There is no ideal in the currency circle, only the smell of copper

Reprinted from panewslab

03/22/2025·2MAuthor: Fairy, ChainCatcher

Edited by: TB, ChainCatcher

You can't forget why you set out just because you walked too far.

In the hustle and bustle of the market, Meme coins are popular, short-term speculation is prevalent, FOMO sentiment pushes up the bubble, and Builder, which really pushes the industry forward, struggles to support it in the cracks. Capital is pursuing profit, the founder leaves, and even the most determined developer begins to shake.

When innovation is kidnapped by traffic and speculation, the market becomes a game of "beating the drum and passing flowers", do we still remember the original belief of this industry?

Long-term narrative dissolution: From “changing the world” to

“speculative casino”

Looking back at the early days of the crypto industry, long-termism was the core driver of innovation. In 2017, foundational projects such as Ethereum, Polkadot, and Cosmos were born. At that time, countless Layer1 and DeFi projects were regarded as puzzles for the next generation of financial infrastructure, and the bull market in 2021 pushed this narrative to the peak: the craze of DeFi Summer and the explosion of NFTs made Uniswap, Aave, Solana and other projects emerge.

However, today's crypto market has changed. The pace of innovation has slowed down, and the industry's focus has gradually shifted from infrastructure to short-term profit-driven areas. Jocy, founder of IOSG Ventures, said bluntly: "If the end result is to lose great talents and turn Web3 into a speculative casino, will their success really shine?"

This change has been revealed among the entrepreneurial community. Crypto KOL Chen Jian Jason pointed out that high-quality entrepreneurs in the Crypto field are leaving on a large scale, in stark contrast to the grand occasion of 2021. The talent and funds that AI can accommodate from Infra to the application level far exceed that of the currency circle. Decent entrepreneurs who are not short of money have no motivation to stay and build large casinos. “Compared with these emerging industries, blockchain seems to have become the boring one.”

What is even more worrying is that this short-term speculative mentality is eroding the industry's long-term development momentum and affecting the positive feedback mechanism of the entire industry. Jocy pointed out, "Who is willing to calm down and polish products and drive growth when making quick money? If the entire industry is tilted towards speculation, the crypto market will eventually only consume itself and lose its true driving force for innovation."

The crypto industry once carried the dream of changing the financial system, but now it is facing the risk of being swallowed up by speculation. The current market is more popular and fragmented, but it has lost its sense of direction.

PVP Inspur dominates the market: Speedway and "drinking" are normalized

According to CoinGecko data, Meme Coin accounted for 31% of the market attention last year, with a total market value soaring from US$20 billion in 2023 to US$140 billion, an increase of up to 600%. But under the bubble, the bubble remains.

CoinWire statistics show that 76% of KOLs have promoted "death" Meme coins, of which 2/3 have returned to zero, and 86% of Meme coins plummeted 90% in 3 months. This model of "quick online, quick pull-up, and short-term cash-out" seems to have become the standard growth path for Meme coins.

From birth to popularity and then to rapid ebbing, the cycle has been greatly compressed. The story of a hundred times increase continues to stimulate investors' FOMO sentiment and attracts a large amount of capital to influx. However, as the popularity faded, "drinking" became the ultimate destination of most Meme coins.

We reviewed some of the once glorious Meme coins in 2024 and took stock of their historical highs and current situations, but as expected, they all turned to "drink".

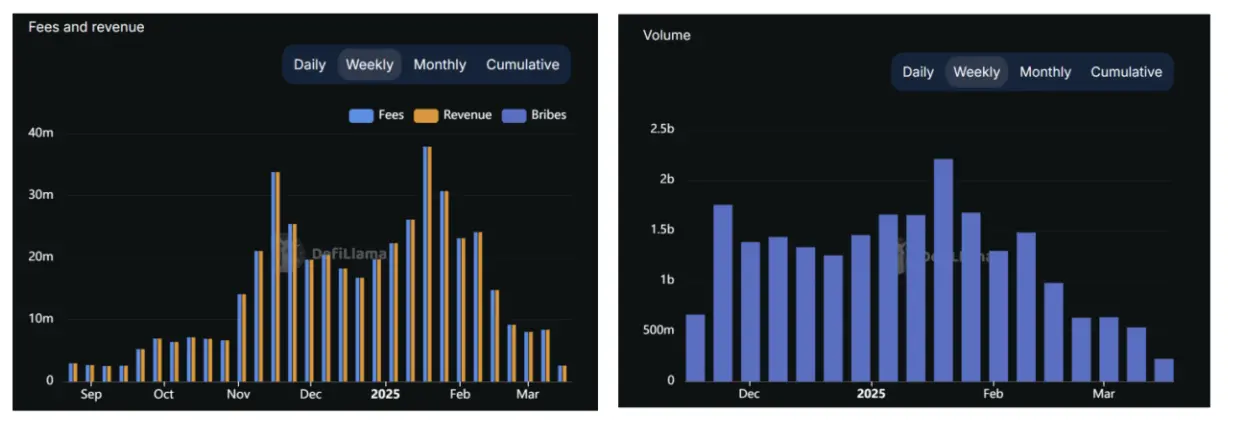

In addition, Pump.fun, considered a Solana Eco-Meme Coin-making Artifact, once soared to $27.92 million in a single week, but has now shrunk significantly to $8 million. Weekly trading volume also fell sharply from $2.2 billion to $536 million. What is more worth noting is that the Pump.fun platform has only one token that can exceed US$1 million in 24 hours for many consecutive days, and even the phenomenon of "zero-point copy" has occurred.

Meanwhile, funds and gaze are turning to BNB Chain and TRON. Every time the wind blows, it may bring a brief carnival; but every time the wind stops, what is left may be "a mess". In the market environment where "suspension" and "drinking" have become the norm, how long can this wind last?

Source: Defillama

Traffic competition among leading exchanges

The crypto industry is trapped in the "casino" model, and the competition among exchanges seems to be starting to compare who will take Meme coins faster and more accurately. As the industry's "locomotive" and Binance also "goes with the flow" in this traffic pursuit battle, and has been following traffic and attention.

According to ChainCatcher statistics, since 2024, Binance has launched 36 Meme coins in the futures and spot markets, and this number has occupied an important proportion in its currency list.

Recently, Binance founders CZ and He Yi have personally come to the scene, active in the community and X (Twitter), playing with memes, posting pictures, picking up memes, creating MEME hype materials, and seizing traffic dividends. In response, Jocy, founder of IOSG Ventures, said bluntly: "The most prestigious individuals and organizations in the industry are focusing on Meme. To be honest, what if you fight this battle well?"

At present, most Meme coins do not have substantial empowerment, and are more like a game of "beating the drum and passing the flowers". They do not have their own hematopoietic ability and lack sustainable value support. They can only rely on social media hype and celebrity effects to maintain short-term popularity, which is difficult to last.

Once upon a time, the project's technical strength, ecological construction and innovation capabilities were the focus of market attention, but now, short-term growth and the popularity of social media have become the key to success or failure. The voice of long-termism is gradually drowned in the noisy speculation wave, and the development trajectory of the crypto market is deviating from its original intention and becoming more and more short-sighted and impetuous.

Do you still remember the original intention of encryption?

Speculation is rising, and the living space for real value investors and high-quality projects is shrinking. Crypto KOL Rick Awsb pointed out that the trend of Memeization has exacerbated the phenomenon of "bad money drives out good money", and pvp has made fewer and fewer real value investors, and the industry's "desertification" in the short term has become an indisputable fact.

Developers who focus on technological innovation and ecological construction are gradually marginalized, and the light of technology and innovation is overshadowed by the hustle and bustle of the market. Bifrost builder Lurpis said bluntly: "In the Web3 field, creating an excellent product is far less effective than pulling the plate."

Despite this, developers, investors and builders still believe in the long-term value of Web3. Although their voices seem weak in the noise of the market, these persistents keep the industry moving forward in amidst turmoil. As Crypto KOL Blue Fox said: "The industry is like a trekking trip, and it is always passers-by. It is really difficult now. A small part is still sticking to it, and even a small part will survive this winter."

Although the cold winter is cold, the pace of spring never stops.

jinse

jinse

chaincatcher

chaincatcher