View of Crypto's "Emotional Change" from Peter Thiel's Four Quadrant: Transition from Crypto Punk to "Standardized Suitor"

Reprinted from panewslab

05/08/2025·17DAuthor: Matti, Zee Prime Capital

Compiled by: Yangz, Techub News

I'm back with another thought-popularity inspired by Peter Thiel. As a self-proclaimed "Tir School", I often look at the future through his "Bible" ("From 0 to 1: Opening the Secrets of Business and the Future"). Thiel's frame is extremely ductile and can accurately dissect perspectives, trends and movements. But sometimes it's more like Wittgenstein's ruler—its reliability is highly dependent on the observation angle—rather than an always clear lens. (Note: "Wittgenstein's ruler" theory believes that unless you have confidence in the reliability of the ruler, if you use a ruler to measure a table, you may also use a table to measure the ruler.)

As a cryptocurrency investor, I often capture opportunities through narrative analysis. Now the industry is at a turning point, and the arbitrage space in emerging technology markets is about to close, and I can’t help but think: How to discover and inspire more outstanding creativity and products?

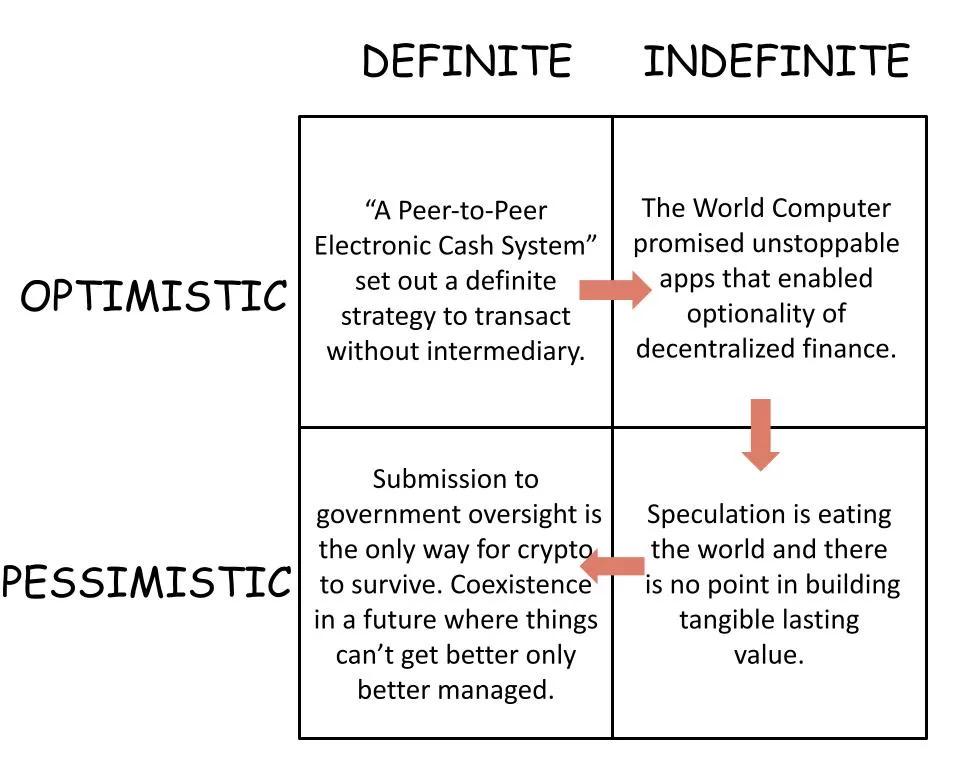

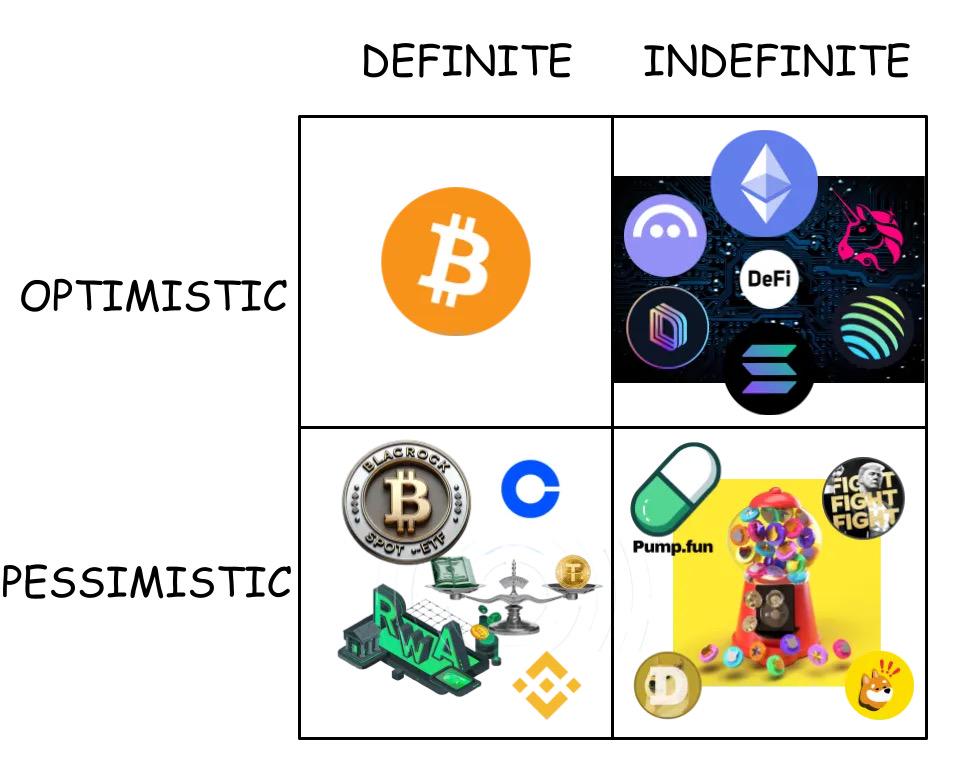

Through Thiel's prism, the cryptocurrency industry's timeline presents an arc from the early "clear optimism" of Bitcoin, to the "blemish optimism" in the grand vision of Web3 (eventually finance became a killer application), to the "blemish pessimism" of the Memecoin casino era, and today's "clear pessimism" of regulatory compromise. This arc starts from the ideal of crypto punk, travels through entrepreneurial fanaticism, falls into degen culture, and eventually goes towards standardization.

However, is this arc universal for all trends? After partial verification, a revolutionary concept will become a hotly hyped "universal antidote"; and when it cannot fulfill its high expectations, it will be despised and eventually return to normal. For now, the revolution has not been fully realized, but we still (for some) follow Gartner's hypercycle to complete a satisfying cycle.

In the cryptocurrency space, the grand technological maturity curve will be overshadowed by price fluctuations. Each cycle—Bitcoin, ICO that promises “world computers”, DeFi, Memecoin, and today’s integration of regulation and traditional finance (TradFi)—is like a fractal of a larger model. Right now, we are in the trough of bubble bursting. And according to Carlotta Perez's theory of technological revolution, we are at a turning point.

Web3 has promised to achieve the profit explosion of Web2 through chain, decentralization and tokenization. However, Web2 or Web3 is not a specific "place" - they are not "things" that are split. As I said two years ago, they should be understood as "user preferences", and today this preference is still niche. If you always need to cite old things to explain new things, it means you are not building a real new thing.

The cryptocurrency industry is no longer a cutting-edge market, but in this increasingly mature space, opportunities still exist in the cutting-edge area. What is the biggest opportunity at this stage? Intuitively, they will come from growth-term dividends or latecomer advantages.

It is worth noting that the centralized exchange (CEX), which once became a "pioneer" in popularizing cryptocurrencies, has now become a "conservative" and only focuses on defending market share rather than promoting on-chain adoption. Ironically, it is these exchanges and L1 public chains that have created the most considerable returns for investors. In these tracks where competition is fierce and idealism gives way to pragmatism, the biggest winner is born.

So, does this mean that there are no "secrets" in the industry? I firmly believe that the "secret" is still there, and today's "secret" is exactly the revelation of the past: how many truly innovative enterprises and networks have we built?

The low-hanging fruit has long been picked. Most projects either clumsyly imitate the routines of previous generations or repackage old elements into so-called innovations. Too many solutions are solving non-existent needs, while others simply copy the traditional financial model to the chain.

Crypto is essentially an unfinished revolution that eventually becomes a revisionist force. Now it is in a core (perhaps false) dilemma: "Is it the right path to stick to idealism, or the reality of losing to the 'making money'?" In other words, are you willing to sell your ideals at the price offered by the old system? More and more revolutionaries are accepting the deal after Memecoin casinos cry.

Those vague ideas based on the builder's wishful thinking (no, users don't care about data sovereignty at all), combined with the real business success of centralized service providers, have jointly created the current dilemma. Today, "clear optimists" are almost hard to find in the cryptocurrency field, but the word "almost" leaves investment opportunities for those willing to stick to the frontier.

jinse

jinse

chaincatcher

chaincatcher