TGE is imminent, analyzing the advantages and potential of oracle rookie RedStone from 5 angles

Reprinted from panewslab

02/21/2025·3MOriginal author: Poopman

Compiled by Odaily Planet Daily

Translator|CryptoLeo

Although the crypto market has been occupied by Meme, Meme and Meme in recent months, compared with the end of 2024, the hot spots of Meme hype have turned into an extremely "distorted" corner, from Trump's issuance of coins to the recent "Libra scandal". ”, Meme sentiment in the market also declined accordingly. Please see the following picture for details:

At the data level, since the launch of LIBRA tokens, pump.fun's daily trading volume (including purchasing and trading of newly issued tokens) has dropped 33.7% from US$184 million to US$122 million. Apart from trading volume, pump.fun has stalled in other aspects. On Tuesday, the platform registered only 59,000 new wallets, a low since November 17, 2024. Compared with the day of President Trump's inauguration last month, the number of active wallets on the platform reached about 110,000. Compared with the current "distorted Meme" stage, I miss the AI Agent Meme period a few months ago, but PvP is not the end of blockchain, and practicality and innovation are the long-lasting topics of the industry.

One of the projects that I am optimistic about recently that combines practicality and innovation is the oracle project RedStone, which completed a US$15 million Series A financing in July 2024, released token economics a week ago, and written by DeFi KOL Poopman yesterday RedStone-related content, the article analyzes RedStone's advantages and potential from several perspectives such as RedStone's modular advantages, market share and token economy. The Odaily Planet Daily compiled as follows:

TL;DR

-RedStone's modular architecture, AVS scalability, strong security and ultra-low latency make it one of the most trusted and fastest oracles in the ecosystem.

-In 2024, with US$3.8 billion TVS and more than 100 partners, RedStone has become the second largest oracle provider in this field.

-RedStone's price update speed is fast, low latency, high stability and accuracy over other oracle prices during the 2024 USD 2 billion large liquidation and Renzo (ezETH) decoupling period.

-Its token RED is a revenue-based utility token that takes value from data and price feedback services. To improve capital efficiency, REDs can be packaged as LRT to deploy in various DeFi protocols for additional benefits.

-Based on Python's $2 billion FDV, the RED dollar is expected to trade at about $2. The token economy focuses more on community growth, with 70% of tokens locked in the first 12 months.

The current market cycle has deviated from fundamentals for some time, and everyone knows that this is unhealthy for the long-term development of the industry. Many of the tokens we are familiar with today are just bubbles or Memes, and innovative protocols with real demand and mass adoption are still in a phase of neglect.

Recently, RedStone Oracle announced that their token RED will be TGE. Its token economics is designed to provide more value to users or token holders.

In this article, the author will analyze the advantages and potential of RedStone from 5 perspectives:

-RedStone features

-RedStone market adoption

- Comparison of differences with other oracles

-RED Token Economy

-RED potential valuation

Why is RedStone better?

As we all know, oracles are one of the most important components of blockchain. Without oracles, blockchain is just a closed ecosystem and cannot access data from external sources. In today's market, every chain and dApp needs a cost-effective, secure and flexible oracle.

And I believe RedStone has successfully filled this gap.

In recent years, RedStone has integrated and provided hundreds of mainstream (Tier 1) protocol price oracles since day one. Including USDe, Pendle, Morph Blue, Berachain, EtherFi and Lombard BTC. But what makes RedStone a favorite among many projects?

The reason is simple: safe and modular.

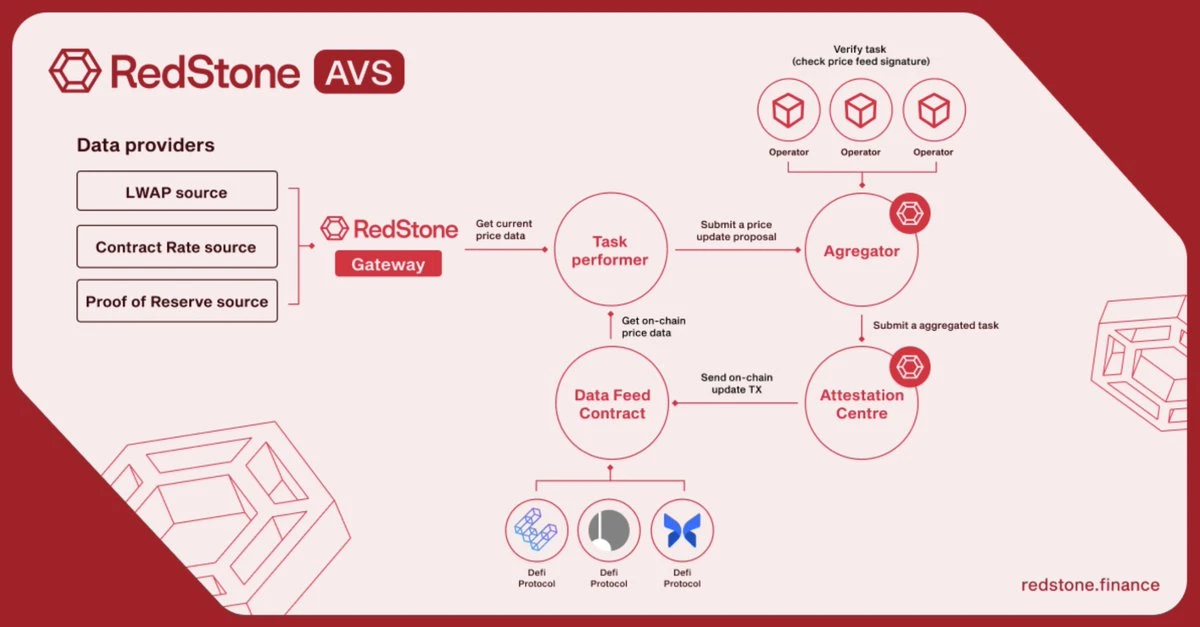

Security under AVS

Unlike other oracles, RedStone can use the EigenLayer AVS framework to verify the accuracy and effectiveness of price feedback data, thus achieving more efficient Gas spending and scalability.

Odaily Note: AVS is Actively Validated Service and is the most important concept in the Eigenlayer ecosystem. AVS is simply a protocol, service or system that needs to be staked to verify "tasks". The AVS service itself undertakes the work of obtaining and reporting prices. At the same time, AVS also corresponds to its service management contract - Service Manager, which communicates with the Eigenlayer contract, which contains statuses related to service functions, such as operators running the service. and the amount of deposit used to protect services.

The traditional oracle price push model works by collecting data from various sources and verifying it through DDL (Data Definition Language) and data consumption modules. Because the on-chain verification process requires a lot of Gas fees, it becomes quite expensive. With RedStone's AVS, RedStone can provide highly optimized verification Gas by processing data off-chain.

The process is as follows: AVS operator obtains the market price and TWAP rate through the data source module, verifys its accuracy, and then feeds the verification results to the chain.

Since most of the computing work is performed off-chain while maintaining trust and validation through AVS, RedStone offers a more cost-effective oracle solution than other solutions in the field.

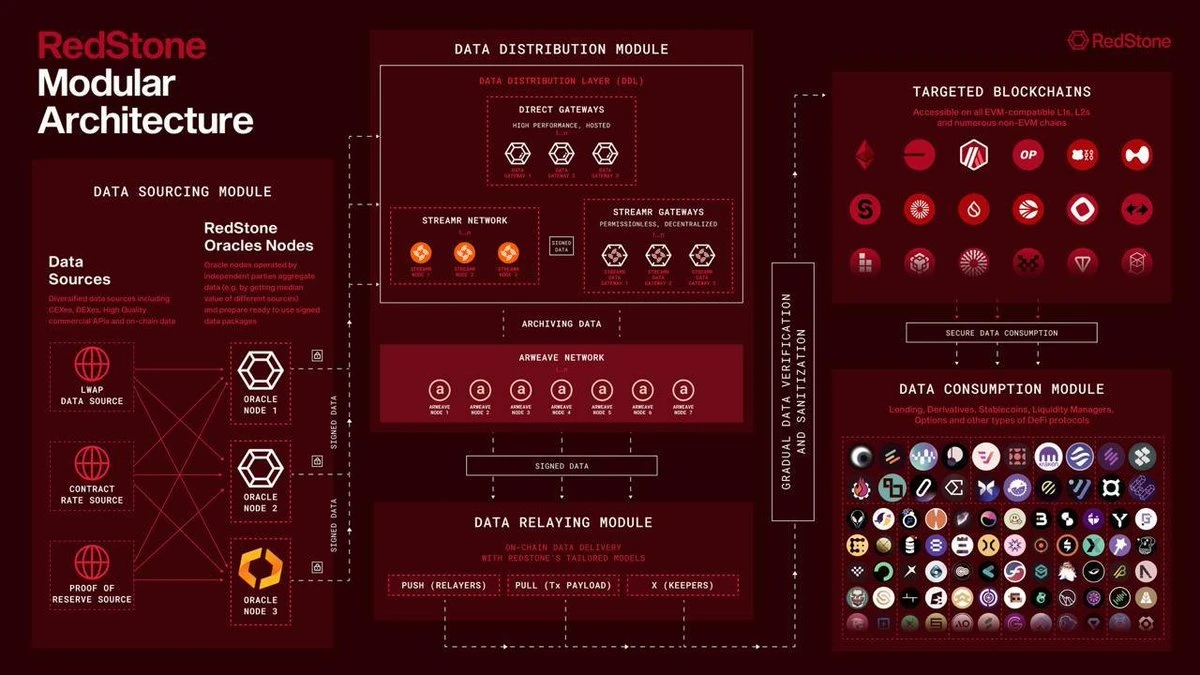

Modular

In addition to scalability, modularity is one of RedStone's main advantages. The module of this platform includes pull and push modes. Provides better flexibility for projects, and can select managed or original oracle data sources based on their specific needs. Projects can choose carefully filtered and verified price feeds or customizable raw data streams to protect their assets.

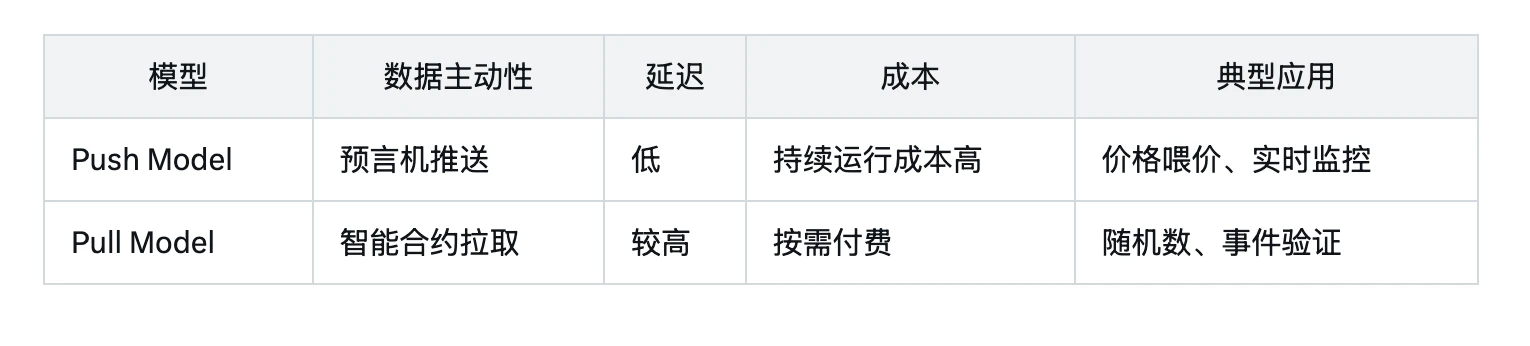

Odaily Note: Pull model and push model are shown in the figure below:

Thanks to its modular architecture, RedStoneinfra allows seamless exchange of components of different systems without compromising system performance or reliability. The modularity of plug-and-play features makes RedStone one of the most versatile oracle solutions in today's DeFi innovative and emerging chain systems.

Market indicators

Customer growth

RedStone's modular, plug-and-play architecture drives user growth for its projects, making it one of the fastest-growing oracle solutions in the blockchain space.

Throughout 2024, RedStone significantly expanded its reach and has partnered with more than 100 new clients and released on over 30 chains. With over $6.8 billion in TVS, RedStone has become the second largest multi-chain oracle provider in the industry, while Chainlink focuses on the ETH ecosystem.

The platform's reputation for reliability continues to attract mainstream players in DeFi. Among them, well-known partners include receiving $3 billion TVS for Spark (Maker's lending agreement), as well as providing price feedback for DeFi leaders such as Pendle, Ethena, and various BTC staking, earnings stablecoins, LST and LRT, and their client list It also reflects the industry's confidence in RedStone's reliable and customizable oracle solutions.

Price feedback time (low latency)

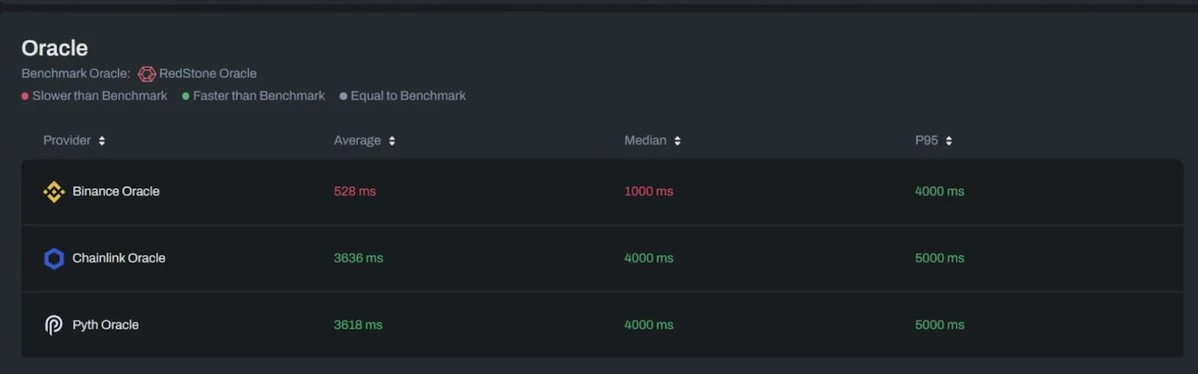

RedStone is one of the fastest and most reliable oracles in the field and remains decentralized, which is considered a triad of difficulties. In terms of speed, RedStone is updated faster than most centralized oracles (only Binance is slightly faster than Redstone). RedStone is good to be able to remain decentralized while competing with CEX.

stability

RedStone also demonstrates reliability in market volatility, maintaining consistent and accurate price feedback at the most important moments. In the US$2 billion liquidation event in February 2024, Redstone successfully pushed 119,000 updates in 24 hours, of which the number of updates of ETH/USDC prices exceeded Chainlink by 30 points, providing it with an updated and more accurate price.

It turns out that during the Renzo (ezETH) decoupling in April 2024, RedStone is better at keeping up with price changes than Chainlink. During this period, RedStone released about 40 price updates in just 3 blocks, while Chainlink only pushed about 20 updates in the same time. This shows that RedStone is actually faster than the market-leading oracle providers. For details, please refer to Chaos Labs report.

Comparative Advantages: Every oracle project has its own advantages, but RedStone learns from its strengths and integrates all functions together.

Comparison of differences between RedStone and other oracles

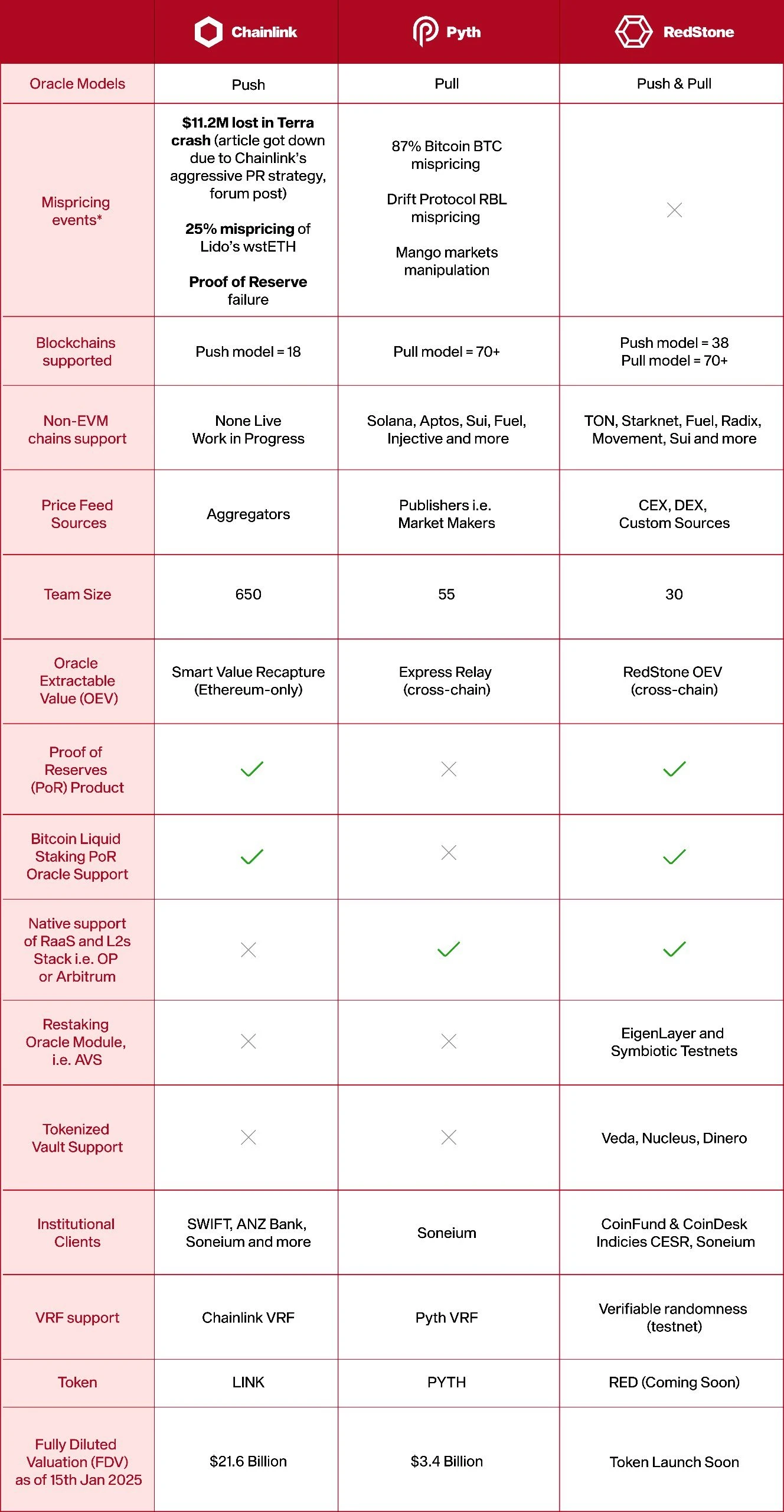

The following is an introduction to the mainstream oracle projects on the market:

Chainlink: mainly targets EVM and OG DeFi, mainly using push model, providing reliable data through bridging using CCIP and expensive integrated settings, and only supports a small number of blockchains;

Python: It mainly targets non-EVM, Perps market, mainly uses pull model, uses Wormhole as a cross-chain repeater, focusing on data push quality;

RedStone: any chain, any market, push model and pull model, use eigenlayer AVS for cost-effective on-chain verification, and reserve proof of wrapped BTC assets, etc.

The following figure shows the comparison of the differences between three important oracle providers on the market:

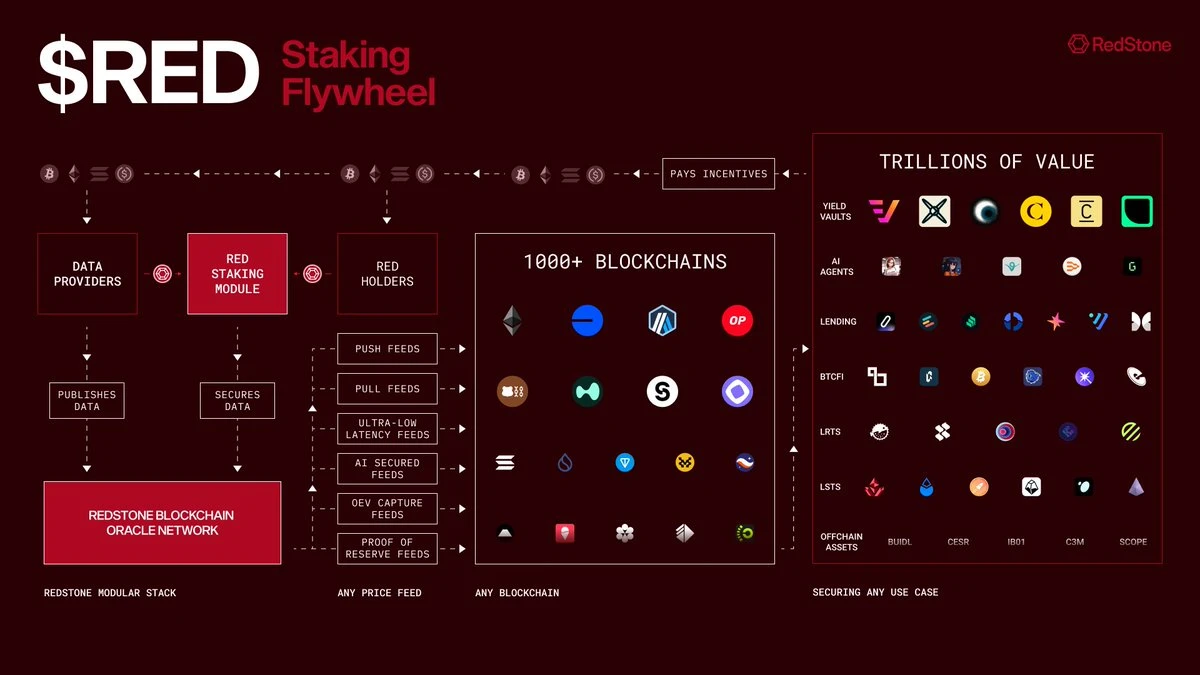

Token Economics of TGE, RED

As RedStone expands to thousands of on-chain protocols, RED tokens will play a key role in decentralizing oracle and gaining value from all integration projects. RedStone’s data providers (operators) have complete flexibility in setting up any collateral, charging any fees (in any token), or establishing any requirements they want.

RED will be used as a practical token that holders can stake and delegate to data providers for a share of fees and rewards.

In addition, RED will also allow restaked versions, allowing its LRT to be used in any DeFi protocol to free up additional economic value (similar to stETH).

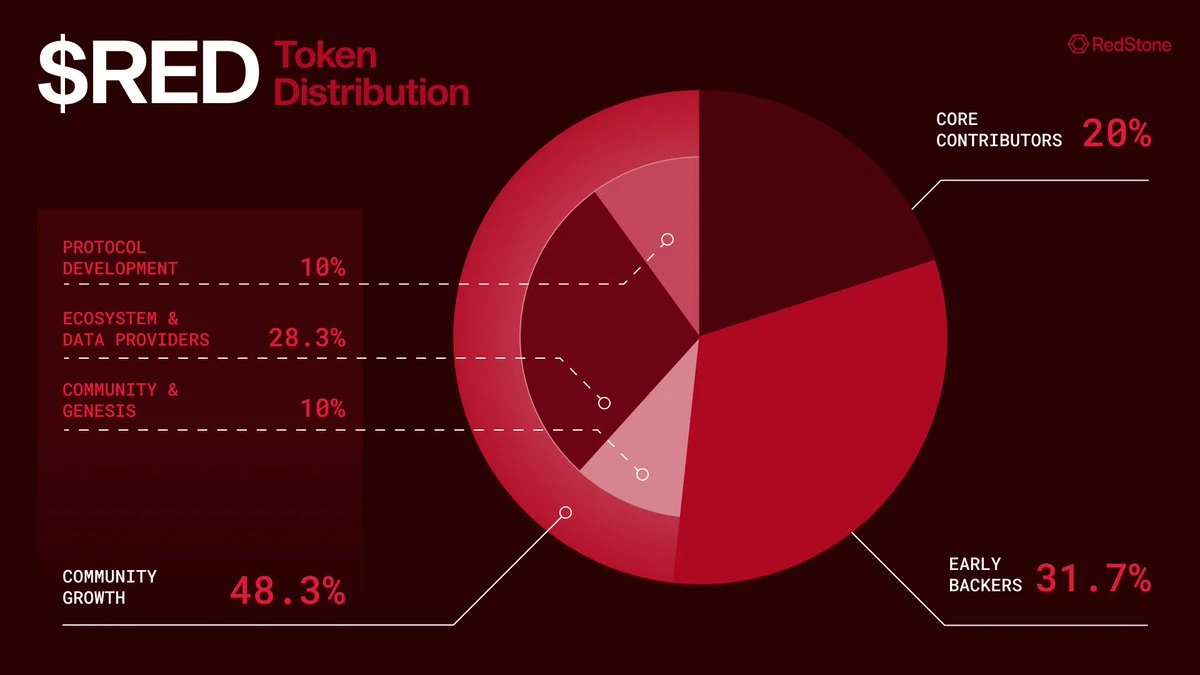

Official data shows that the total supply of RED tokens is 1 billion. Among them, initial circulation accounts for 30%, and RED will be issued as ERC-20 tokens, but can then be bridged to Solana, Base and all other supported networks through the Wormhole native transmission standard.

RED’s design is community-centric: the majority of the token supply (48.3%) will be allocated to community growth plans, including airdrops, future donation plans and incentives, and 20% will be allocated to core contributors;

To ensure long-term sustainability of RED, 70% of RED tokens will be fully locked within 12 months after TGE and gradually unlocked within the next 36 months.

As the RedStone customer base grows, operators will receive more fees and will also increase the revenue of RED token holders. A higher rate of return will lead to a higher token staking rate, ultimately forming a positive feedback loop.

RED token valuation

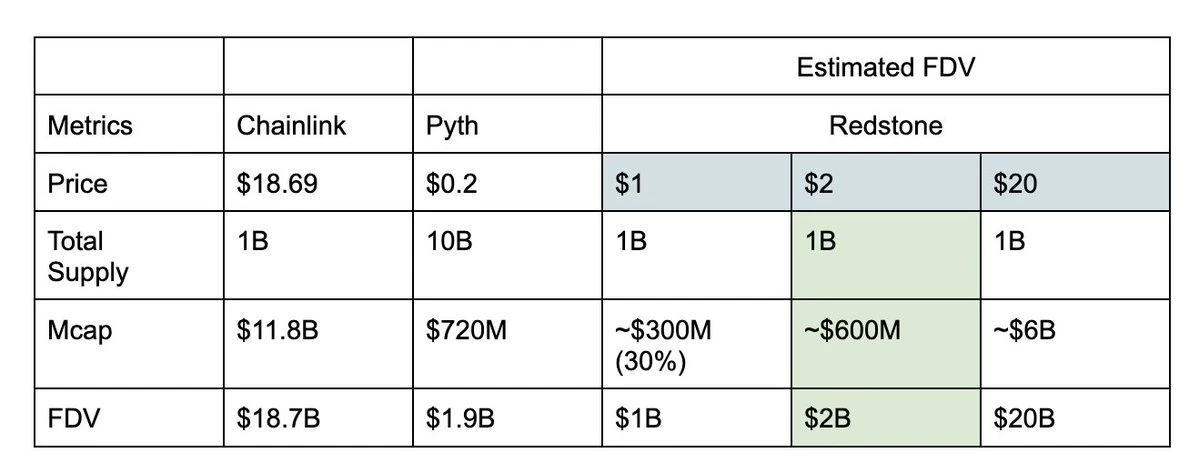

The leading oracle project FDV on the market has reached billions of dollars, and is also the leading oracle protocol. Comparing RedStone with Chainlink and Python can better infer the price of RED tokens:

With a total supply of 1 billion tokens, the initial price of $1 will bring RedStone’s FDV to $1 billion, but given the current market positioning of the project, $1 seems a bit conservative.

A better way to guess valuation is to compare it to Python’s $2 billion FDV, which takes into account the initial 30% circulating supply, and the price per token is $2, which is what I would expect from the RED token price.

Considering that if the market conditions get better, RED may reach Chainlink's FDV, and the token price may rise to US$20 per coin.