Trump’s currency: Crypto’s “sovereignty transfer”

Reprinted from chaincatcher

01/22/2025·3M

Author: YBB Capital Researcher Zeke

Preface

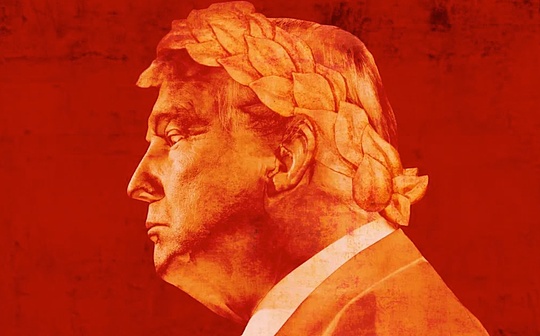

On the eve of the inauguration of the US President, on the evening of January 17th local time, Trump announced the launch of his personal token-TRUMP coin through the social media platform Truth Social he founded. Initially, many people mistakenly believed that this move was the result of a hack of Trump's account, but dozens of minutes later, Trump used his personal main account on X (formerly Twitter) to repost about the coin. Promotion information, officially confirming the authenticity of this news.

What followed was a surge that could be recorded in the history of cryptocurrency, and a large amount of money began to pour into it. TRUMP quickly climbed from zero market value to a maximum market value of US$80 billion in just two days, siphoning almost all the market capital. Liquidity. The spread of this incident is no less widespread than the assassination incident Trump experienced in Pennsylvania last year, and its magical level is no less magical than the bullet he dodged by turning his head. Regarding this incident, I also have some simple thoughts to share.

Meme

In this big Eastern country where I live, the final realization of private domain traffic is often accomplished through the live streaming of goods through an app called “Douyin”. On the other side of the Atlantic, the 47th President of the United States has done something unprecedented. The head of the "Lighthouse of the World" is using an electronic token to measure the value of his influence and power, and to accumulate huge wealth for his family. There is no doubt that we are entering a special era, an era in which Crypto can be officially called Web3.0.

The original intention of the Internet was to end those radio and television stations that monopolized the attention economy and return it all to users, but in the end its development path deviated from the original route. Internet companies that mastered chat platforms and search engines in the early days of Web 2.0 have developed into the behemoths we see today, such as Google and Tencent. They completed primitive accumulation and achieved long-term monopoly by controlling a large number of traffic entrances. Today, ByteDance almost dominates social media in China and the West. Although it is undeniable that the short video platform has brought many opportunities for grassroots to make a comeback, in most cases this benefit is still shared by Internet celebrity bloggers and the platform, and the platform has absolute say.

No matter how the form changes, the economy of monopoly around traffic is the eternal theme of Web2.0 giants. The opportunities for ordinary people to benefit from it are very limited. Users can almost only continuously contribute traffic and money to this feast. Meme Coin may be a new opportunity. It is true that participating in Meme PVP is dangerous, and there are also scams. You even need to accept an absolutely unfair distribution of 2:8 like TRUMP, but what are the chances that ordinary people can benefit from the traffic of the President of the United States? The process of TRUMP going from 0-80 may be the only time.

In the past, I wanted to explain what Meme Coin was, but I couldn't explain it clearly. But now I think it can be explained in the simplest words. The value of Meme is the pricing of something, someone, and a certain meme in a certain period of time. Just as the market gave President Trump the initial price a few days ago, The price is 80B. On the other hand, Meme is also a carve-up of the traditional Internet attention economy. People are keen on these things that can make their eyeballs stop. Meme gives users an opportunity to participate in value distribution in hot events.

Pump

I once mentioned in a past article that the best form of SocialFi is not a well-regulated Dapp like Friend.tech, but Pump. The currency issuance team behind the president also chose Pump. The reason is also very simple. People have the need to belong to a certain group, but it does not mean that they have to accept unfairness for this need. Friend.tech’s pricing of Key and subsequent complicated gameplay around Token were the main reasons for its limited ceiling and eventual failure. Looking back at the past SocialFi projects, dividing people into three, six or nine levels based on their Token holdings to allocate empowerment and services was also the cause of their failure.

Small and fine will never apply to Crypto, which relies on community culture. Likewise, this applies to many tracks outside of SocialFi, such as the NFT that Trump also issued. The huge supply of Meme often allows it to quickly gain a huge community. Whether you hold 100U tokens or 10WU tokens, you belong to this group.

In the past, when we established a project, we needed to use Twitter to promote it on social media, and then introduce users to Tg and DC to build a community. In the more distant past, with ancient memes like Doge, you could only find "organizations" through some forums. Pump integrates the advantages of traditional social media on the basis of AMM and returns the rule setter to Creator, which is the main reason for its success. It compresses countless fitting processes and you can always use countless tokens on the Pump homepage. Find your sense of belonging behind the icon.

retro trend

No matter what you think about Trump’s issuance of personal tokens, we are entering an era where Meme becomes mainstream and many things are tokenized. In fact, this is somewhat similar to the European medieval coinage power that I mentioned in my article on stablecoins last year. Compared with the various Chinese dynasties that have implemented the same standard currency system for most of the time, Europe has always been in bulk. Each country and even each noble and bishop has the right to mint and issue their own currency.

Although TRUMP is not essentially a practical currency backed by gold and silver, after all, the president has set a precedent, and many European and American celebrities will inevitably join this medieval retro wave. Another point worth pondering is that Trump owns 80% of the tokens. Will the tokens really be as announced on its official website? "Trump Memes are intended to serve as a representation of the ideals and beliefs embodied in the symbol "$TRUMP" and related artworks. Expressions of support and participation. They are not intended to be, and should not be considered to be, the subject of an investment opportunity, investment contract or security of any kind. An asset used to realize rights?

Among the many conspiracy theories, I am actually more inclined to think that this is a grand beginning for the TRUMP family to completely shift from real estate to encryption. The ability to use the influence of the media is engraved in the DNA of this family member. A nonsensical event can quickly build momentum, so choosing Meme as the starting point is perfect. It not only has various eye-catching myths of getting rich, but also has a sense of contrast with the president's superiority. I think that in the end, most of the remaining tokens (perhaps three uses according to the token release chart) can be airdropped to voters, donated to the United States to pay off debt, and used for construction. All of them will help consolidate Trump as the cultural totem of the United States and reverse the public’s stereotype of Crypto after the FTX incident. The family’s transformation from industrial capital will start with this IP worth nearly 100 billion. (According to Jinshi’s report, Trump does not know much about the family’s encryption projects or even his own tokens. This further proves that the team behind it and his children are operating around Trump’s IP. .)

Ethereum

Solana is undoubtedly the biggest winner of this crypto weekend, achieving various historical records in just two days, setting new SOL price highs and daily transaction volume exceeding Ethereum multiple times. In contrast, the Ethereum community seems very lonely. The core OGs are increasingly protesting against the Ethereum Foundation and the development of the second layer.

However, judging from Solana’s handling fees and failed transaction volume that have soared dozens of times, encryption is still a certain distance away from true Mass Adoption. So on the issue of Ethereum, I still maintain the same view as in the past. The route around Layer 2 is just too fast and too advanced. There is almost no one in the entire Ethereum ecosystem that can compete with Solana in terms of social popularity. Yes, even Base is extremely reluctant. The demand for small amounts and high frequency on the first layer has completely shifted to the second layer, and the Dapps on the second layer have not made any breakthroughs. There is a large amount of free block space that no one cares about, and the handling fees are pitifully low. This is the current situation of Ethereum, and it is also It is the epitome of the ETH Killers of the past.

The paradox of public chain development is not only the triangle problem, but also the conflict between Gas income and technological development behind the triangle problem. To use a very popular metaphor, Ethereum can be assumed to be a casino that requires tickets. In the past few years, business has been full, tickets are in short supply, and some people have even continued to increase the price to purchase them for investment. The price of this ticket has begun to rise. The boss realized that the casino was indeed not big enough and spacious enough, so he built a casino that was 100 times larger. In view of this scale, he lowered the admission price by 100 times. In the past, one ticket could be used 100 times. It turned out that there were still so many customers, the existing equipment did not require such a large venue, and ticket prices began to languish.

This is the conflict between the advanced development of Ethereum technology and the price of tokens. In addition, Ethereum has never relied on influence on social media, but on the moat accumulated from the ICO era to DeFi Summer, so the problem of lack of fresh blood still exists. Continuously amplifying.

In addition to the urgent need for changes in the foundation (I said this in this article " Why is the King of Copycats Embattled on All Sides?" ) , how to gain advantages at the social level (making it easier for users to understand various obscure technical concepts of Ethereum, which are mostly integrated into traditional social media), how to provide better feedback from Layer 2 (buyback, modify DA pricing, ecological feedback to the main chain) , how to better support the development of emerging dapps (Ethereum Grant no longer focuses on infrastructure projects, and various L2s should have better interoperability and compatibility). The situation of stagnation at the application layer, public chain competition It’s often the details and differentiation.

Encryption 2.0

Trump has ushered in the 2.0 era, and the next era of encryption will also be dominated by this family. What do they want to do? Although the family's first project, World Liberty Financial (WLFI), is not yet online, we can still get a glimpse of it from the project's proposal forum. The first proposal described it this way:

The WLFI protocol will provide liquidity for Ethereum (ETH), Wrapped Bitcoin (WBTC), certain stablecoins, and possibly other digital assets. WLFI will enable WLFI Protocol users to access WLFI Protocol Aave instances, and WLFI Protocol Aave instances will be managed through Aave's risk management system. WLFI aims to introduce a new class of users to over-collateralized lending, which is one of the most important features of decentralized finance (DeFi). WLFI plans to attract new users into the DeFi space by providing users with a seamless experience to supply and borrow digital assets. Many of these users will be first-time DeFi users, which will help build brand loyalty and awareness of WLFI and Aave, helping Aave maintain its market leadership in the digital asset lending and supply space.

Initially, the WLFI protocol will allow USDC, USDT, ETH, and WBTC to be used for lending and borrowing. More assets may be added in the future via WLFI voting proposals.

WLFI will use the same reserve ratio system in this Aave V3 instance as the main Aave instance. AaveDAO will receive 20% of the protocol fees generated by WLFI Aave V3 instances and will receive approximately 7% of the total circulating supply of $WLFI tokens to participate in future WLFI governance procedures, liquidity mining and promote the decentralization of the WLFI platform. Centralization. Revenue distribution will be set up through a trustless smart contract, which will direct the corresponding protocol fee percentages to the AaveDAO treasury and WLFI treasury addresses.

Judging from the recent large-scale purchases of various project tokens, WLFI can be regarded as an on-chain lending institution established by Donald John Trump Jr. by borrowing his father’s influence. Sell WLFI tokens with your left foot and buy value coins with your right foot (if there is a big project to invest in, WLFI’s left and right foot can step up to the sky more happily), and it will spiral directly to the sky. In addition, WLFI is also actively buying various domain names. According to information posted by Cointelegraph on Twitter, WLFI has currently purchased daolationship.eth, yatogame.eth, WorldLiberty.eth, trumpcoin.eth, erictrump.eth, barrontrump.eth, 9290.eth. It is not difficult to see from this that the future theme of the Trump family will still revolve around the TRUMP IP, but the track will be more extensive. In the next four years, the Trump family projects may be like the Trump Group real estate that is now spread across New York. Exists in each public chain.

The curtain slowly falls, and a very special era is about to come. Whether you accept this "crypto president" or not, you must admit that many major events that can affect Crypto in the next four years will happen across the Atlantic, and what Crypto can do is either follow it, or make it happen all over the world. Rebirth.

panewslab

panewslab

jinse

jinse