Staking + airdrop dual returns, how does Doppler Finance unlock new opportunities for XRP holders?

Reprinted from panewslab

05/09/2025·12DLooking back at the performance of major mainstream currencies in this cycle, although many people will have a lot of impressions that this round of market is the "one-on-one" of BTC, in fact, there are still a few tokens that outperform BTC - Ripple (XRP) is the best representative.

Based on the bottoming price of US$0.287 in June 2022, XRP rose to US$3.4 for a time, with the maximum increase of about 1085% this cycle; as of the time of publication, XRP has fallen back to around US$2.1 due to the overall pullback in the market, but it still has an increase of more than 630% from the cyclical low. With the general poor performance of other altcoins, XRP's strong performance helped it return to the top 3 cryptocurrency market capitalization rankings. Based on the full circulation valuation (FDV), XRP even temporarily surpassed ETH many times and once became the second largest cryptocurrency after BTC.

XRP holders' dilemma: Limited profit opportunities

Although XRP's secondary performance is amazing, for XRP believers, there is still a relatively obvious dilemma in this ecosystem for a long time. Due to the blockchain characteristics of XRP Ledger, the chance of holding XRP is limited, and users cannot obtain other returns other than price growth through long-term holding of XRP.

In short, since XRP Ledger adopts the Federated Byzantine Agreement (FBA) consensus mechanism, it cannot support native staking like PoS networks such as Ethereum and Solana, so XRP holders cannot earn profits through native staking or liquid staking like ETH and SOL holders; in addition, since the XRP Ledger network itself does not support smart contracts, the DeFi ecosystem surrounding XRP is relatively slow, and it is difficult for XRP holders to release greater value through various DeFi tools.

Doppler Finance, the protagonist of this article, hopes to solve this problem head-on. To this end, Doppler Finance proposed a new concept called "XRPfi" to help XRP holders unlock new earnings opportunities using XRP and other assets within the XRPL ecosystem, such as the Ripple stablecoin RLUSD.

Doppler Finance said that due to the lack of revenue channels, 92% of the total XRP supply is currently idle, corresponding to a market value of approximately US$113 billion. The core mission of the agreement is to convert these idle XRP into active assets, helping XRP holders "make more."

Specifically, Doppler Finance will explore new revenue opportunities for XRP from multiple channels by combining CeFi and DeFi.

First of all, the most core XRPfi product, Doppler Finance allows XRP holders to participate in institutional-level revenue strategies in a secure way by integrating institutional-level hosting solutions.

Secondly, Doppler Finance will also provide liquid staking services similar to Ethereum and Solana on XRPL side chains (such as the Root Network of PoS mechanism), allowing users to obtain pledge income without sacrificing liquidity.

In addition, Doppler Finance has launched a lending protocol customized for the XRPL sidechain, allowing users to use XRP and other assets to lend in the entire pan-XRPL ecosystem, further expanding the profit possibilities in the XRPL ecosystem.

According to the survey results provided by Doppler Finance, about 52% of XRP holders are eager to unlock new revenue opportunities through channels such as pledge, which means that Doppler Finance's products have a very high market demand fit, and since Doppler Finance officially launched in the first quarter of this year, the rapidly growing business figures have once again proved this.

How much room is there for demand? Talking about practical data

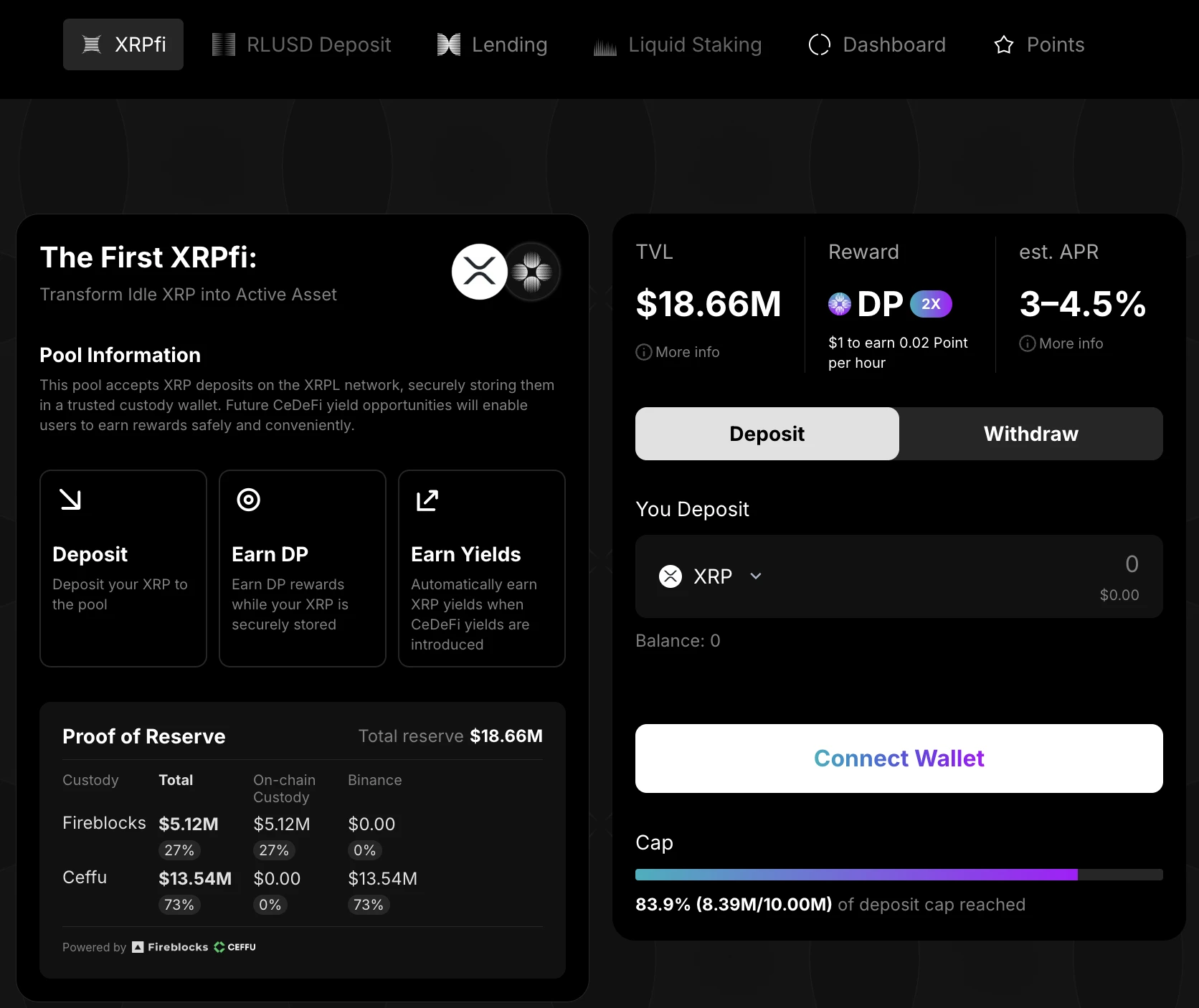

On February 14 this year, Doppler Finance was officially launched. For security reasons, the agreement adopted a limited deposit mechanism in the early stage.

On the first day of its launch, Doppler Finance's deposit limit was 200,000 XRP, and the amount was quickly robbed within 1 minute; on February 16, Doppler Finance once again opened the second batch of deposits, with a total limit of 1 million XRP, but users were still quickly filled in 15 minutes; on March 21, Doppler Finance opened the third batch of deposits, with a total limit of 5 million XRP, and a large number of users and funds poured in again, causing the total locked position value of the agreement to quickly exceed 10 million US dollars.

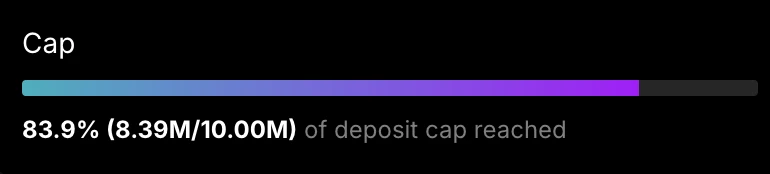

On April 14, Doppler Finance has opened its fourth batch of deposits with a total limit of 10 million XRP. As of the time of publication, about 8.39 million XRP has been deposited, corresponding to TVL is approximately US$16.73 million - Compared with static holdings of XRP, all XRP deposited in Doppler Finance can enjoy 3-4.5% real-time APY returns.

Potential airdrop opportunity: Points plan is online

In addition to the underlying earnings, users participating in Doppler Finance are expected to earn another potential gain – by earning points, or unlocking future airdrops.

Doppler Finance has now launched the points plan, and the points are divided into Doppler Points (DP) and Resonance Points (RP). The difference between the two is that DP mainly focuses on the XRPfi scenario, that is, participate in various institutional-level income strategies through XRP deposits; RP mainly focuses on the liquidity pledge scenarios and lending scenarios on the side chain.

DP points are now launched. For every USD 1 token deposited by users, they can obtain 0.01 DP per hour. In order to incentivize early users to participate, the current fourth batch of deposits can receive a 2x DP points bonus. In addition, users can also receive 10% of the invitee's points by inviting (invited persons can also receive 10% acceleration).

RP is not yet online, but according to Doppler Finance's disclosure, the points calculation model will remain roughly similar to DP.

Although Doppler Finance does not explicitly mention the future utility of DP and RP, but only emphasizes that obtaining points can become an "early contributor" to the agreement, according to industry practice, points are often linked to airdrops, so the future value of DP and RP is worth looking forward to.

Introduction to the participation tutorial

In terms of interaction, Doppler Finance's UI design is relatively clear, so interaction is not complicated. Currently, Doppler Finance has launched its core XRPfi products and lending products based on the side chain Root Network.

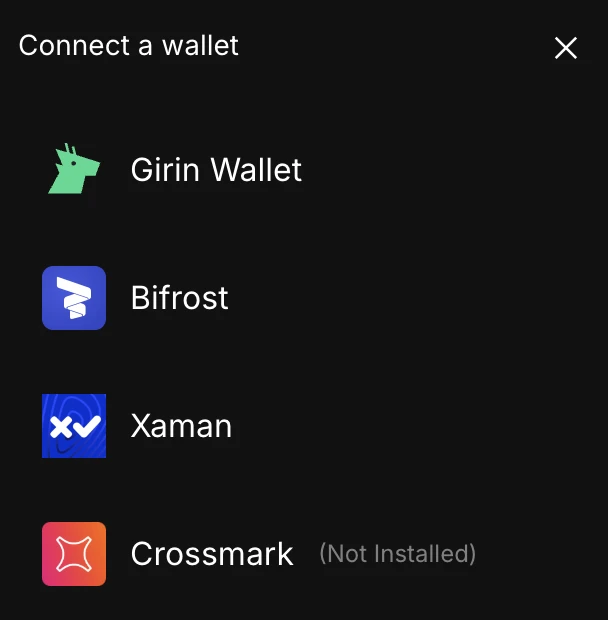

Taking the most core XRPfi product as an example, since it uses the XRPL network, users need to download Girin Wallet and other wallet solutions.

After the wallet is downloaded, transfer the XRP you hold to the wallet address. After linking the wallet, click "Deposit" in the front section of the Doppler Finance application, and selectively deposit a certain amount of XRP to complete the interaction. After that, users can also view positions and points status in real time through the Dashboard and Points interfaces.

Ripple accelerates its development, Doppler Finance is indispensable

Since Trump's victory, the regulatory environment of the cryptocurrency industry has improved significantly. Recently, the SEC has reached a preliminary settlement agreement with Ripple, which means that Ripple has finally gotten rid of its long-term regulatory burden and officially entered a period of accelerated development.

At the end of last year, Ripple officially announced the launch of RLUSD, making a high-profile entry into the stablecoin track; in the following months, the progress around XRP ETF continued; last month, Ripple officially announced the acquisition of cryptocurrency-friendly broker Hidden Road for US$1.25 billion to expand its services for institutional investors; CME has also recently confirmed its intention to add XRP futures; not long ago, rumors of Ripple intending to bid between US$4 billion and US$5 billion to acquire Circle (although it has been rejected) have even been rumored in the market...

If you look closely at Ripple's recent achievements, most of them are still focusing on the B-end field, and the layout of the C-end is relatively limited, while the emergence of Doppler Finance just fills this gap. Through the new revenue channel provided by Doppler Finance, the XRP in users will no longer be forced to stay idle because of "nowhere to go", but can actively seek opportunities to survive in the fields of CeFi and DeFi - in this way, the ecological value of XRP worth hundreds of billions of dollars will be "awakened", thereby completely activate the ecological activity of XRP.

jinse

jinse

chaincatcher

chaincatcher