Trump's two tweets to save the market Is the US's strategic cryptocurrency reserve really coming

Reprinted from jinse

03/03/2025·2MCompiled by: Deng Tong, Golden Finance

Just as almost everyone doubts whether the crypto bull market is over, two tweets released by Trump on March 2 reversed the decline in the crypto market, and crypto assets collectively soared.

Trump's two tweets ignite the market

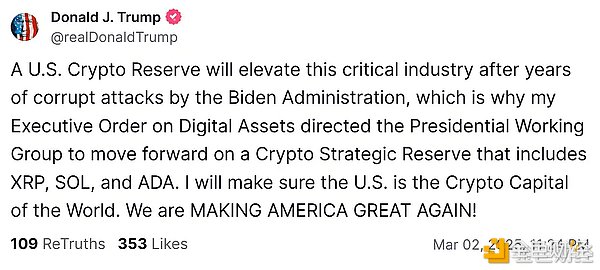

On March 2, Trump posted on social media that the U.S. cryptocurrency reserves will enhance the status of this key industry after years of suppression by the Biden administration, which is why my digital assets executive order directed the presidential task force to advance cryptocurrency strategic reserves including XRP, SOL and ADA. I will make sure the United States becomes the cryptocurrency capital of the world. We are making America great again!

Then, Trump released another message: Obviously, BTC and ETH and other valuable cryptocurrencies will also be the core of the reserves, and I also like Bitcoin and Ethereum.

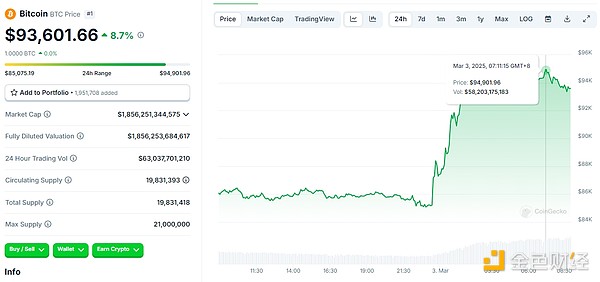

Affected by the positive news, BTC reached a maximum of more than $94,000, at $94,901.96, up 20.22% from the low of $78,940.44 on February 28.

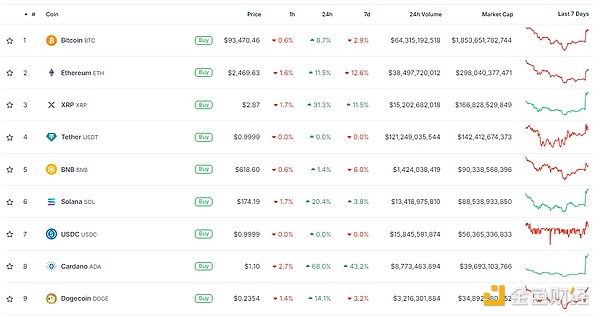

The trend of crypto assets is improving, especially the several crypto assets named by Trump have even recorded double-digit gains. As of press time, ETH was $2469.63, up 11.5%; XRP was $2.87, up 31.3%; SOL was $174.19, up 20.4%.

According to Polymarket data from the forecast market, the probability of the forecast Solana ETF being approved in 2025 is 85%, and the probability of the Solana ETF being approved by July 31 has increased from 19% to 34%. It is predicted that the probability of Trump establishing Bitcoin reserves within 100 days of taking office has risen to 17%.

After being selected as one of Trump's five major targets for cryptocurrency reserves, Ripple (XRP) has surpassed Tether and has become the world's third largest cryptocurrency again. This morning, its market value exceeded US$170 billion in a short period of time.

Real encryption strategic reserves or rat trading? What industry insiders

say

News about Trump has sparked a lot of discussion among industry insiders. There are voices that agree with or disagree with.

Real encryption strategic reserve?

White House AI and crypto czar David Sacks posted on X, saying: "President Trump announced the establishment of a strategic reserve of cryptocurrencies composed of bitcoin and other top cryptocurrencies. This is consistent with executive order No. 14178 issued a week ago. President Trump is fulfilling his promise to make the United States the "world's cryptocurrency capital." More content will be revealed at the summit.

Coinbase co-founder and CEO Brian Armstrong commented on social media about the "Trump is advancing the cryptocurrency reserve program" that Bitcoin may be the best choice in terms of asset allocation for strategic reserves. As the successor of gold, Bitcoin has the simplest and clearest narrative. If people want more types, market capitalization weighted indexes can be used to keep things fair. But it may be the easiest thing to choose only Bitcoin.

Michael Saylor, founder of MicroStrategy, said: Bitcoin is the foundation of the crypto economy.

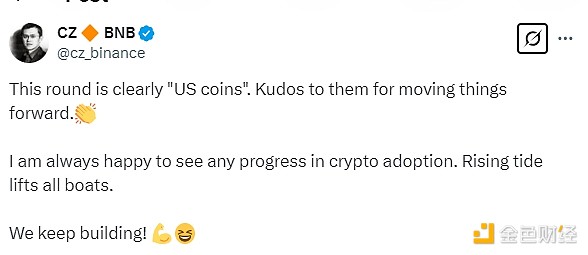

Binance founder CZ said that the market is currently clearly dominated by "U.S. crypto assets" and recognized its progress in promoting the development of the industry. He stressed that any adoption of cryptocurrency is a positive signal, and the industry benefits as a whole, and said Binance will continue to build.

CZ also pointed out that Trump said that "BTC, ETH and other valuable cryptocurrencies will be included in the crypto strategic reserve", but now all holders are focusing on "other". He believes that there is no need to over-analyze it. More "valued cryptocurrencies" may be added over time, and more countries will follow suit.

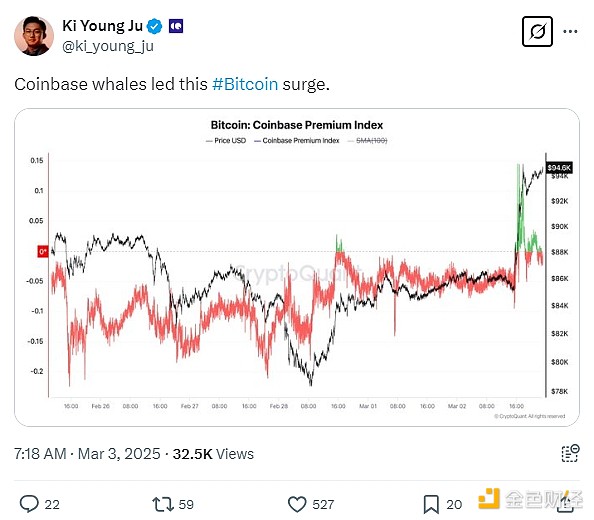

CryptoQuant founder and CEO Ki Young Ju posted on the X platform that Bitcoin’s current rise is driven by whales on the crypto exchange Coinbase. He backed up his comments with a Bitcoin Coinbase premium index chart, which tracks the price difference between Coinbase and Binance's BTC price.

Tomasz K. Stańczak, co-executive director of Ethereum , said that with the release of the reserve fund announcement, it is currently a short window of opportunity suitable for all developers who build large-scale stable decentralized finance, institutional custody solutions, institutional stakes, stablecoins and institutional wallets to demonstrate the maturity, security of the Ethereum ecosystem and its extensive integration in global finance. Stańczak said there is no guarantee that the Etherealize foundation will deliver results quickly enough, and it is not certain whether Etherealize is fully running to perform the matter within hours, so he encouraged developers not to wait and act immediately. He said the Ethereum Foundation will seek improvements, but emphasized that Ethereum is a collection of all outstanding developers and is able to handle highly institutionalized investments.

Pierre Rochard, vice president of Riot Platforms, tweeted, "When countries have large bitcoin positions and a small basket of their own domestic cryptocurrencies, the new world reserve currency is Bitcoin by default. Few people understand this."

Rat's trunk?

Just as the crowd was applauding, some people were also suspicious of Trump's policy driving the surge in the crypto market.

Just before Trump released two messages, some traders used 50 times leverage to go long Bitcoin and Ethereum, and used about $4 million in funds to leverage positions with a total amount of about $200 million. At that time, the prices of Bitcoin and Ethereum were $85,000 and $2,210 respectively. Subsequently, Trump released good news, but the address that was 50 times long was closed and exited in an orderly manner. For details, please click "Trump then stands for cryptocurrency and Bitcoin soars. Some people ambush accurately and make profits suspected of being a rat's position." Therefore, some industry insiders believe that there may be suspicion of holding a rat in this round of upward trend.

Udi Wertheimer, OP_CAT advocate and co-founder of TaprootWizards, said that the best view I have seen about strategic reserves so far is that this is just Trump’s classic negotiation strategy. To truly realize reserves, Trump must convince Congress that he cannot decide alone. Whenever Trump needs to convince other stakeholders, he always starts with a ridiculous proposal, and then he can take it back later: "Trump Gaza", Canadian annexation, and now "Cardano Strategic Reserve". So in Trump's chess language, it just means he is telling Congress that if you don't give me bitcoin reserves, I'm going to stuff Ripple into your throat. Is this really something happening? I don't know, but it's a compelling theory. But to be honest, I'll be happy no matter how things go. Too interesting.

BitMEX co-founder Arthur Hayes commented on the incident of "Trump's announcement that it will advance its strategic reserves of cryptocurrencies". "Nothing new, it's just a word. Let me know when they get Congressional approval to borrow or re-raising the price of gold. Without these, they won't have the money to buy bitcoin and altcoins. Of course, I'm not bearish, I'll still stick to bullish. But I won't buy more tokens at this point."

Some analysts also believe that Bitcoin may fall again in the short term. They expect Bitcoin to fall to around $70,000 before the next bull market begins. As Nexo analyst Iliya Kalchev believes, Bitcoin may "build solid support in the range of $72,000 to $80,000."

appendix:

A list of Trump's policies and classic quotes about cryptocurrencies.

-

March 2, 2025: Instruct the Presidential Working Group to advance strategic reserves of cryptocurrencies including XRP, SOL and ADA;

-

March 2, 2025: BTC and ETH will also be the core of crypto reserves;

-

February 20, 2025: Hope to be at the forefront of everything, including cryptocurrencies. The Biden administration’s war on bitcoin and cryptocurrencies has ended;

-

February 19, 2025: Sign executive orders to strengthen constraints on independent federal regulators such as the SEC;

-

February 13, 2025: Choosing crypto-friendly person and former Bitfury executive Jonathan Gould leads the Currency Supervision Office;

-

February 12, 2025: The list of permanent CFTC leaders selected, with a16z crypto policy manager ranked first;

-

January 27, 2025: 100% support for the cryptocurrency industry and will push Bitcoin to a new level;

-

January 24, 2025: Establish a cryptocurrency working group to explore the creation of national digital asset reserves;

-

January 21, 2025: Swearing in, becoming the first "crypto president" in American history;

-

January 18, 2025: Launch personal Meme coin TRUMP;

-

January 16, 2025: Will do something "great" with cryptocurrency;

-

January 7, 2025: The US Congress officially certifies Trump as president, and Vance is elected the next vice president;

-

December 15, 2024: We will use cryptocurrency to do "some great things" and become an industry leader;

-

December 12, 2024: Some great things will be done in cryptocurrency and artificial intelligence;

-

December 5, 2024: Posted to celebrate Bitcoin’s breakthrough of $100,000; Trump chose Paul Atkins as Chairman of the US SEC;

-

November 21, 2024: Trump’s team considers setting up the first cryptocurrency-related position in history at the White House;

-

November 6, 2024: Trump is elected the 47th President of the United States;

-

July 2024: Trump attends the Bitcoin Conference and proposes to ensure that the United States becomes the cryptocurrency capital on earth and the world's Bitcoin superpower.

panewslab

panewslab