Understand the key differences between Ethereum, Solana and Aptos in the life cycle of a transaction

Reprinted from panewslab

03/15/2025·3MAuthor: Kevin, the Researcher at Movemaker

Comparing the technical differences between Move language, Aptos and other public chains, it may appear boring due to different observation depth. General analysis is inevitable to scratch the surface, and when you go deep into the code, you can easily see trees but not forests. To quickly and accurately understand the difference between Aptos and other public chains, it is crucial to choose a suitable anchor point.

The author believes that the life cycle of a transaction is the best entry point. By analyzing the complete steps of transactions from creation to final state update - including creation and initiation, broadcast, sorting, execution and status update - we can clearly grasp the design ideas and technical choices of the public chain. Taking this as a benchmark, take a step back and understand the core narratives of different public chains; moving forward, you can explore how to create market-attracting applications on Aptos.

As shown in the figure below, all blockchain transactions revolve around these five steps, and this article will focus on Aptos, analyze its unique design and compare the key differences between Ethereum and Solana.

Aptos: Optimistic parallelism and high-performance design

Aptos is a public chain that emphasizes high performance. Its transaction life cycle is similar to Ethereum, but it has achieved significant improvements through unique optimistic parallel execution and memory pool optimization. Here are the key steps of the transaction lifecycle on Aptos:

Create and initiate

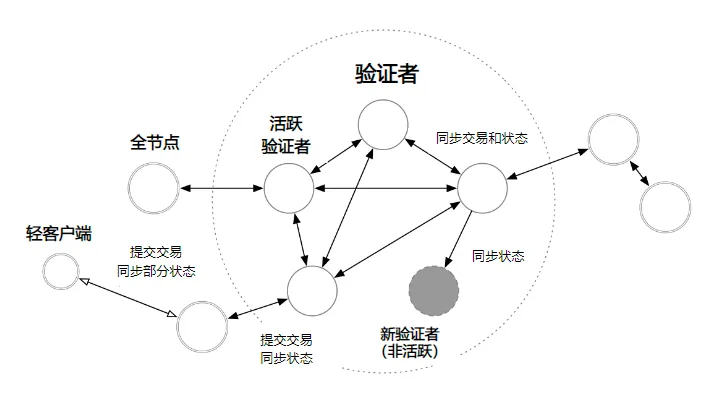

The Aptos network consists of light nodes, full nodes and validators. The user initiates transactions through a light node (such as a wallet or application). The light node forwards the transactions to a nearby full node, and the full node is synchronized to the verifier.

broadcast

Aptos retains the memory pool, but it is not shared between memory pools after QuorumStore. Unlike Ethereum, its memory pool is more than just a transaction buffer. After the transaction enters the memory pool, the system pre-sorted according to rules (such as FIFO or Gas fees) to ensure that there is no conflict in subsequent parallel execution. This design avoids the high hardware requirement of Solana that requires pre-declaring read and write collections.

Sort

Aptos adopts the AptosBFT consensus, and in principle the proposer cannot sort transactions freely. Aip-68 gives the proposer the right to fill in the delayed transactions. Memory pool pre-sorting has completed conflict evasion in advance, and block generation relies more on collaboration among validators than on the proposing.

implement

Aptos uses Block-STM technology to achieve optimistic parallel execution. Transactions are assumed to be conflict-free and processed at the same time. If conflicts are found after execution, the affected transactions will be re-execute. This method uses multi-core processors to improve efficiency, with TPS up to 160,000.

Status update

Verifiers synchronize state, finality is confirmed by checkpoints, similar to Ethereum's Epoch mechanism, but more efficient.

The core advantage of Aptos lies in the combination of optimistic parallelism and memory pool pre-sorting, which not only reduces node performance requirements, but also greatly improves throughput. As shown in the figure below, Aptos' network architecture clearly supports this design:

Source: Aptos White Paper

Ethereum: Benchmark for serial execution

As the pioneer of smart contracts, Ethereum is the origin of public chain technology, and its transaction life cycle provides a basic framework for understanding Aptos.

Ethereum Trading Life Cycle

-

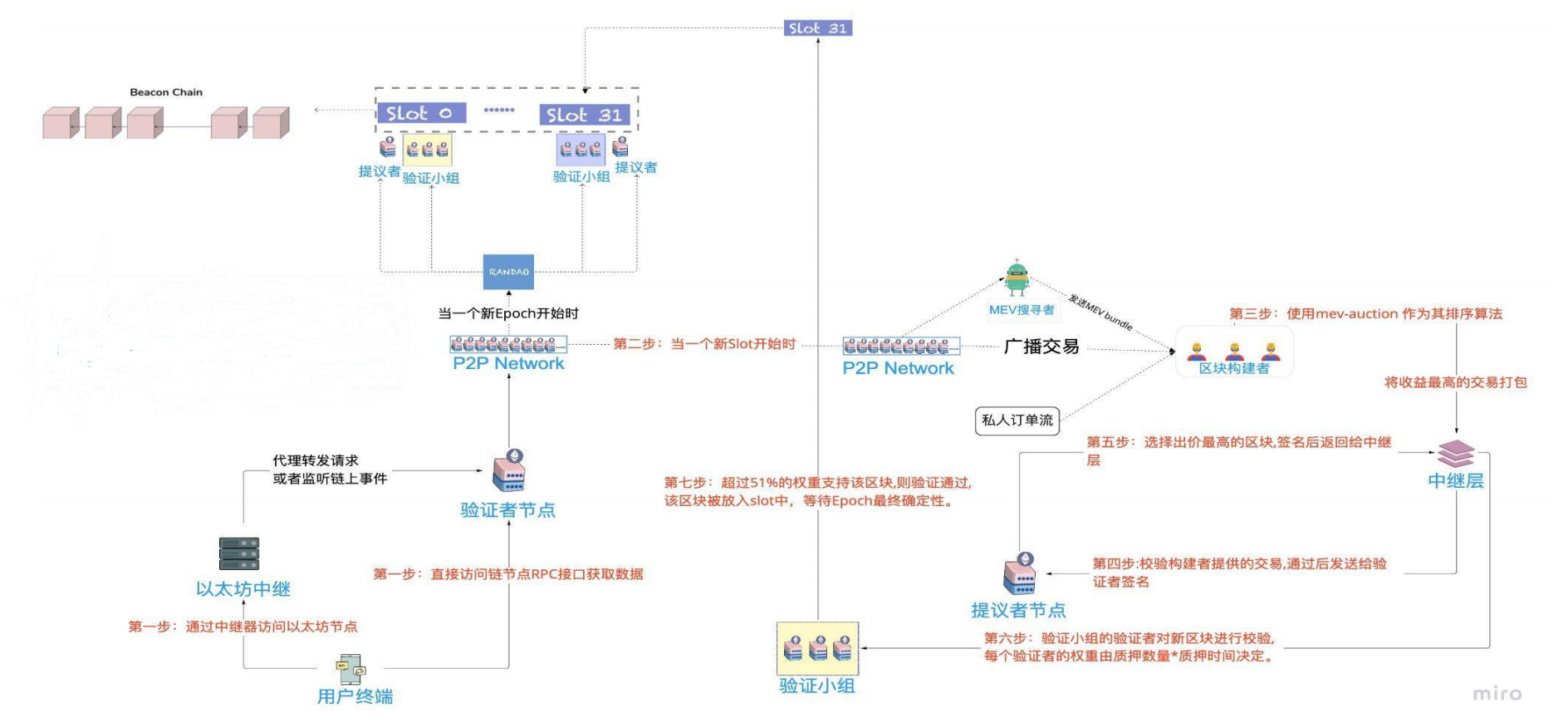

Creation and Initiation: The user initiates transactions through the wallet via the relay gateway or RPC interface.

-

Broadcast: Transactions enter public memory pools, waiting to be packaged.

-

Sort by: After PoS is upgraded, the block builder packages transactions according to the principle of profit maximization, and submits them to the proposer after bidding on the relay layer.

-

Execution: EVM serial processing transactions, single thread update status.

-

Status update: The block needs to confirm the finality through two checkpoints.

Ethereum's serial execution and memory pool design limit performance, with a block time of 12 seconds/slot and a low TPS. In contrast, Aptos has achieved a qualitative leap through parallel execution and memory pool optimization.

Solana: The ultimate optimization of deterministic parallelism

Solana is known for its high performance, and its transaction life cycle is significantly different from Aptos, especially in memory pools and execution methods.

Solana Trading Life Cycle

-

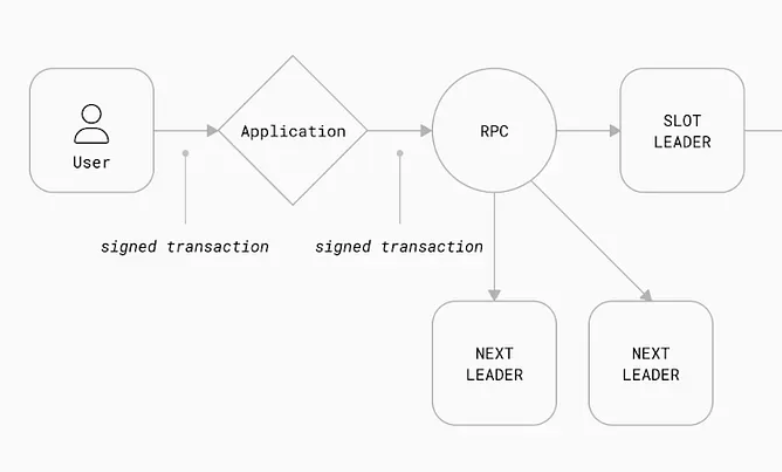

Create and initiate: The user initiates transactions through the wallet.

-

Broadcast: No public memory pool, transactions are sent directly to the current and next two proposers.

-

Sort: The proposer packages blocks based on PoH (Proof of History), with a block time of only 400 milliseconds.

-

Execution: Sealevel virtual machines adopt deterministic parallel execution, and read and write sets need to be declared in advance to avoid conflicts.

-

Status update: Quick confirmation of BFT consensus.

The reason Solana does not use memory pools is that memory pools can become performance bottlenecks. Due to the lack of a memory pool and Solana's unique PoH consensus, nodes can quickly reach a consensus on transaction sequence, avoiding the need to queue up in the memory pool, and transactions can be completed almost instantly. However, this also means that when the network is overloaded, transactions may be discarded rather than waited and the user needs to resubmit.

In contrast, Aptos' optimistic parallelism does not require declaring read and write sets, with lower node thresholds and higher TPS.

Source: shoal research

Two paths for parallel execution: Aptos vs Solana

The execution of a transaction represents the update of the block state and is the process of converting the transaction initiation instruction into a final state. How to understand this change? Assuming that the transaction is successful, the node calculates its impact on the network state, and this calculation process is execution.

Therefore, parallel execution in a blockchain refers to the process by which a multi-core processor simultaneously calculates the state of the network. In the current market, parallel execution is divided into two ways: deterministic parallel execution and optimistic parallel execution. The root of the difference between these two development directions is how to ensure that parallel transactions do not conflict—that is, whether there is a dependency between transactions.

It can be seen that in the transaction life cycle, determining the timing of parallel transaction dependencies conflicts - determines the differentiation between two development directions: deterministic parallel execution and optimistic parallel execution. Aptos and Solana chose different directions:

-

Deterministic parallelism (Solana): Before transaction broadcasting, read and write sets must be declared. The Sealevel engine handles conflict-free transactions in parallel according to the declaration, and conflict transactions are executed in serial. The advantage is efficiency, and the disadvantage is the high hardware demand.

-

Optimistic parallelism (Aptos): Assuming that the transaction has no conflict, Block-STM is executed in parallel and try again if there is a conflict. Memory pool pre-sorting reduces the risk of conflict and makes nodes less burdened.

For example: Account A has a balance of 100, transaction 1 has a transfer of 70 to B, transaction 2 has a transfer of 50 to C. Solana confirms the conflict in advance through statements and handles it in sequence; if the balance is insufficient after Aptos is executed in parallel, readjust it. Aptos' flexibility makes it more scalable.

Optimistic parallelization to complete conflict confirmation in advance

The core idea of optimistic parallelism is to assume that transactions processed in parallel will not conflict, so the application side does not need to submit a transaction statement before the transaction is executed. If a conflict is found during verification after the transaction is executed, Block-STM will re-execute the affected transaction to ensure consistency.

However, in practice, if the transaction dependencies are not confirmed in advance whether they conflict, a large number of errors may occur during real execution, resulting in lag in the operation of the public chain. Therefore, optimistic parallelism does not simply assume that transactions are free of conflict, but avoids risks in advance at a certain stage, which is the transaction broadcasting stage.

On Aptos, after transactions enter the public memory pool, they will be pre-sorted according to certain rules (such as FIFO and Gas fees) to ensure that transactions within a block do not conflict when executed in parallel. It can be seen that Aptos' proposals do not actually have transaction sorting capabilities, and there are no block builders in the network. This transaction pre-sorting is the key to Aptos' ability to achieve optimistic parallelism. Unlike Solana that requires the introduction of transaction statements, Aptos does not require this mechanism, so the requirements for node performance are greatly reduced. In terms of network overhead to ensure that transactions do not conflict, the impact of Aptos joining the memory pool on TPS is much smaller than the cost of Solana introducing transaction statements. Therefore, Aptos' TPS can reach 160,000, more than twice as many as Solana. The impact of transaction pre-sorting is that it is more difficult to capture MEVs on Aptos, which has both pros and cons for users. I will not repeat it here.

Security-based narrative is the development direction of Aptos

-

RWA: Aptos is actively promoting real-world asset tokenization and institutional financial solutions. Compared with Ethereum, Aptos' Block-STM can process multiple asset transfer transactions in parallel to avoid delays in rights confirmation caused by network congestion. On Solana or Sui, although the transaction speed is fast, the memory pool design may discard transactions when the network is overloaded, affecting the stability of RWA's rights confirmation. Aptos' memory pool pre-sorting ensures transactions are executed in order, and can maintain the reliability of asset records even at peak times. RWA requires complex smart contract support such as asset splitting, earnings allocation and compliance checks. Move language modular design and security make it easier for developers to build reliable RWA applications. In contrast, the complexity and vulnerability risks of Ethereum Solidity increase development costs, while Solana's Rust programming is efficient, but it requires high developers' learning curve. Aptos' eco-friendliness is expected to attract more RWA projects to be implemented and form a positive cycle. Aptos' potential in the RWA field lies in the combination of security and performance. In the future, it can focus on cooperating with traditional financial institutions to put high-value assets such as bonds and stocks on the chain, and use the Move language to create highly compliant tokenization standards. This "safe + efficient" narrative can make Aptos stand out in the RWA market.

- In July 2024, Aptos officially announced that it would introduce Ondo Finance's USDY into the ecosystem and integrate it into major DEX and lending applications. As of March 10, USDY's market value on Aptos was approximately US$15 million, accounting for about 2.5% of USDY's total market value. In October 2024, Aptos announced that Franklin Templeton has launched the Franklin On-chain U.S. Government Money Fund (FOBXX) represented by BENJI tokens on the Aptos Network. In addition, Aptos cooperated with Libre to promote securities tokenization, bringing investment funds from Brevan Howard, BlackRock and Hamilton Lane to enhance institutional investors' access.

-

Stablecoin payment: Stablecoin payment needs to ensure the finality of transactions and the security of assets. Aptos' Move language prevents double payments through resource models, ensuring the accuracy of each stablecoin transfer. For example, when users use USDC to pay on Aptos, transaction status updates are strictly protected to avoid loss of funds due to contract vulnerabilities. In addition, Aptos' low Gas fees (benefiting from high TPS cost sharing) make it extremely competitive in the small payment scenario. Ethereum's high Gas fees limit its payment applications, while Solana is low in cost, but the risk of transaction dropout in network overload may affect the user experience. Aptos' memory pool pre-sorting and Block-STM ensure the stability and low latency of payment transactions.

-

PayFi and stablecoin payments need to take into account decentralization and regulatory compliance. AptosBFT's decentralized consensus reduces centralization risks, while its modular architecture supports developers to embed KYC/AML checks. For example, a stablecoin issuer can deploy compliance contracts on Aptos, ensuring transactions comply with local regulations without sacrificing network efficiency. This is better than Ethereum's centralized relay model and also makes up for the potential compliance shortcomings dominated by Solana's proposals. Aptos' balanced design makes it more suitable for financial institutions to enter.

-

Aptos' potential in PayFi and stablecoin payments lies in the trinity of "safe, efficient and compliant". In the future, we will continue to promote the large-scale adoption of stablecoins, build a cross-border payment network, or cooperate with payment giants to develop on-chain settlement systems. High TPS and low cost can also support micro payment scenarios, such as real-time rewards from content creators. Aptos' narrative can focus on the "next generation payment infrastructure" to attract two-way traffic for enterprises and users.

-

The advantages of Aptos in security—memory pool presorting, Block-STM, AptosBFT and Move languages—not only improve their attack resistance, but also lays a solid foundation for RWA and PayFi narratives. In the RWA field, its high security and throughput support asset tokenization and large-scale transactions; in PayFi and stablecoin payments, low cost and efficiency have promoted the implementation of real-life applications. Compared with Ethereum's robust but inefficient and Solana's high speed but high threshold, Aptos opens up new situations with a balanced approach. In the future, Aptos can rely on these advantages to shape the "security-driven value network" narrative and become a bridge connecting the traditional economy and blockchain.

Summary: Aptos' technical differences and future narrative

Through the perspective of the transaction lifecycle, we can clearly compare the differences between Aptos and Ethereum, Solana and Sui in technical design and reveal their respective core narratives. The following table summarizes the similarities and differences between the four in the broadcast, sorting and execution stages, and Aptos' unique advantages are also highlighted:

Aptos’ design strikes a clever balance between performance and safety. Its memory pool pre-sorting combined with Block-STM's optimistic parallelism not only lowers the node threshold, but also achieves a high throughput of 160,000 TPS, surpassing Solana's deterministic parallelism and Sui's object-level parallelism. Compared with Ethereum's serial execution, Aptos' parallel capabilities have brought a qualitative leap; compared with the radical optimization of Solana and Sui cutting off memory pools, Aptos retains the pre-sorting mechanism, ensuring the stability of the network under high loads. This "stable and fast" idea, supplemented by the resource model of the Move language, gives Aptos higher security - whether it is to resist DDoS attacks or prevent contract vulnerabilities, is better than Ethereum's traditional architecture and Solana's high hardware dependency. Compared with Sui, which is also based on the Move language, the differentiation between Aptos and Sui is more inspiring. Sui is object-centric, pursues ultimate performance through DAG sorting and object-level parallelism, and is suitable for high-concurrency asset management scenarios; while Aptos is account-centric, relying on memory pools and optimistic parallelism, taking into account universality and ecological compatibility. This difference not only reflects the choice of technology paths, but also indicates a differentiation in application directions: Sui may be better at complex asset operations, while Aptos has an advantage in security-driven scenarios. It is based on this combination of security and performance that Aptos has shown great potential in RWA and PayFi narratives. In the RWA field, Aptos' high throughput supports large-scale asset rollover, and its recent cooperation with Ondo Finance (USDY with a market capitalization of approximately US$15 million), Franklin Templeton and Libre has begun to show results. Among PayFi and stablecoin payments, Aptos' low cost, high efficiency and compliance support for micropayments and cross-border settlement has become a strong candidate for the "next generation payment infrastructure".

In summary, Aptos incorporates security and efficiency considerations in every link of the transaction life cycle, which is different from Ethereum's robustness and inefficiency, Solana's high performance and high threshold, and Sui's object-driven ultimate optimization. In the future, Aptos can rely on the narrative of "security-driven value network" to connect traditional finance and blockchain ecosystems, continue to make efforts in the fields of RWA and PayFi, and build a new public chain pattern that combines trust and scalability.