The MegaETH, which Vitalik is mainly supported, is online for testing network. Is there still a chance for Ethereum Layer2?

Reprinted from panewslab

03/05/2025·3MAuthor: Alvis

Introduction: Ethereum dilemma and Layer2 breakout moment

The crypto market in 2025 is undergoing a deep value reconstruction. The transaction volume of Ethereum main network continues to shrink, Gas fees continue to decline, and the TVL of top Layer2 projects such as Arbitrum and Optimism has shrunk by more than 40% from its peak in 2024. When the industry questioned whether the Layer2 narrative ended, a project called MegaETH, with a technical declaration of "100,000 TPS + 1 millisecond delay", will launch a public test network on March 6 with a US$30 million financing with Vitalik Buterin.

MegaETH gets direct investment from V God

Is this counter-trend charge a prelude to disruptive innovation or a bubble created by capital? This article will deeply decode from three dimensions: technical anatomy, ecological game and market timing.

MegaETH Technology Panorama: Reconstructing Layer2 Performance Ceiling

MagaETH Introduction:

MegaETH is the Layer 2 blockchain, Layer 2, aims to enhance the scalability and performance of Ethereum by implementing real-time transaction processing. It is compatible with Ethereum Virtual Machine (EVM). MegaETH is designed to achieve unprecedented performance levels, capable of handling over 100,000 transactions (TPS) per second.

MegaETH plans to start deploying its public testnet on March 6.

This deployment will be carried out in phases. The test network will be officially deployed on March 6, marking the beginning of opening the network to the public.

From March 6 to March 10, the focus will be on the onboarding of the application and infrastructure teams, allowing developers to refine the architecture that deploys and adapts to MegaETH.

1.1 "Three-Level Engine" of Performance Monsters

MegaETH claims to be the "first real-time blockchain" and its technical architecture directly points to the current core pain point of Layer2 - the contradiction between performance and decentralization. Through three breakthrough designs, the project attempts to push the EVM ecosystem to the limits of the hardware:

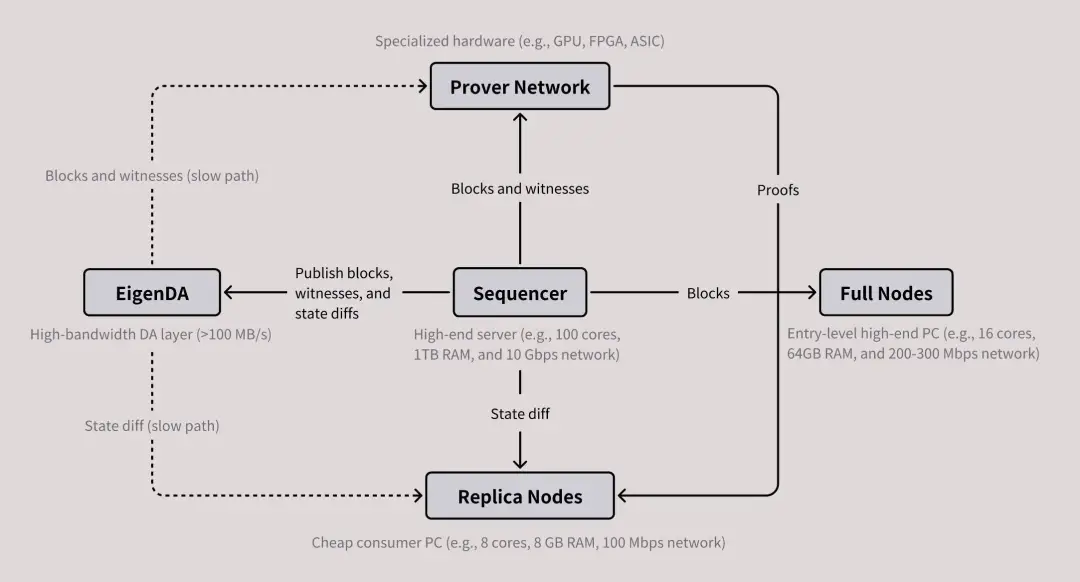

Heterogeneous node architecture: split network nodes into three categories: Sequencer, full node, and verifier. The sorter uses a customized server to store the EVM state tree completely in memory, achieving a state access speed of 1000 times that of the SSD; the entire node synchronizes state differences through point-to-point protocols to avoid repeated calculations; the verifier focuses on generating zero-knowledge proofs. This "professional division of labor" centralizes performance-critical tasks while security verification remains decentralized.

Hyper-optimized EVM execution environment: Introducing a real-time JIT compiler (Just-In-Time) to dynamically compile smart contract code into native machine code, eliminating the performance loss of traditional interpreters. Test network data shows that the execution speed of computing-intensive contracts has increased by 100 times. In addition, the project party reconstructed the state tree structure and adopted a Merkle-Verkle tree-like solution to reduce disk I/O operations by 90%.

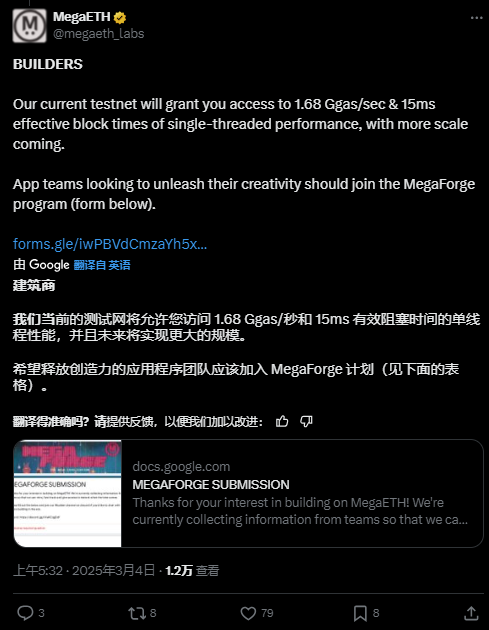

Submillisecond level consensus mechanism: Through pipelined block production, transaction sorting, execution, proof generation and other links are processed in parallel. The test network has achieved an effective block time of 15 milliseconds in the early stage, which is two orders of magnitude higher than Optimism's 2 seconds. The team claims that after the main network is online, the single-thread throughput can reach 1.68 Ggas/second, 50 times the existing Rollup solution.

1.2 Data measurement: Test network performance analysis

According to the official disclosure on March 4, the test network will open the following capabilities in the first phase:

- Throughput: 1.68 Ggas/second, can support approximately 5000 simple transfers per second

- Delay: End-to-end confirmation time ≤15 milliseconds (including network transmission)

- Fee Model: The cost of a single transaction is less than $0.001, which is two orders of magnitude lower than Arbitrum

It is worth noting that these data are based on a single-sorter mode and have not yet demonstrated the scalability in multi-node parallelism. The team said that in the future, TPS will be increased to more than 100,000 through sharding technology.

Capital Game: Strategic Ambitions Behind $30 million

2.1 Financing map and community of interests

MegaETH’s capital story is full of “top configuration” colors:

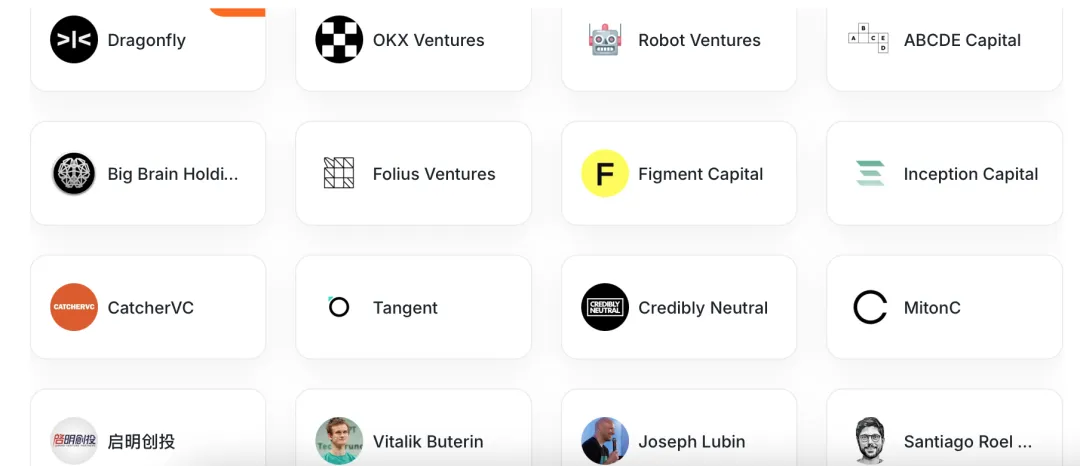

- 20 million USD Seed Round (June 2024): Leading the investment by Dragonfly, followed by Vitalik Buterin, Joseph Lubin (founder of ConsenSys), Sreeram Kannan (founder of EigenLayer) and other Ethereum "establishment"

- 10 million USD Community Round (December 2024): Completed through the Echo platform, adopting the "Equity + Token Warrants" structure, with a valuation of hundreds of millions of USD

- NFT Financing (February 2025): Issuing "The Fluffle" series NFTs, raising 4964 ETH (approximately US$13 million), and holders can enjoy 5% of future token airdrops

V God's in-depth participation is particularly interesting. As the founder of Ethereum with very few direct investment projects, its bet on MegaETH is seen as a "vote of no confidence" on the existing Layer2 technology route. Industry insiders speculate that V God may hope to use MegaETH to verify the "modular blockchain" theory, that is, to achieve a balance between performance and security through the combination of dedicated execution layer (MegaETH) + consensus layer (Ethereum) + DA layer (EgenDA).

**2.2 Eco-position: "Infrastructure Bet" for Full-chain Games and

DePIN**

Early adopters of MegaETH focused on two types of tracks:

- Full-chain games: projects such as Dark Forest, AI Arena, etc. have been announced to be moved to the test network, using millisecond delay to achieve real-time combat logic

- DePIN (Decentralized Physical Infrastructure): High-frequency sensor data on the linkage, real-time edge computing and other scenarios require ultra-low fees and deterministic delays.

- This "vertical scene deep cultivation" strategy forms a differentiated competition with Arbitrum and Optimism's "general Rollup". The project party also claimed that its performance can support "Web2-level user experience", such as DEX's pending order transaction speed comparable to Coinbase.

Counter-cyclical launch: gamble or rational?

3.1 Layer2 The "Ice and Fire Poles" of the Market

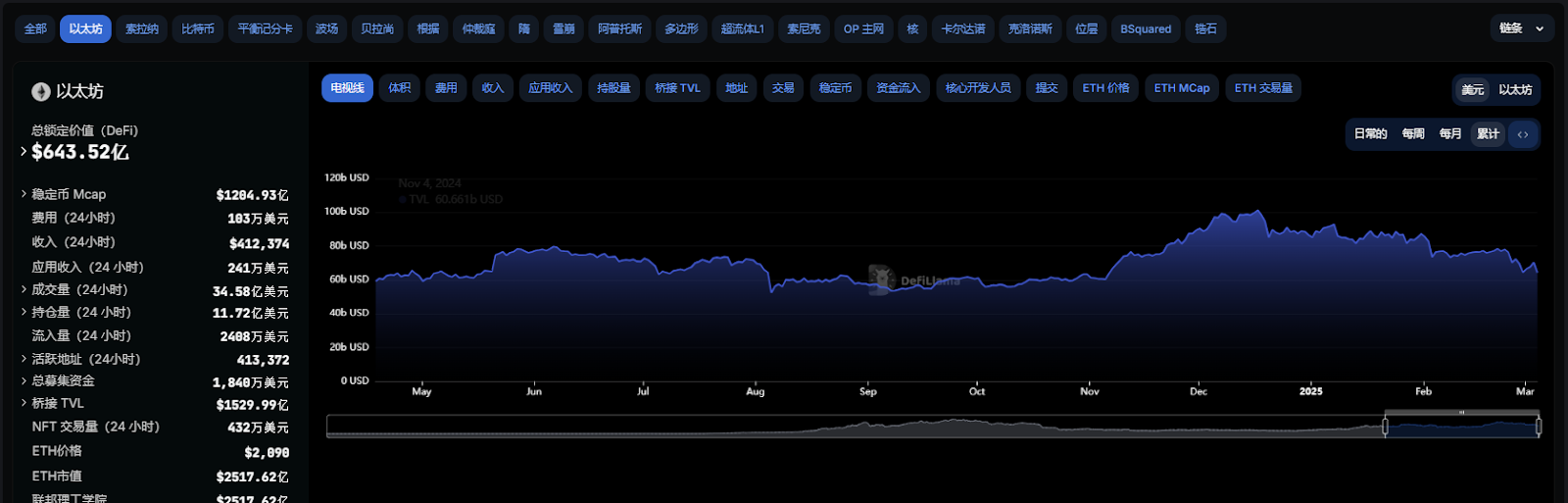

According to defilama data, Ethereum TVL fell from its high point by US$100 billion to the current US$64 billion, and the Ethereum Layer2 ecosystem showed cruel differentiation,:

- Top shrinks: Arbitrum TVL fell 40% from its 2024 high, and Optimism's daily trading volume fell below 100,000. Base TVL has fallen 12% in the past month.

- New forces are exhausted: The StarkNet and Scroll of the ZK-Rollup series have not been effectively verified with their account abstraction and privacy features.

- Capital retreat: VC financing in Layer2 field decreased by 82% year-on-year in Q1 2025

Against this background, MegaETH's test network is online, which can be called "counter-cyclical operation". Its logic may include:

- Technical window period: Use the market downturn to polish the structure to avoid chain instability under high concurrent pressure

- Reduced ecological migration cost: developers are more willing to try and make mistakes, and are more willing to try new high-performance chains

- Token expectation management: If the main network is launched at the bottom of the bull market cycle, it may replicate the surge in Solana's "performance narrative" in 2021

Risk warning: Four major uncertainties

Despite the grand blueprint, MegaETH faces multiple challenges:

- Centralized hidden dangers: The test network adopts a single-sequencer architecture, and whether the main network can achieve multi-node competition still needs to be verified

- Status explosion problem: Memory computing relies on TB-level servers, which may lead to excessive entry threshold for validators in the long run.

- Ecological cold start: Currently, there are only less than 20 projects that promise to migrate, which is far lower than the data of zkSync during the same period.

- Token Economics Risk: MegaETH has not yet clarified the token model

Epilogue: The eve of Layer2's "Cambrian Explosion"?

MegaETH's test network is online, just like a sharp sword piercing the cold winter of Layer2. Its technical route shows a possible direction: through heterogeneous architecture and hardware collaboration, blockchain performance will be promoted to the "enterprise level". If the main network achieves 100,000 TPS as scheduled, it may trigger an infrastructure revolution in DeFi, GameFi and even traditional finance.

However, historical experience shows that excessive pursuit of performance is often accompanied by decentralized compromises. Can MegaETH find a new balance point in the "Impossible Triangle"? This experiment in 2025 may reshape all our perception of blockchain scalability.

chaincatcher

chaincatcher

jinse

jinse