly charged, having suffered fraud during currency exchange, or lacking clear and accessible guidance in obtaining funds. These experiences are extremely destructive and have brought huge real harm to consumers.

(Unlock the opportunity in cross-border payments, VISA)

Fraud risks are a barrier to the use of cross-border payments, and the proportion of consumers who stop cross-border transactions due to concerns about fraud risks is quite high. About two-thirds of consumers say the risk of fraud has caused them to abandon some kind of cross-border payment method.

Consumers who remittance across borders, the younger generation, and consumers from the UAE, the Philippines, Mexico and Brazil are more likely to stop using a certain payment method because of fear of fraud. Among Gen Z and Millennials, 76% and 71% had discontinued transactions due to suspected fraud, compared with 52% of baby boomers and older consumers. Traditionally, older generations have established higher trust in traditional banks, while younger generations have become more casual when choosing cross-border payment service providers, some of which may be newer market participants and have not yet established enough trust.

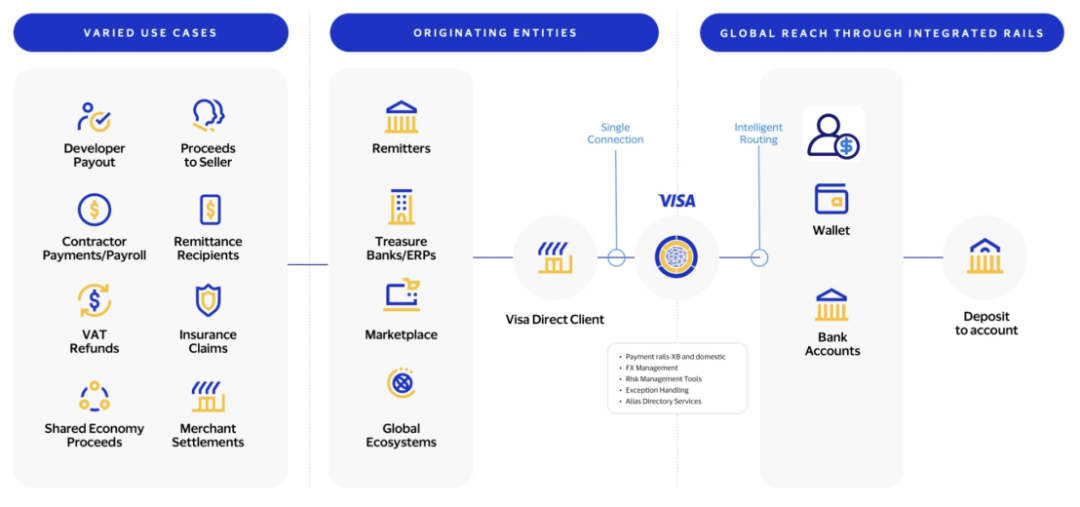

4. VISA's cross-border payment solution-VISA Direct

With the rise of financial technology, the previously led fund transfer business led by banks is no longer limited to a specific place, but anywhere that can be connected to the Internet. In the past, cross-border payment methods were mainly dominated by bank remittances and card payment methods. VISA, the global leader in digital payment technology, is also exploring how to integrate with VISA's existing card organization banking network through digital methods to provide consumers with a more convenient cross-border payment experience - VISA Direct.

4.1 What is VISA Direct

VISA Direct is a payment platform that enables nearly real-time domestic and international fund transfers. The platform utilizes the processing capabilities of VISANet's global network to enable payment initiators to "push" funds to the recipient's bank account or VISA card in a safe and convenient manner through the acquiring agency.

Users can use VISA Direct to remit money to more than 2 billion VISA cardholders and account holders around the world (A2 A), and transfer funds to qualified bank cards, deposit accounts and digital wallets in more than 190 countries and regions. VISA Direct supports a variety of uses, including individual-to-person (P2 P), business-to-consumer (B2 C) and business-to-business (B2 B) payments.

VISA Direct solutions are supported by more than 500 VISA partners, including acquiring agencies, banks, fintech companies and other partners. Through this solution, VISA’s global customers and partners can connect to VISA Direct through a single access point and push payments to qualifying VISA cards or accounts, enabling domestic or cross-border payments.

(VISA Direct Account and Wallet)

Although the function is currently only applicable to some VISA cards, and whether it accepts it depends on the cooperation of the cardholder's institution, its scope of application is continuing to expand. In fiscal year 2023, VISA Direct handled more than 7.5 billion transactions in more than 2,800 projects around the world, supporting more than 65 usage scenarios. Recently, in March 2025, VISA officials said that cross-border transactions in VISA Direct increased by 50% year-on-year, P2 P transactions increased by 80% year-on-year, and the annual compound growth rate of transactions reached 40%.

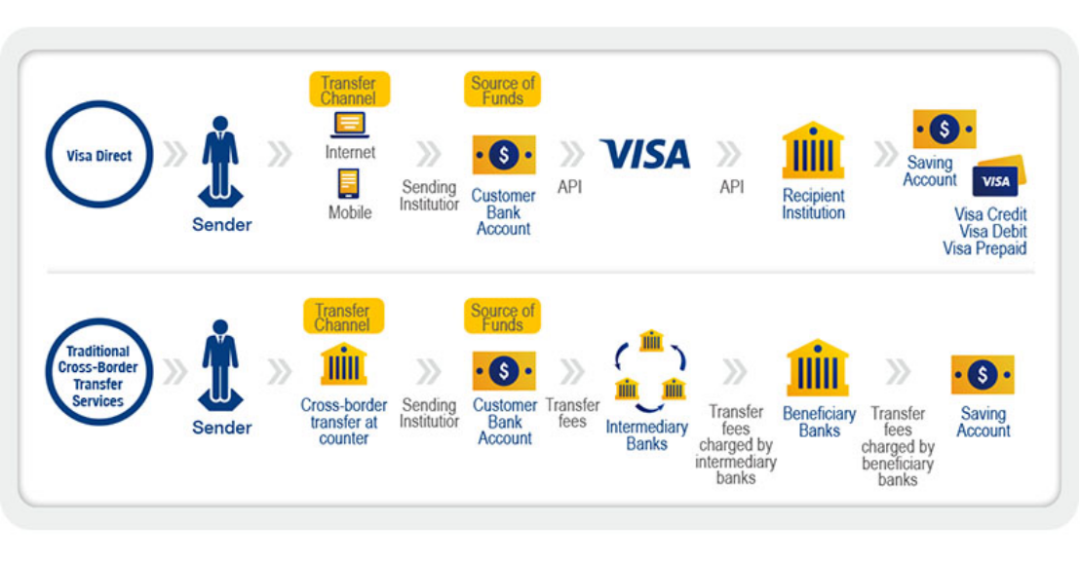

In terms of cross-border payments, the core of VISA Direct is: 1) to establish an efficient global VISANet card organization network to replace the old SWIFT proxy bank network system; 2) to connect many digital partners through the form of a digital VISA API; 3) to connect the bank account system and the VISA card account system, and provide one-stop access.

(Simplify how you send money abroad)

4.2 What are the advantages of VISADirect?

VISA Greater China President Yu Shirley said: As a network that gathers networks, VISA is the driving force for the transformation of cross-border capital flows, connecting the world through innovative technologies. From banks to card issuers to fintech companies, customers of all kinds can connect to VISA Direct through a single point of access, creating cross-border payment tools that provide consumers and businesses with fast, secure and reliable global capital flows.

This type of real-time cross-border payment contains huge opportunities. Data shows that companies that use global real-time payment networks for cross-border transactions can increase transaction volume by about 15% each year and increase profits when entering new markets. In addition, businesses are expected to reduce customer churn by up to 60%, while improving payment reliability and security.

VISA can provide solutions, and VISA Direct empowers five major advantages of cross-border payments:

A. Global coverage

VISA Direct provides a single access point that connects more than 8.5 billion terminal devices. Real-time cross-border payment solutions allow users to easily access billions of bank cards, network terminals, accounts and digital wallets around the world through one connection.

B. Simplify compliance

VISA Direct provides compliance support to users through its strong partner ecosystem and VISA Network. When using card base networks, more and more peer-to-peer transactions are implemented. The payment chain will be significantly simplified when the remitter and the payee use the same banking service; this process will be further optimized when making payments through a digital wallet.

C. Continuous innovation

With more than 60 years of industry experience, VISA Direct is committed to promoting the continuous advancement of payment technology through innovation to create future-oriented payment functions.

D. Improve transparency

VISA Direct is helping financial institutions and other payment providers improve transparency in foreign exchange rates. VISA uses multiple existing market indicators to generate foreign exchange rates, including data from top market data providers, pricing and liquidity data from forex trading platforms, and central bank pricing indicators.

E. Cost-effective advantages

VISA Direct modernizes the cross-border payment capabilities of enterprises, allowing it to leverage VISA's industry-leading infrastructure without making high investments in its own infrastructure.

The ability to move funds across borders quickly and securely is crucial in an increasingly connected global economy. VISA Direct provides a comprehensive solution based on a card organization network to help businesses simplify cross-border transaction processes, reduce costs and enhance customer experience.

But as mentioned earlier, VISA Direct is still optimizing an old system, just like refueling in the air, rather than sailing into the sea of stars.

5. Web3 payment solution

Just like the essential attributes (value scales) and core functions (mediates of exchange) of money are unchanged, although they have experienced carriers or manifestations of currency such as shells, currency raising, cash, deposits, electronic currency, stablecoins. The essence of Web3 payment remains the same - Exchange of Value, what needs to be changed is the service methods of banks, payment institutions, etc., and what needs to be considered is how to provide better financial payment services in a distributed, digitalized, and transcend time and space scenario.

Web3 payment is a new payment method based on blockchain technology and digital currency. Compared with traditional payment systems, Web3 payment has the following characteristics:

- Instant settlement: instant transaction settlement can be achieved worldwide through blockchain technology.

- Reduce costs: Web3 payments can significantly reduce transaction costs and administrative expenses due to the elimination of intermediaries. Global Accessibility: Anyone with an Internet connection can make payment transactions at any time, especially in areas that cannot be covered by the traditional financial system (Under-banked and Unbanked).

- Decentralization: Web3 payments achieve permissionless access and asset ownership through decentralized finance (DeFi).

- Programmability and interoperability: Combined with smart contract technology, Web3 payments can create more financial derivative services, such as lending and financial management.

- Enhanced transparency and openness: The open and transparent nature of blockchain increases visibility of capital flows and simplifies the cross-border payment process.

Overall, Web3 payment is not only a new payment method, it also provides a more open, efficient and innovative financial payment solution through the combination of blockchain technology and digital currency.

This can be an embedded solution, just like Gate Pay helps to embed digital currency payment with Crypto option in traditional payment gateways, or cost reduction and efficiency enhancement solutions based on blockchain and stablecoins, such as Stripe's acquisition of Bridge, or a brand new innovative financial form based on blockchain settlement layer, taking into account both on-chain and off-chain, like the Morph Black product that MorphPay aims to create.

In fact, behind the payment method, what Web3 payment most significantly brings is the change in accounting methods - blockchain, an open and transparent global public ledger. The current Web3 transformation of SWIFT network and card organization network is also a process of gradually moving to the blockchain settlement network.

5.1 Web3 transformation of cross-border e-commerce

As previously analyzed, the payment scenarios of cross-border e-commerce will be more likely to be that consumers make consumer payments in their own country through the payment gateway of overseas e-commerce platforms. For cross-border e-commerce, Web3 payment can intervene in two aspects:

- Embed the option of Pay With Crypto in the payment gateway or digital wallet to facilitate consumption of digital currency payment people;

- Use blockchain as a settlement network to optimize the settlement of funds between users and merchants to reduce payment procedures between users and merchants and improve the efficiency of funds utilization of merchants.

Although we can see that Web3 payment can indeed bring benefits to cross-border e-commerce payments, a very realistic issue and a question that has been discussed by the industry are: how to implement the Mass Adoption of cryptocurrency - how to enable users to own Crypto, and how to enable merchants to accept Crypto.

5.1.1 Bridge - Stripe spent $1.1 billion to acquire stablecoin infrastructure

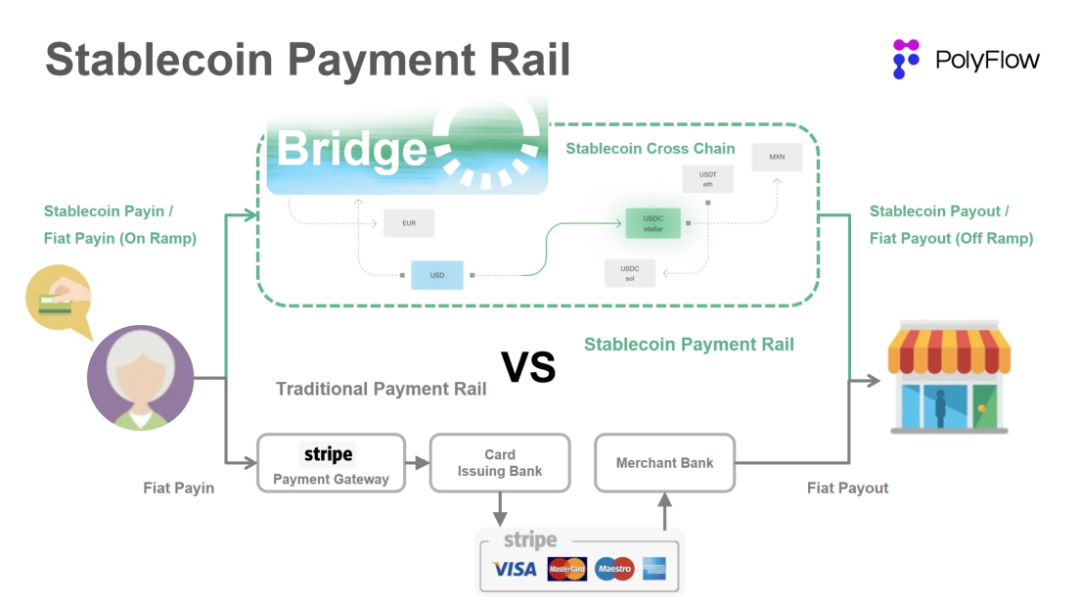

Stripe, one of the three major payment giants in the United States, acquired Bridge.xyz, a stablecoin infrastructure company that was established for only two years for US$1.1 billion in October 2024, creating the largest acquisition deal in the crypto industry. Bridge is a stablecoin API infrastructure that provides software tools that help businesses accept stablecoin payments.

Bridge's main product is the Orchestration API, an API that integrates stablecoin collection and payment into the existing business of the enterprise. After integration, Bridge will handle all the complex issues of compliance, regulation and technology.

Through the Orchestration API, combined with Bridge itself, 1) cross-chain transactions of stablecoins, 2) fiat currency/cryptocurrency deposit and exit acceptances, and 3) virtual bank accounts can help users transfer funds around the world within minutes, seamlessly send stablecoin payments, convert local fiat currency into stablecoins, and provide global consumers and businesses with USD and Euro accounts, allowing users to save and spend in USD and Euro.

(PolyFlow Insights: The Next Step Beyond Stripe & Bridge is PayFi)

For Stripe, one of the world's largest payment service providers, the emergence of Bridge, on the one hand, can help the implementation of the Stripe Pay With Crypto strategy, so that more and more existing businesses will be settled by stablecoins to achieve internal cost reduction and efficiency improvement, and the smooth and seamless user product experience; on the other hand, Stripe can build a stablecoin payment path outside the original bank, card organization, and SWIFT payment system through Bridge, expanding to its ecosystem, and at the same time compatible with DeFi.

Therefore, after combining Bridge, Stripe's network effect is no longer limited to its ecosystem, but to the entire stablecoin market. Similarly, the PayFi ecosystem built with DeFi can break through the geographical restrictions of traditional financial services and realize the free circulation of value and financial inclusiveness of global users. This is also the direction Paypal, which issues stablecoins, is working hard to achieve.

Bridge's official announcement article stated: "The two sides will work together to accelerate the adoption and practicality of tokenized USD, so that everyone in the world can transfer, store and consume currencies more easily. Through many practical cases, stablecoins can be the core global capital flow infrastructure, representing a brand new payment platform. This is not because consumers or businesses are born to want "cryptocurrencies", but because stablecoins solve key financial problems."

5.1.2 Gate Pay - Starting from the exchange to make payments

Gate Pay作为行业领先的B2 B加密货币支付解决方案,提供一站式的加密货币收单、下发、法币出入金全流程服务,同时还提供白标支付网关以及其他定制化解决方案。

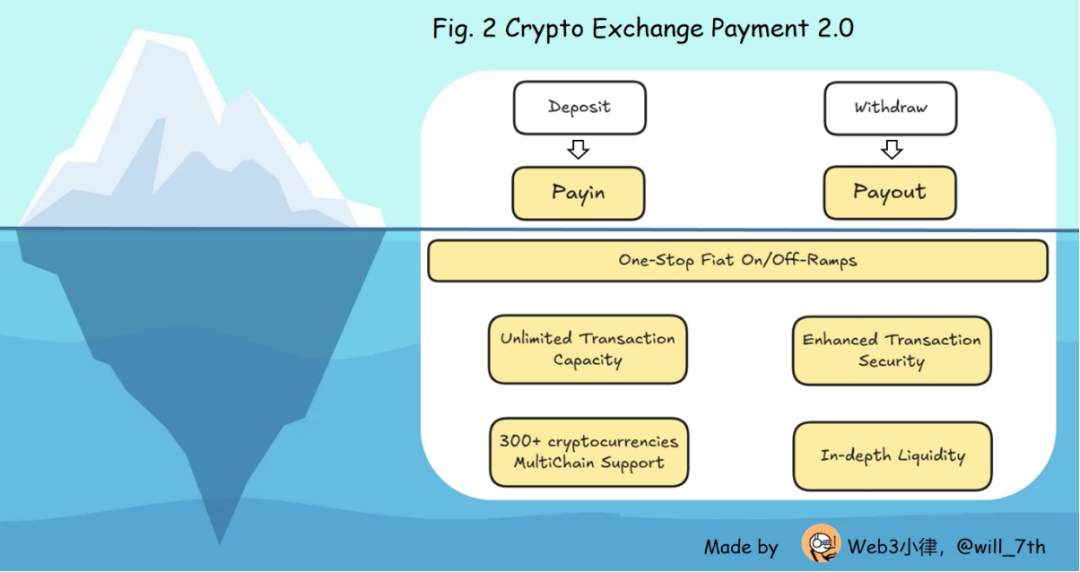

在交易所发展的早期,就能看到例如Binance, Crypto.com, Gate.io这些交易所推出基于自身生态的交易闭环功能,如Gate.io推出的Gate Life商户商城、礼品卡中心等(支持商户入驻,并支持用户通过加密货币付款)以及Gate.io推出的Crypto Payment Card。交易所支付1.0的核心的本质是2 C业务,去竞争用户,去满足交易所本身的大规模C端用户的现实消费需求,保持用户留存,并通过一些激励手段促进用户的活跃度与忠诚度。

而随着行业的发展,Gate Pay将交易所支付的能力抽象出来,形成一套对外2 B的加密支付解决方案。任何商户和机构可以使用API或者通过白标的方式,来接入Gate Pay所有的产品能力。商户可以自定义自己的前端和展示,以商户自身的品牌去触达自己的商户网络。Gate Pay愿意去做促进加密币支付这种大规模应用场景的基础设施建设者和方案提供方,无论是幕前还是幕后。

就像Gate Pay负责人Feng所说的:“交易所支付从最开始的Crypto Payment Card的开始,发展到交易所内部的商城Marketplace,再到内部生态之间生成二维码的支付。从本质上讲,这些都是2C的业务,大部分交易所支付都没有2B的能力。其实此前也提到了交易所支付1.0更大的目的,是去服务交易所现有的用户,提供用户的留存与忠诚度。

交易所支付2.0的更大目的,是去服务交易所之外的用户,一方面能够借助交易所自身已经构建好的各个成熟模块,去更好地进行业务的2B拓展,一方面也能够间接地进行部分2C用户的转换,最大化2B2C两端的优势。 ”

5.2 跨境出行的Web3改造

如前所述,跨境出行的支付场景更多的会是:境外线下支付,通过借记卡/信用卡或者数字钱包App支付平台扫码的形式。Web3支付更多的是嵌入到数字钱包之中,通过类似二维码支付的形式,向商家支付。我们先从一个线上跨境旅行网站预订的视角,再从一个线下消费的视角来看Web3支付在其中的作用。

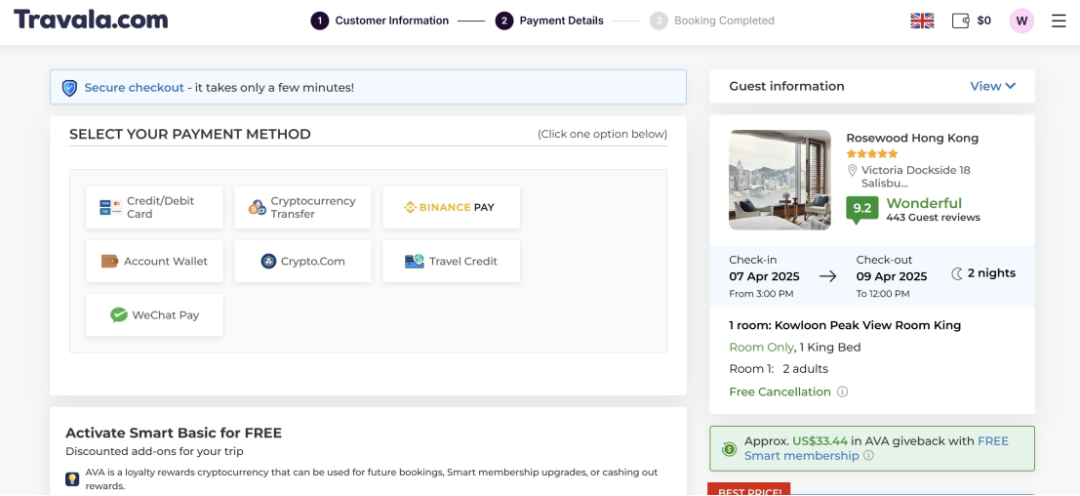

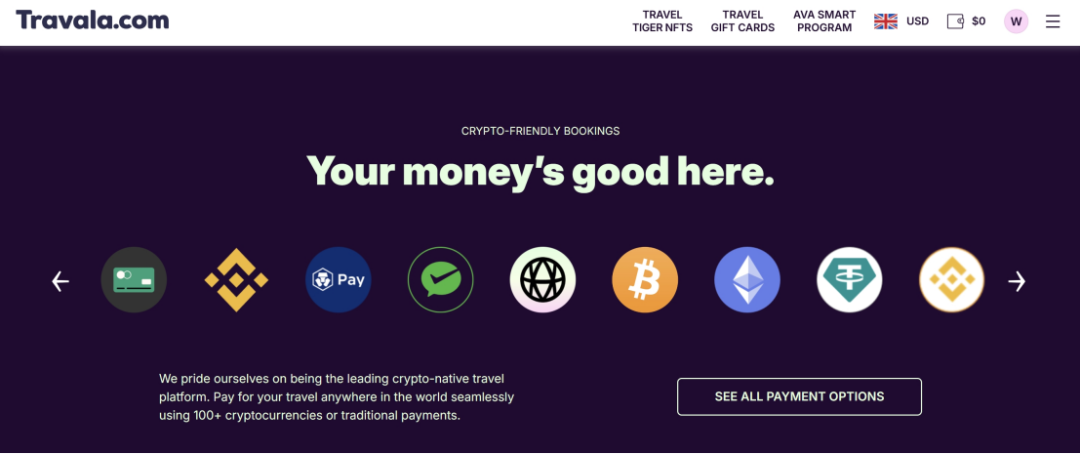

5.2.1 Travala——领先的加密货币旅行服务提供商

Travala.com是一家领先的加密货币原生旅行预订服务提供商,拥有220万+房源,覆盖230个国家、40万+活动以及600 +航空公司。Travala.com提供无缝的旅行预订体验,融合了下一代区块链技术、代币化激励措施以及住宿和活动的“最佳价格保证”。

(www.travala.com/ava)

除了传统支付方式外,Travala.com还支持100多种领先的加密货币支付,旅行者可以使用加密货币预订,并通过AVA计划获得高达10%的比特币或AVA返还、折扣、AVA代币奖励等。AVA计划为在Travala.com上进行的合格预订提供折扣和忠诚度奖励,对于处于更高会员等级的会员,还将提供更大的优惠。

AVA是一种忠诚度奖励代币,比传统积分更具灵活性。旅行者可以使用AVA预订Travala.com上的未来旅行,提升其AVA智能计划会员等级,或者在接受AVA的其他在线平台上消费AVA。

Travala.com由一群经验丰富的旅游、金融科技和区块链行业专家创立,其使命是通过旅行推动加密货币的普及。Travala.com的愿景是将旅行预订与去中心化技术的理念相结合:促进全球任何人的可及性;提供抗审查和点对点的交易;并创建一个由用户治理的旅行生态系统。

(www.travala.com/ava)

尽管如上所述,Travala.com在官网的表述中加入了Web3的各种使命愿景价值观,但是我们透过现象看本质:

- Travala.com的本质是一家添加了加密支付选项的OTA旅行平台,其收到客户的加密货币之后出金承兑到法币,最终与商家结算。从这个角度来看,仅仅是促进了数字货币的普及支付,接入了加密客户群体;

- 通过使用加密货币,并通过区块链做结算能够为平台,以及商户节省大量的交易费用,例如Stripe网关法币支付收取的标准交易费用为每笔交易收取2.9% + 0.30美元,国际卡额外+ 1.5%,涉及货币转换+ 1%。那么无论是平台还是商家节省下来的费用就能够回馈给用户,实现“最佳价格保证”;

- 旅行平台的会员忠诚度计划由AVA这个代币经济来运行。一般来说,酒店、航司会员忠诚度计划的积分都是企业的负债,但是拥有代币经济的好处是,它是一家企业的资产,并且项目方前期投入获取资产的成本为“0”。一旦代币经济运转起来,就能够实现全球触达。

5.2.2 线下街角咖啡厅的Web3支付

低额交易,是一个Web3支付潜在的机会,尤其是低欺诈的面对面线下交易场景,例如在餐馆、咖啡店或街角商店进行的交易。由于利润率低,这些企业对成本很敏感,因此有些支付解决方案收取的15美分交易费对其盈利能力可能就有很大影响。

顾客每花2美元买咖啡,只有1.70到1.80美元流向咖啡店,其余近15%流向信用卡公司。这些高昂的手续费仅仅,也只是为了促成交易,信用卡在这里只有便利支付者这一个目的。

无论是消费者还是商店,都不需要额外的功能来证明交易的合理性:消费者不需要欺诈保护(他们只是拿到了一杯咖啡)或贷款(咖啡2美元),而且咖啡店的合规性和银行集成需求有限(咖啡店通常使用综合餐厅管理软件或根本不使用)。因此,如果有便宜、可靠的替代方案,这些商户就会使用它。

(How stablecoins will eat payments, and what happens next, a16z)

那么线下通过二维码扫码形式的Web3支付就能够解决上述的痛点,直接通过区块链与稳定币进行结算,可以将信用卡的高额费率抛在脑后,商户能够获得更大的利润空间,并能够即时得到支付款项,何乐而不为呢?

5.3 跨境汇款的Web3改造

全球汇款是世界各地许多家庭的命脉,在过去的几年中,尽管我们看到一批一批新的金融科技公司(FinTechs)致力于促进简化数字支付,但是传统汇款渠道长期以来一直受到高费用、转账时间缓慢和流程繁琐的困扰。

根据国际银行的统计,在全球范围内,汇款的平均成本占汇款金额的6.62%。

跨境汇款可能需要长达五个工作日才能完成结算。国际清算银行(BIS)报告称,由于流动性效率低下,清算和结算流程的延迟每年给全球经济造成了数十亿美元的损失。

由此,许多消费者开始转向使用加密货币作为支付选项,以避免跨境汇款过程中的痛点,比如处理时间过长以及转账费用过高。PYMNTS的研究发现,有相当一部分消费者(24%)将能够以加密货币接收资金的选项视为选择支付服务提供商(PSP)的主要动机之一。对于解决方案提供商而言,为传统汇款支付方式提供替代方案(例如区块链支付选项)存在巨大的机会。

(The Digital Currency Shift: The Cross-Border Remittances Report, PYMNTS)

PYMNTS与Stellar Development Foundation的2021年研究报告显示:虽然加密货币通常被视为一种替代投资或数字支付方式,但许多消费者认为它们是一种可行的方式。在其他国家向朋友或家人支付在线费用的受访者中,有23%使用了至少一种加密货币。事实上,13%的受访消费者表示,加密货币是他们在线跨境汇款最常用的支付方式。PYMNTS的研究发现,采用加密货币的消费者也倾向于使用其他跨境支付转移方式,以消除支付过程中的摩擦。使用加密货币发送跨境汇款的消费者更有可能将其直接送入移动钱包(46%)。

随着跨境支付市场的不断发展,支付服务提供商面临着降低汇款费用和解决延迟问题的压力。许多消费者因朋友或家人的紧急财务需求而进行汇款,因此他们更倾向于选择能够快速、安全地完成支付的解决方案。

5.3.1 BCRemit——用USDC解决菲律宾劳工跨境汇款障碍

BCRemit试图为移民工人改变这种状况,特别是在英国和美国工作的菲律宾工人。通过整合Circle的USDC,BCRemit为其用户重新定义了汇款体验——使其比以往更快、更便宜、更方便,解决了传统汇款面临的诸多挑战,为用户提供了更高效、低成本的汇款体验。

BCRemit的创始人Oliver Calma本人曾是海外务工人员,深知传统汇款的高昂成本和复杂流程。通过USDC,BCRemit能够实现即时24/7/365交易,即使在周末和节假日也能快速处理汇款,满足用户随时转账的需求。

与传统银行和汇款公司相比,BCRemit的跨境汇款费用只有1%,降低了高达90%,远远低于联合国可持续发展目标中设定的到2030年将汇款成本降至3%以下的目标。

同时,USDC的快速结算能力减少了BCRemit在目标国家预融资账户所需的大量资金储备,降低了流动性约束和利息支出,优化了其工作资本,使其财务状况更加健康,能够将更多资金投入到服务和增长中。

BCRemit将USDC无缝集成到其后台运营中,用户在使用BCRemit应用程序时,无需直接接触加密货币或复杂的流程,依然可以轻松地进行汇款。这种用户友好的设计使得即使是技术背景较弱的用户也能方便地使用该服务。

BCRemit还通过提供多种收款方式,包括银行账户、电子钱包充值以及在菲律宾超过17000个地点的现金提取选项,确保了即使是无银行账户的接收者也能轻松获取资金,从而促进了更广泛的金融包容性。通过降低成本和简化汇款流程,BCRemit使海外务工人员能够更有效地支持他们的家庭,改善了他们的生活质量。

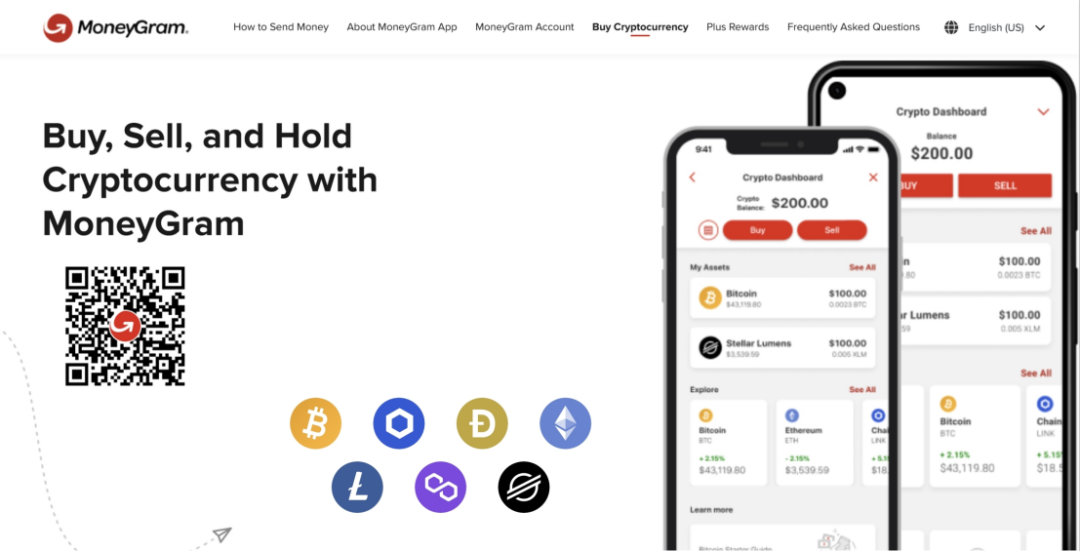

5.3.2 MoneyGram——打通“最后一公里”

MoneyGram International(速汇金)通过其创新的MoneyGram Access™产品,成功将数字资产与传统现金服务相结合,解决了数字资产在“最后一公里”配送中的痛点。MoneyGram Access由Stellar区块链支持,利用Stellar网络的高效性和低成本优势,为用户提供现金与加密货币之间的无缝转换。

具体而言,MoneyGram Access允许用户在MoneyGram的全球网点将现金兑换为USDC(一种稳定币),用户可以以前所未有的方式使用他们的资金,以保护本国货币免受贬值的影响。同时,用户也通过区块链网络快速、安全地将资金发送到全球任何支持该服务的地区。每当他们需要实物形式的资金时,用户可以通过他们的USDC在参与MoneyGram的网点提取当地货币,从而实现数字资产与传统现金经济的无缝对接。

这一服务特别针对那些无法获得银行账户或信用卡的非正规经济参与者,使他们能够通过现金方式参与数字资产的存储和转移。此外,MoneyGram还与TruBit等合作伙伴携手,进一步拓展其数字资产服务的覆盖范围。例如,在拉丁美洲,MoneyGram与TruBit合作,将MoneyGram Access服务引入墨西哥、阿根廷、巴西和哥伦比亚等核心市场,满足该地区对高效跨境支付的需求。

通过整合Stellar区块链技术和USDC稳定币,MoneyGram不仅提升了跨境汇款的速度和安全性,还降低了交易成本,推动了金融普惠。这种创新模式为全球支付行业提供了一个将传统金融服务与新兴数字技术相结合的成功范例。

(moneygram.app/buy-cryptocurrency)

BCRemit的案例从一个单点场景出发(海外菲律宾劳工汇款场景),通过区块链技术与稳定币的结合,实现了用户汇款成本的大幅下降,并保证了资金转移的及时性。尽管稳定币在链上的流转已经非常丝滑,但是依旧需要打通数字货币到法币的“最后一公里”,BCRemit的解法提供包括银行账户、电子钱包充值以及在菲律宾超过17000个地点的现金提取选项,而MoneyGram则是直接在其原本的跨境汇款业务上接入数字货币,并打通其全球35万+个代理货币兑换网点。

六、Web3支付,不仅仅只是支付

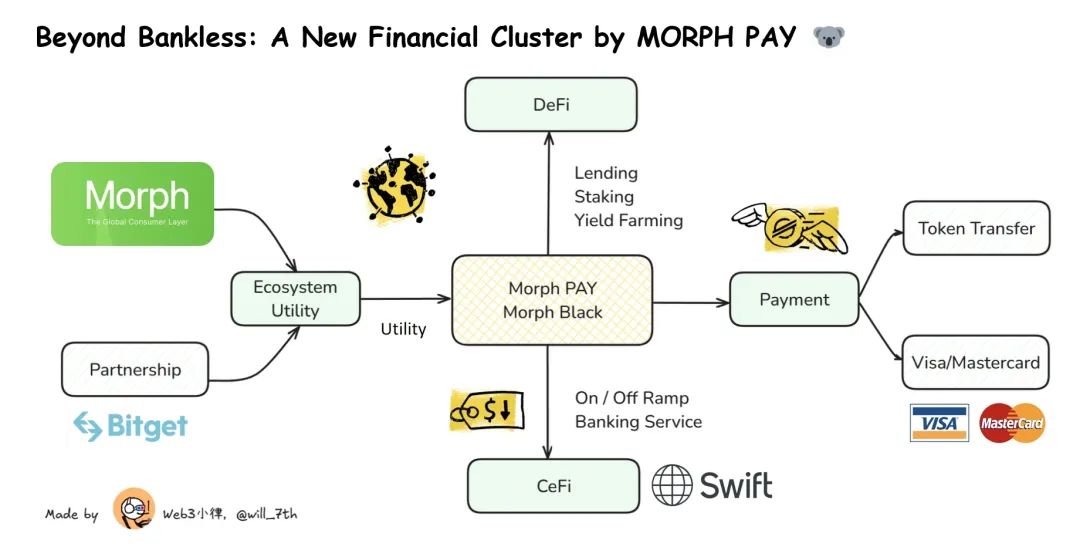

上面讲的很多案例都是基于传统金融支付方式的Web3改造,但是如果从一个更大的角度来看,是否能够通过区块链以及数字货币,构建起一个在原有的银行、卡组织、SWIFT支付体系之外的,针对消费者的Web3支付路径,同时可兼容DeFi的更优解呢?

(x.com/MorphLayer)

Morph Pay正在利用最前沿的Web3技术革新数字支付。我们在近期Morph Pay推出号称“年轻人的第一张黑卡”的Morph Black上面看到了方向,兼顾了消费者在跨境支付中所必需多个解决方案:

A.区块链作为结算层。Morph Pay利用致力于推动Web3大规模普及的全球消费级公链Morph作为结算层,实现消费支付的即时结算、24/7/365、低交易费用、可编程及互操作性。

B.CeFi的兼容性。Morph Pay也能够通过其合作的持牌金融机构,为消费者提供数字货币到法币的便捷转换,以及灵活的银行服务。

C.消费支付。无论后端连接的是VISA/Mastercard的借记卡,还是打通数字钱包支付场景,都能够为消费者提供替代原有老旧支付方式的更优解。

以上三个点其实是Web3支付解决方案必须实现的,但是原生的Web3支付解决方案能够提供的远远不止这些:

D.DeFi的兼容性。Morph Pay作为消费级公链Morph推出的支付产品,不仅能够为消费者打造一站式的DeFi收益聚合方案,支持加密资产存款年化收益率高达30%,还能够支持智能合约的创新操作,由此构建出传统金融支付难以企及的场景。例如将DeFi收益直接用于日常支付,实现资产增值与支付场景的无缝衔接,将此前的Buy Now Pay Later进化到Buy Now Pay Never。

E.生态治理赋能。链上:用户将能够参与Morph及其生态系统合作伙伴提供的独家生态系统空投和激励活动;链下:提供消费的返现、Aspire出行礼宾服务、行业峰会等等权益,为用户进一步提供效用。

我们能够通过Morph Pay的案例看到,基于区块链以及数字货币的解决方案,已经不再局限于一个单一产品以及单一场景。这种链上的可组合性已经能够搭建起一个新型的金融服务综合体,涵盖支付、储蓄理财、借贷、汇款转账、生态治理。这里不仅仅是数字货币,还可以包含法币。

以前我们经常会说我们需要bankless,但是如今看来,显然我们已经突破了bankless的边界。

七、写在最后

最后,我用我非常认同Gate Pay Feng的一句话做结尾:

“在传统互联网领域,支付是黏性最大的应用场景:每个人手机上不一定会有券商或交易类的App,但一定有多个支付类的App,这同样适用于Web3。当前,Web3绝大多数受众或者用户是被加密货币的交易属性和赚钱效应吸引入场,但即使这样,拥有加密货币的人群依旧只占互联网全部用户的5%不到,渗透率极低。如果有一天,当加密市场或Web3可以触达90%以上的互联网用户时,那么这个场景一定不是DeFi和Crypto Trading,而是Payment支付。”

chaincatcher

chaincatcher