Trump's "major news" + Fed rate cuts: On-chain data indicates Bitcoin storm

Reprinted from panewslab

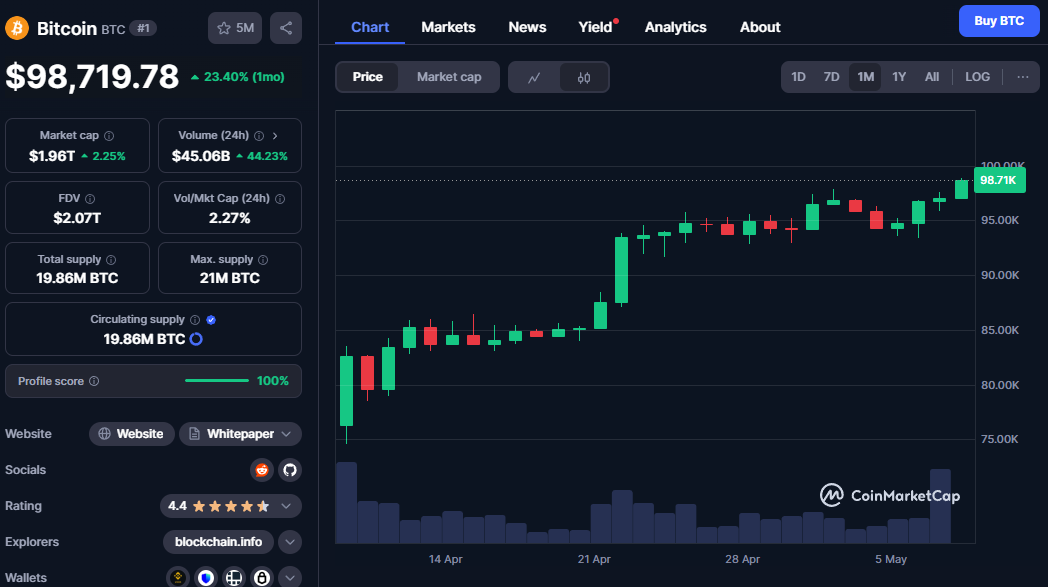

05/08/2025·16D In May 2025, Bitcoin (BTC) price was like a wild horse, sprinting to a nearly

two-month high of $97,900, and then briefly breathed around $94,000, and

quickly rebounded to around $97,000. This price carnival ignited the passion

of the crypto market and also made investors start asking: What is driving

this wave of rise? Is it Trump’s high-profile trade declaration or the Fed’s

monetary policy trend? Or is it an accelerated embrace of crypto assets by

Wall Street giants? The answer may be the interweaving of the three. This

article will be narratively told, sorting out how recent news ignites the

spark of Bitcoin, deeply analyze the delicate pulse of data on the chain, look

forward to market opportunities and hidden worries, and strive to be both

fascinating and professional in-depth.

In May 2025, Bitcoin (BTC) price was like a wild horse, sprinting to a nearly

two-month high of $97,900, and then briefly breathed around $94,000, and

quickly rebounded to around $97,000. This price carnival ignited the passion

of the crypto market and also made investors start asking: What is driving

this wave of rise? Is it Trump’s high-profile trade declaration or the Fed’s

monetary policy trend? Or is it an accelerated embrace of crypto assets by

Wall Street giants? The answer may be the interweaving of the three. This

article will be narratively told, sorting out how recent news ignites the

spark of Bitcoin, deeply analyze the delicate pulse of data on the chain, look

forward to market opportunities and hidden worries, and strive to be both

fascinating and professional in-depth.

Trump's trade gamble: market sentiment igniter

On May 8, Trump announced that he would issue a major statement in the Oval Office the next morning, covering a trade agreement with "a respected great power." The New York Times then revealed the answer: the object of the agreement is the United Kingdom. This news was like a spark, quickly igniting market speculation. Trump's trade policy has always been a weather vane for global financial markets, and this time is no exception. He also predicted that a "very significant news" will be announced before his visit to the Middle East next week, further pissing investors' nerves.

Trump's trade actions have caused waves many times in 2025. In early April, when he announced a 145% tariff on China, the price of Bitcoin fell to $77,730, and global stock markets also fell into the most violent fluctuations since 2020. However, on April 10, he unexpectedly suspended some tariffs for 90 days, and market sentiment flipped rapidly, and Bitcoin soared 7% to $82,350 in a single day. Today, a trade deal with the UK is seen as a potential positive, which could ease global trade frictions and boost the attractiveness of risky assets. JPMorgan strategist Bram Kaplan keenly captured the trend and advised investors to buy S&P 500 call options, saying Trump's announcement could push up the market. This optimism quickly spread to the cryptosphere, and a craze of capital inflows followed.

The Fed's subtle game: a catalyst for rate cut expectations

On the same day, Federal Reserve Chairman Jerome Powell threw a big signal at a press conference: the monetary policy outlook may include interest rate cuts, but the specific path will anchor economic data. He downplayed the significance of GDP fluctuations and stressed that the Fed would remain flexible. This statement injects a touch of warmth into the market, because interest rate cuts are often regarded as the spring breeze of risky assets.

In 2025, the Fed's policy will have a particularly significant impact on Bitcoin. On April 23, Trump denied rumors of firing Powell, the market breathed a sigh of relief, and Bitcoin rebounded immediately. However, the tariff shock in early April had sent Bitcoin to a low of $81,500, highlighting the traction of the macro environment on the crypto market. The expectation of interest rate cuts indirectly adds money to the rise of Bitcoin by reducing market liquidity costs, weakens the attractiveness of the dollar, and strengthens inflation hedging demand.

But Powell's cautious words also laid the groundwork. He made it clear that policies will keep a close eye on economic data, and if inflation or employment data exceeds expectations, interest rate cuts may be postponed. The market is in a delicate balance, and subtle changes in external variables may cause severe fluctuations.

Wall Street's crypto ambitions: The surge of institutional funds

On May 1, Morgan Stanley announced plans to launch crypto trading services on the E*Trade platform in 2026, marking a new stage in Wall Street's embrace of digital assets. Previously, its wealthy customers had been able to invest in crypto assets through Bitcoin ETFs and futures, and the consultant was approved to promote ETFs since August 2024. Organizations such as Charles Schwab followed closely behind, planning to launch similar services. These actions pushed Bitcoin to briefly break above $97,000 on May 2.

The influx of institutional funds is reshaping the market ecology. The US spot Bitcoin ETF has absorbed US$4.6 billion in the past two weeks, and its asset management scale is approaching the historical high of 1.171 million BTC. In contrast, the continued outflow from March to April had put pressure on the market, highlighting the sensitivity of institutional funds to the macro environment. Institutional participation not only improves market liquidity, but also paves the way for the mainstreaming of Bitcoin. However, in mid-April, affected by the tariff storm, Bitcoin ETFs leaked about $1 million for seven consecutive days, reminding investors that institutional funds are not solid.

On-chain data: delicate portrayal of market pulse

On-chain data provides us with a window to peek into the internal dynamics of the Bitcoin market. The recent price rebound has triggered a series of significant changes, revealing the delicate evolution of investor behavior and market structure.

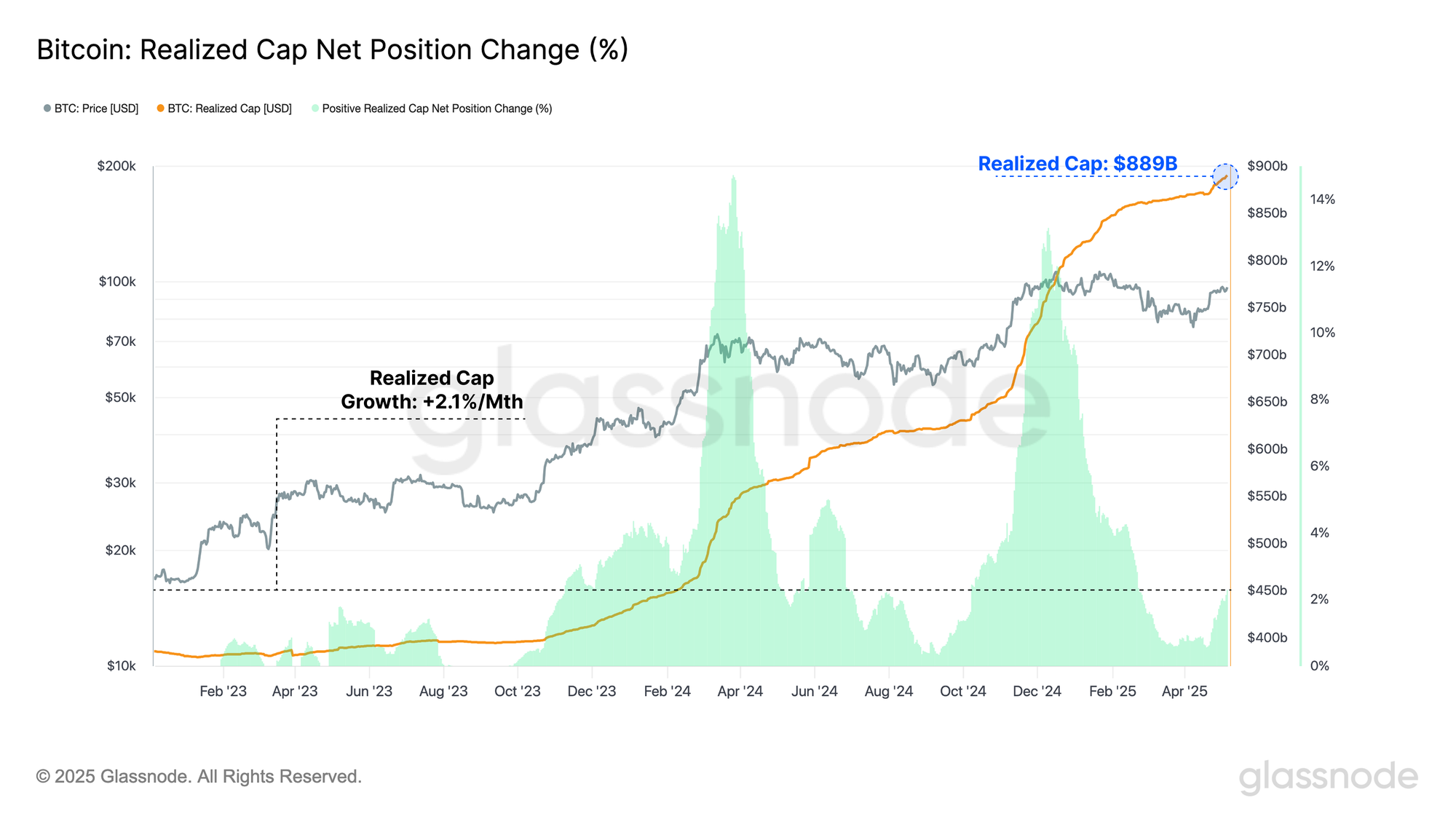

First, Bitcoin’s Realized Cap climbed to an all-time high of $889 billion, up 2.1% in the past month. This indicator measures cumulative net capital inflows and reflects the strong momentum of capital injection. The net realized profit/loss indicator further shows that daily net capital inflows exceed $1 billion in recent weeks, indicating that buyers are willing to absorb sell orders at current prices and strong demand. In contrast, the realization of losses accounts for only 1-2% of the total trading volume, suggesting that most investors who buy at high levels are still holding the currency and waiting and market sentiment is more optimistic.

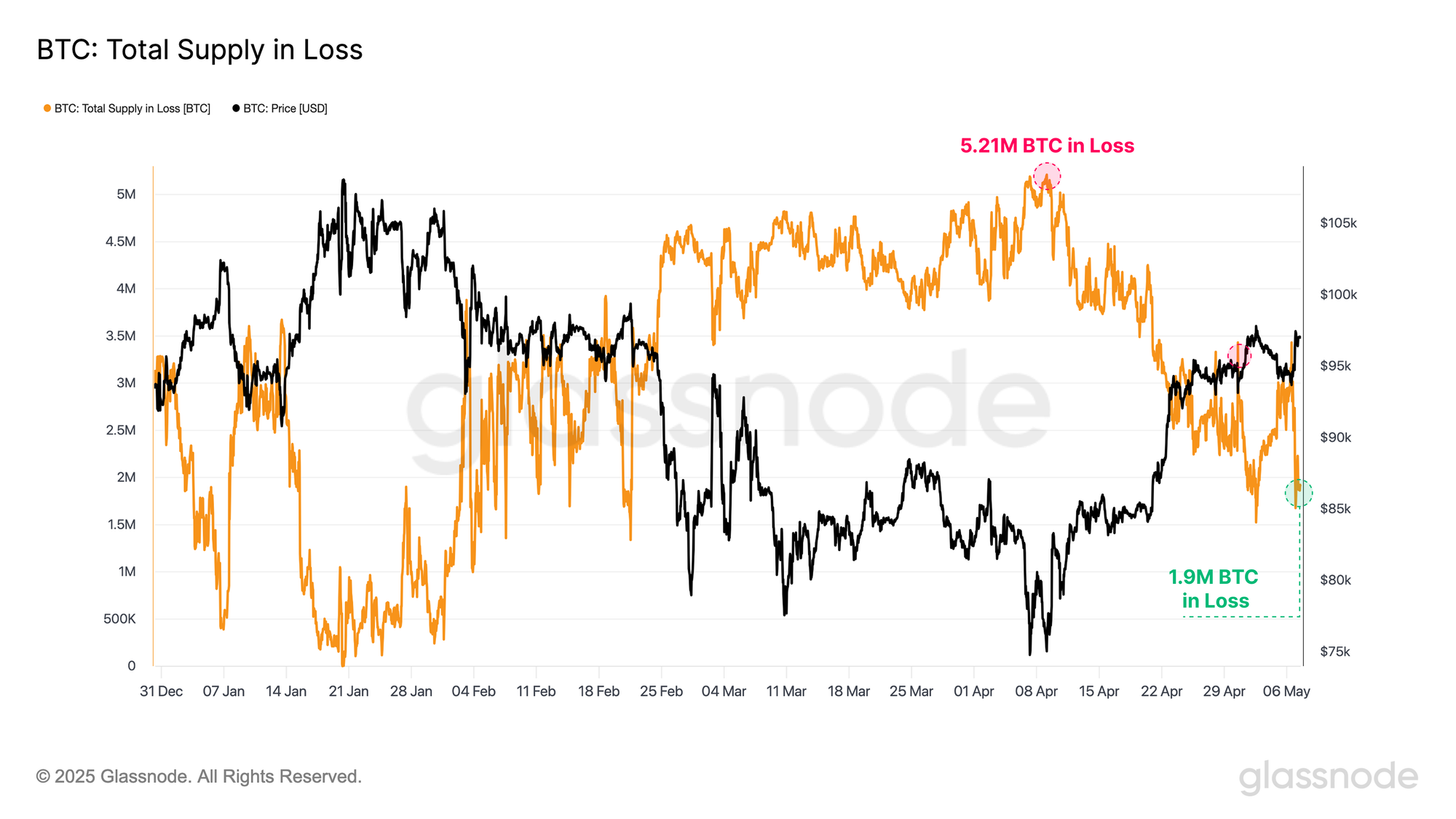

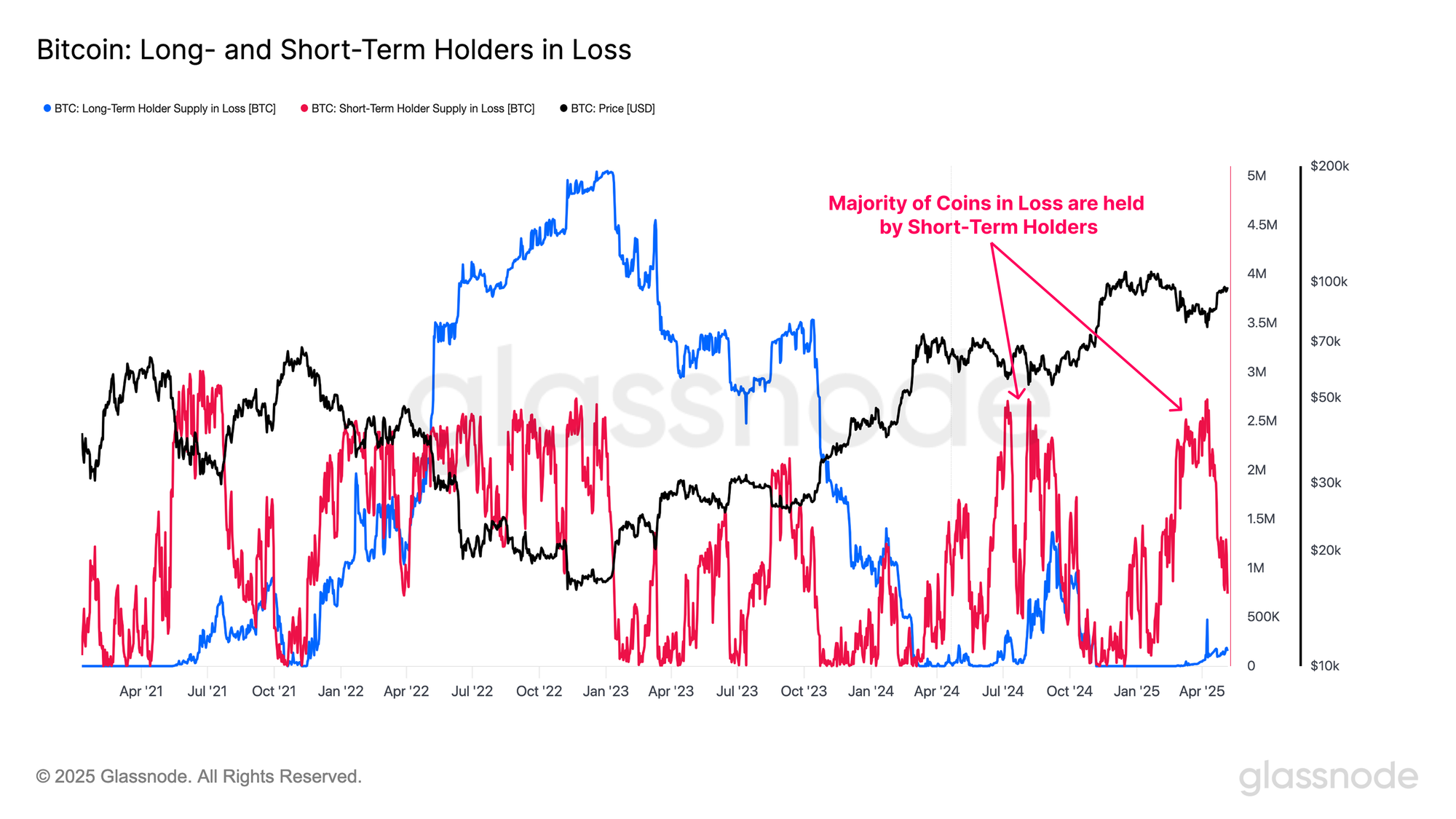

Secondly, the rebound in prices has significantly alleviated the financial pressure on investors. At the recent low of $74,000, more than 5 million BTCs were in a floating loss state. As the price rebounded to $97,000, about 3 million BTC returned to profitability, especially the portfolio of short-term holders (STHs) was repaired. The unrealized loss indicator shows that short-term holders' financial pressure has fallen back to neutral levels from the collapse of the yen arbitrage trading in August and the high level of +2σ when the market was sluggish in early 2025. This improvement is directly reflected in trading behavior: the proportion of profitable trading of short-term holders has surged, marking a turning point in the market's shift from loss-dominated to profit-dominated.

In addition, the behavior of long-term holders (LTH) is also worthy of attention. More than 254,000 BTCs have been held for more than 155 days since the lows, showing long-term investors' confidence in the current price. The Realized Supply Density indicator further reveals that a large number of BTC with similar cost bases are gathered near the current price. These coins have mainly accumulated between December 2024 and February 2025, and have experienced recent troughs and have not been sold. The existence of this part of the supply increases the market's sensitivity to price fluctuations, and small changes may trigger large-scale transactions.

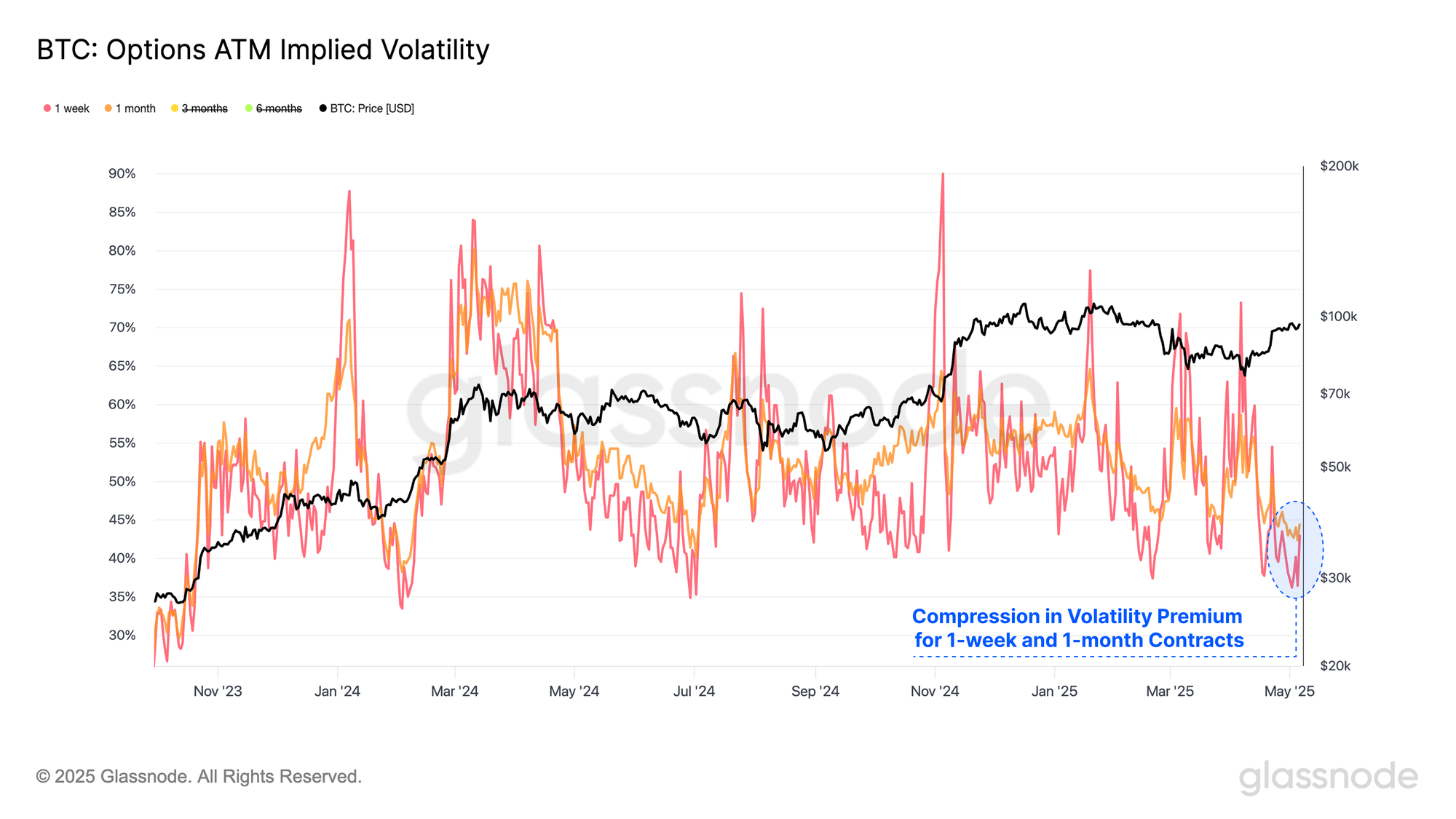

Finally, the options market provides an external perspective of volatility. The implied volatility of ATMs for 1 week and 1 month fell to its lowest since July 2024, reflecting investors' underestimation of future volatility. Historically, low volatility often indicates the arrival of a high volatility period, and combined with the high supply density on-chain, the market may be brewing a storm.

Market critical point: hidden worries under the craze

Bitcoin is in full swing, but the market is at a delicate tipping point. Prices hover around the short-term holder cost base (approximately $95,000), a level that has historically been the touchstone of the uptrend. If this support can be firmly maintained, the market may further rise; if it falls below, momentum may be set in the near future.

Signals from on-chain and options markets further exacerbate this uncertainty. High supply density means that the market is more sensitive to price volatility, while low implied volatility suggests investors may underestimate the risks of future oscillations. External catalysts—such as Trump’s trip to the Middle East or the Fed’s economic data interpretation—can be a spark that ignites volatility.

Epilogue: Bitcoin’s Opportunities and Fog

The Bitcoin market in 2025 is like a drama that is full of climaxes. Trump's trade policy injects vitality into risky assets, the Fed's expectation of interest rate cuts ignites market imagination, and Wall Street's crypto layout endorses Bitcoin's long-term value. The on-chain data outlines the picture of capital inflows, repair of investor confidence and enhanced market sensitivity with delicate strokes.

However, there is a fog hidden under the craze. The market is at a critical juncture, and subtle changes in external variables may break the fragile balance. Trump's next hand, the Fed's policy path, and the flow of institutional funds will be key clues in the short term. In the long run, Bitcoin’s decentralized nature and scarcity remain its core charm, but macroeconomic uncertainty, regulatory pressure, and competition for traditional safe-haven assets may pose challenges.

For investors, this is a moment when opportunities and risks coexist. A sentence from an analyst on the chain may be worth recalling: "The value of Bitcoin lies in the sovereignty it gives to individuals, not temporary price fluctuations." In this digital wave, rationality and patience will be the best beacons. No matter how the market fluctuates, maintaining a clear judgment may lead to the distance more than chasing the craze.

chaincatcher

chaincatcher