Tron TRON Industry Weekly: Trump speaks to reverse the decline, LRT sector financing is booming

Reprinted from chaincatcher

03/04/2025·2M1. Forecast

1. Macro-level summary and future forecast

The overall U.S. stock market showed a downward trend last week, especially technology stocks and artificial intelligence-related stocks performed weakly. However, U.S. stocks rebounded to a certain extent on Friday, indicating that short-term sentiment has rebounded. The US macroeconomic is showing a weak but not out of control. The decline in the stock market and the local rebound coexist, and macro uncertainty continues to affect market confidence. Investors need to pay attention to upcoming economic data (such as the February non-farm employment report), which will provide key clues to the Federal Reserve's March meeting.

2. Market changes and early warnings in the crypto industry

Last week, the crypto market fell significantly due to macro pressure and policy uncertainty, with a sluggish sentiment and a tendency to conservative capital flows. Trump's crypto reserve remarks became a turning point on Sunday night, triggering a big rebound in mentioned cryptocurrencies such as BTC, ETH, SOL and ADA, revitalizing market confidence. However, in the future, we still need to pay attention to the implementation of tariff policies, the adjustment of the Fed's expectation of interest rate cuts and the progress of the regulatory framework, and short-term fluctuations may continue. Investors should pay close attention to the White House crypto summit hosted by Trump this Friday and its follow-up policy details.

3. Industry and track hot spots

Knidos is committed to redefining the true decentralization of the Proof-of-Stake network through its modular decentralization enhancement layer, and gaining a strong platform for the Avalanche Foundation; Obol Collective is a decentralized operator ecosystem designed to enhance the security, resilience and decentralization of Layer 1 blockchain and infrastructure networks;

Byzantine is a trustless and efficient re-staking layer that supports the creation of license-free strategies, with the latest financing of $3 million.

2. Market hot tracks and weekly potential projects

1. Potential track performance

1.1. Briefly analyze how Knidos, a Depin protocol obtained by obtaining the strong platform of the Avalanche Foundation, converts static staking systems into mobile systems to improve user income

Knidos is a protocol dedicated to redefining the true decentralization of the Proof-of-Stake network through its modular decentralized enhancement layer.

The protocol focuses on the development of innovative solutions that promote blockchain decentralization. Knidos aims to contribute to the decentralization of the Proof-of-Stake blockchain through a trustless, network-independent orchestration layer.

The Proof-of-Stake network achieves consensus through validator nodes, which requires a lot of initial capital and deep technical expertise. Knidos Labs’ decentralized enhancement layer addresses these limitations through modular validator nodes, separate funds and technical settings. This creates opportunities for liquidity providers who lack technical expertise and developers and operators who lack sufficient liquidity capital. Additionally, the integrated Node-Fi protocol activates sleeping capital without sacrificing true hosting or decentralization.

Architecture Overview

Knidos Decentralized Enhancement Layer **

**Knidos’ decentralized enhancement layer provides a trustless, network-independent orchestration environment designed to help decentralize Proof-of-Stake networks. We activate sleeping capital through modular validator nodes

and through integrated Node-Fi mechanisms. The tripartite agreement includes

the following collaborative sublayers:

- Funding layer **

**The first sub-layer attracts capital by providing the highest annualized rate of return (APR) besides setting up individual validator nodes. The fund pool is initiated by the user without permission, and the pool initiator defines the verification configuration. Investors can flexibly contribute any funds of their choice and invest in split nodes.

Split node ownership allows users to truly own a portion of the blockchain node rather than just delegating their coins, which decentralizes access to network consensus by making node consensus easier to access and affordable. Partial ownership of each node is represented by a non-fungible token (NFT) held by the user. All fees and rewards incurred by the node are collected by the holder of the NFT.

All processes take place within a trustless framework, ensuring that the Knidos protocol itself has no access to funds at any moment.

- Node Management Layer **

**The second sub-layer creates a DePIN market for node operators, enabling them to monetize their hardware and technical capabilities without investing in liquid capital.

The operator pairs with capital from the fund pool to establish a Proof-of-Stake validator node in any network in a completely unmanaged manner. All processes are trustless and the node key is transferred to the verification engine through the on-chain ZK proof.

The verification engine starts the verification process and the node joins the consensus. The operator node will be verified by the Knidos protocol node.

- Node-Fi layer **

**The third sub-layer activates the sleeping capital in the staking pool and will not re-mortgage or sacrifice real custody.

Liquidity providers can pledge their NFTs (see 3.3. Funding Layer) and continue to earn rewards, supporting network consensus and security. They can also borrow directly from the integrated Node-Fi engine for the wider DeFi ecosystem, with the entire structure completely trustless. The lender provides capital to the smart contract, and the interest paid by the borrower will incentivize the lender. This introduces a new financialization level to sleeping assets, improving the network's TVL (total value lockout) and user activities.

Income Model **

**The protocol charges fees for staking rewards generated by validator nodes

and generates revenue through its Node-Fi engine. Rates can be dynamically

adjusted through governance to start liquidity and operators, drive activity

and TVL, and promote decentralization.

- Investor reward fee : deducted from the investor's pledge reward.

- Operator Reward Fees : Deducted from the operator's fees.

- Node-Fi lending fees : Added to the base rate to further increase fiscal reserves and ensure solvency.

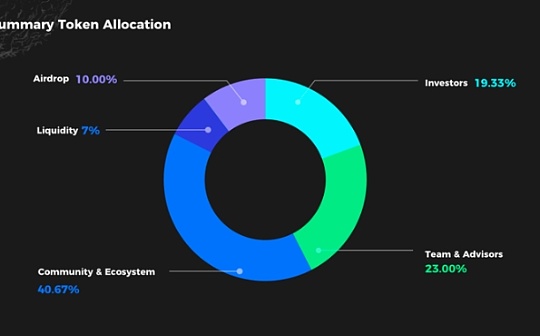

$KNIDOS **

**Expected to launch in the second quarter of 2025, $KNIDOS will serve as a

pillar of the entire protocol, providing access to tools, governance and

protocol revenue:

- Operator Registration : To register as a node operator in the Knidos protocol, users need to lock $KNIDOS tokens as security deposit.

- Revenue Sharing : $KNIDOS stakeholders will be able to obtain some of the revenue generated by the agreement after governance is approved.

- Governance : Stakers will participate in key decisions about the future of the platform, giving the community a voice in shaping the direction of the Knidos protocol, including rate adjustments, the design of incentives, and strategic deployment of liquidity to promote TVL growth and/or developer activities.

Comments

Knidos cooperates with three sub-levels to form a large enhancement layer. Through the dynamic mechanism of this enhancement layer, it liberates the income limitations of the traditional staking model, infinitely amplifies the benefits of nodes and node clients, and maintains extreme decentralization.

The role of Depin network in Knidos is more like a tool that generates additional benefits for nodes, and is not the core function of the protocol. This is the first agreement in the industry to only use the Depin business as an affiliate business that generates revenue. Therefore, from the perspective of income, the agreement has great potential. With the close cooperation with Avalanche, users who are interested in Staking can pay attention.

1.2. Does the unique performance of Torch Finance, a stablecoin exchange protocol on Ton, reignite the liquidity of new and old stablecoins?

Obol Collective is a decentralized operator ecosystem designed to enhance the security, resilience and decentralization of Layer 1 blockchain and infrastructure networks. By providing modular tools and technologies such as Charon middleware clients and Techne credentials, Obol enables node operators to run high-performance, cut-resistant nodes. The ecosystem promotes collaboration between staking protocols, node operators and household stakers, aiming to effectively scale the decentralized network.

Participants can earn OBOL tokens through programmatic incentives and feedback funds, driving the growth and sustainability of decentralized infrastructure.

Expand infrastructure network **

**Obol focuses on extending consensus by providing permissionless distributed

validators (DVs), which not only prevents client problems and key management

errors, but also has Byzantine Fault Tolerance. We believe that distributed

validators should and will become an important part of mainnet validator

configuration, and a new trust paradigm has been opened as the Ethereum

community transitions to distributed validators.

Distributed Verifier Middleware Client Charon

By enabling squad staking, the security, resilience and decentralization of the Ethereum validator network is improved. This ecosystem is powered by Obol's economic model, which supports ecological projects through retroactive funding, forming a positive flywheel effect that accelerates DVs adoption and expands infrastructure networks like Ethereum.

Core elements

Execution client **

**Execution client runs EVM (Ethereum Virtual Machine) and manages the

transaction pool of the Ethereum network. These clients provide the consensus

client with an execution payload to include it in the block.

Consensus client **

**The responsibility of the consensus client is to run Ethereum 's Proof of

Stake consensus layer, commonly known as Beacon Chain.

DV middleware client (DV middleware client) **

**The DV client intercepts standardized REST API communication between any

consensus client and validator client pair and coordinates with other Charon

clients in the cluster to reach consensus, determine what needs the validator

signature, and aggregate the returned signatures.

Validator client **

**The validator client works as usual, using the validator key share to sign

the message it receives from Charon and then passes it back to Charon for

aggregation.

Comparison of Obol and other DV implementations

No private key to link

- Obol's distributed key generation (DKG) event generates a key share for nodes in each DV cluster. The private key of the entire validator never exists in one place . The key is generated locally on the node and can be backed up. The private keys of Obol DVs are never uploaded to the Internet or publicly published on the chain.

- An alternative is to split the private key into multiple shares, encrypt each share using the public key of the node operator, and then publish the encrypted private key to the chain. The operator's node key can decrypt the private key. However, we don't think this practice is safe. We believe the safest way is to avoid the existence of a single private key and should never publish the private key to the public chain.

Cluster independence: The cluster can be upgraded independently and does not rely on public P2P chat networks

In Obol 's DV cluster, nodes use LibP2P for direct communication, and communication is end-to-end encryption via TLS. Clusters are independent of each other and can run different versions of Charon and do not need to be upgraded together. This means that when Obol releases a new Charon version, the Obol DV cluster can be upgraded independently based on its schedule without the need to be upgraded with other clusters. Charon never needs hard forks or simultaneous updates between clusters.

This direct communication between nodes improves latency performance and makes cluster communication more difficult to deal with Denial of Service (DOS) attacks. Additionally, this allows Obol DV clusters to run on a private network . This can save data export costs for operators running cluster nodes in multiple cloud provider locations.

Obol segmentation

Obol develops and maintains a set of smart contracts for use with distributed Validators (DVs). These contracts include:

- Withdrawal Recipients : The contract used for the withdrawal address of the validator.

- Split contracts : a contract used to allocate Ether to multiple entities, developed by org.

- 分割控制器(Split controllers) :能够改变分割器配置的合约。

Two key objectives of validator reward management are:

- It is possible to distinguish between reward ether and principal ether so that node operators can pay based on the percentage of rewards they accumulate for principal providers, rather than based on the percentage of principal + rewards.

- Ability to extract rewards in a continuous manner without having to exit the validator.

The following section outlines the different contracts that can be combined to form solutions to achieve one or both of them.

Withdrawal Recipients

The validator has two revenue streams, namely consensus layer rewards and execution layer rewards. The withdrawal recipient is concerned with the former, continuously receiving balances from validators holding more than 32 ethers and receiving principal of the validator when the validator exits.

Optimistic Withdrawal Recipient

This is the primary withdrawal recipient used by Obol, as it allows for the separation of the reward from the principal and allows for the continuous withdrawal of accumulated rewards.

Comments

Obol's unique features such as Charon middleware, back-financing funding mechanism, queue staking and decentralized collaboration make it stand out in other DV implementations. It provides more modular, secure and scalable solutions for building resilient blockchain infrastructure, especially in the context of Ethereum’s transition to distributed validators, Obol provides greater fault tolerance and decentralization. Obol focuses on Byzantine fault tolerance and distributed trust, making it an important choice for the future development of blockchain infrastructure.

1.3. What innovations are the decentralized income aggregator, Byzantine Finance, which has raised $3 million in the latest financing, claiming to be "can pledge any assets at any location" ?

Byzantine is a trustless and efficient restaking layer that supports permissionless policy creation. We support the deployment of a minimized, independent and isolated replenishment policy vault by specifying the following:

A re-staking strategy consists of the following parts:

- A set of AVS/network

- One or more re-staking agreements

- A mortgaged asset

- Portfolio flexibility (not modifyable or modifyable strategy)

- Investor permissions (open or whitelist pledgers)

- (Optional) Liquidity Token

The Byzantine protocol is trustless and is designed to be more efficient, modular and flexible than any other decentralized restaking platform. All vaults are completely independent of each other: funds are completely isolated between them, and risks are completely independent. The vault is not affected by governance.

Separate risk management and infrastructure

The policy vault is just one example of permissionless risk management built on Byzantine. Any agreement, DAO or individual can be built on the Byzantine infrastructure layer to help users manage risks or integrate resolute proceeds into existing services.

The key is that risk management is performed outside of Byzantine. Therefore, Byzantine has nothing to do with any particular investment outcome.

Basic Components **

**Byzantine is a decentralized protocol that allows the creation of a separate

cross-protocol re-staking policy vault without permission.

It separates the roles of investors (stakeholders), risk managers (strategy managers), and infrastructure levels. Users can create policy vaults without permission according to their needs, and can optionally open these vaults to other pledgeers.

- ByzVault Factory: A smart contract for deploying ByzVaults without permission.

- ByzVault: A deployed vault with a specific restaking policy. Process the reward settlement of PoS rewards (if ETH is collateral) and resolute rewards.

- AVS and Network Policy: A combination of AVS/network and protocols into which a specific policy vault replenishes.

- Operator Registry: A licensed institutional node operator registry that allows unauthorized vault deployers to select one or more of them.

- Ethereum Verifier: Ethereum Verifier for ETH staking.

- Re-pled operator: operator with re-pled strategy.

- Trust Market Agreement: Protocols like EigenLayer, Symbiotic, or Babylon.

Native vs. Liquidity re-staking

The Byzantine protocol uniquely supports native and liquid restaking strategies.

Liquidity re-pled **

**Liquidity re-staking allows pledgeers to pledge liquidity pledged tokens

(LSTs), stablecoins, or other ERC-20 tokens and receive additional rewards

from re-staking. This improves the utility and capital efficiency of the

underlying tokens and is the easiest way to re-stake.

Byzantine policy vault can deploy various ERC-20 assets as underlying collateral tokens.

Native re-pled **

**Native re-staking enables the staker to pledge and re-stake ETH in the same

operation. The process is as follows:

- Pledge ETH : The pledger pledges ETH through the Byzantine vault. Verifiers are handled by operator partners that policy managers can choose.

- Delegated staked ETH : Through a smart contract with Byzantine, the verifier containing the staked ETH will automatically delegate to the trust market selected by the policy manager. Staking ETH ensures the AVS and network required by policy managers.

- Earn re-pled rewards!

Byzantine Policy Vault handles native restaking policies through a group of licensed Ethereum operators. When deploying a vault, policy managers can choose specific operator partners if they wish.

Advantages of native re-staking

- Double-layer reward : The pledger receives both pledge reward and re-pled reward.

- Risk Isolation : While LSTs bring together deposited assets, native Byzantine vaults use validators specially set for vaults. Therefore, the risks of pledge and re-pled are completely isolated.

- Higher transparency : Policy managers and stakeholders have clear visibility and control over their dedicated validators.

- Higher profit potential : pledge and re-pled through one agreement, and the pledger does not have to pay the fees for multiple agreements. In addition, removing the integration requirements between protocols reduces friction and can improve capital efficiency.

Comments

At Byzantine, users can deploy your policy instantly by choosing any restaking protocol, network, operator and collateral assets.

Byzantine vaults are easily integrated into DeFi. You can trade and leverage your vault shares, or build your own customized services, products, and even assets based on Byzantine's flexible architecture.

Depositors can withdraw money at any time. Since the depositor owns the treasury shares, the depositor has full control over its assets. The vault owner can change the policy but never withdraw the user's assets, adding an additional layer of security.

Each part of the Byzantine protocol has been audited several times before it goes live. No one has the right to access or decide how to handle the user's assets. All deployed vaults can only be upgraded by the vault owner, which means no one except you can change the functionality of the vault. Your vault liquidity will never be mixed with other vaults and will not share rewards.

2. Detailed explanation of the project that week

2.1. Will the unique performance of the Swap protocol, the main stablecoin on Ton, reactivate the liquidity of a pool of backwater on the chain?

Introduction

Torch Finance is a cutting-edge decentralized exchange (DEX) designed for the TON blockchain. With innovation as the core, Torch Finance focuses on achieving stable transactions, allowing users to trade liquid pledged tokens (LSTs), stablecoins and earnings-bearing tokens (YBTs) with unparalleled convenience and efficiency.

Key Features

- StableSwap: Provides efficient and low slippage stablecoins, liquid pledged tokens (LSTs) and earnings-bearing tokens (YBTs) trading to optimize maximum capital efficiency.

- Cross-chain transactions (coming soon): seamlessly bridge assets on different chains to achieve a truly interconnected DeFi ecosystem.

Technical analysis

- Torch Finance 's solution

Torch Finance: Stablecoin Center **

**Torch Finance is the ultimate stablecoin trading center on the TON

blockchain, aiming to solve the inefficiency problem of existing platforms. By

leveraging the industry-leading StableSwap algorithm, Torch Finance provides:

- Customized price curve : Tailored for each pool, ensuring unparalleled flexibility.

- Maximum capital efficiency : reduce slippage and save user funds, especially when trading volumes are high.

With Torch Finance, users can enjoy a seamless and efficient trading experience, completely changing the way stablecoins are traded on TON.

Beyond Stablecoins: Explore LSTs and YBTs **

**TON blockchain is not only the center of stablecoins, it is also a growing

ecosystem covering assets such as liquid staking tokens (LSTs) and earnings-bearing tokens (YBTs). These asset classes have the potential to simplify the

DeFi earnings experience and attract 900 million users on Telegram to the DeFi

ecosystem, and Torch Finance is born to unlock their value.

Instant liquidity of LSTs **

**Liquid pledged tokens usually take up to 36 hours to complete the

verification process before they can be converted back to TON. For users who

need instant liquidity, Torch Finance provides a seamless solution.

By using Torch, users can instantly exchange LSTs to TON with minimal

slippage, ensuring quick liquidity when needed most.

YBTs ' professional market **

**Earnings-bearing tokens (YBTs) are a key innovation in DeFi that provides

passive income through the returns of underlying assets. However, YBTs often

face liquidity challenges due to their unique value dynamics and reliance on

earnings strategies.

Torch Finance creates customizable liquidity pools optimized for YBTs trading by leveraging its StableSwap infrastructure. These pools provide:

- Efficient pricing mechanism : Taking into account the gradual accumulation of returns.

- Enhanced liquidity : Ensure that users can make transactions without significant slippage while accumulating returns from YBTs.

By providing a customized trading environment for YBTs, Torch Finance not only improves their accessibility, but also ensures fair and competitive pricing. This approach simplifies the trading experience of YBTs and attracts more users to participate in the wide DeFi ecosystem on TON. With Torch Finance, TON blockchain is no longer restricted by the inefficiency of traditional switching mechanisms. By focusing on stablecoins, LSTs and YBTs, Torch Finance makes itself the preferred platform for optimizing transactions, helping users unlock the full potential of assets on TON.

- Torch Finance Architecture

TON Virtual Machine (TVM): The Basics of Scalability **

**TON Virtual Machine (TVM) provides support for smart contracts on the TON

blockchain and has cutting-edge features such as Infinity Sharding Paradigm,

enabling dynamic scalability and ultra-fast transaction processing. This

unique approach ensures that TON can cope with growing demand, making it a

strong foundation for DeFi innovation platforms like Torch Finance.

However, TVM also presents unique challenges:

- No transaction rollback (between addresses) : Failed transactions cannot be rolled back between different addresses, which requires more caution when designing contracts.

- No cross-contract status access : Contracts cannot retrieve status information directly from other contracts, so innovative solutions are needed to handle complex interactions.

Advantages of Torch Finance Architecture **

**Torch Finance’s architecture is designed to overcome these challenges and

maximize TVM capabilities. Its architecture offers several key advantages:

-

High-speed transactions **

**Torch Finance uses TVM 's Infinity Sharding to enable ultra-fast transaction processing, ensuring scalability is maintained even during peak demand. -

Unilateral liquidity provision **

**Users can provide liquidity through a single token without the need to use a token pair. -

Quasi-Atomic Swaps supports multi-token pools **

**Supports multi-token pools, allowing seamless exchange between any tokens in the pool. Faster exchange and reduce routing complexity. Almost atomic execution ensures reliable transaction results.

Meta pool liquidity aggregation **

**Aggregate liquidity into smaller products, improve its availability while

delivering higher returns to liquidity providers.

Fuel Optimization **

**By building on DeDust and introducing further optimizations, Torch Finance

reduces fuel costs for single and cross-pool operations.

-

Core elements **

**Torch Finance 's architecture is built around five key components: Factory , Vaults , Pools , LP Account , and Oracle . Each component plays a vital role in managing liquidity and facilitating seamless asset exchanges and transactions, ensuring that agreements remain stable and efficient. -

Factory

Factory is the core coordinator of Torch Finance, and is responsible for deploying all contracts, including Vaults, Pools, and LP Accounts.

Factory can be compared to supermarket managers, deciding which checkout stations should be set up, which cash registers need to be started to handle discounts and redemptions, and arranging delivery services (LP Accounts) to deliver all purchased items to users in a centralized manner, ensuring faster and more efficient transactions.

When a new asset enters the system, Factory deploys a new Vault (checkout) to manage and store the asset, ensuring it has a dedicated space to handle.

If a new liquidity pool is needed, Factory will set up the corresponding Pool (cash register) to be responsible for asset exchange, discount calculation and transaction processing.

Depending on the needs of different users, Factory will create special LP Accounts (delivery services). These accounts will deliver assets to users efficiently at one time after all transactions are completed, ensuring that transactions are smoother and more concise.

Whether deploying new liquidity pools or LP Accounts, Factory quickly allocates and deploys resources to ensure smooth Torch systems and ensure seamless coordination among components.

- Vaults

Vault is a key component in Torch Finance, responsible for managing user

assets and leveraging TON 's sharding mechanism. **

**Each Vault stores and manages specific types of assets, protects user funds,

and performs transfer operations according to the instructions of the Torch

contract.

In Torch, TON and Jetton are considered different asset types:

- TON is a unique asset type managed by TON Vault , which is used to store and process users' TON assets.

- Jetton stands for another asset type, managed by Jetton Vaults . Each Jetton has a dedicated Vault, such as USDT Vault or tsTON Vault.

The main function of a Vault contract is to store user assets and handle deposits, exchanges and withdrawal operations when users interact with the system.

- Pools

In Torch's design, asset management is processed by a Vault contract, which directly informs Pools of the type and quantity of assets of the user. This separation allows Pools to focus on trading and liquidity algorithms without processing the storage or retrieval of assets.

This design decouples Pools from Vaults, giving Torch excellent flexibility and scalability when creating liquidity pools.

- LP Account

Due to the asynchronous nature of TON, separate transactions are required when depositing assets to transfer assets to Vault.

When a user deposits assets in bulk, LP Account is like a delivery service. Until all items are checked out and packaged, all assets will be delivered to the user's home (Pool) for asset exchange or liquidity provision at one time.

If the user deposits only one asset, the LP Account is not required – Vault will send the asset directly to the Pool for processing, simplifying the transaction process.

- Oracle

In Torch Finance, general Stable Pools do not require oracles. However, if a pool contains assets that increase over time, using these assets directly results in slippage increasing over time.

To solve this problem, Torch Finance cooperated with Python, the leading oracle in the blockchain industry, to launch Yield Bearing Stable Pool. By utilizing Python to reference income-generating assets, the redemption rate can be calculated based on the underlying assets, thereby significantly improving the user's trading experience.

Summarize

Torch Finance revolutionizes decentralized transactions by providing a seamless, user-centric experience. Inspired by Curve Finance and Balancer’s innovation pool abstract model, Torch Finance enables efficient, low-slip transactions for stable assets while paving the way for cross-chain interoperability.

3. Industry data analysis

1. Overall market performance

1.1 Spot BTCÐ ETF

ETF, November 1, ET) Ethereum spot ETF total net outflow of 10.925,600 US dollars

1.2. Spot BTC vs ETH Price Trend

BTC

Analysis

Last week, BTC showed an unfavorable trend of falling by more than 18% throughout the trading day cycle, but although the unfavorable fundamentals always suppressed the currency price, the negative news was almost all shattered by Trump's speech on Sunday night. Given that several major economic indicators will be released this week, it is still difficult to predict whether the rebound can continue. However, assuming that the number of non-farm and initial unemployment claims meets expectations, BTC's pullback can stabilize above $90,000, then it will be expected that it will continue to rebound and break through the upper edge of the decline wedge pattern at the end of this week. Once the breakthrough is confirmed to be effective, the short-term downward trend can be said to have been reversed. The subsequent rebound points can continue to pay attention to the three key resistance ranges in the chart.

On the contrary, if the above two economic indicators do not meet expectations and trigger a decline in the capital market, then there is also a probability that BTC will fall below the support range of 90,000 or even $88,000 again. Of course, from the Trump administration's positive attitude towards the crypto market to protect the market, this is a low-probability event, but the market is changing rapidly, and users still need to be vigilant.

ETH

Analysis

For ETH, the rebound after falling to nearly $2,000 was also suppressed by the bottom of the February consolidation range, that is, $2,550, and has entered a pullback market. However, judging from the current pullback intensity, it is a high probability that the price will stabilize above $2,400, but there are many resistance ranges above, especially the large-cycle downward trend line marked in black. Although this trend line failed at the end of January, it once again verified the effectiveness of the trend line in the February 25 market. Therefore, it can be determined to be a false breakthrough to a certain extent.

Therefore, the trend of ETH is relatively clear. Before it breaks through again and stabilizes above the downward trend line, the trend of ETH is weak. On the contrary, it is highly likely that the impact will even break through US$3,000 again.

1.3. Panic & Greed Index

Analysis

The index fell to 22 this week, indicating that the market is in a state of "extreme fear". This decline reflects investors' uneasiness, and the main reasons include the following:

1. Market volatility intensifies : the prices of major cryptocurrencies such as Bitcoin and Ethereum have fallen sharply, causing market concerns about a spiral decline. This strong volatility often leads investors to become more cautious, which increases market fear.

2. Decline in trading volume : The recent trading activity has decreased significantly, indicating that investors are not confident enough. Lower trading volumes may amplify price fluctuations, making the market more susceptible to sharp declines, further exacerbating investor panic.

3. Macroeconomic uncertainty : Global economic instability, including concerns about monetary policy, interest rates and geopolitical tensions, prompts investors to reassess investment in high-risk assets such as cryptocurrencies. This risk aversion has led to an increase in market fear.

At present, panic is declining as prices stabilize. Pay attention to the strength of Bitcoin's rebound this week. If the rebound is strong, it may mean that the 22 index will become history, otherwise it may continue to fall.

2. Public chain data

2.1. BTC Layer 2 Summary

Analysis

The Layer 2 ecosystem has experienced important developments and challenges between February 24 and February 28, 2025.

Bitlayer 's BitVM implementation and strategic cooperation

On March 1, Bitlayer announced significant progress in implementing BitVM. BitVM is a technology that enhances Bitcoin programmability and scalability, which can be achieved without forking. This progress has been supported by strategic cooperation of the following blockchain platforms:

- Base : Bitlayer's BitVM bridging enables Bitcoin to be transferred within the Base ecosystem, allowing Bitcoin holders to participate in decentralized finance (DeFi) applications.

- Arbitrum : This integration enables users to bridge assets between Bitcoin and Arbitrum, enhancing liquidity and opportunities for decentralized finance while maintaining a framework that minimizes trust.

- Starknet : Bitlayer’s partnership with Starknet aims to provide fast transactions and low fees to Bitcoin users and ensure security through STARK proof, promoting the development of the Bitcoin DeFi hub.

- Plume Network : Through its partnership with Plume Network, Bitlayer is committed to optimizing the liquidity of real-world asset (RWA) use cases and bringing institutional-level products into the Bitcoin ecosystem.

2.2. EVM &non-EVM Layer 1 Summary

Analysis

From February 24 to February 28, 2025, important developments related to multiple EVM and non-EVM Layer 1 blockchains have attracted industry attention.

EVM Layer 1 related progress:

- Autonomys Labs Developer Synchronous Conference: On February 24, Autonomys Labs held a biweekly developer conference at the ETH Denver event to discuss various updates and innovations within the community, focusing specifically on the progress of its decentralized autonomous organization (DAO) governance model.

- Cross-chain integration between EVM and non-EVM networks: Recent integration has enabled trustless cross-chain messaging between EVM and non-EVM Layer 1 networks (such as Solana), promoting secure interaction between different blockchain ecosystems.

Non-EVM Layer 1 related progress:

- Discussion on the potential of Stacks smart contracts: There is research that deeply explores Stacks' smart contract potential as a Bitcoin Layer 2 solution, emphasizing that it integrates with the Bitcoin main chain by submitting anchor transactions to ensure immutability and allows settlement of transactions on the Bitcoin main chain.

2.3. EVM Layer 2 Summary

Analysis

The following is a comprehensive summary of the main progress and trends of the EVM Layer 2 Ecological Head Agreement from February 24 to February 28, 2025:

- 1. MetisDAO: Optimize withdrawal speed and governance innovation

- Application of Ranger mechanism : MetisDAO further shortens asset withdrawal time based on Optimistic Rollup by introducing the Ranger role. Ranger improves transaction credibility by verifying transactions locally on Layer 2, thereby reducing the waiting period for users to withdraw assets from Layer 2 to the Ethereum main network.

- DAC Ecosystem Expansion : MetisDAO emphasizes the concept of "decentralized autonomous company" (DAC), and is committed to providing a customized execution layer for specific application scenarios, further attracting enterprise-level users and developers to participate in ecological construction.

- Governance experiment : The team may explore the deep integration of DAO governance and Layer 2 technology during this period to promote a more decentralized network operation model.

- ****Optimism: Public goods funding and ecological access

- Public Goods Funding Allocation : The Optimism team may announce a new round of public goods funding plans during this period, continuing its commitment to use profits to support open source projects and infrastructure, and attract community developers to participate.

- Adjustment of ecological access mechanism : Optimize the review process of DApp deployment, balance openness and security, and may introduce new governance tools to improve the quality of ecological projects.

- Cross-chain bridge integration : Cooperate with cross-chain bridges such as Hop Protocol to improve the efficiency of users transfer assets between different Layer 2 and alleviate the problem of liquidity splitting.

- ****Rollux (Syscoin): Bitcoin-enabled security innovation

- 合并挖矿技术 :Rollux通过结合比特币的算力安全性,进一步巩固其作为高性能EVM Rollup的定位。此期间可能公布更多基于比特币合并挖矿的合作伙伴或技术细节。

- 低成本与高吞吐量 :团队持续优化交易费用(低至07美元/次)和TPS(最高达576),吸引高频交易类DApp迁移至其网络。

- AI与区块链融合 :通过SuperDapp等AI增强型社交平台,探索Layer 2在社交金融(SocialFi)等新兴领域的应用。

四.宏观数据回顾与下周关键数据发布节点

上周公布的美国1月核心PCE物价指数年率2.6%表明通胀在缓慢回落,符合预期并创半年新低,但月率0.3%的增长显示通胀压力尚未完全消退。结合个人收入强劲但支出疲软的表现,美国经济呈现复杂态势。宏观环境受特朗普政策不确定性主导,市场对通胀数据的敏感度降低,未来需关注3月美联储会议及关税政策落地的实际影响。

本周(3月3日-3月7日)重要宏观数据节点包括:

3月5日:美国2月ADP就业人数

3月6日:美国至3月1日当周初请失业金人数

3月7日:美国2月季调后非农就业人口

五. 监管政策

本周市场在28日遭遇大跌,但在此前来自美国的监管部门与多个加密平台达成和解,或者是暂停调查,在这一系列影响之下,并没有带动市场回暖。直到3月2日晚,特朗普公布了美国加密火币储备计划,并明确提出包含BTC、ETH等5种资产。这意味着美国正式启动比特币国家储备,市场随之迎来大涨,从跌破80000美元下方回到950000美元的位置。

美国:成立加密战略储备

美国总统特朗普宣布成立美国加密战略储备,旨在确立美国在数字资产创新方面的领导地位。该储备最初将包括比特币(BTC)、以太坊(ETH)、XRP、Solana(SOL)和Cardano(ADA)。这一举措导致这些加密货币的市值大幅上升,并显示出政策从过去的监管转向更多支持加密产业的趋势。

2月21日,SEC宣布撤销对Coinbase的诉讼,并在过去一周终止了对Uniswap Labs和Gemini的调查,同时终止指控的平台还有OpenSea和RobinHood Crypto。另一方面,2月27日,SEC请求暂停对孙宇晨及波场(TRON)基金会的诉讼,以寻求潜在的解决方案。

欧洲联盟:实施MiCA监管欧盟的加密资产市场监管(MiCA)已于2024年12月30日全面生效。MiCA为加密资产提供了一个全面的监管框架,旨在在保障投资者权益的同时推动区块链技术的普及。该法规涵盖了市场中的各类参与者,包括发行人、交易平台、交易所和托管钱包服务提供商。

阿联酋:正式批准USDC和EURC

迪拜金融服务管理局(DFSA)正式批准Circle 旗下稳定币USD Coin(USDC)和EURC 为首批获认可稳定币。新规定将使迪拜国际金融中心(DIFC)内企业能在支付、资金管理等多项数字资产应用中使用这两种稳定币。自2004 年成立以来,DIFC 已吸引近7000 家活跃企业,并严格仅允许认可的加密代币运营。

中国香港:将发表第二份发展虚拟资产政策宣言

香港财政司司长陈茂波在2025 至26 年《财政预算案》中宣布,即将发表第二份发展虚拟资产政策宣言,探讨如何结合传统金融服务优势与虚拟资产领域的技术创新,并提高实体经济活动的安全性和灵活性,亦会鼓励本地和国际企业探索虚拟资产技术的创新及应用。陈茂波重申,政府会在年内就虚拟资产场外交易及托管服务的发牌制度进行咨询。在稳定币监管方面,港府已向立法会提交条例草案,待条例通过后,金管局会尽早审批牌照申请。

国际动态:OECD推出加密资产报告框架(CARF)

经济合作与发展组织(OECD)推出了加密资产报告框架(CARF),旨在促进各国间的自动信息交换,从而应对与数字资产相关的逃税风险。根据CARF要求,加密资产服务提供商(CASP)必须收集用户的个人信息(如税务居住地和身份证号码),并将这些数据上报给国内税务机关,随后这些机关将国际交换信息,以提升税收合规性和监管效率。

jinse

jinse