Trump takes office for a full moon: What are the significant changes he brings to the cryptocurrency industry?

Reprinted from panewslab

02/24/2025·2MArticle Author: Aaron Wood

Source: Cointelegraph

Article Compilation: Ada, MetaEra

It has been a month since U.S. President Donald Trump was sworn in and began comprehensive and controversial reforms, many of which have directly impacted the cryptocurrency industry.

After only 30 days as president, Trump selected several cryptocurrency-backed executives to take senior regulatory roles and created the Department of Government Efficiency (DOGE), a temporary organization in which Musk is the actual leader.

In a February 18 interview with Trump and Musk, the two said DOGE and Musk himself aim to provide “technical support” to the government, streamline the government’s wasteful spending, and fundamentally reorganize federal agencies.

Here are some major events related to cryptocurrencies in Trump’s 30 days in office.

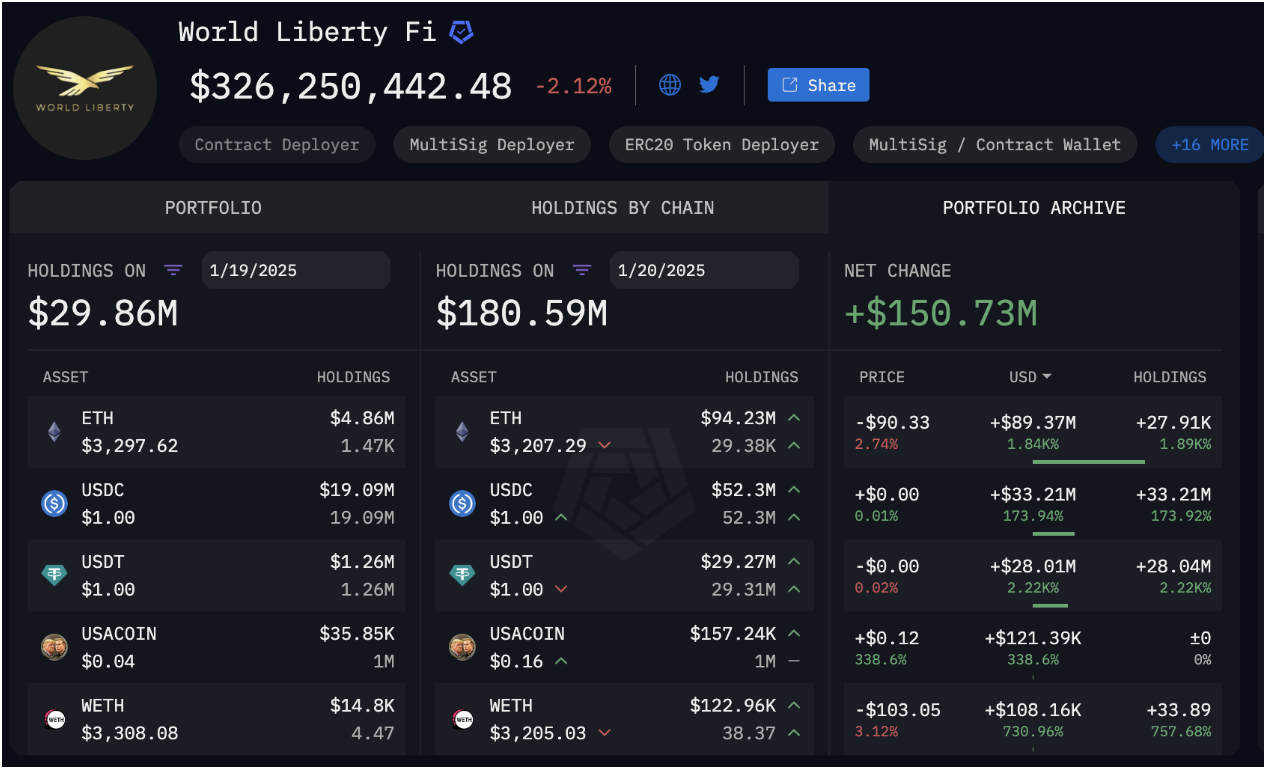

January 20 – Trump’s World Liberty Financial buys tens of millions of

dollars in cryptocurrency on the day of the inauguration

On his first day of office, Trump issued a series of executive orders—42 to be exact. The cryptocurrency industry is disappointed to learn that none of them is targeted, but cryptocurrency supporters have not waited long.

On the day of the inauguration, World Liberty Financial (WLFI), a decentralized financial enterprise of the Trump family, purchased nearly $47 million in cryptocurrency to commemorate the inauguration. The purchase brings WLFI's total holdings to $326 million.

January 21 – SEC changes leadership and changes cryptocurrency strategy

On January 21, the Trump administration began to adjust the leadership of major federal agencies, including the SEC, to nominate SEC member Paul Atkins to replace Gary Gensler. Gary Gensler).

While Atkins is awaiting confirmation from the Senate—he has not been confirmed as of press time—acting chairman Mark Uyeda is leading the agency to treat the cryptocurrency industry in a more friendly way.

Uyeda criticized the SEC's law enforcement under Gensler, saying it "is not conducive to capital formation and does not protect investors."

January 21 – The SEC Working Group sets out to address crypto policy

issues

On January 21, the U.S. Securities and Exchange Commission (SEC) formed a cryptocurrency working group under the guidance of cryptocurrency support commissioner Hester Peirce, and quickly began to improve cryptocurrency regulatory regulations.

Acting Chairman Ayuda said the group’s main goal is to “help the committee draw clear regulatory routes, provide practical pathways, develop a reasonable regulatory framework, and deploy law enforcement resources wisely.”

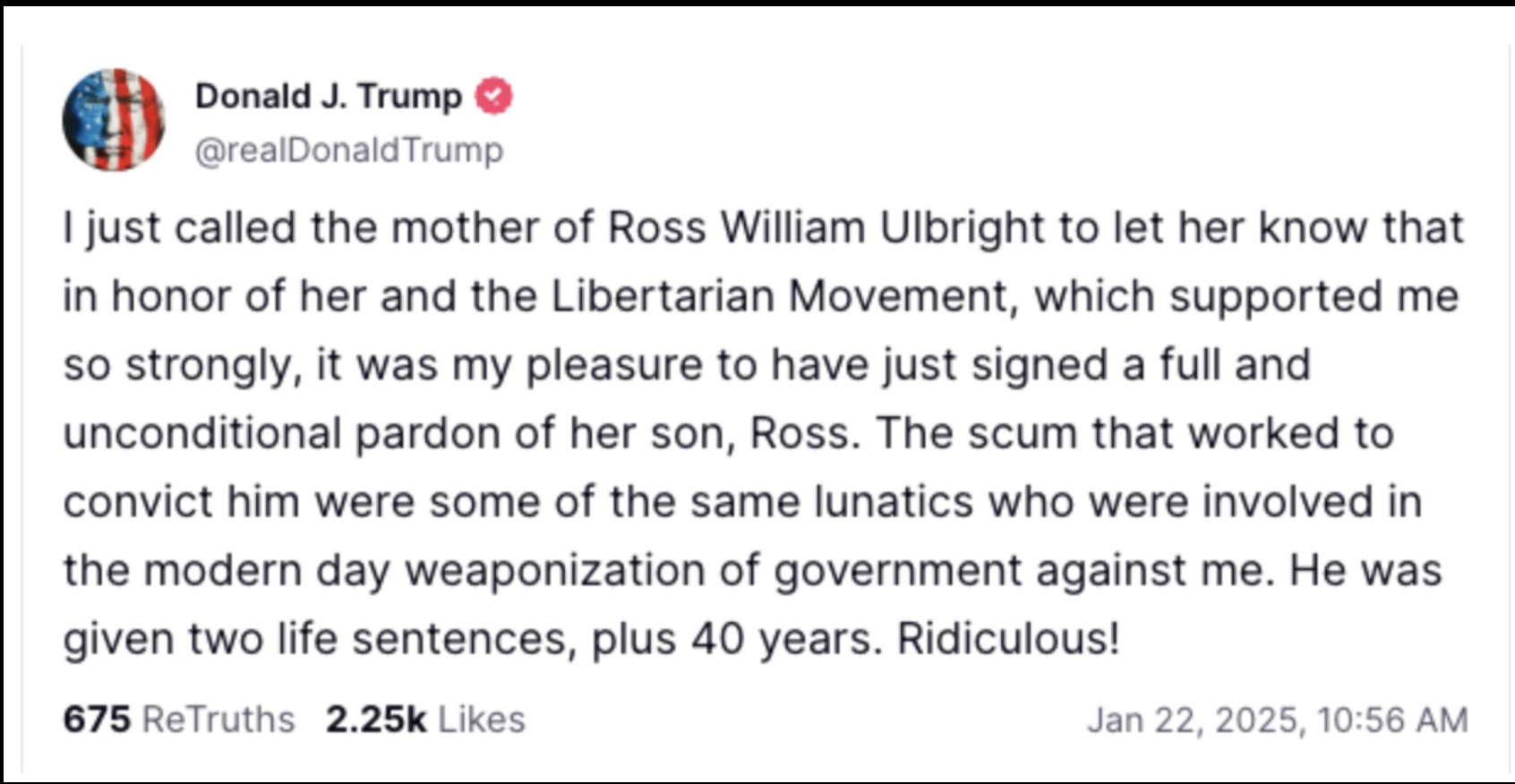

January 22 – The founder of Silk Road was pardoned

On January 22, Trump pardoned Silk Road founder Ross Ubricht, who has served nearly a decade in federal prison. After years of hard work by prison reform advocates, liberal groups and cryptocurrency industry insiders, the president finally gave him a pardon.

Ublich has been serving his sentence since 2015, and Trump fulfilled his campaign promise to release him immediately after taking office.

January 23 – Trump sets up a crypto working group

On January 23, Trump established an "internal working group to make the United States the world capital of cryptocurrencies" through executive orders. The team's mission is to study the feasibility of establishing national cryptocurrency reserves and develop a cryptocurrency regulatory framework. It also bans the creation of central bank digital currencies.

The working group consists of the U.S. Treasury Secretary, Attorney General, the Securities and Exchange Commission Chairman, the Commodity Futures Trading Commission, members of the Trump Cabinet and heads of other relevant institutions.

It is worth noting that the order explicitly excludes the Federal Reserve and Federal Deposit Insurance Corporation.

The team will report to the government's official AI and crypto tsar David Sacks.

January 27 – The U.S. Senate confirms Treasury Secretary who supports

cryptocurrencies

On January 27, the U.S. Senate voted 68 to 29 to pass Scott Bessent's nomination as U.S. Treasury Secretary.

When Trump first appointed Becente in November 2024, Fox Business reporter Eleanor Terrett described him as “very supportive of cryptocurrencies, especially Bitcoin.”

He reportedly said: "I'm very excited about the president's support for cryptocurrencies, and I think it's very compatible with the Republican Party, cryptocurrencies represent freedom and the cryptocurrency economy will always exist."

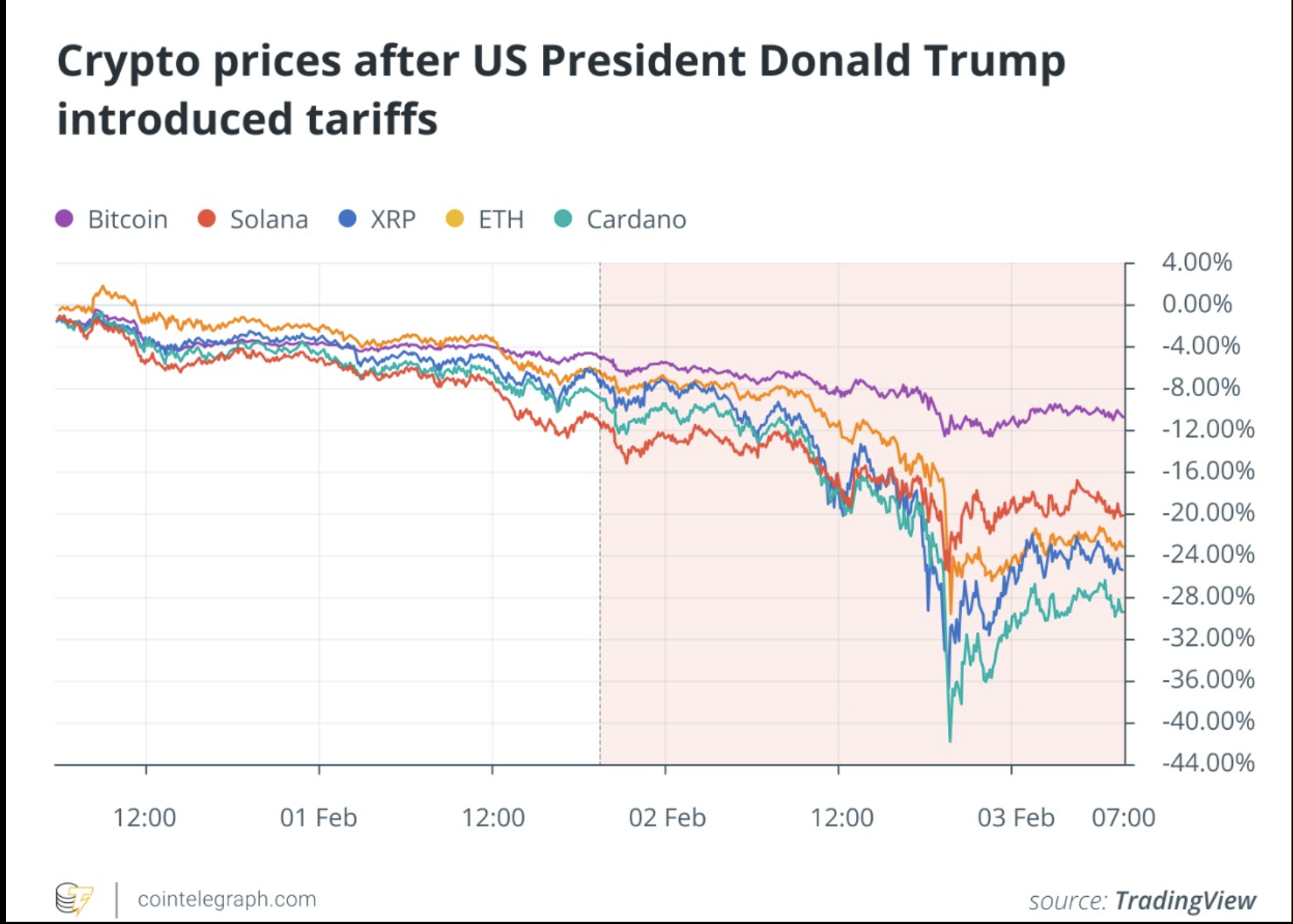

February 2 - Trump tariffs hit stock and cryptocurrency markets

On February 2, Trump signed another executive order to impose tariffs on goods produced in Mexico, Canada and China.

The market responded violently, with some technology stocks hitting the biggest drop in Wall Street in a single day.

Trump eventually suspended tariffs on Mexico and Canada, but the move was seen as his economic strategy. The ensuing impact of the crypto market also highlights the increasing correlation between crypto assets and traditional financial markets.

February 3 – Trump fires head of consumer protection regulators

On February 3, Trump fired Rohit Chopra, director of the Consumer Financial Protection Bureau (CFPB). The CFPB oversees the financial sector and has jurisdiction over banks, securities companies, payday lenders, and other for-profit institutions.

In an official notice, the Consumer Financial Protection Bureau said Bessent will serve as the acting head of the government agency until a successor is found.

The exact reason behind this move is not yet clear. But reports have been reported as part of numerous measures to reduce regulation in the banking industry, with Musk previously calling for the “cancellation” of the institution.

February 7 - The CFTC Chairman resigns

On February 7, former CFTC chairman Rostin Behnam announced that it was his last day at the agency, after he served as a member of the CFTC and chair of the regulator for eight years. Bennan previously said he would leave one month early and let the new acting chairman take over his position until the new chairman is appointed.

Bennan called on lawmakers to develop clear guidelines for cryptocurrencies and said: “The cryptocurrency era highlights the need for us to set rules to address the direction of the derivatives industry.”

February 9 – Tariffs cause Bitcoin price to plummet again

On February 9, Trump announced a 25% tariff on all steel and aluminum imported into the United States, and said he would impose corresponding tariffs on countries that impose tariffs on U.S. goods.

The White House further adopted radical economic policies, which led to a plunge in Bitcoin prices. Market observers expect market volatility will be further intensified as Trump proposes the idea of imposing tariffs on the EU, semiconductors, oil, gas, steel and copper.

February 12 – Trump exchanges prisoners with Russia

On February 12, the United States exchanged Marc Fogel, a former operator of cryptocurrency exchange BTC-e, for the exchange for US teacher Marc Fogel, who was detained in Russia.

In May 2024, Vinnik pleaded guilty to conspiracy to commit money laundering, and he illegally transferred funds through cryptocurrency exchange BTC-e.

Fogel has been detained in Russia since he was arrested in 2021 for possession of marijuana at Moscow airport.

February 12 – Nominated for the new CFTC Chairman

Just one week after Benan stepped down, Trump nominated Brian Quintenz, a former member of the Commodity Futures Trading Commission and Kalshi executive of the event betting market, as the new head of the regulator.

Quintenz, who has also worked for a16z, a venture capital firm that supports cryptocurrency, is expected to bring welcome changes to the cryptocurrency industry as he makes several statements supporting cryptocurrency. He reportedly gave several speeches on Bitcoin and decentralized finance during his time at the CFTC.

February 17 – DOGE will challenge SEC

It is reported that after a wave and reorganization of other federal agencies, the next goal of DOGE under Musk's actual leadership is SEC.

“They are at the door,” an anonymous source said in a Feb. 17 Politico report.

A DOGE-related account on X (with dozens of them) posted a post on February 18 asking about information about “discovering and resolving SEC waste and fraud.”

February 19 – Senate confirms Trump's commerce secretary

On February 19, the U.S. Senate confirmed billionaire Howard Lutnick as the next Secretary of Commerce.

After the 52-45 vote, Lutnik immediately resigned as CEO of financial services company Cantor Fitzgerald. Although his company owns a stake in crypto stablecoin issuer Tether, Lutnik said he will sell his stake in commercial and other private investments within 90 days.

What is Trump’s next plan?

This is a turbulent time for the current US president. Although he did not involve cryptocurrencies on his first day in office, he made up for this shortfall with a large number of executive orders over the next few days.

Many of Trump’s support for cryptocurrency nominees have been appointed and are expected to introduce crypto-friendly policies that consolidate the industry’s growth potential in the coming years.

The president's allies in Congress have begun to formulate stablecoin legislation in an effort to "introduce" the industry into the United States.

At the state level, momentum to create state bitcoin reserves is growing, with crypto-focused legislators taking action at the local level.

chaincatcher

chaincatcher