Trump lost more than $500 million in a week in tariff war

Reprinted from panewslab

04/10/2025·2MAuthor: Penny

Since Trump announced on April 3 that it would impose "reciprocal tariffs" on major trading partners including China, Japan, and Vietnam, stock markets around the world have begun to experience varying degrees of diving - the epic collapse of US stocks. After the policy was announced, the Nasdaq futures fell by 4.7% in a single day, the S&P 500 futures fell by 5%, and the Dow Jones futures fell by 1822 points at one point. As of April 9, the S&P 500 index fell by 18.9% from its February high, and its market value evaporated by 5.8 trillion US dollars, setting a record for the worst four-day consecutive decline since 1950; technology stocks became the "hardest hit area" of this stock market crash. Apple's stock price plummeted 23% in four days, and the market value of seven major technology giants such as Microsoft and Nvidia evaporated by 1.65 trillion US dollars. This impact was directly caused by the risk of supply chain disruption - Apple 75% The components rely on Asian production, and the pressure of tariff costs is huge; Bloomberg statistics show that the total market value of global stocks shrank by US$10 trillion, Vietnamese stock market fell by more than 6% in a single day, Nikkei 225 index plummeted by nearly 3%, and the three major European stock indexes all fell by more than 1%.

When global investors are heartbroken, Trump himself cannot survive this global plunge.

Personal wealth is "backlashed" by US$500 million

According to Forbes' report on April 8, when Trump announced a large-scale tariff plan on April 2, his net worth was estimated at $4.7 billion, but less than a week, his assets fell to $4.2 billion, evaporating $500 million in a week. The biggest loss of his personal wealth comes from Trump Media and Technology Group, whose share price has fallen about 5% since April 3, and Trump holds 114.75 million shares, and that alone evaporates about $170 million in total assets.

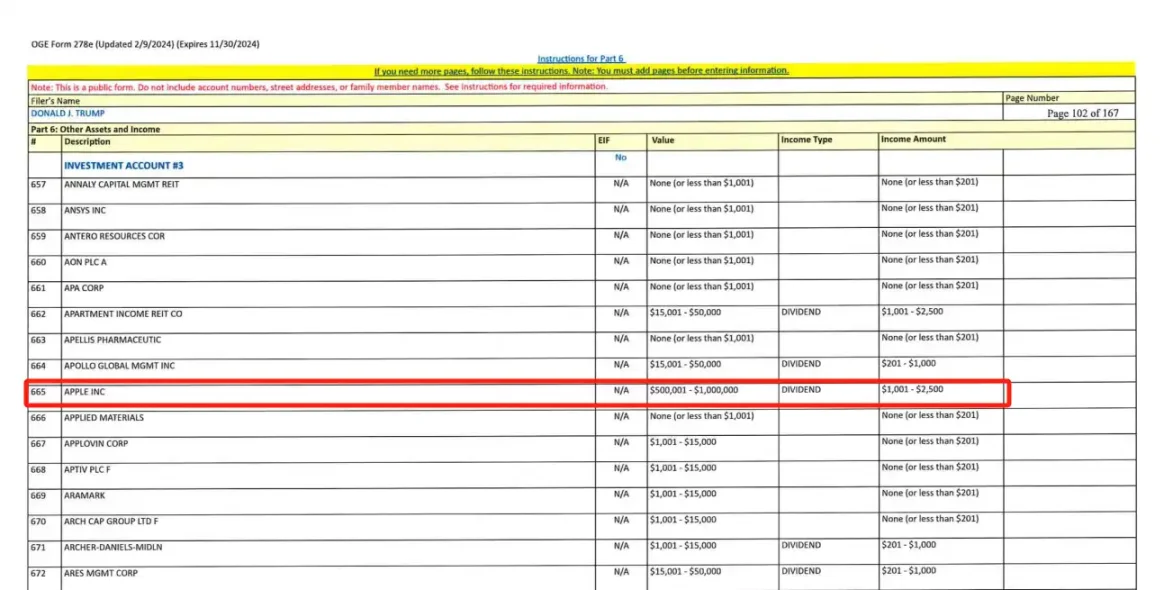

In addition, Trump also holds a large number of tech giant stocks. According to the Federal Election Commission (FEC), presidential candidates must submit personal financial disclosure reports before May 15 each year, covering their assets, liabilities and income sources, including stock investments, etc. Trump, as a presidential candidate, must abide by this regulation for disclosure. Its latest 2024 report shows that Trump holds stocks such as Apple, Microsoft, Nvidia, Amazon, Alphabet (Google), Meta Platforms, Berkshire Hathaway, PepsiCo, JPMorgan Chase, etc., with value ranging from $100,000 to $1 million, of which Apple, Microsoft and Nvidia holds more than $500,000. The total value of the above-mentioned stocks alone is between 2.25 million and 4.75 million US dollars. If Trump does not change his stock position significantly within 8 months after the disclosure, the plunge will have a significant impact on his book wealth.

Image source: Trump\'s personal financial disclosure report

In addition, the value of the real estate portfolio held by the U.S. president also shrank from $660 million to $570 million during this period, a decrease of about $90 million. Its golf-related assets have also been lost because many golf balls, clubs and jerseys sold in professional stores are imported.

In addition, Trump's family crypto project WLFI also suffered huge losses due to trading ETH. On April 9, according to Lookonchain monitoring, wallets suspected of WLFI related sold 5,471 ETH for an average price of US$1,465, in exchange for US$8.01 million. The address previously spent about US$210 million to buy 67,498 ETH, with an average price of US$3,259, and the current book loss has reached approximately US$125 million.

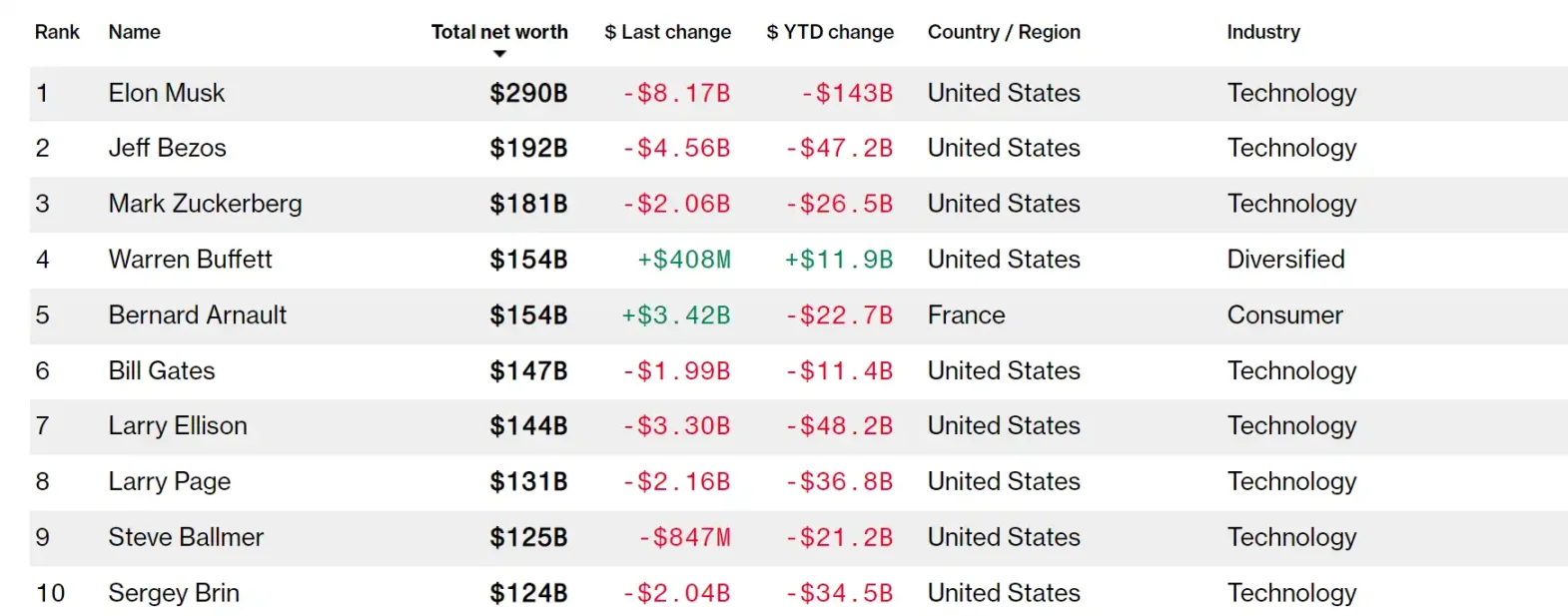

The world's richest man has started to lose 10 billion yuan per person

The Guardian reported that since Trump announced the increase in tariffs on April 3, 500 wealthy people around the world lost $536 billion in the first two days of stock trading, the largest two-day wealth loss recorded in the Bloomberg Billionaire Index in history. Among them, the wealth of several wealthy people who support Trump or attend Trump's inauguration ceremony in January has shrunk to varying degrees, and the first ones are Elon Musk, Mark Zuckerberg and others. The picture below shows the Bloomberg Billionaire Real-time Ranking (as of April 9).

The picture shows the Bloomberg Billionaire Ranking on April 9

Musk, the world's richest man and CEO of Tesla, has shrunk significantly after becoming a highly-watched and controversial figure in the Trump administration, and has been hit hardest. As the stock price plummeted, Musk's net assets evaporated by $31 billion by the close of last Friday. From the beginning of this year to now, Musk's wealth has shrunk by about $143 billion, but he is still firmly in the throne of the world's richest man, with a net worth of $290 billion.

Facebook founder and Instagram and WhatsApp owner Zuckerberg ranked second in losses, with more than $27 billion. The world's third-richest man, whose net worth is estimated at $181 billion, was hit hard by the plunge in Meta's market capitalization. The company's share price fell nearly 14% in two days as the tariff war hit tech companies particularly hard. Many of the world's largest companies rely on Asian markets for manufacturing, computer chips and IT services, which are one of the countries where Trump imposes the most severe tariffs. Zuckerberg made a striking "Trump turn" to Meta a few weeks before Trump took office, and his personal wealth has evaporated by more than $26.5 billion so far this year.

Amazon founder and Washington Post owner Jeff Bezos ranked third in two-day losses at $23.5 billion. As the world's leading seller of imported goods, Amazon's market value has shrunk by hundreds of billions of dollars this year. Chinese sellers account for more than 50% of Amazon's third-party market, and their cloud service business also mainly relies on technologies produced by manufacturers in Asia. In February, Bezos' $10 billion Climate and Biodiversity Fund stopped funding to one of the world's most important climate certification organizations, a move that some sees as "rejection" to Trump and his position against climate action. Bezos is the second richest man in the world, with an estimated net worth of US$192 billion. His wealth has evaporated by US$47.2 billion this year.

Despite the two-day plunge, not all billionaires’ net worth has shrunk. Buffett, the chairman and largest shareholder of the savvy investment firm Berkshire Hathaway, has grown its fortune to $154 billion this year. His wealth has indeed lost $2.57 billion in the two-day stock market crash, but his net worth has increased by $11.9 billion so far this year.

Trump's tariff policy is a high-risk experiment that deeply binds personal political demands with financial markets. Trump and other richest people in the world's wealth evaporated in just a few days, not only exposing the conflict of interests between policy makers and the capital market, but also revealing the self-paradox of "protectionism" in the era of globalization -when politicians try to build walls with tariffs, the first one is often the first to collapse. For investors, this storm once again verifies an iron law: in the highly linked global market, no one can truly survive.