Traditional institutions embrace the timeline and full-page colouring of the crypto industry

Reprinted from panewslab

03/30/2025·1MAuthor: insights4.vc

Compiled by: Deep Tide TechFlow

Since 2020, major U.S. banks, asset management companies and payment institutions have gradually shifted from cautious wait-and-seeness to actively investing, cooperating or launching related products.

As of early 2025, institutional investors had held about 15% of the Bitcoin supply, and nearly half of hedge funds began to allocate digital assets.

Key trends driving this integration include the launch of regulated crypto investment vehicles (such as the listing of the first spot bitcoin and Ethereum ETFs in the United States in January 2024), the rise of tokenization of real-life assets (RWA) on blockchain, and the growing use of stablecoins in settlement and liquidity management by institutions.

Institutions generally regard blockchain networks as an effective tool to simplify traditional backend systems, reduce costs and enter new markets.

Many banks and asset management companies are piloting licensed decentralized finance (DeFi) platforms that combine the efficiency of smart contracts with KYC (Know Your Customers) and AML (Anti-money laundering) compliance.

At the same time, they are also exploring permissionless public DeFi in a controlled way. Its strategic logic is very clear: DeFi's automated and transparent protocols can enable faster settlement, all-weather market operations and new revenue opportunities, thereby solving the long-standing inefficiency problems of traditional finance (TradFi).

However, significant resistance remains to hinder the process, including regulatory uncertainty in the United States, challenges in technology integration, and market volatility, which have suppressed the adoption rate.

Overall, as of March 2025, the interaction between traditional finance and crypto is showing a cautious but gradual acceleration. Instead of just staying in the cryptocurrency role, traditional finance has begun to carefully bury in some use cases with tangible advantages (such as digital asset custody, on-chain lending and tokenized bonds). The next few years will be a critical period to determine whether TradFi and DeFi can be deeply integrated in the global financial system.

Paradigm Report - "The Future of Traditional Finance" (March 2025)

As a leading crypto venture capital fund, Paradigm surveyed 300 traditional finance (TradFi) practitioners from multiple developed economies in its latest report. Here are some of the most interesting statistics and insights from the report.

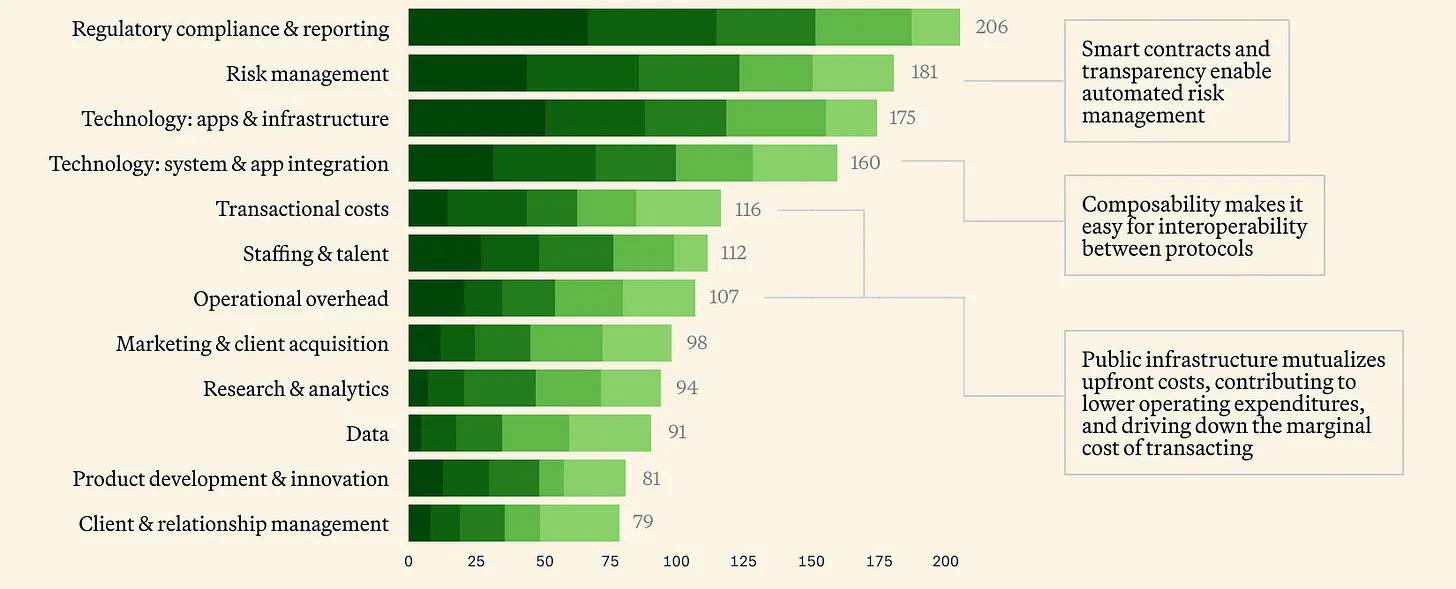

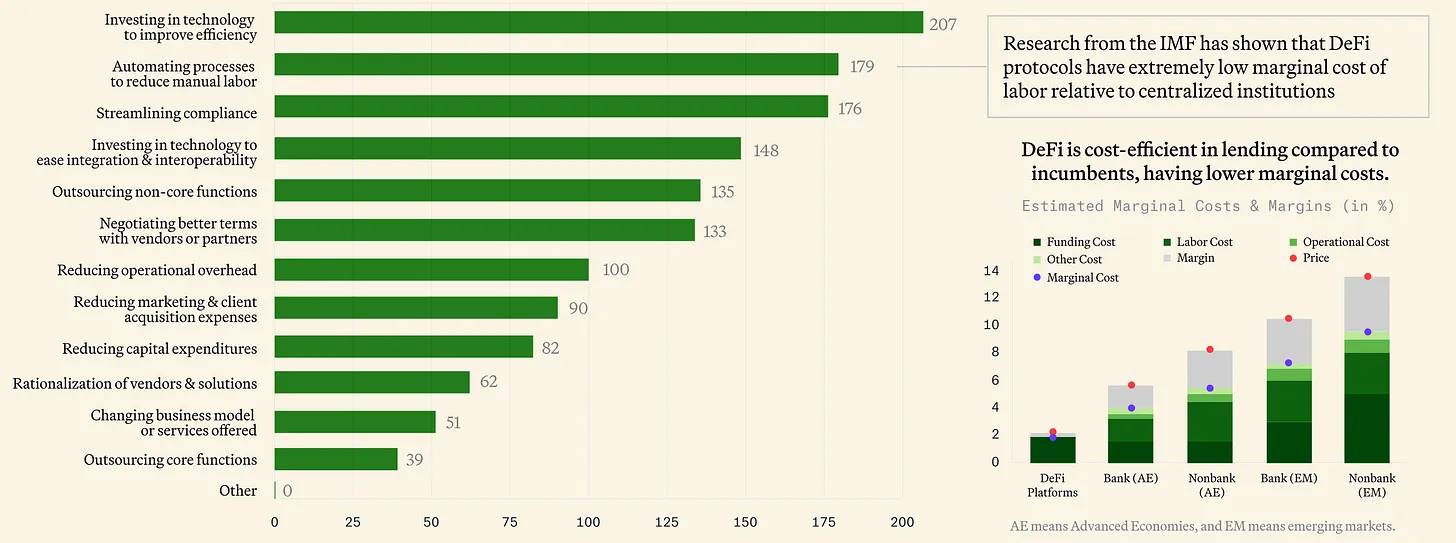

Which areas contribute the most to the cost of providing financial services?

What cost-cutting strategies does your organization use when providing financial services?

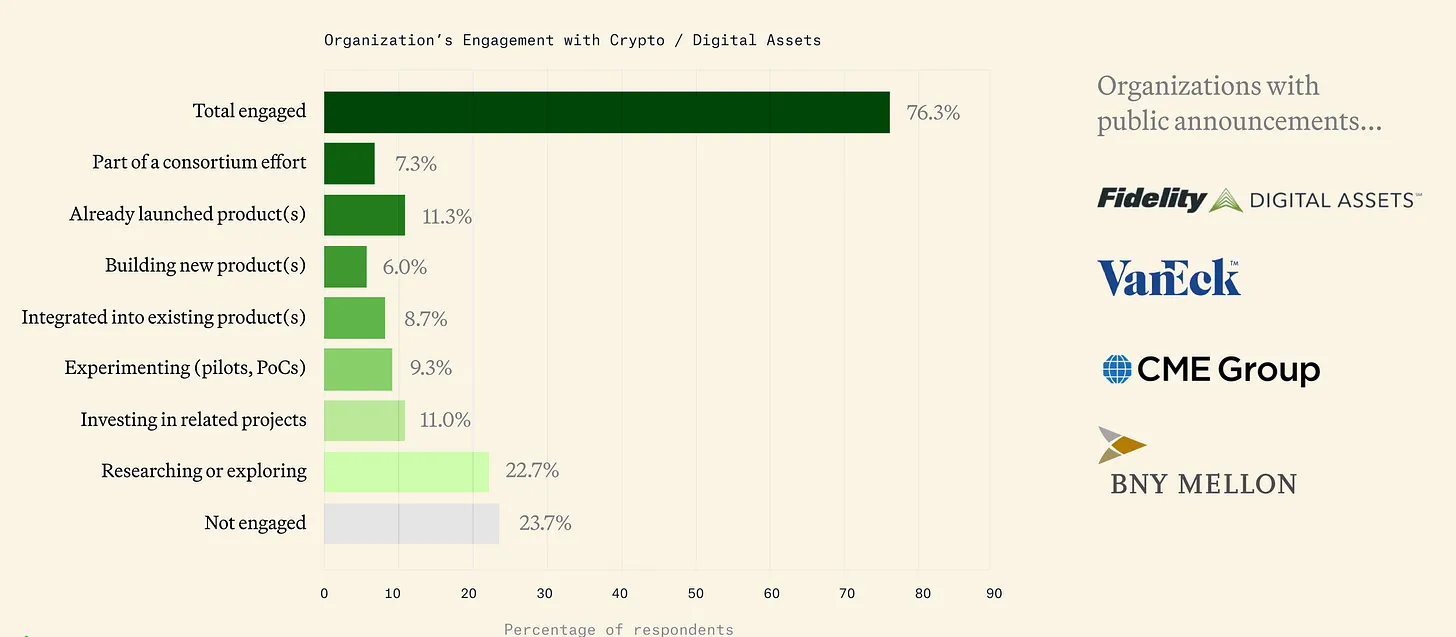

Currently about 76% of companies are involved in cryptocurrencies.

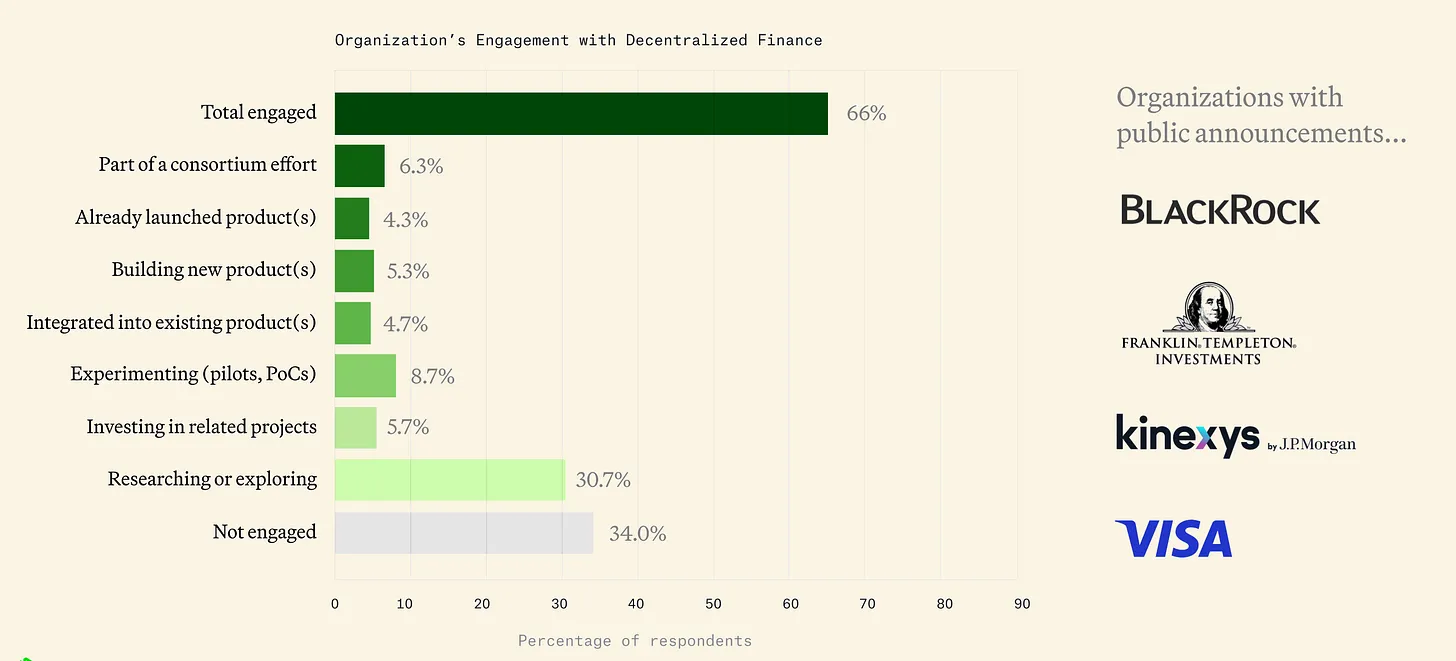

About 66% of traditional financial companies are being associated with decentralized finance (DeFi).

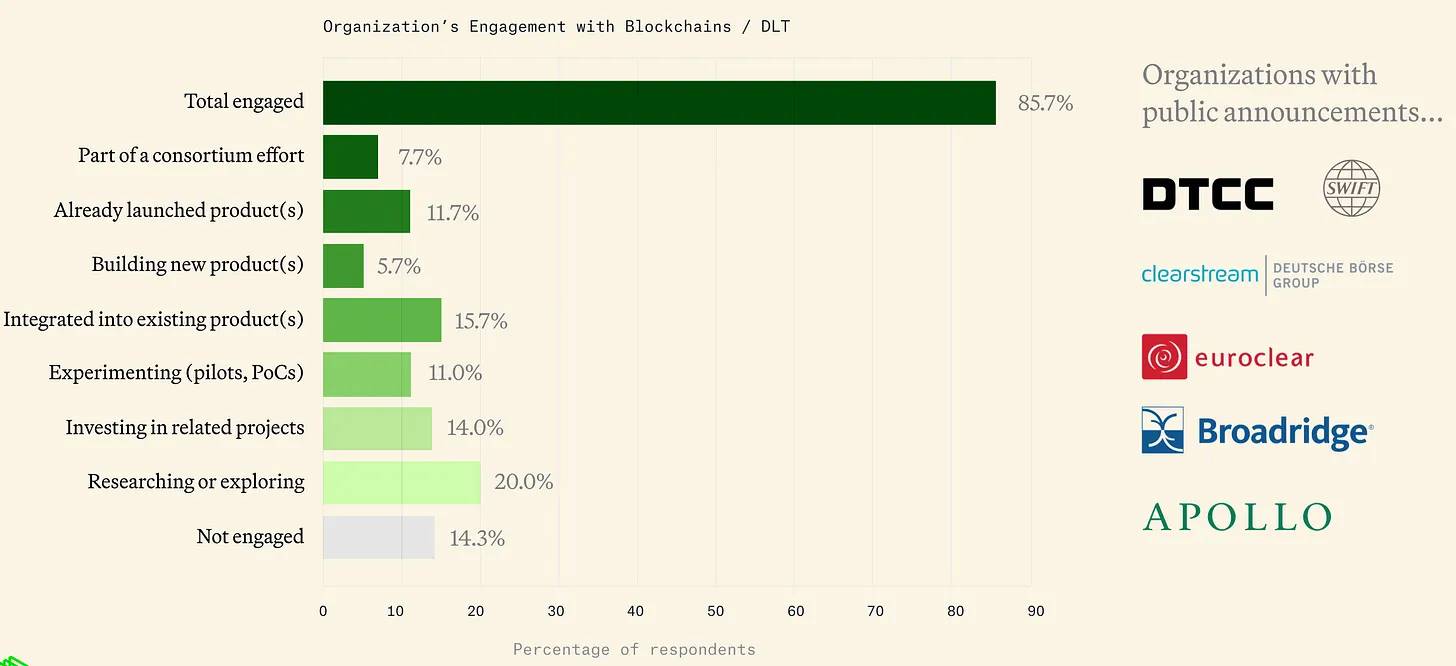

About 86% of companies are currently involved in blockchain and distributed ledger technology (DLT).

Timeline for institutions to enter the encryption field (2020-2024)

2020 - Preliminary Exploration:

Banks and traditional financial institutions are beginning to enter the crypto market tentatively. In mid-2020, the U.S. Currency Complaint (OCC) made it clear that banks can custody crypto assets, which opened the door to custodians like BNY Mellon.

BNY Mellon then announced the provision of digital asset custody services in 2021. That same year, corporate finance departments also began to get involved in the crypto space: MicroStrategy and Square made high-profile Bitcoin purchases as reserve assets, marking an increase in institutional confidence.

Payment giants are also starting to act—PayPal launched a cryptocurrency trading service for U.S. customers at the end of 2020, bringing digital assets to millions of users. These moves mark the beginning of mainstream institutions to view cryptocurrencies as a legal asset class.

2021 - Rapid expansion:

As the bull market begins in full swing, 2021 has witnessed the acceleration of the integration of traditional finance and crypto fields. Tesla's purchase of $1.5 billion in Bitcoin and the milestone event of Coinbase's listing on Nasdaq in April 2021 have become an important bridge connecting Wall Street with the crypto field.

Investment banks also meet customer needs: Goldman Sachs restarted its crypto trading division, and Morgan Stanley began providing access to Bitcoin funds to wealthy clients. In October of the same year, the first Bitcoin Futures ETF (ProShares BITO) in the United States was officially launched, providing institutions with regulated crypto investment tools.

Major asset management companies such as Fidelity and BlackRock have also begun to set up special digital asset divisions. In addition, Visa and Mastercard have established partnerships with stablecoins (such as Visa's USDC pilot project), demonstrating confidence in the crypto payment network.

The report clearly depicts how traditional finance can go from preliminary testing to rapid expansion, laying the foundation for the further integration of crypto and traditional finance in the next few years.

2022 - Bear market and infrastructure construction:

Despite the crypto market slump in 2022 (marked by events represented by the Terra crash and FTX bankruptcy), institutions are continuing to build infrastructure. In August of that year, BlackRock, the world's largest asset management company, cooperated with Coinbase to provide crypto trading services to institutional clients and launched a private Bitcoin trust for investors. This move unleashed strong market confidence.

Traditional exchanges and custodians are also expanding digital asset services. For example, BNY Mellon launched crypto asset custody services for some customers, while Nasdaq developed a custody platform. Meanwhile, JPMorgan uses blockchain for interbank transactions through its Onyx division, and JPM Coin processes hundreds of billions of dollars in wholesale payments.

Tokenization pilot projects are also gradually emerging: JPMorgan Chase and other institutions used public blockchains to simulate DeFi transactions of tokenized bonds and foreign exchange in the "Project Guardian" project.

However, U.S. regulators have adopted a more stringent attitude towards market turmoil, which has led some businesses (such as Nasdaq at the end of 2023) to suspend or slow the launch of crypto products, waiting for clearer rules.

2023 - Institutional interest rekindled:

2023 ushered in a cautious recovery in institutional interest. In the middle of the year, BlackRock submitted a spot Bitcoin ETF application , and then Fidelity, Invesco and other companies followed suit. This wave of application is an important turning point, especially considering the previous multiple rejections of similar proposals by the Securities and Exchange Commission (SEC). In the same year, traditional financial-backed crypto infrastructure began to be launched: EDX Markets, a digital asset exchange supported by Charles Schwab, Fidelity and Citadel, was officially operated in 2023, providing institutions with a compliant trading platform.

Meanwhile, the tokenization of traditional assets has accelerated —for example, private equity giant KKR has tokenized some funds on the Avalanche blockchain, while Franklin Templeton has moved its tokenized money market fund holding U.S. Treasury bonds to the public blockchain.

The international regulatory environment has also improved (the EU passed the Crypto Assets Markets Act (MiCA), and Hong Kong reopened crypto trading under the new regulations), further promoting US institutions to prepare for the global competitive landscape.

By the end of 2023, Ethereum Futures ETF will be approved, and the market is full of expectations for the approval of spot ETFs. At the end of the year, institutions' adoption of crypto assets showed a trend that they would accelerate if regulatory barriers were cleared.

Early 2024 - Approval of spot ETF :

In January 2024, the U.S. Securities and Exchange Commission (SEC) finally approved the first U.S. spot bitcoin ETFs (and then Ethereum ETFs), a landmark event marking the mainstreaming of crypto assets on U.S. exchanges and unlocking billions of dollars in funding for pensions, registered investment advisors (RIAs), and conservative portfolios that previously could not hold crypto assets.

In a few weeks, crypto ETFs have attracted a large amount of capital inflows, significantly expanding investor participation. During this period, institutional crypto products continued to expand—from stablecoin programs such as PYUSD stablecoins launched by PayPal to investing in digital asset custody startups such as Deutsche Bank and Standard Chartered. As of March 2025, almost every major U.S. bank, brokerage firm and asset management company has launched crypto-related products or formed strategic partnerships in the crypto ecosystem, reflecting the comprehensive entry of institutions into the crypto field since 2020.

What traditional finance views on DeFi from 2023 to 2025

Traditional finance (TradFi) has a curious and cautious attitude towards decentralized finance (DeFi).

On the one hand, many institutions recognize the innovation potential of unlicensed DeFi – the open liquidity pool and automation markets still perform well in the crisis (for example, decentralized exchanges are still running smoothly even in the 2022 market turmoil). In fact, industry surveys show that most TradFi practitioners foresee that public blockchain networks will gradually become an important part of their business in the future.

On the other hand, compliance and risk management concerns have made most institutions more inclined to choose a "licensed DeFi" environment in the short term. These platforms are usually private or semi-private blockchains that both retain the efficiency advantages of DeFi and limit participants to audited entities.

A typical case is JPMorgan’s Onyx network, which runs proprietary stablecoin (JPM Coin) and payment channels, serving institutional clients—essentially a “walled garden” version of DeFi. Similarly, Aave Arc launched a licensed liquidity pool in 2023, and all participants need to pass the whitelist review agency Fireblocks for KYC certification, combining DeFi technology with TradFi compliance requirements.

This dual-track perspective—both embracing automation and transparency, and exerting control over participants—has become the main feature of traditional finance to explore DeFi by 2025.

Institutional DeFi pilot projects

Between 2023 and 2025, many well-known institutions have explored the potential of decentralized finance (DeFi) through a series of high-profile pilot projects. JPMorgan’s Onyx platform cooperates with other banks and regulators to participate in the Project Guardian led by the Monetary Authority of Singapore (MAS), completed tokenized bond transactions and foreign exchange swaps on public blockchains, and achieved instant atomic settlement through smart contracts.

These experiments show that even without license agreements (such as Aave and Uniswap, after KYC compliance modification), can be exploited by regulated entities under appropriate security measures. Asset management giant BlackRock launched the " BlackRock USD Digital Liquidity Fund" (BUIDL) at the end of 2023, tokenizing U.S. Treasury money market funds.

Distributed to qualified investors through the Securitize platform, BUIDL provides institutions with a compliance method to hold tokenized income assets on the Ethereum network, which shows that traditional finance's acceptance of public blockchain is increasing under the premise that intermediaries ensure compliance.

Other examples include Goldman Sachs’ digital asset platform (DAP), which issues tokenized bonds and facilitates digital repurchase transactions, and HSBC’s use of Finality blockchain platform for foreign exchange settlement.

These initiatives reflect the “learning and doing” strategy – large institutions evaluate the potential advantages of DeFi technology in speed and efficiency through limited-range experiments on core activities such as payments, lending and transactions.

Infrastructure construction supported by venture capital

A strong crypto infrastructure ecosystem is taking shape, and these businesses are often supported by venture capital and traditional financial institutions to connect traditional finance (TradFi) with DeFi. Hosting and security service providers such as Fireblocks, Anchorage and Copper have raised significant funds to develop “institutional-level” platforms for storing and trading digital assets (including tools for secure access to DeFi protocols).

Compliance technology companies such as Chainalysis and TRM Labs provide transaction monitoring and analysis, allowing banks to meet anti-money laundering (AML) requirements when interacting with public blockchains. Additionally, brokers and fintech startups are simplifying the complexity of DeFi and providing institutions with a friendly usage interface.

For example, crypto prime brokers can now provide access to yield farming or liquidity pools as services while handling technical operations partly off-chain. This kind of VC-driven construction of wallets, APIs, identity solutions and risk management is gradually solving the operational barriers of traditional finance entering DeFi, paving the way for deeper integration in the future.

By 2025, decentralized exchanges (DEXs) and lending platforms have begun to integrate institutional portals to ensure that counterparty identities are verified.

Overall, traditional finance (TradFi) views on DeFi have changed profoundly: DeFi is no longer seen as a "wild west" to avoid, but rather a collection of financial innovations that can be used cautiously within the compliance framework. Large banks are becoming early adopters of DeFi in a controlled way , recognizing that ignoring DeFi’s growth could mean lagging behind in the next change in finance.

The regulatory environment in the United States and global comparison

In the field of crypto, the United States' regulatory clarity has been lagging behind the pace of technological innovation, which not only brings friction to traditional finance entering the field of crypto, but also creates opportunities. The Securities and Exchange Commission (SEC) took a tough stance: In 2023, the SEC filed several high-profile lawsuits against major exchanges, accusing it of providing unregistered securities and putting forward rules that could classify many DeFi platforms as stock exchanges. This regulatory environment has led to more caution in U.S. institutions participating in DeFi, as most DeFi tokens lack clear legal status.

However, from the end of 2024 to the beginning of 2025, there has been an important shift in the regulatory environment. Under pressure from all parties, the SEC approved spot crypto ETFs, marking a pragmatic shift in its attitude. At the same time, court judgments such as the 2024 Grayscale case began to clarify the scope of the SEC's regulatory authority. The Commodity Futures Trading Commission (CFTC) is also in play, and its position on viewing Bitcoin and Ethereum as commodities remains clear. Nevertheless, the CFTC imposed penalties on some DeFi protocol operators who did not comply with compliance requirements in 2023, while also advocating for a clearer framework to support innovation.

Meanwhile, the U.S. Treasury Department has turned its attention to DeFi from the perspective of anti-money laundering (AML). In 2023, the DeFi illegal financial risk assessment report released by the Ministry of Finance pointed out that the anonymity of DeFi may be exploited by criminals, which laid the groundwork for the possible implementation of KYC ( know your customers ) obligations on decentralized platforms in the future. Similar to the 2022 sanctions against Tornado Cash show that even code-based services cannot escape the scrutiny of the law if they are related to illegal funding flows.

For banks, U.S. banking regulators (OCC, Federal Reserve, FDIC) have issued guidance on restricting direct access to crypto assets, effectively directing institutional participation to regulated custodial services and ETFs rather than using the DeFi protocol directly. As of March 2025, the U.S. Congress has not passed comprehensive cryptocurrency legislation, but several proposals (such as stablecoin regulation and clarification of securities and commodity definitions) have entered the advanced discussion phase. This means that traditional U.S. financial institutions need to be extra cautious when participating in DeFi: They usually limit DeFi activity to sandbox trials or offshore subsidiaries to await clearer regulatory guidance. In particular, clarity in the stablecoin space (which may be designated by federal law as a new payment tool) and custody rules (such as the SEC's custody proposal) will have a significant impact on the depth of institutions' participation in the DeFi protocols within the United States.

Europe: MiCA and forward-looking rules

In sharp contrast to the United States, the EU has passed a comprehensive crypto-regulatory framework - the Crypto-Assets Market Supervision Act (MiCA, Markets in Crypto-Assets). As of 2024, MiCA provides clear rules for crypto asset issuance, stablecoins and the operation of service providers in each member state. MiCA combines with a pilot program for tokenized securities trading to provide innovative certainty for banks and asset management companies in Europe. By early 2025, European companies have already known how to apply for operating licenses for crypto exchanges or wallet services, and guidelines for institutional stablecoins and even DeFi are also being formulated. This relatively clear regulatory environment has driven pilot projects for traditional European financial institutions in tokenized bonds and on-chain funds.

For example, several EU commercial banks have issued digital bonds through regulatory sandbox programs and legally processed tokenized deposits under regulatory supervision. The UK has taken a similar path, clearly expressing its desire to become a "crypto hub". As of 2025, the Financial Conduct Authority (FCA) is developing rules for crypto trading and stablecoins, while the UK Law Commission has included crypto assets and smart contracts in the legal definition. These moves may allow London institutions to launch DeFi-based services earlier than their U.S. counterparts.

Asia: Regulatory balance and innovation-driven

Singapore and Hong Kong provide a stark contrasting case for global regulation. The Monetary Authority of Singapore (MAS) has implemented a strict crypto company license system since 2019, but it is also actively exploring DeFi innovation through public-private cooperation.

For example, Singapore's major bank DBS has launched a regulated crypto trading platform and has participated in DeFi transactions (such as tokenized bond transactions completed in partnership with JPMorgan Chase). Singapore’s approach regards permissioned DeFi as a controllable field of exploration reflects the concept of formulating reasonable rules through regulated experiments.

After years of restrictions, Hong Kong changed its policy direction in 2023 and introduced a new framework to issue licenses for virtual asset exchanges and allow retail crypto transactions under supervision. This policy shift has been supported by the government, attracting crypto businesses around the world and encouraging Hong Kong banks to consider providing digital asset services in a regulated environment.

In addition, Switzerland has promoted the development of tokenized securities through the Distributed Ledger Technology Act (DLT Act), while the UAE has formulated special encryption rules through the Dubai Virtual Assets Regulatory Authority (VARA). These examples further demonstrate that globally, regulatory attitudes range from cautious acceptance to active promotion, demonstrating the diversity and potential of crypto financial development.

The impact and differences of DeFi participation

For financial institutions in the United States, the possibility of most direct participation in DeFi remains limited due to the fragmentation of regulatory rules until compliance solutions emerge. Currently, Bank of America is focusing more on alliance blockchains or transactions tokenized assets that meet existing legal definitions. In contrast, institutions appear more relaxed in interactions with similar DeFi platforms in jurisdictions with clearer regulatory frameworks.

For example, European asset management companies may provide liquidity for a licensed lending pool, while Asian banks may use decentralized trading protocols internally forex swaps, while ensuring regulators are informed. However, the lack of unified rules around the world also presents challenges: a multinational agency needs to balance strict rules in one region with opportunities in another. Many have called for the development of international standards or a "safe harbor" policy specifically for decentralized finance in order to unlock the potential of DeFi (such as efficiency and transparency) without damaging financial integrity.

To sum up, regulation remains the biggest determinant of the speed of participation of traditional finance (TradFi). As of March 2025, while some progress has been made – such as the U.S. approved spot crypto ETFs and global regulators have also begun issuing customized licenses – it still takes more effort to establish sufficient legal clarity to enable institutions to embrace license-free DeFi on a large scale.

Key DeFi protocols and infrastructure: a bridge connecting traditional

finance

Many leading DeFi protocols and infrastructure projects are directly meeting the needs of traditional finance, creating entry points for institutional use:

Aave Arc (Institutional Lending Market)

Aave Arc is a licensed version of the popular Aave liquidity agreement launched between 2022 and 2023 and is designed for institutional users. It provides a private lending pool that allows only participants who pass whitelist authentication and complete KYC (Know Your Customer) verification to borrow and lend digital assets. By introducing anti-money laundering (AML) and KYC compliance mechanisms (powered by whitelisted agents such as Fireblocks) and accepting only pre-approved collateral, Aave Arc addresses the key needs of traditional financial institutions (TradFi)—trust and regulatory compliance for counterparties. At the same time, it retains the lending efficiency driven by DeFi smart contracts. This design enables banks and fintech lenders to obtain secured loans without being exposed to the anonymous risk of public liquidity pools.

Maple Finance (on-chain capital market)

Maple is an on-chain institutionalized low mortgage loan market that can be compared to the syndicated loan market on blockchain. With Maple, certified institutional borrowers (such as trading companies or medium-sized businesses) can obtain liquidity from lenders worldwide, and the terms of the transaction are due diligence and facilitated by Pool Delegates. This model fills a gap in traditional finance: low mortgages usually rely on networks and lack transparency, while Maple brings transparency and 24/7 settlement capabilities to such lending. Since its launch in 2021, Maple has led to hundreds of millions of dollars in loans, showing how well-credited businesses can raise funds on-chain more efficiently . For lenders in traditional finance, the Maple platform provides a way to earn stablecoin gains by lending to reviewed borrowers, effectively simulating the private debt market while reducing operating costs. Maple shows how DeFi can simplify loan issuance and services (such as interest payments, etc.) through smart contracts, thereby significantly reducing administrative costs. This innovation provides traditional financial institutions with an efficient and compliant on-chain capital market solution.

Centrifuge (real asset tokenization)

Centrifuge is a decentralized platform focusing on introducing real-world assets (RWAs) into DeFi as collateral. It allows asset initiators (such as trade finance, receivable factoring or borrowers in the real estate sector) to tokenize assets such as invoices or loan portfolios into interchangeable ERC-20 tokens. These tokens can then be financed through the DeFi liquidity pool (Centrifuge's Tinlake platform). This mechanism effectively connects traditional financial assets with DeFi liquidity—for example, invoices for small businesses can be pooled, supported by stablecoin lenders around the world. For institutions, Centrifuge provides a template for converting illicit assets into tools on the investment chain, while reducing investment risks through transparent risk stratification mechanisms. It solves one of the core pain points in traditional finance: it is difficult for some industries to obtain credit. Through blockchain technology, Centrifuge is able to leverage the funding pool of global investors, and by 2025, even large agreements like MakerDAO will introduce collateral through Centrifuge, while traditional financial institutions are also observing how this technology reduces capital costs and unlocks new sources of financing.

Ondo Finance (tokenized income product)

Ondo Finance provides tokenized funds that bring traditional fixed income opportunities to crypto investors. It is worth noting that Ondo has launched products such as OUSG (Ondo Short-term U.S. Treasury Fund) – the token is entirely backed by short-term U.S. Treasury ETFs – and USDY , a tokenized share of a high-yield money market fund. These tokens are sold to qualified investors under the Regulation D and can be traded 24/7 on-chain. Ondo actually plays the role of a bridge, packaging real-world bonds into tokens compatible with DeFi .

For example, stablecoin holders can convert their assets into OUSG, get about 5% of their returns from short-term Treasuries, and then seamlessly exit back to the stablecoin. This innovation solves the common problem in the traditional finance and cryptocurrency: it brings the security and benefits of traditional assets into the digital asset field, while opening up new distribution channels for traditional fund managers through DeFi. Ondo's tokenized Treasury bond product (issuance of hundreds of millions of dollars) has triggered imitation from competitors and traditional financial institutions, blurring the line between money market funds and stablecoins. This model not only provides investors with more choices, but also further promotes the integration of traditional finance and DeFi.

EigenLayer (re-staking and decentralized infrastructure)

EigenLayer is a brand new Ethereum-based protocol launched in 2023 and supports the "restaking" function, which is to protect new networks or services by reusing the staking ETH security. Although this technology is still in its infancy, it is of great significance for institutions in terms of infrastructure scalability . EigenLayer allows new decentralized services such as oracle networks, data availability layers, and even institutional settlement networks to inherit the security of Ethereum without the need to establish a separate validator network. For traditional financial institutions (TradFi), this means that future decentralized transactions or clearing systems can operate on existing trust networks (Ethereum) without having to be built from scratch. In practical applications, banks may deploy a smart contract service in the future (such as for interbank loans or forex transactions) and re-stake to ensure that the service is secured by billions of pledged ETH - a level of security and decentralization that is almost impossible to achieve on licensed ledgers. EigenLayer represents the cutting-edge technology of decentralized infrastructure, and although not currently used directly by TradFi, it could become the fundamental pillar of next-generation institutional-level DeFi applications by 2025-2027.

These examples show that the DeFi ecosystem is actively developing solutions that integrate with TradFi requirements—whether it is compliance (Aave Arc), credit analysis (Maple), real-world asset access (Centrifuge/Ondo), or strong infrastructure (EigenLayer). This convergence is a two-way path: TradFi is learning how to use DeFi tools, and DeFi projects are constantly adapting to meet the requirements of TradFi. This interaction will ultimately lead to a more mature and interconnected financial system that paves the way for future financial innovation.

The prospect of real asset tokenization

One of the most substantial intersections between traditional finance (TradFi) and cryptocurrency fields is the tokenization of real assets (RWA)—that is, the migration of traditional financial instruments such as securities, bonds and funds to the blockchain. As of March 2025, institutional participation in the field of tokenization has moved from the proof of concept to the implementation of actual products:

Tokenized funds and deposits

Several large asset management companies have launched tokenized versions of funds. For example, BlackRock’s BUIDL fund, and Franklin Templeton’s OnChain U.S. Government Money Fund (which records shares using public blockchains), allows qualified investors to trade fund shares in the form of digital tokens. WisdomTree has launched a series of blockchain-based fund products (covering Treasury bonds, gold, etc.) aimed at achieving 24/7 trading and simplifying how investors participate. These plans are usually carried out under existing regulatory structures, such as issuing private securities through exemptions, but they mark an important step in the transaction of traditional assets on the blockchain infrastructure.

In addition, some banks have explored tokenized deposits (i.e. regulated liability tokens), which represent bank deposits but can be circulated on the blockchain, attempting to combine bank-level security with the speed of transactions of cryptocurrencies. These projects show that institutions view tokenization as an effective way to improve liquidity and shorten the settlement time of traditional financial products.

Tokenized bonds and debts

The bond market is one of the early success stories of tokenization. Between 2021 and 2022, European Investment Bank and other institutions issued digital bonds on Ethereum, and participants completed the settlement and custody of bonds through blockchain, rather than relying on traditional clearing systems. By 2024, institutions such as Goldman Sachs, Santander, and others have facilitated bond issuance through their private blockchain platforms or public networks, indicating that even large-scale debt issuances can be accomplished through distributed ledger technology (DLT).

Tokenized bonds bring instant settlement (T+0, compared to traditional T+2), programmable interest payments, and more convenient fragmented ownership. This not only reduces issuance and management costs for issuers, but also provides investors with broader market access and real-time transparency. Even some governments and finance ministries have begun to study the application of blockchain in bonds. For example, the Hong Kong government issued a tokenized green bond in 2023.

Although the current market size of on-chain bonds is still relatively small (about hundreds of millions of dollars), growth in this area is accelerating as the legal and technical frameworks gradually improve.

Tokenization of securities in private equity markets

Private equity and venture capital firms are tokenizing to convert traditionally less liquid assets, such as private equity shares or pre-listing stocks, into tradable forms, providing liquidity to investors. For example, KKR and Hamilton Lane, in partnership with fintech companies such as Security and ADDX, have launched tokenized fund shares that allow eligible investors to buy tokens representing economic interests in these alternative assets. Despite its limited size, these attempts indicate that the future secondary markets of private equity or real estate may run on the blockchain, reducing the liquidity premium investors demand for these assets.

From an institutional perspective, the core of tokenization is to expand asset distribution channels and unlock capital potential by turning traditionally locked assets into small units that can be tradable. This innovation not only improves the accessibility of assets, but also injects new vitality into traditional finance.

The rise of DeFi native platforms

It is worth noting that the trend of tokenization is not limited to the dominance of traditional financial institutions - DeFi native real-life asset platforms are also solving the same problem from another perspective. Agreements such as Goldfinch and Clearpool (as well as the aforementioned Maple and Centrifuge) are driving on-chain financing to support real-world economic activity without waiting for action from large banks.

For example, Goldfinch provides funding for real-world loans (such as fintech lenders in emerging markets) through liquidity provided by cryptocurrency holders, essentially acting as a decentralized global credit fund. Clearpool provides institutions with a marketplace that allows them to launch unsecured loan pools in anonymous capacity (in combination with credit scores), which are priced and funded by the market.

These platforms often work with traditional institutions to form a hybrid model of DeFi transparency and TradFi trust mechanisms. For example, fintech borrowers in Goldfinch’s lending pool may conduct financial audits through third parties. This cooperation model not only ensures the transparency of on-chain operations, but also introduces a prudent trust system of traditional finance, providing a solid foundation for the further development of tokenization.

The future of realistic assets (RWA) tokenization is full of hope. In the current high interest rate environment, the demand for real asset returns in the crypto market has further boosted the tokenization of bonds and credit (Ondo's success is a typical case). For institutions, the efficiency improvement brought by the tokenized market is very attractive: transactions can be settled in seconds, the market can operate 24/7, and reduce reliance on intermediaries such as clearing institutions. Estimates from industry organizations show that if regulatory barriers are resolved, trillions of dollars in real assets may be tokenized in the next decade. By 2025, we have seen the early network effects of tokenization. For example, a tokenized Treasury bond can be used as collateral in a DeFi lending agreement, meaning institutional traders can borrow stablecoins with tokenized bonds to obtain short-term liquidity, something that is not possible in traditional financial environments. This composability, uniquely powered by blockchain, is expected to revolutionize collateral management and liquidity management for financial institutions.

To sum up, tokenization is bridging the gap between traditional finance (TradFi) and decentralized finance (DeFi) more directly than any other trend. It not only brings traditional assets into the DeFi ecosystem (providing stable collateral and cash flows on-chain), but also provides a test site for traditional financial institutions (as tokenization tools can often be restricted to operating in licensing environments, or issuance under known legal structures). In the coming years, we may see larger pilot projects—such as the launch of tokenization platforms by major stock exchanges and the central bank exploring wholesale central bank digital currency (CBDC) that interoperates with tokenized assets—further consolidate the core position of tokenization in the future of the financial industry.

Challenges and strategic risks of traditional finance in decentralized

finance

Regulatory uncertainty

Despite the huge opportunities, traditional financial institutions face many challenges and risks when integrating into the DeFi and encryption fields. Among them, regulatory uncertainty is the primary issue. Due to the lack of clear and consistent regulations, banks are concerned that cooperation with the DeFi agreement may be identified by regulators as illegal securities transactions or unregistered asset transactions, thus encountering enforcement actions.在法律尚未完善之前,机构面临着潜在的监管反弹或处罚,这使得法律和合规团队对批准DeFi相关计划持谨慎态度。这种不确定性具有全球性,跨司法辖区的规则差异进一步复杂化了加密网络的跨境使用。

合规与KYC/AML

公共DeFi平台通常允许匿名或化名参与,这与银行的客户身份识别(KYC)和反洗钱(AML)义务相冲突。机构必须确保交易对手没有受到制裁或涉及洗钱活动。尽管通过白名单、链上身份认证或专用合规预言机(oracles)实现链上合规的技术仍在发展,但这一领域尚未成熟。机构在DeFi中无意间促进非法资金流动的操作风险,构成了重大声誉和法律威胁,这也迫使传统金融机构倾向于许可制或强监管的环境。

托管与安全性

安全托管加密资产需要新的解决方案。私钥管理带来的托管风险尤为突出——一旦私钥丢失或被盗,后果可能是灾难性的。机构通常依赖第三方托管机构或内部冷钱包存储,但加密领域频发的高调黑客事件让高层对安全问题心存疑虑。此外,智能合约风险也是一个重要因素——锁定在DeFi智能合约中的资金可能因漏洞或攻击而丢失。这些安全问题使得机构通常限制对加密资产的接触或要求强有力的保险,而数字资产保险目前仍处于初级阶段。

市场波动性与流动性风险

加密市场以高波动性著称。对于向DeFi资金池提供流动性或在资产负债表上持有加密资产的机构来说,必须承受剧烈的价格波动,这可能直接影响收益或监管资本。此外,在危机时刻,DeFi市场的流动性可能迅速枯竭,机构在试图平仓大额头寸时可能面临滑点风险,甚至可能因协议用户违约(如低抵押贷款违约)而遭遇对手方风险。这种不可预测性与传统市场中更可控的波动性以及中央银行提供的托底机制形成鲜明对比。

集成与技术复杂性

将区块链系统与传统IT基础设施整合是一个复杂且昂贵的过程。银行必须升级系统以与智能合约交互并管理全天候实时数据,这是一项艰巨的任务。此外,专业人才的短缺也是一大难题——评估DeFi代码和风险需要特殊的知识技能,这意味着机构需要在竞争激烈的人才市场中招聘或培训专家。这些因素导致了较高的初始进入成本。

声誉风险

金融机构还需考虑公众和客户的看法。参与加密领域是一把双刃剑:尽管展现了创新性,却可能引发保守客户或董事会成员的担忧,尤其是在经历了交易所崩盘等事件后。如果机构卷入DeFi黑客攻击或丑闻,声誉可能受损。许多机构因此小心翼翼,选择在幕后进行试点,直到对风险管理有足够信心。此外,声誉风险还延伸至不可预测的监管舆论——官员对DeFi的负面评论可能给相关机构蒙上阴影。

法律与会计挑战

关于数字资产的所有权和可执行性仍存在未解决的法律问题。例如,如果银行持有一个代表贷款的代币,这是否在法律上被认定为拥有该贷款?基于智能合约的协议缺乏成熟的法律先例,进一步增加了不确定性。此外,尽管会计处理正在改善(预计到2025年将允许按公允价值计量),但数字资产的会计处理以往存在不少问题(如减值规则),而监管机构对加密资产的资本要求也很高(如巴塞尔协议将无担保加密资产视为高风险资产)。这些因素从资本角度看,使得持有或使用加密资产的经济吸引力大打折扣。

面对上述挑战,许多机构正在采取战略性的风险管理方式:从小规模试点投资开始,通过子公司或合作伙伴试水,并主动与监管机构沟通以争取有利的结果。此外,机构还积极参与行业联盟,推动合规DeFi的标准制定(例如嵌入身份的代币或专为机构设计的“DeFi护照”提案)。克服这些障碍对于实现更广泛的采用至关重要,而时间表将主要取决于监管框架的明确性以及加密基础设施向机构标准的持续成熟。

展望2025-2027:传统金融与DeFi融合的情景分析

展望未来,传统金融与去中心化金融之间的融合程度在未来2-3年内可能会沿着多种路径发展。以下是乐观、悲观和中性情景的概述:

乐观情景(快速融合)

在这一积极的情景中,到2026年,监管清晰度显著提高。

例如,美国可能通过一项联邦法律,明确加密资产类别并建立稳定币及甚至DeFi协议的监管框架(或许会为合规的DeFi平台创建新的特许或许可证)。随着规则的明确,大型银行和资产管理公司加速其加密战略——直接向客户提供加密交易和收益产品,并在某些后台功能中使用DeFi协议(例如利用稳定币进行隔夜资金市场)。

特别是 稳定币的监管 可能成为关键催化剂:如果以美元支持的稳定币获得官方批准和保险,银行可能开始大规模使用它们进行跨境结算和流动性管理,并将稳定币嵌入传统支付网络。

技术基础设施的改进也在乐观情景中发挥重要作用:以太坊(Ethereum)计划中的升级和Layer-2扩容技术使交易速度更快、成本更低,同时稳健的托管和保险解决方案成为行业标准。这使得机构能够以更低的操作风险进入DeFi领域。

到2027年,可能会看到银行间借贷、贸易融资和证券结算的大部分在混合去中心化平台上进行。在乐观情景中,甚至 以太坊 质押 (ETH Staking)的整合 也变得普遍。

例如,企业的财务部门将质押的ETH作为一种收益资产(类似于数字债券),为机构投资组合增添新的资产类别。此情景预见了传统金融与DeFi的深度融合:传统金融机构不仅投资于加密资产,还积极参与DeFi的治理和基础设施建设,推动形成一个受监管、可互操作的DeFi生态系统,与传统市场互为补充。

悲观情景(停滞或退缩)

在悲观情景下,监管打压和不利事件将严重阻碍传统金融与DeFi的融合。可能出现的情况是,美国证券交易委员会(SEC)和其他监管机构加强执法力度,而不提供新的合规路径——实际上禁止银行接触开放式DeFi,仅允许接触少数获得批准的加密资产。在这种情况下,到2025/2026年,大多数机构仍然选择观望,仅限于投资ETF(交易所交易基金)和少数许可网络,但由于法律风险却远离公共DeFi。

此外,一两起高调的失败事件可能进一步打击市场情绪。例如,一种主要的稳定币崩溃,或一个系统性DeFi协议被黑客攻击,导致机构参与者蒙受损失,从而加深“加密领域风险过高”的印象。在这一情景中,全球市场的分裂加剧:欧盟和亚洲可能继续推进加密整合,而美国则落后,这可能导致美国企业失去竞争力,甚至游说反对加密,以求在市场上维持公平竞争。传统金融机构甚至可能对DeFi采取抵制态度,尤其是当它们将DeFi视为威胁而没有可行的监管支持时。这可能导致 创新放缓 (例如,银行仅推广私有分布式账本技术(DLT)解决方案,并劝阻客户参与链上金融)。本质上,悲观情景描绘了一个传统金融与DeFi协同发展的承诺未能实现的局面,加密领域在2027年之前仍然只是一个小众或次要的机构投资领域。

中性情景(渐进且稳步的整合)

最可能的情景介于两者之间——一种持续的渐进整合,虽然 步伐缓慢但却稳健 。在这一基准预期中,监管机构将继续发布指导意见和一些狭义规则(例如,稳定币立法可能在2025年前通过,SEC可能调整其立场,或许豁免某些机构级DeFi活动,或逐案批准更多加密产品)。尽管不会出现全面的监管改革,但每年都会带来一些新的明确性。

传统金融机构则谨慎扩大其对加密领域的参与:更多银行将提供托管和执行服务,更多资产管理公司将推出加密或区块链主题基金,更多的试点项目将上线,将银行基础设施与公共区块链连接起来(特别是在贸易融资文件、供应链支付以及代币化资产的二级市场交易领域)。我们可能会看到由联盟主导的网络与公共网络选择性地互联——例如,一组银行可能运行一个许可型借贷协议,并在需要额外流动性时桥接到 公共 DeFi 协议 ,一切都在商定的规则下进行。

在这一情景中, 稳定币 可能被金融科技公司和一些银行广泛用作结算工具,但尚未取代主要支付网络。 以太坊 质押 (ETH Staking) 和加密收益产品开始以小规模进入机构投资组合(例如,某些养老金基金将其配置的少量资金投入到收益型数字资产基金中)。到2027年,在中性情景下,传统金融与DeFi的整合比今天明显更深——比如某些市场中5-10%的交易量或贷款发生在链上,但它仍然是传统系统的 平行轨道 ,而非完全替代。更重要的是,这一趋势线是向上的:早期采用者的成功案例将说服更保守的同行参与进来,尤其是在竞争压力和客户兴趣不断增加的情况下。

值得关注的关键驱动力

在所有情景中,有几个关键驱动力将决定传统金融(TradFi)与去中心化金融(DeFi)融合的最终结果。

首当其冲的是监管动态——任何能够提供法律明确性的举措(或相反,新增限制的政策)都将直接影响机构行为的转变。

其中, 稳定币政策 的演进尤为关键:安全且受监管的稳定币可能成为机构级DeFi交易的核心基石。技术的成熟度是另一个重要驱动力——区块链扩展性的持续提升(通过以太坊Layer 2网络、替代性高性能链或互操作协议)以及工具的改进(如更好的合规集成、隐私交易选项等)将使机构对DeFi的接受度更高。

此外,宏观经济因素也可能产生影响:如果传统收益率保持高位,机构对DeFi收益的迫切需求可能会减弱,从而降低兴趣;但如果传统收益率下降,DeFi额外收益的吸引力可能再次上升。

最后, 市场教育和行业表现 也至关重要——每一年DeFi协议的韧性得到验证,每一个成功的试点项目(例如某大型银行通过区块链顺利结算1亿美元)都将增加市场信任感。

到2027年,我们预计关于“传统金融是否应采用DeFi”的争论将转变为“ 传统金融如何更好地利用DeFi ”,类似于云计算在银行业经历初期怀疑后逐步被广泛采用的过程。总的来说,未来几年可能会见证传统金融与DeFi从谨慎的试探走向更深层次的合作,其步伐将由技术创新与监管框架的互动决定。