Trading Moment: Gold hits record high blood-sucking BTC, market focus on tariffs and non-farm data cost week

Reprinted from panewslab

03/31/2025·1M

1. Market Observation

Keywords: BNB, ETH, BTC

Bitcoin seems to have been sucked by gold. Spot gold broke through $3,100 per ounce this morning, setting a new record high again. Goldman Sachs predicts that it will reach $3,300 by the end of the year. By contrast, Bitcoin closed down last week and is currently fluctuating around $82,000. Economist Peter Schiff warned that if gold rises to $5,000, Bitcoin could fall 95% from its 2021 high to $10,000. In addition, the on-chain market on weekends was also relatively cold, and the popularity of BNB chains gradually faded. Despite SOL's pullback nearly 60% from its all-time high, trader Eugen still established long positions at $125, believing that the sharp fluctuations of $88,000 to $82,000 provide a good risk-reward ratio.

Market data shows that the total market value of the cryptocurrency field has shrunk by US$610 billion since 2025. About 8,000 Bitcoins that have been silent for many years have been transferred recently, worth US$674 million, exacerbating market concerns. Bloomberg strategist Mike McGlone said that if Bitcoin cannot resume stable growth, altcoins may be sold even further, and ETH may even fall to $1,000 later this year. However, not everyone is pessimistic. Architect Partners Elliot Chun predicts that by 2030, 25% of S&P 500 companies will include Bitcoin on their balance sheets. Currently, listed companies hold a total of 665,618 bitcoins, accounting for 3.17% of the total supply, of which MicroStrategy dominated with a holding of 506,137. Meanwhile, Zhu Su observed in Hong Kong that some family offices are closely following Michael Saylor's strategy and considering adopting a similar Bitcoin reserve model.

In addition, the regulatory environment continues to improve, and multiple positive factors are forming. Crypto-friend Paul Atkins is about to take over as SEC chairman, which could drive Ethereum ETF staking and lead to approval of more digital asset ETFs. In addition, US strategic Bitcoin reserve legislation is expected to be issued in May, which may make Bitcoin and gold a sovereign asset. The Hong Kong Monetary Authority is also formulating a stablecoin regulatory framework, and the relevant bills have entered the Legislative Council's deliberation stage. At the same time, Panama announced a draft cryptocurrency bill, planning to identify digital assets as legal payment tools. The US FDIC has revoked the policy of banks in providing crypto services that require early approval, clearing obstacles for traditional financial institutions to enter the crypto market.

However, the macro environment is still full of uncertainty and the market is facing multiple tests. Capital Flows analysts believe that if Bitcoin wants to exceed $100,000, it requires sustained changes in macro liquidity, otherwise if the stock market falls, Bitcoin may pull back to the range of $72,000-75,000. The market generally believes that against the backdrop of intensifying global trade frictions and rising uncertainty, gold's risk-haven attractiveness continues to increase. Bank of America analysts pointed out that the market is currently undergoing five major disruptive changes, including the end of the "big government" era in the United States, the transformation of technology stocks, the EU fiscal stimulus, the end of Japan's deflation and the recovery of China's consumption, which will profoundly affect the market trend. In addition, tariff adjustments on April 2 and non-farm data on April 4 are expected to be key variables in short-term market trends.

2. Key data (as of 13:30 HKT on March 31)

-

Bitcoin: USD 82,117.28 (-12.33%), daily spot trading volume USD 17.854 billion

-

Ethereum: USD 1,806.71 (-46.01%), daily spot trading volume is USD 12.316 billion

-

Corruption Index: 34 (Fear)

-

Average GAS: BTC 1 sat/vB, ETH 0.35 Gwei

-

Market share: BTC 61.4%, ETH 8.2%

-

Upbit 24-hour trading volume ranking: XRP, LAYER, BTC, ETH, DOGE

-

24-hour BTC long-short ratio: 0.9928

-

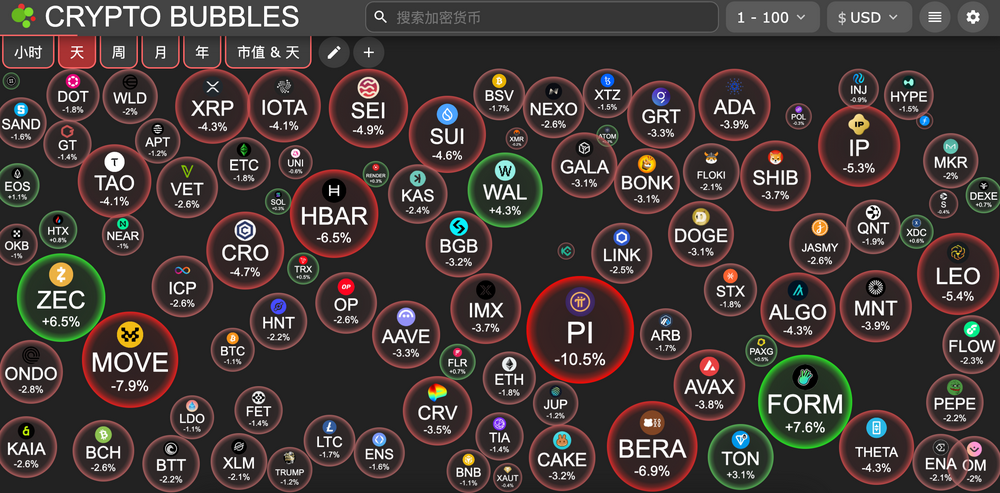

The sector rises and falls: The crypto market generally fell, with the PayFi sector falling 3.71%, and the Meme sector falling 2.88%.

-

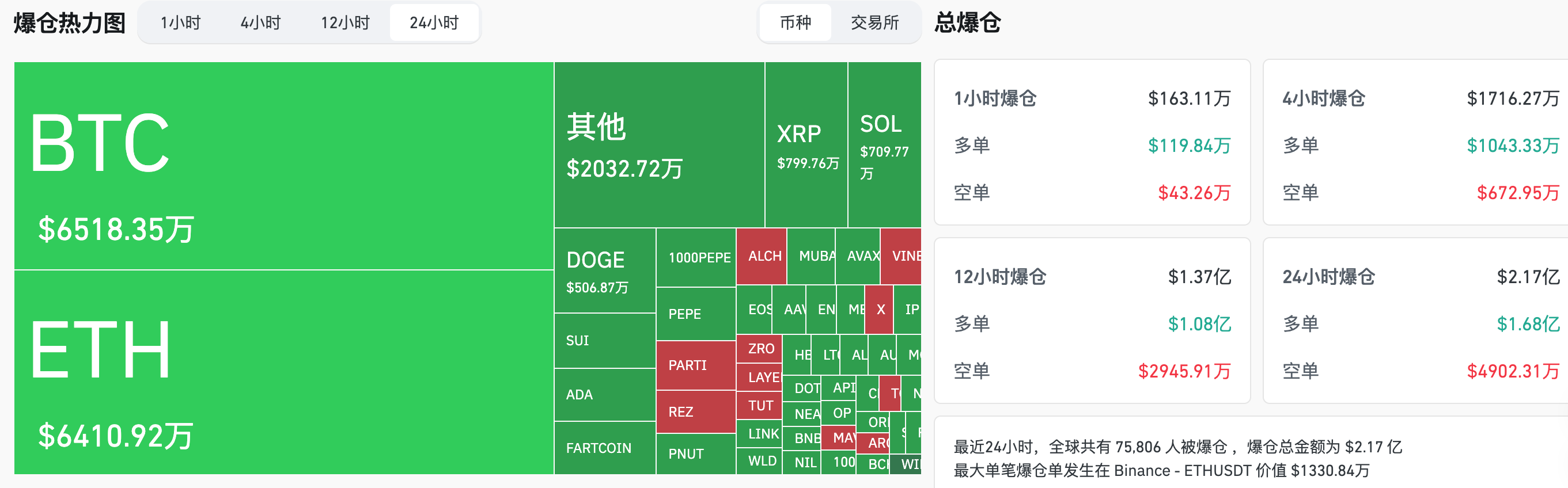

24-hour liquidation data: 75,806 people around the world were exposed, with a total liquidation amount of US$217 million, with a BTC liquidation of US$65.18 million and ETH liquidation of US$64.1 million

3.ETF flow direction (EST as of March 28)

-

Bitcoin ETF: -93.16 million USD

-

Ethereum ETF: USD 4.68 million

4. Looking forward today

-

Four.meme will switch to PancakeSwap V2 liquidity scheme on March 31 and destroy new token LP

-

Terraform Labs will open the crypto asset loss claims portal on March 31 with a deadline of April 30

-

Binance Launchpool will be launched on GUNZ (GUN) at 21:00 on March 31

-

mtnDAO announces unlimited sales of $MTN tokens on MetaDAO Launchpad

-

Binance will remove USDT and other non-compliant stablecoins from European users

-

Japanese Bitcoin company Metaplanet conducts 10:1 stock split

-

Jupiter: The complaint for the address mislabeled as a witch or Bot will end on April 1

-

Binance will remove GALA/BNB, PERP/BTC, USDT/CZK, USDT/RON trading pairs

-

Optimism (OP) will unlock approximately 31.34 million tokens at 8 a.m. on March 31, with a ratio of 1.93% to the current circulation and a value of approximately US$23.8 million;

-

Sui (SUI) will unlock approximately 64.19 million tokens at 8 a.m. on April 1, with a ratio of 2.03% to the current circulation, and a value of approximately US$152 million;

-

ZetaChain (ZETA) will unlock approximately 44.26 million tokens at 8 a.m. on April 1, with a ratio of 6.05% to the current circulation and a value of approximately US$13.2 million;

-

dydx (DYDX) will unlock approximately 8.33 million tokens at 8 a.m. on April 1, with a ratio of 1.09% to the current circulation and a value of approximately US$5.4 million.

The biggest gains in the top 500 market cap today: X Empire (X) rose 27.61%, Alchemist AI (ALCH) rose 17.08%, Concordium (CCD) rose 10.44%, CZ'S Dog (BROCCOLI) rose 9.95%, and LayerZero (ZRO) rose 9.39%.

5. Hot News

-

Macro outlook for this week: Trump's table rises, April 2 may become a watershed in global assets

-

Spot gold broke through $3,100 per ounce on Monday, setting a new record high again

-

Goldman Sachs raises U.S. recession probability and tariff rate expectations

-

Movement Labs deposits 17.15 million MOVEs into Coinbase, worth $7.74 million

-

Report: Average stablecoin liquidity per token decreased by 99% from March 2021 to 2025