Three major trends in DeFi

Reprinted from jinse

01/14/2025·4MAuthor: Mason Nystrom, Pantera partner; Compiler: 0xjs@金财经

Consumer DeFi

As interest rates fall, DeFi yields start to become more attractive. Increased volatility brings more users, yields, and leverage. Coupled with the more sustainable yields brought by RWA, building consumer-grade crypto-financial applications suddenly becomes much easier.

When we combine these macro trends with innovations in chain abstraction, smart accounts/wallets, and the general shift to mobile, there is a clear opportunity to create a consumer-grade DeFi experience.

Some of the most successful crypto-financial applications of the past few years have been born out of a combination of improved user experience and speculation.

● Trading bots (e.g. Telegram) – provide users with the ability to trade within a messaging and social experience

● Better crypto wallets (e.g. Phantom) – improve existing wallet experience and provide a better experience across multiple chains

● New terminals, portfolio trackers and discovery layers (e.g. Photon, Azura, Dexscreener, etc.) – Provide advanced features for power users and allow users to access DeFi through a CeFi-like interface

● Robinhood for memecoins (e.g. Vector, Moonshot, Hype, etc.) – So far, cryptocurrencies have primarily favored desktop, but mobile-first experiences will dominate future trading apps

● Token launchpad – (e.g., Pump, Virtuals, etc.) – Provides permissionless access to token creation to anyone, regardless of technical ability.

As more consumer-grade DeFi applications are launched, they will look like fintech applications, with the standard user experience that users prefer, but they will aggregate and provide a personalized experience of DeFi protocols on the back end. These applications will focus on the discovery experience, products offered (e.g. types of yields), appeal to power users (e.g. offering convenient features like multi-collateral leverage), and generally abstract away the complexities of on-chain interactions.

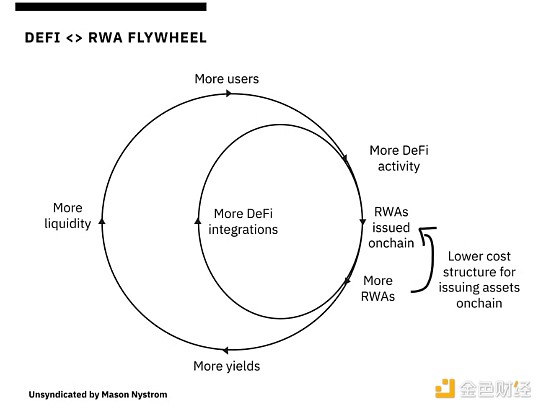

RWA flywheel: endogenous growth and exogenous growth

Since 2022, high interest rates have supported an influx of on-chain real- world assets (RWA). But now, the shift from off-chain to on-chain finance is accelerating as large asset managers such as BlackRock realize that issuing RWA on-chain brings meaningful benefits, including: programmable financial assets, issuance and maintenance Low-cost structuring of assets and greater asset accessibility. These benefits, like stablecoins, are a 10x improvement over the current financial landscape.

According to data from RWA.xzy and DefiLlama, RWA accounts for 21-22% of Ethereum assets. These RWAs primarily come in the form of A-rated, U.S. government-backed U.S. Treasury securities. This growth is primarily driven by high interest rates, which make it easier for investors to go long the Fed rather than DeFi. Although the macro winds are changing, making Treasury bonds less attractive, the Trojan horse of on-chain asset tokenization has made its way to Wall Street, opening the floodgates for more risky assets to enter the chain.

As more and more traditional assets move onto the chain, this will trigger a compound flywheel effect that slowly merges and replaces traditional financial rails with DeFi protocols.

Why is this important? Cryptocurrency growth comes down to exogenous versus endogenous capital.

Much of DeFi is endogenous (basically cyclical in the DeFi ecosystem) and capable of growing on its own. Historically, however, it has been quite reflexive: it goes up, it goes down, and then it comes back to square one. But over time, new primitives have steadily expanded DeFi’s share.

On-chain lending through Maker, Compound, and Aave expands the use of crypto- native collateral as leverage.

Decentralized exchanges, especially AMMs, expand the range of tradable tokens and initiate on-chain liquidity. But DeFi can only develop its own market to a certain extent. While endogenous capital (e.g., speculation on on-chain assets) has propelled crypto markets into a strong asset class, exogenous capital (capital that exists outside of the on-chain economy) will be necessary for the next wave of DeFi growth.

RWA represents a large amount of potential exogenous capital. RWA (commodities, stocks, private credit, foreign exchange, etc.) provides the greatest opportunity for the expansion of DeFi, so that it is no longer limited to circulating capital from the pockets of retail investors to the pockets of traders. Just as the stablecoin market needs to grow through more exogenous uses (rather than on-chain financial speculation), other DeFi activities (such as trading, lending, etc.) also need to grow.

The future of DeFi is that all financial activities will be moved to the blockchain. DeFi will continue to see two parallel expansions: a similar endogenous expansion through more activity native to the chain, and an exogenous expansion through the transfer of real-world assets to the chain.

DEFI’s platform

“Platforms are powerful because they facilitate relationships between third- party providers and end users.” – Ben Thompson

Crypto protocols are about to have their platform moment.

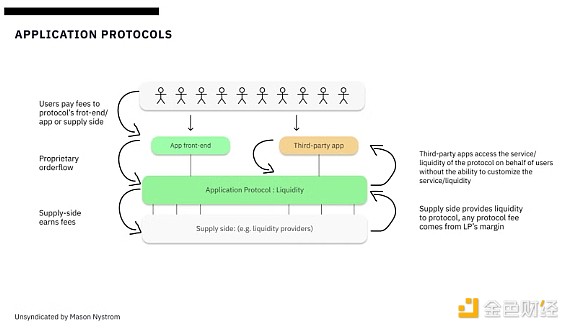

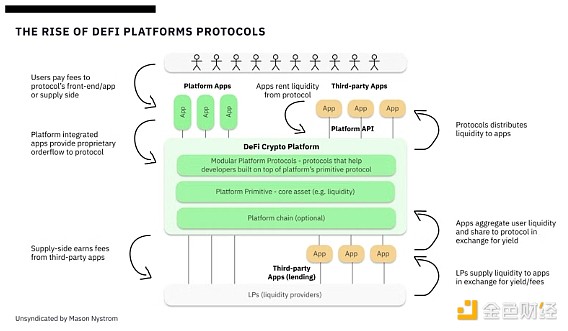

DeFi applications are all evolving towards the same business model, evolving from standalone application protocols to full-fledged platform protocols.

But how exactly do these DeFi applications become platforms? Today, most DeFi protocols are relatively rigid, providing one-size-fits-all services for applications that want to interact with these protocols.

In many cases, applications simply pay the protocol for its core assets (such as liquidity) like standard users, rather than being able to build differentiated experiences or program logic directly within the protocol.

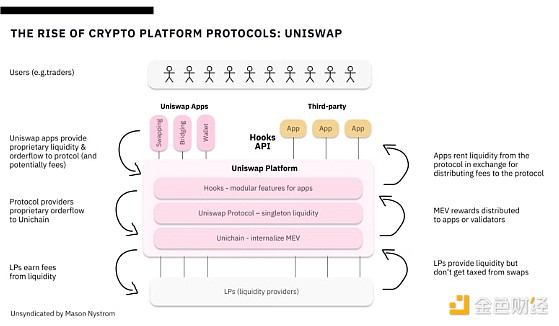

This is how most platforms start, solving a core problem for a single use case. Stripe initially provided a payments API that allowed individual businesses (such as online stores) to accept payments on their websites, but it only worked for individual businesses. Stripe launched Stripe Connect, enabling businesses to process payments on behalf of multiple sellers or service providers, making Stripe the platform it is today. Later, it expanded its network effect by giving developers better ways to build more integrations. Likewise, DeFi platforms like Uniswap are now moving away from standalone applications (such as DEXs) that facilitate exchanges to building DeFi platforms that allow any developer or application to create their own DEX on top of Uniswap's liquidity.

Key drivers of DeFi platform transformation are business model shifts and the evolution of singleton liquidity primitives.

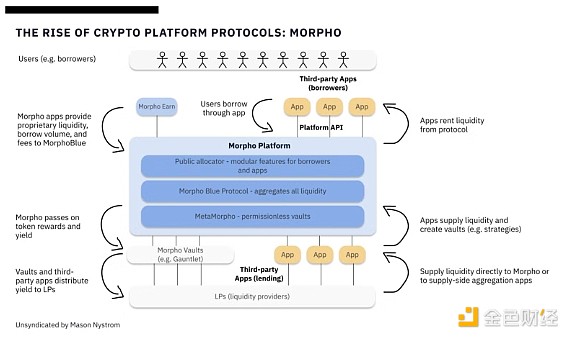

Singleton liquidity primitives – Uniswap, Morpho, Fluid – aggregate liquidity for DeFi protocols, allowing access by both modular parts of the value chain (e.g. liquidity providers and applications/users). The liquidity provider experience becomes more streamlined, with funds allocated to a single protocol rather than protocols with differentiated pools or siled vaults. For applications, they can now rent liquidity from DeFi platforms instead of simply aggregating core services (such as DEX, lending, etc.).

Here are some examples of emerging DeFi platform protocols:

Uniswap V4 is driving a singleton liquidity model whereby applications (e.g., hooks) can rent liquidity from Uniswap's V4 protocol, rather than simply routing liquidity through the protocol as in Uniswap V2 and V3.

Morpho has moved to a similar platform model, where MorphoBlue serves as the core liquidity primitive layer, with permissionless access via vaults created by MetaMorpho, a protocol built on top of the liquidity primitive MorphoBlue.

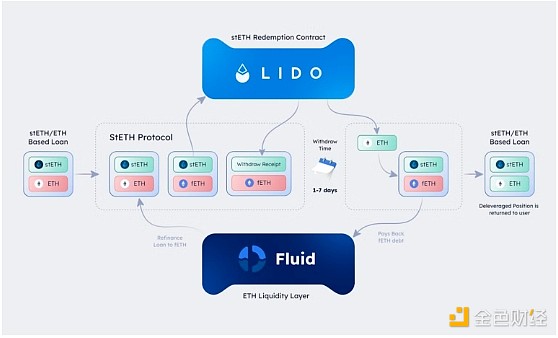

Similarly, Instadapp’s Fluid protocol creates a shared liquidity layer that its lending and DEX protocols can leverage.

While there are differences between these platforms, the common thread is that emerging DeFi platforms share a similar model, building a singleton liquidity contract layer on top and building more modular protocols on top to enable greater application flexibility. and customization.

DeFi protocols evolve from standalone applications to mature platforms, marking the maturity of the on-chain economy. By adopting singleton liquidity primitives and modular architecture, protocols such as Uniswap, Morpho and Fluid (formerly Instadapp) are unleashing new levels of flexibility and innovation. This shift reflects how traditional platforms, such as Stripe, empower third-party developers to build on top of core services, driving greater network effects and value creation. As DeFi enters the platform era, the ability to facilitate customizable, composable financial applications will become a defining feature, expanding the market for existing DeFi protocols and enabling a new wave of applications to be built on these DeFi platforms.

chaincatcher

chaincatcher

panewslab

panewslab