The Trump family entered the mining circle and jointly established American Bitcoin, aiming to go public and become the world's largest Bitcoin mining company

Reprinted from panewslab

04/04/2025·1M

Author: Weilin, PANews

On March 31, a seemingly ordinary official announcement of the structural restructuring of mining companies is brewing the latest evolution of the Bitcoin mining landscape in North America.

North American mining giant Hut 8 announced a partnership with Trump's second son Eric Trump to establish a new company American Bitcoin, with the goal of becoming the world's largest and most efficient Bitcoin mining company. This is not only a strategic transformation of Hut 8's business structure, but also a sign of another intersection between capital, Trump's family influence and the crypto world.

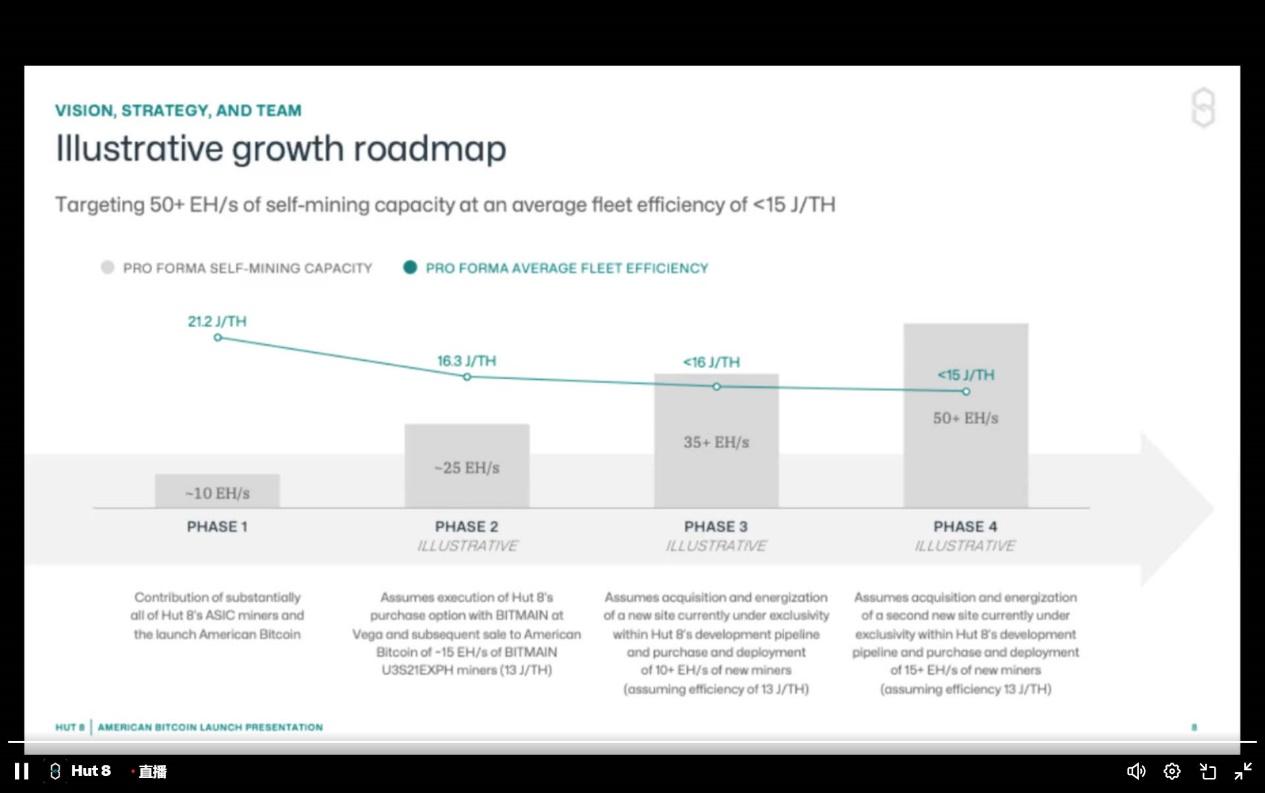

In a subsequent conference call, the new company American Bitcoin proposed a four-stage development roadmap, planning to achieve a total computing power of more than 50 EH/s, overall energy efficiency is less than 15 J/TH, and finally complete listing.

Architecture restructuring: Hut 8 Bitcoin mining business "split up and

set off again"

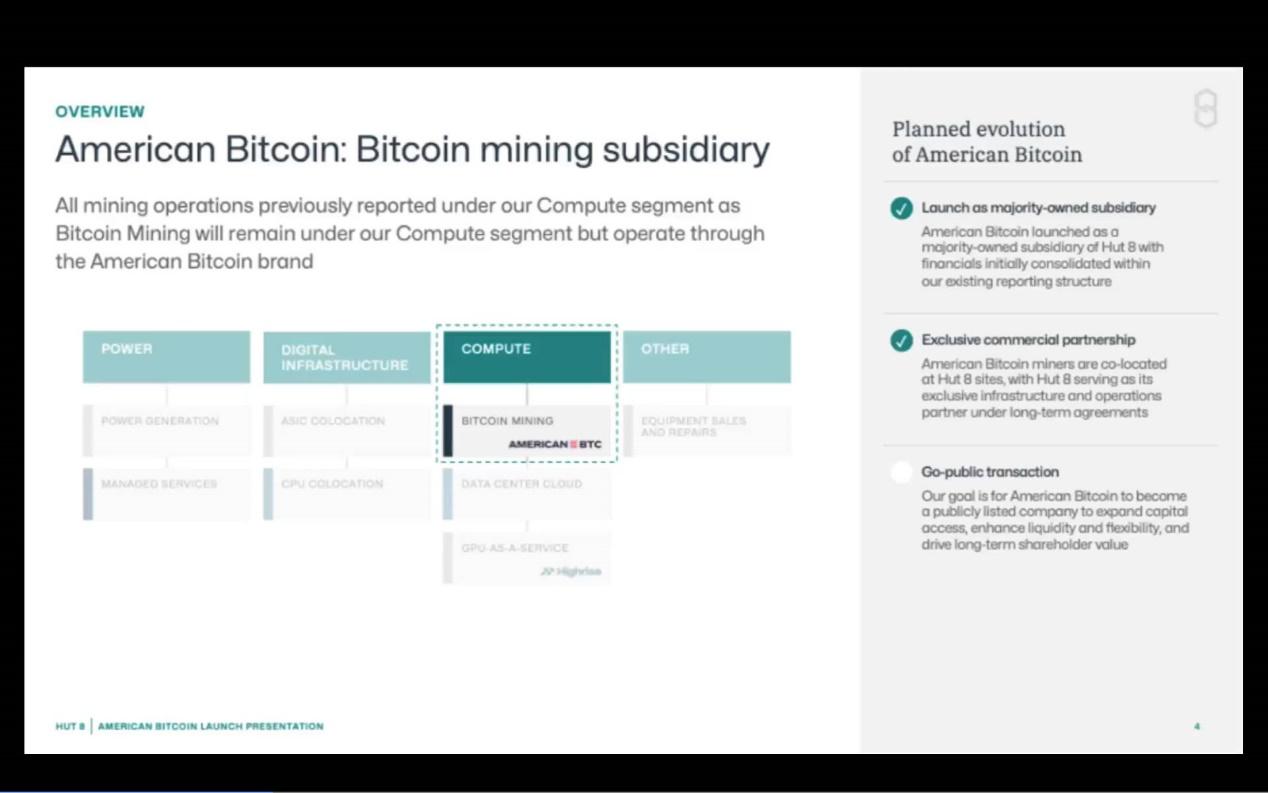

The core of this transaction is Hut 8's important restructuring of its mining business structure. As a mining company, Hut 8 chose to transfer all its own mining machine assets (including ASIC miners with computing power of more than 10 EH/s) to its subsidiary American Data Centers, which was renamed American Bitcoin. Meanwhile, Hut 8 retains 80% of the new company's controlling stake, with Trump's two sons Eric Trump, Donald Trump Jr., and other original shareholders of American Data Centers.

It is worth noting that American Bitcoin will operate as an independent mining company in the future, with plans to expand computing power through the capital market and obtain profits through the Bitcoin rise. Hut 8 itself will transform into a "digital infrastructure" company, focusing on power, data center hosting and operation management services. Its revenue sources will no longer rely on Bitcoin output, but will come from stable fiat currency revenue

- electricity and custody service fees.

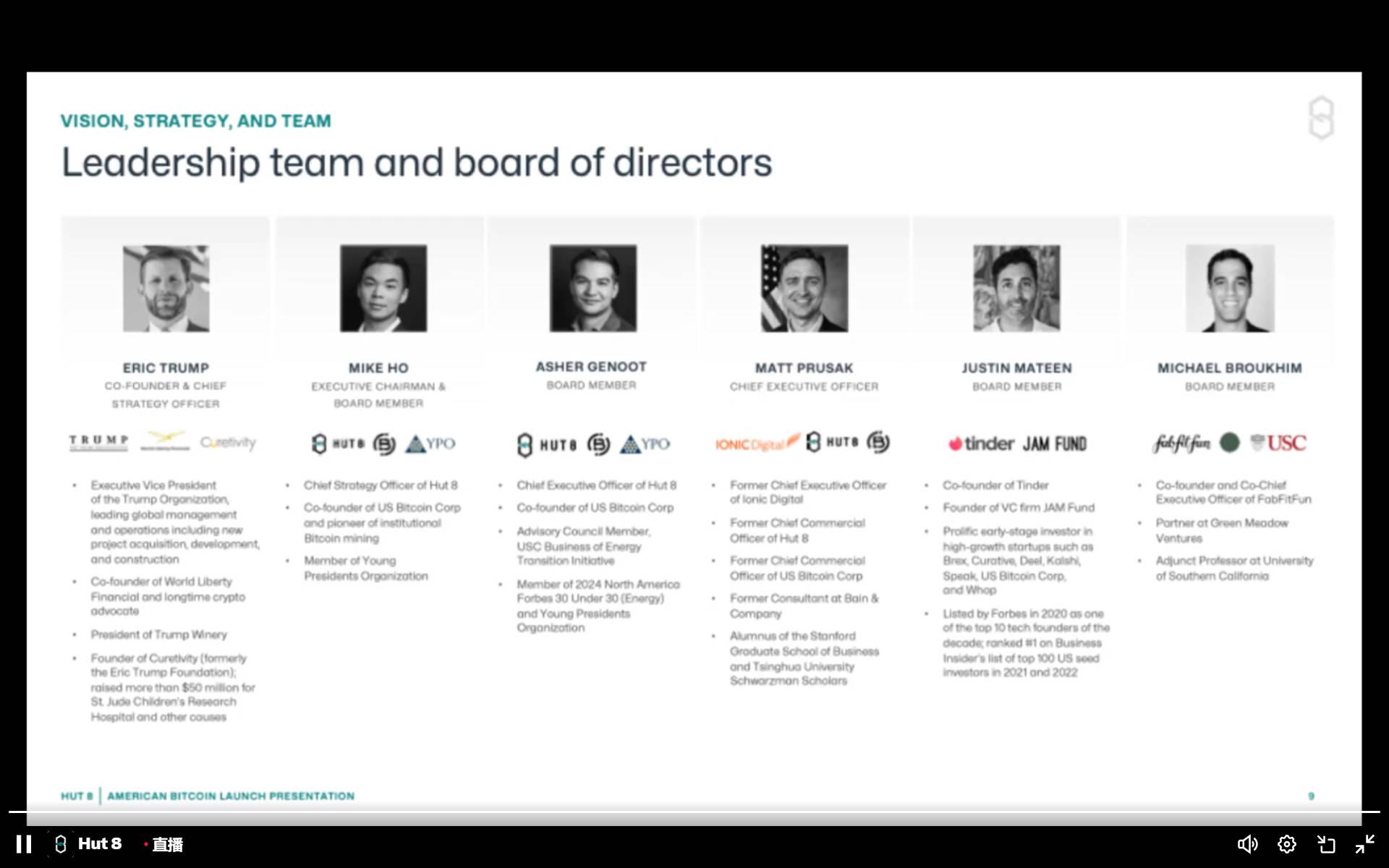

In terms of leadership structure, Trump’s second son Eric Trump will serve as chief strategy officer at American Bitcoin, responsible for driving and defining the company’s long-term strategic direction. His responsibilities cover capital raising, corporate development and market docking. Eric will establish strategic partnerships in the financial and operations sectors to align growth trajectory with changing market and capital dynamics.

Other executives include Executive Chairman Mike Ho (Chief Strategy Officer at Hut 8), Board Member Asher Genoot (CEO of Hut 8), CEO Matt Prusak, and two board members Justin Mateen (Co-founder of Tinder) and Michael Broukhim (Co-founder of e-commerce startup FabFitFun).

Borrowing the capital market expansion **, vow to build the best

Bitcoin mining company**

The official said that private equity financing will be carried out before listing, and firmly believes that the company has the ability to continue financing through private equity and the open market. The core logic of this transaction was brewing for a long time and it was not truly implemented until we met the Eric team. Hut8 will become a power infrastructure and custodian service provider with stable cash flow, and the US Bitcoin company will carry the profit opportunities brought by Bitcoin volatility.

As American Bitcoin’s chief strategy officer, Eric Trump’s speech at the launch ceremony was quite personal and also revealed the value motivation behind this cross-border cooperation.

“I’ve been dealing with physical assets all my life – we built the best hotels, golf courses, real estate projects, commercial and residential buildings,” Eric recalls. “It wasn’t until I was involved in a world of crazy politics that I really realized the power of cryptocurrencies, and I really had an awareness and love for cryptocurrencies, especially Bitcoin. I saw banks banning personal accounts for no reason, seeing the weaponization of the financial system, and some people worked with banks for 20 years and had to wait 6 months to get a basic mortgage, and that didn’t make sense.”

In his opinion, Bitcoin is an all-weather, global, and instantly flowing "digital gold" that does not conflict with real estate, golf courses and other physical assets, but instead forms a complementary form. He stressed that through American Bitcoin, we hope to "bridge the gap between traditional finance and digital finance" and achieve this goal by building the world's largest and best Bitcoin mining company.

In terms of hardware supply, executives revealed that BitWechat has set up a factory in the United States to produce ASIC mining machines, and Bitmain is also following up. Through decentralized procurement and localized production, American Bitcoin hopes to create a global hardware layout with risk resistance. The advantage of the contract with Bitmain is the flexibility to choose to purchase mining machines in full or in batches. As the site is put into production, the procurement rhythm will be dynamically adjusted based on the computing power price and machine cost.

American Bitcoin said it maintains cooperation with leading manufacturers such as Bitmain and Microbit, and also set up R&D centers in Southeast Asia to test equipment from various manufacturers. Currently, Microbit has set up a factory in the United States, and Bitmain is also following up. It is maintaining supply chain security dialogue with all suppliers to reduce risks through diversified cooperation.

Cooperation details: Four phases and three key agreements

American Bitcoin's development path has been carefully broken down into four stages, each stage has clear target computing power and energy efficiency indicators, and relies on collaboration with Hut 8's existing resources:

In the first phase, American Bitcoin undertakes the 10 EH/s mining machine transferred by Hut 8 (average efficiency is about 21.2 J/TH). This part of computing power has become the cornerstone of the company's expansion.

In the second phase , Hut 8 plans to enable a super-large site, execute a signed procurement option, deploy 15 EH/s U3S21EXPH devices on the site, and sell these ASICs to American Bitcoin. These devices operate in a liquid-cooled architecture independently developed by Hut 8, which will increase the final power to about 25 EH/s and reduce the efficiency to about 16.3 J/TH.

In the third phase , American Bitcoin will further acquire and enable another site that has obtained exclusive rights in the Hut 8 pipeline and deploy an additional 10+ EH/s U3S21EXPH mining machine, so that the final computing power reaches 35+ EH/s and the efficiency is reduced to below 16 J/TH.

In the fourth phase , this mode will be copied at another site that already has exclusive rights, and a 15+EH/s Bitmain U3S21EXPH mining machine will be added to achieve the final goal: 50+EH/s, with an overall efficiency lower than 15 J/TH. Officials said American Bitcoin’s preliminary roadmap demonstrates a replicable, capital-efficient growth strategy, with clear investment and orderly execution, and each round of deployment can bring compound interest learning and optimization.

To ensure operational synergy and cost advantages, Hut 8 signed three key agreements with American Bitcoin:

1. Colocation Agreement

The Colocation Agreement gives Hut 8 exclusive rights to host American Bitcoin’s ASIC miners on its site. The agreement will bring sustained fiat currency revenue to Hut 8’s “digital infrastructure” segment, while giving American Bitcoin access to high-density, cost-effective infrastructure without capital expenditure.

2.Managed Services Agreement

Under the agreement, Hut 8 will operate all of American Bitcoin’s mining operations at the hosting site. This brings a second sustained fiat currency revenue to Hut 8’s “power” sector, while enabling American Bitcoin to leverage Hut 8’s mature mining operation platform.

3. Shared Services Agreement

Hut 8 will manage American Bitcoin’s core business functions, including financial, human resources and compliance matters. The agreement is designed to reduce the burden on American Bitcoin’s self-built management teams, enabling it to expand with a streamlined and efficient cost structure.

The merger of the three agreements enables American Bitcoin to achieve a cost structure similar to vertically integrate miners, while avoiding the asset burden caused by self-built infrastructure and management teams. Therefore, almost all of American Bitcoin’s capital can be used to increase computing power and accumulate Bitcoin.

chaincatcher

chaincatcher