The copycat season has not come because the Fed did not release money?

Reprinted from panewslab

02/14/2025·3MAuthor: CryptoAmsterdam

Compiled by: TechFlow

Is the statement that “there is no copycat season without quantitative easing ( QE )” correct?

Recently, my comment section is full of similar views:

-

“We need QE to usher in the copycat season.”

-

"Without QE, the copycat season will never begin."

Let's make an analysis.

This is usually not the area I mainly study, but since everyone is discussing QE, I will give a brief analysis.

(Note: I am not an expert in this field. If there are any errors, please correct me. To simplify the discussion, we only start with the charts and do not make too many guesses. Please refer to them with caution.)

1.What are QE and QT?

QE ( Quantitative Easing , quantitative easing ):

-

Central banks inject funds into the market by creating new currencies

-

The specific operation is to increase market liquidity by purchasing assets

-

Increase in liquidity = favorable to risky assets (such as cryptocurrencies)

QT (Quantitative Tightening, Quantitative Tightening):

-

Central banks reduce money supply in the market

-

Methods include selling assets or letting them mature, thereby recovering liquidity

-

Reduced liquidity = unfavorable to risky assets

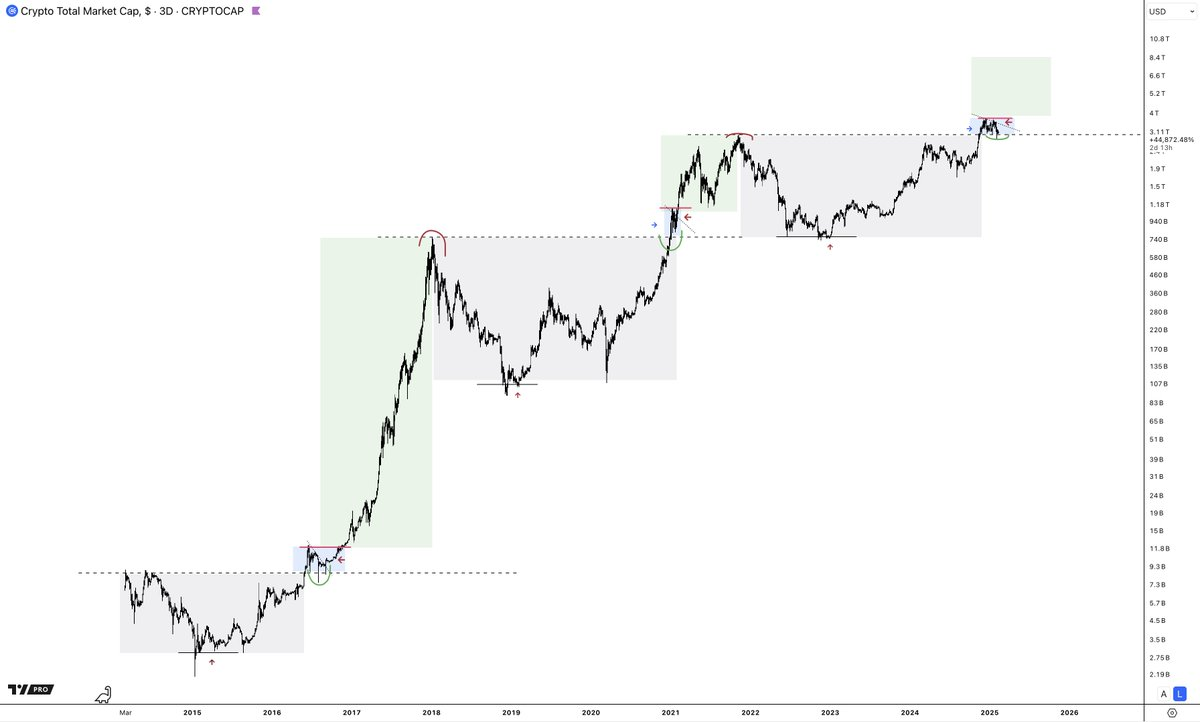

If we superimpose the overall market value chart of the entire copycat market with the Bitcoin dominance chart and mark the time intervals of QE (favorable to the market) and QT (favorable to the market), we will find that these two statements do not hold true.

Even without QE , the crypto market has experienced significant ups, bull markets and copycat seasons.

In fact, QE only coincides with the bull market once, that is 2021.

Summary of chart analysis:

-

The arrival of the copycat season does not depend on QE.

-

During the QT period, the total market value of the counterfeit market soared from US$400 billion to US$1.7 trillion.

-

While QE can promote the market, it is not a necessary condition – other factors may also trigger market growth, such as the introduction of ETFs, support from government policies, SBR (which may refer to some stablecoin reserve mechanism) or Bitcoin value Improvement.

-

Stopping QT would theoretically be beneficial to the market, but the market still achieved growth during the QT period, which shows that QT is not the decisive factor in market performance.

2. What is Altseason?

In the cryptocurrency market, it can usually be divided into two main stages:

-

Bitcoin Season

-

Altcoin Season

Bitcoin Season:

-

The Bitcoin quarter is characterized by an increase in Bitcoin dominance (Bitcoin Dominance), which is the market value of Bitcoin in the entire cryptocurrency market. This is because funds flow from counterfeits to Bitcoin, resulting in the overall performance of counterfeits becoming worse than Bitcoin.

-

New funds mainly flow into Bitcoin, and the proportion of counterfeit market has decreased.

Copycat season:

-

The copycat season is characterized by a decline in Bitcoin dominance as funds flow into the copycat from Bitcoin.

-

The inflow of new funds has driven the market share of counterfeits to increase, and the total market value of counterfeits will soar rapidly.

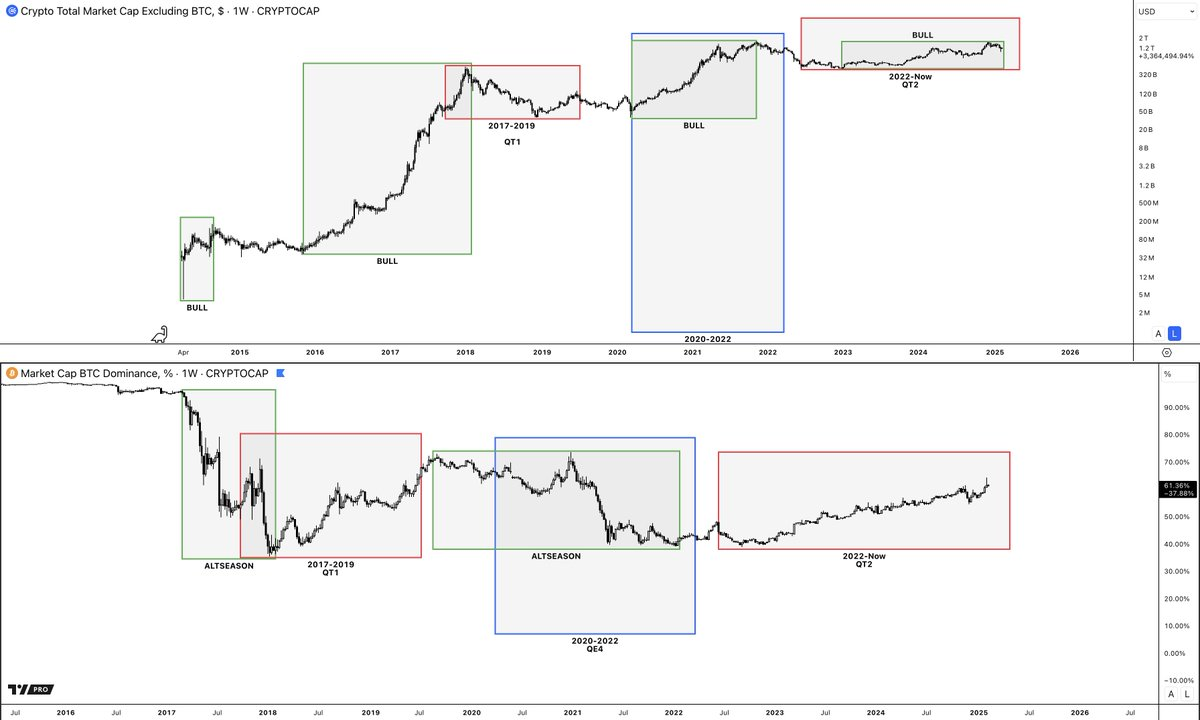

Judging from historical data, the market is in the Bitcoin season most of the time , and the performance of counterfeits is usually inferior to Bitcoin. Here are a few typical Bitcoin season phases:

-

Bitcoin is in a bear market? This is the Bitcoin season.

-

Bitcoin bottoms out and rebounds? It's still Bitcoin quarter.

-

Bitcoin begins to rise initially? Bitcoin Season.

-

Bitcoin rose to its highest point in the previous cycle? Bitcoin Season.

-

Bitcoin breaks through a new high? It's still Bitcoin season.

The emergence of a copycat season usually has certain rules: it often occurs after Bitcoin breaks through a new high for the first time and enters the consolidation stage. Subsequently, when Bitcoin rises again, the copycat season will truly arrive. At this time, the dominance of Bitcoin begins to decline and the copycat market ushers in an explosion.

3. What factors will trigger Altseason?

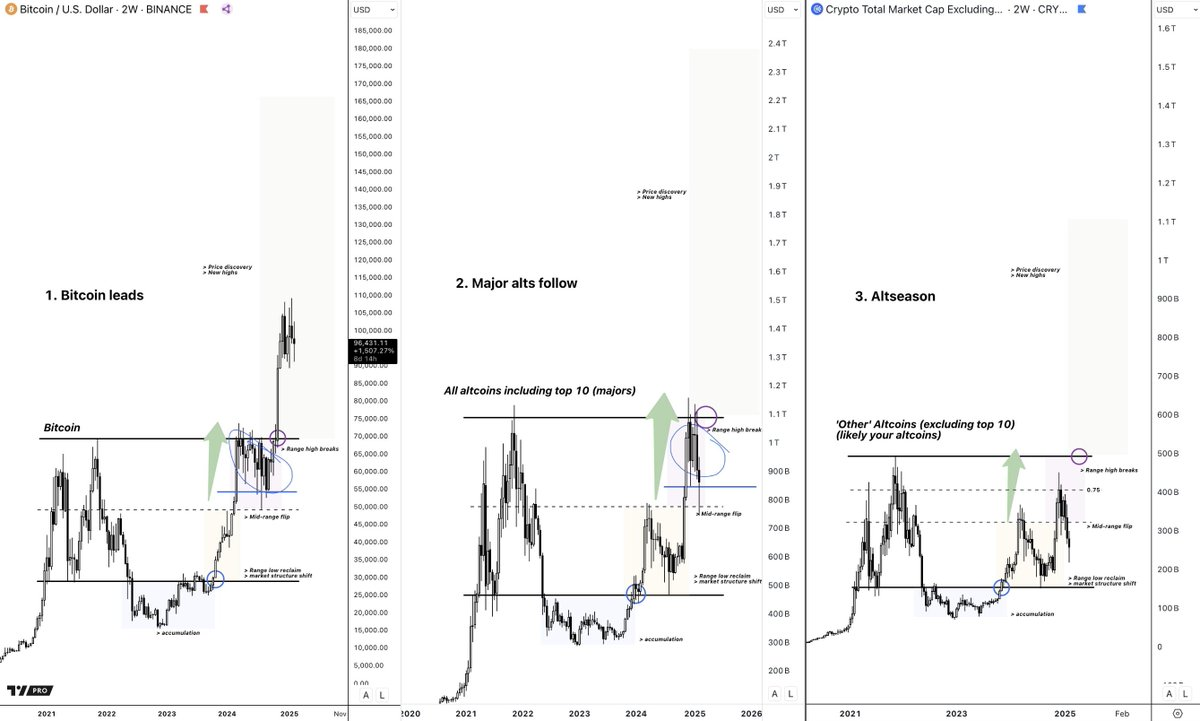

The copycat season is usually triggered by the start of a bull market in Bitcoin. (It should be noted that this does not depend on quantitative easing QE; we are currently in the stage of quantitative tightening QT. Other possible triggers include the value and cycle of Bitcoin, the stablecoin reserve mechanism SBR, the launch of Bitcoin ETFs, etc.)

The first step in capital flows is usually the influx of Bitcoin and major scattered scatters.

The next result is:

-

Media hype has attracted the attention of retail investors, and retail investors may start buying counterfeits.

-

At the same time, investors who make profits in Bitcoin will turn their funds to the counterfeit market in order to pursue higher returns.

Judging from historical data, this phenomenon usually occurs at the stage when Bitcoin breaks through the second high. This rule can be observed from the previous chart.

There is a clearer path for capital flows in the crypto market:

Bitcoin → Main Copyright → High Market Cap Token → Medium Market Cap Token → Low Market Cap Token

For example, on January 18, 2021, Bitcoin was in the consolidation stage and tried to break through a new high (shown by the red arrow in the figure), while Total 3 (i.e., the total market value indicator of the copycat market) was still at the middle level (red arrow in the figure) shown).

From this we can see that Bitcoin is usually the starting point of capital flow, followed by the total market value of the main copy (Total 3), and finally it is other tokens (including high-market and medium-market tokens).

The trigger of the copycat season does not depend on quantitative easing QE. (Of course, QE does help the market.)

The key is that a large amount of funds flows into Bitcoin and the main copycats first, and then the market's greed will drive the funds to further flow to other copycats.

This is the trigger mechanism of the copycat season. So far, we have been on the right track whether it is QE, QT, or other external factors. The entire cryptocurrency market (mainly composed of bitcoin and some major cottages, as the cottage season has not yet arrived) has grown from $700 billion to nearly $4 trillion.