The most pro-crypto-government team in history, the secret of Trump's cabinet official holdings

Reprinted from panewslab

04/15/2025·24DThis original | Odaily Planet Daily

Author|Wenser

Recently, after voting, the U.S. Senate officially confirmed that Trump's nomination Paul Atkins is the SEC chairman. Since then, the main government officials during Trump's current term have basically confirmed their position, and this group of people will also become key figures that will affect the political and economic situation in the United States and the world in the next four years and the cryptocurrency market.

As a result, although major officials of the Trump administration are stymied by the US government's Ethics Office, the crypto positions of the public may still become one of the important incentives to affect subsequent regulatory policies and the benefits of cryptocurrency projects. Based on this, Odaily Planet Daily will organize the cryptocurrency-related positions of the main characters in this article for readers' reference.

Vice President Vance: Specializes in BTC

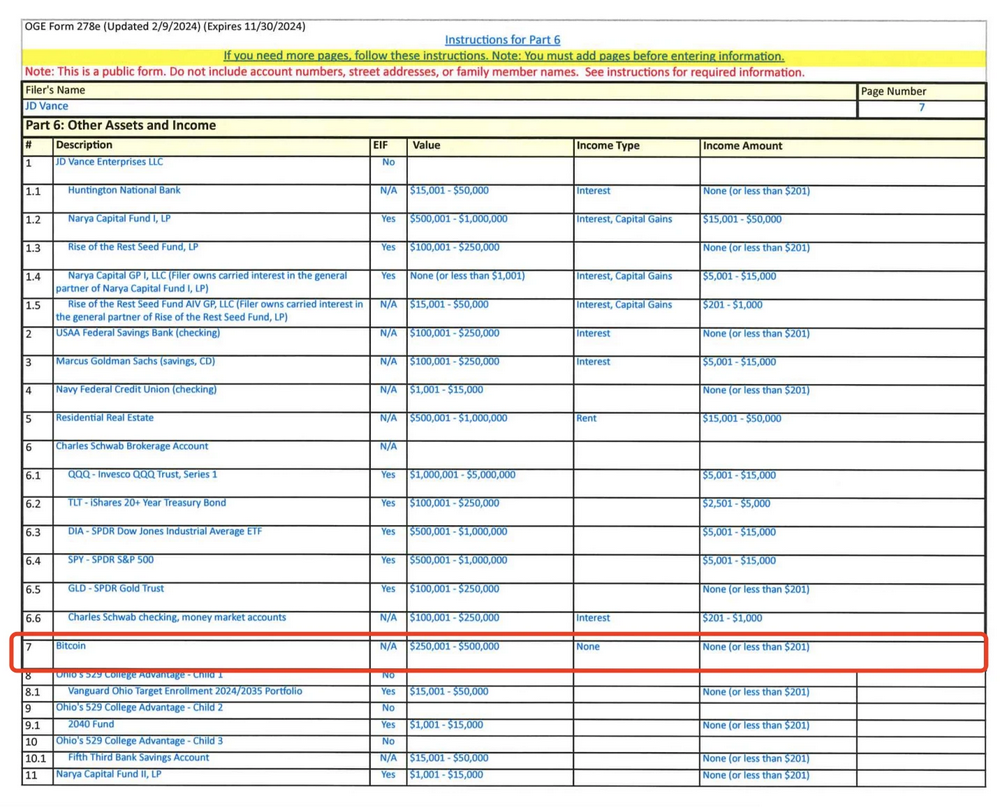

According to a previous report by Business Insider, the personal financial information for 2023 disclosed by current US Vice President JD Vance in August 2024 shows that Vance himself holds about US$4 million in assets; of which the relevant crypto assets are about US$250,000-500,000, all of which are Bitcoin.

In addition, index funds related to crypto assets and crypto asset management company funds are also among them.

Vance Personal Financial Status Disclosure Document Information

David Sacks, head of AI and encryption at White House: He once held BTC,

ETH, SOL, and BITW, and has now cleared his position

The White House memorandum documents show that David Sacks, director of AI and cryptocurrency, sold more than $200 million in digital asset-related investments through his individual and his company Craft Ventures before taking office, with approximately $85 million in revenue owned by his individual, including Bitcoin, Ethereum, Solana and the Bitwise 10 Crypto Index Fund (BITW), and sold shares in Coinbase (COIN) and Robinhood (HOOD).

In addition, he also withdrew from investments related to Multicoin Capital, Blockchain Capital and Bitwise Asset Management, and began to gradually withdraw his holdings in some private digital asset companies. In addition, Sacks still holds interests in some funds under Craft Ventures, which invest in companies such as BitGo and Lightning Labs. These investments are difficult to completely withdraw due to liquidity restrictions, accounting for less than 3.8% of its total investment assets.

The above information has also been confirmed and responded by David Sacks himself, and Multicoin Capital managing partner Kyle Samani and Bitwise CEO Hunter Horsley also explained this accordingly.

SEC Chairman Paul Atkins: Indirect holdings in BTC

According to the crypto KOL @0x_Todd, it is estimated that Paul Atkins' encryption-related assets are about 2-6 million US dollars. The Off The Chain Capital fund, which it invests in, adopts a Bitcoin strategy (focusing on low-priced Bitcoin investment opportunities, such as Mentougou's debt, Bitcoin mining machines, Bitcoin leverage, etc.), and therefore indirectly holds Bitcoin.

In addition, it also holds shares in the crypto company Securities and Anchorage Digital, the only crypto bank in the United States, with an asset magnitude of about US$250,000-500,000.

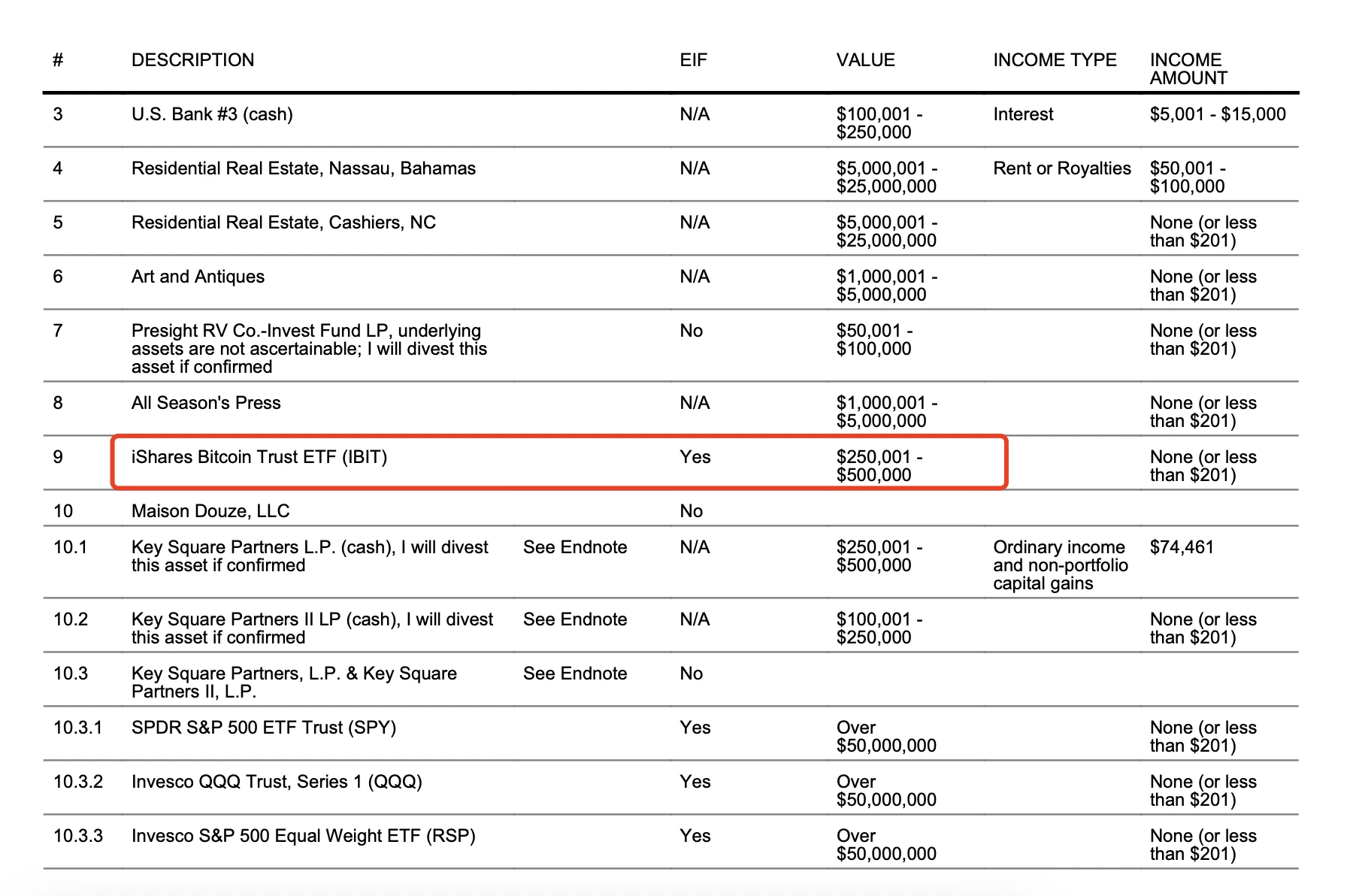

US Treasury Secretary Scott Bessent: Holding IBIT

U.S. Treasury Secretary Scott Bessent previously disclosed personal property documents in August 2024 show that his total financial assets are approximately US$521 million.

In comparison, its crypto assets only include Bitcoin spot ETF IBIT, and its assets are about US$250,000-500,000, accounting for less than 0.1% of its personal assets.

In addition, its portfolio also includes assets related to cryptocurrencies, such as the SPDR S&P 500 Trust Fund (SPY), the Invesco QQQ Trust Fund (QQQ), etc., with a value of more than US$100 million.

[Source of position information](https://extapps2.oge.gov/201/Presiden.nsf/PAS+Index/49D5550BCEB079A185258C0F00335A1B/%24FILE/Bessent,%20Scott%20%20final278.pdf)

U.S. Secretary of Commerce Howard Lutnick: Holds 5% of Tether shares and

several BTC

According to financial disclosure documents released by the U.S. Office of Ethics (OGE), current U.S. Secretary of Commerce Howard Lutnick disclosed his holdings of crypto assets and related investments in a report filed on January 24, 2025.

Previously, he had made it clear that he held Bitcoin and regarded it as a global free-trading asset "like gold"; under his name, Cantor Fitzgerald, is the main partner of stablecoin issuer Tether, managing approximately $39 billion in U.S. Treasury bonds. According to previous reports, Lutnick plans to hand over the company's Tether business relationship to his son Brandon Lutnick.

In addition, Cantor Fitzgerald reportedly holds a 5% stake in Tether, with a valuation of about $600 million; Cantor Fitzgerald also planned to launch a Bitcoin financing business last year to provide Bitcoin investors with leverage support of up to $2 billion in initial funding.

Musk, head of DOGE department: BTC and DOGE

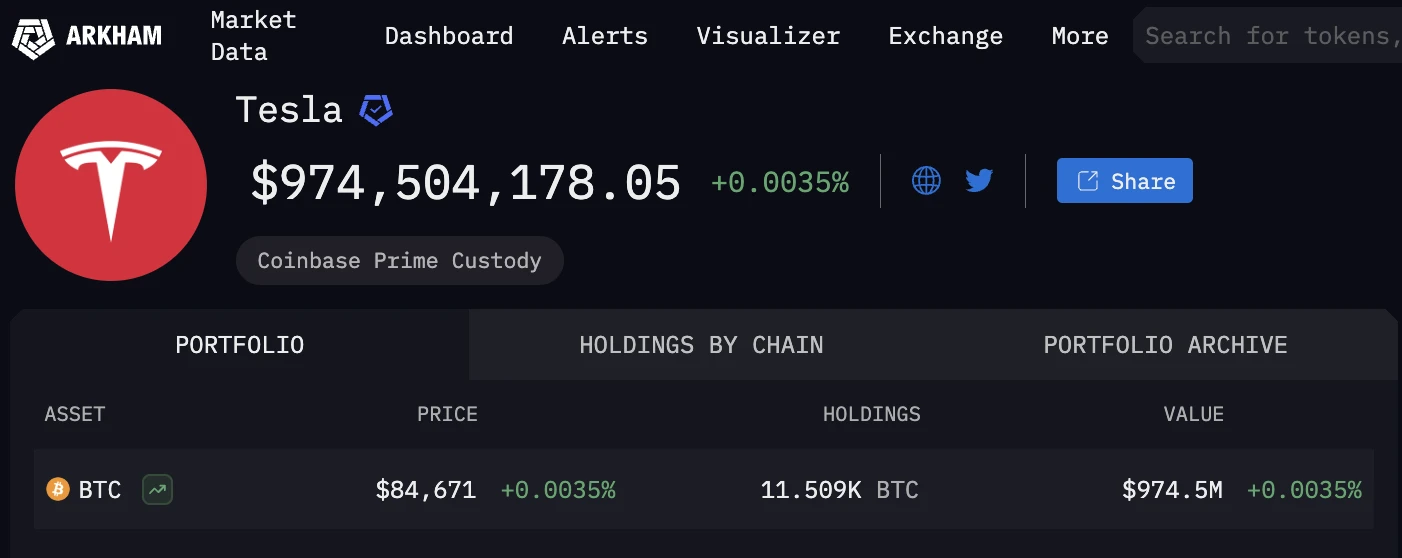

As a "star player" in Trump's current administration, Musk's crypto positions have always been the focus of market attention.

According to Arkham platform data, on March 7, Musk's subsidiary Tesla's Bitcoin holdings increased to 11,509, an additional 1,789 BTC compared to the 9,720 BTC balance reported in the last financial report.

Just last November, Dogecoin UI designer DogeDesigner, who interacts frequently with Musk, shared a Musk audio clip on the X platform, in which Musk said, "I still hold a large amount of Dogecoin, and SpaceX still holds Bitcoin."

Tesla BTC holding information

chaincatcher

chaincatcher