Trading time: 15 projects start repurchases, and Bitcoin and US stocks are correlated with several times of volatility.

Reprinted from panewslab

03/26/2025·1M

1. Market Observation

Keywords: MOVE, ETH, BTC

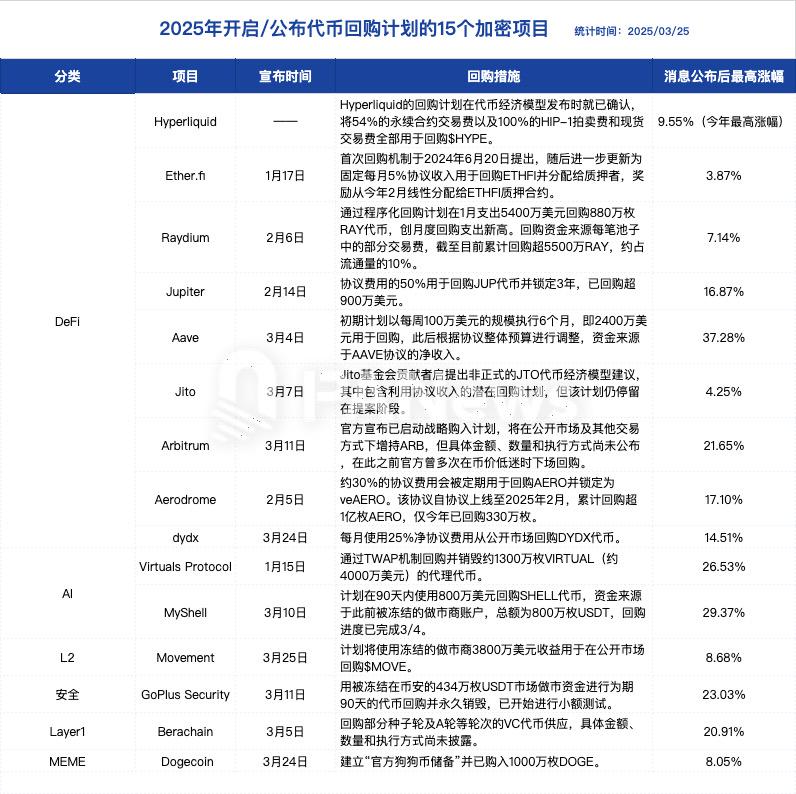

A "buyback wave" has been set off in the crypto industry, including 15 projects including Aave, Arbitrum, and Movement, successively announced token repurchase plans, ranging from millions to tens of millions of dollars. The sources of repurchase funds cover agreement income, confiscated assets and fund expenditures. This move is not only a stopgap measure to save the market in the short term, but is also regarded as an important strategic layout for projects to reshape the token economy and give long-term value. At the same time, Immutable received a notice of termination of the SEC investigation, bringing a clear signal to the Web3 gaming industry.

Bitcoin price continues to show a trend that is highly correlated with the US stock market, with volatility remaining several times the US stock market. Investors on both sides focus on the Fed's expectations of interest rate cuts. Analyst Daan Crypto Trades pointed out that Bitcoin still maintains a solid spot premium trading trend, and if it can maintain this level and slowly rebound to above $90,000, it is expected to set a new high. The Greeks.live community briefing shows that the market has differences on the trend of cryptocurrencies, and some investors believe it is suitable to buy on dips, while short sellers expect Bitcoin to fall to the $84,500 range.

In the regulatory field, the SEC announced that it will hold four roundtables from April to June 2025, covering key issues such as crypto trading, custody, asset tokenization and DeFi. Commissioner Hester Peirce called the move "a spring sprint to crypto clear" showing regulators are moving from law enforcement to constructive dialogue. It is worth noting that traditional financial institutions have continuously increased their acceptance of Bitcoin, and the GameStop board of directors has unanimously updated its investment policy to include Bitcoin as one of the company's reserve assets. At the same time, the Oklahoma House of Representatives passed the Strategic Bitcoin Reserve Act, which further reflects the recognition of Bitcoin by institutions and governments. In addition, Ripple reached a preliminary settlement agreement with the SEC, and the SEC agreed to refund the fine of $75 million, marking the end of a long-term legal dispute between the two parties.

At the macro level, the market generally expects the Fed to shift from quantitative tightening (QT) to quantitative easing (QE), which may inject new liquidity into the financial market. However, Benjamin Cowen, CEO of crypto research firm IntoThe CryptoVerse, reminded that the quantitative tightening has not ended completely, but the scale has dropped from $60 billion a month to $40 billion. In addition, Goldman Sachs' latest report warns that Trump's upcoming reciprocal tariff policies may lead to severe fluctuations in the market "first collapse and then stabilize", and the actual tax rate may reach twice the market expectations.

2. Key data (as of 13:30 HKT on March 26)

-

Bitcoin: $87,346.87 (-6.65% during the year), daily spot trading volume $28.634 billion

-

Ethereum: USD 2,055.65 (-38.48%), daily spot trading volume is USD 11.309 billion

-

Corruption index: 47 (neutral)

-

Average GAS: BTC 1.4 sat/vB, ETH 0.36 Gwei

-

Market share: BTC 60.7%, ETH 8.7%

-

Upbit 24-hour trading volume ranking: MOVE, XRP, LAYER, BTC, CRO

-

24-hour BTC long-short ratio: 1.0496

-

Sector rises and falls: Meme sector rises 4.74%, Layer2 sector rises 4.62%

-

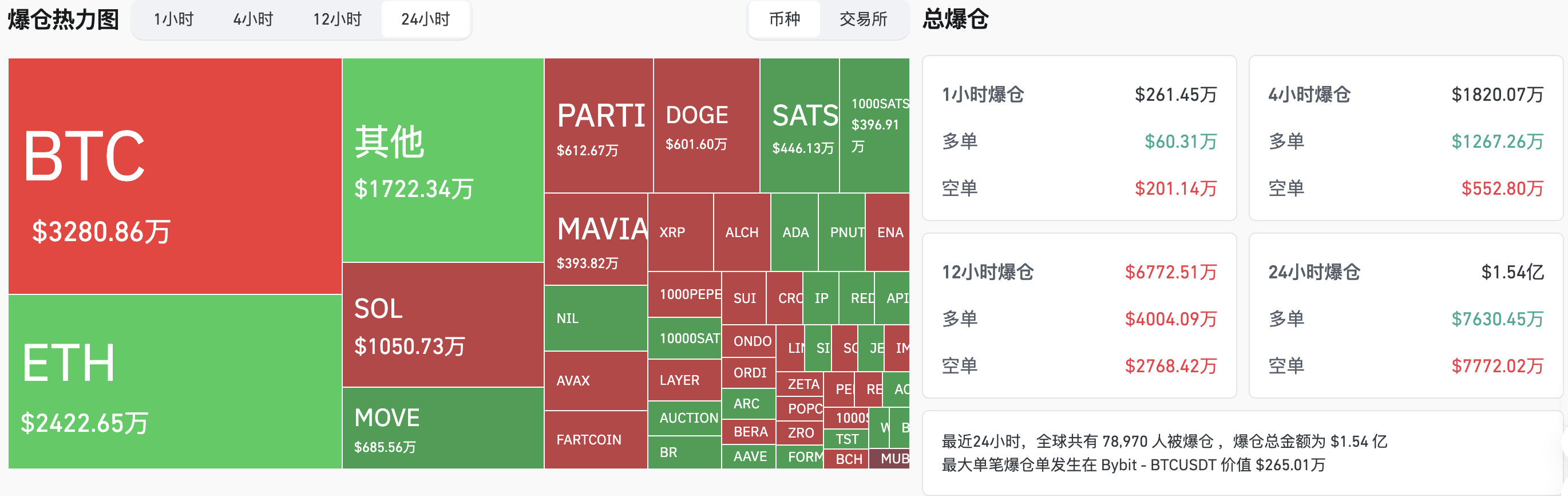

24-hour liquidation data: 78,970 people around the world were liquidated, with a total liquidation amount of US$154 million, with a BTC liquidation of US$32.8 million and an ETH liquidation of US$24.22 million.

3.ETF flow direction (EST as of March 25)

-

Bitcoin ETF: $26.83 million

-

Ethereum ETF: -$3.21 million

4. Looking forward today

-

Celo officially activates the Ethereum L2 main network, with hard fork block height of 31057000

-

US Senate holds hearing on Paul Atkins' qualifications to become SEC chairman on March 27

-

GRASS Airdrop One application ends (planned on March 27, Block 329341917)

-

Binance launches BNSOL super staking phase seven project Solv Protocol (SOLV)

-

Yield Guild Games (YGG) will unlock approximately 14.08 million tokens at 22:00 on March 27, with a ratio of 3.28% to the current circulation and a value of approximately US$3 million.

The biggest gains in the top 500 market cap today: WhiteRock (WHITE) rose 64.41%, Movement (MOVE) rose 29.04%, Gigachad (GIGA) rose 26.88%, Particle Network (PARTI) rose 25.61%, and Solayer (LAYER) rose 17.92%.

5. Hot News

-

Movement wallet address has received 10 million MOVE USDC from Binance in the early morning. Treasury added 300 million USDCs to Ethereum in the early morning. Ripple will recover $75 million in court fines from the SEC and withdraw its appeal

-

The US SEC terminates investigations into Immutable and related parties and finds no violations

-

Pai Shield: GMX and MIM Spell hacking losses have reached about $13 million

-

Bithumb will launch Redstone (RED) and Nillion (NIL) won trading pair

-

Oklahoma House of Representatives passes Strategic Bitcoin Reserves Act

-

Dogecoin Foundation sets up official reserves and purchases 10 million DOGEs for the first time

chaincatcher

chaincatcher