Six pictures decipher the capital battle behind Bitcoin $100,000

Reprinted from panewslab

05/16/2025·29DJPMorgan Chase analyzes the performance of cryptocurrency leaders in April

- Bitcoin has crushed gold in the past year

- Bitcoin's prospects continue to improve

This is a sharp turn from the decline when Bitcoin hovers at $80,000 a few months ago. JPMorgan Chase research found that Bitcoin prices continued to strengthen in April, while the rise in May was even more rapid.

The market suffered a heavy blow in the past few weeks - US President Trump's announcement of a full increase in tariffs has caused panic in the global trade war, resulting in general pressure on the international market.

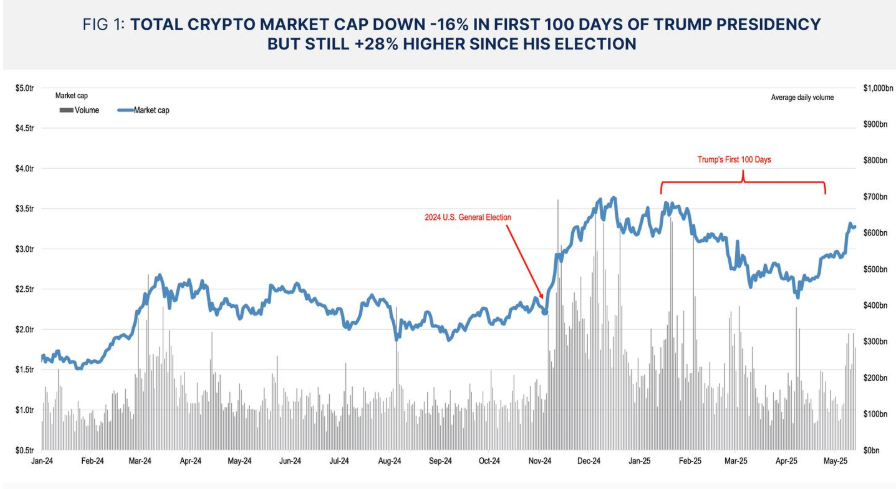

In a report on May 14, JPMorgan Chase pointed out that although Trump advocated support for cryptocurrency policies, his 100-day administration failed to push up crypto prices nor achieved regulatory reforms.

But as Trump concessions on trade issues and more signs of global cryptocurrency adoption emerged at the corporate and national levels, market pessimism has gradually faded.

"The bull market foundation of Bitcoin has never been so solid," David Marcus, a former PayPal executive and well-known Bitcoin supporter, tweeted on May 10, "Fit up your seat belt."

The top cryptocurrency has risen 10% since May and is now at $103,500.

JPMorgan outlines its recovery trajectory through six charts.

Revaluation of Bitcoin’s value

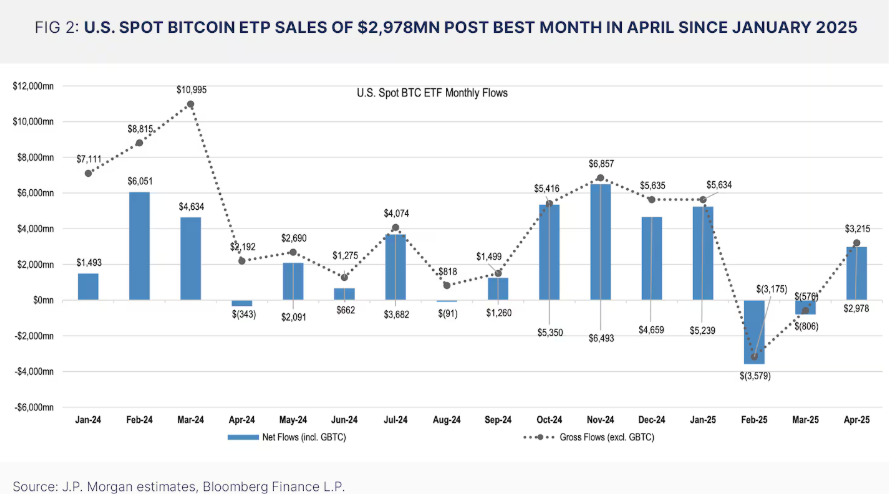

The plunge at the beginning of the year has now reversed, with exchange-traded products including Bitcoin ETFs issued by BlackRock and Fidelity turning positive, setting their best monthly performance since January.

Total Crypto Market Capitalization Jumps to $2.9tr (+10% MoM) at End of April, but Volumes Remain Muted this Month.Source: JPMorgan.

JPMorgan pointed out that BlackRock's IBIT is undoubtedly the biggest winner in April, with the fund accounting for 84% of the total inflow of Bitcoin ETFs and the overall amount absorbed in April reached US$3 billion.

US Spot Bitcoin ETP Sales of $2,978mn Post Best Month in April Since January 2025.Source: JPMorgan

Dune Analytics data shows that the Bitcoin ETF market is currently dominated by BlackRock IBIT, with a market share of up to 52%.

According to DefiLlama statistics, the Bitcoin ETF has absorbed a total of US$96 billion since its launch in 2024, compared with the size of Ethereum ETF managed assets of only US$5 billion.

Bitcoin value "recovers lost ground"

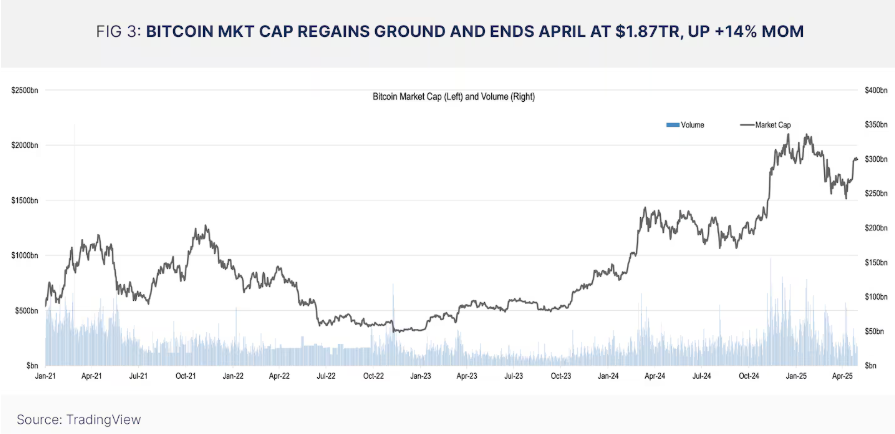

The April market was dominated by Trump's tariff turmoil, and the market fluctuated violently for a while. It was not until the recent suspension of tax increases and the agreement reached to drive prices back up.

The Nasdaq Index, a major technology stock market that has always been linked to Bitcoin, was about 15% lower than Trump's inauguration date in January in most of April.

As Bitcoin now breaks through the $100,000 mark, the Nasdaq has also recovered simultaneously. JPMorgan pointed out that Bitcoin's monthly gains "a largely concentrated in the last week."

Bitcoin Mkt Cap Regains Ground and Ends April at $1.87tr, Up +14% MoM.Source: JPMorgan.

Contest with gold

BlackRock CEO Larry Fink once advocated that Bitcoin has the potential of a safe-haven asset similar to gold.

But JPMorgan research found that the potential has not yet been revealed.

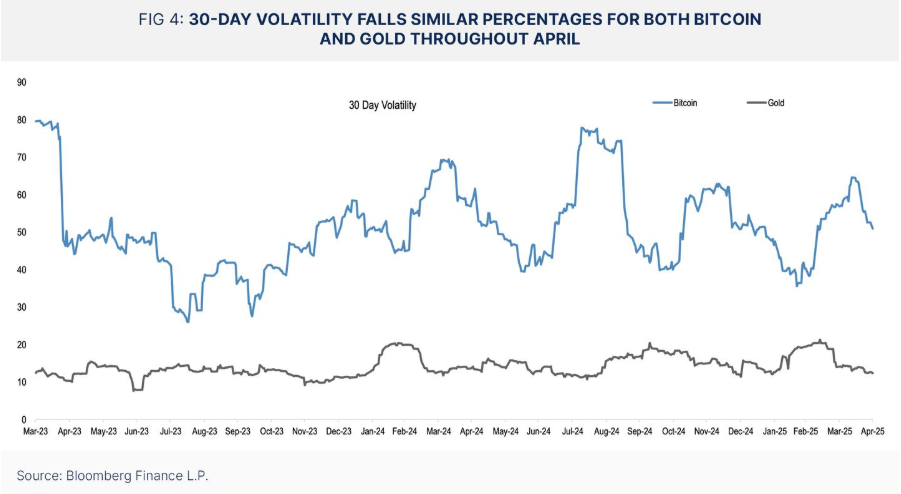

At the same time, Bitcoin volatility continues to decline. According to CoinGlass data, JPMorgan pointed out that the 30-day volatility of Bitcoin and gold has shown a synchronous downward trend.

30-Day Volatility Falls Similar Percentages for both Bitcoin and Gold Throughout April.Source: JPMorgan.

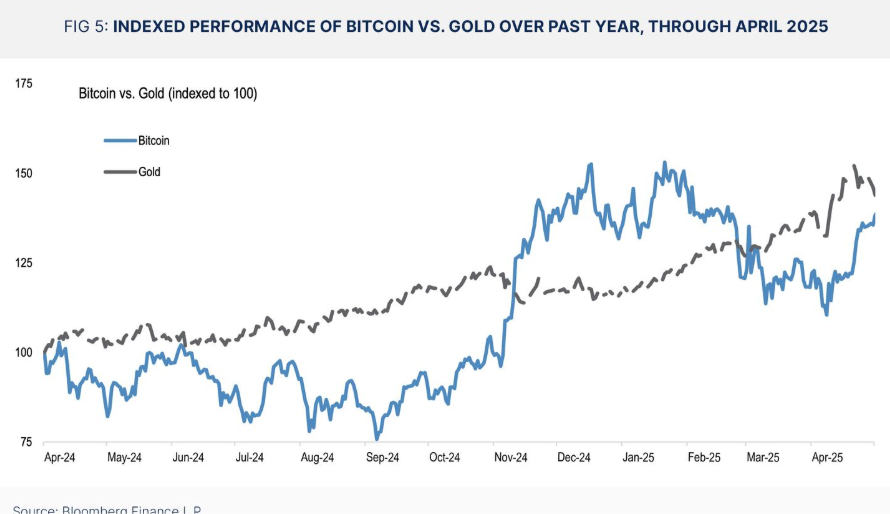

In standardized comparisons (setting the values of two or more assets at the beginning of a specific period to equalize for comparison performance, as shown in the chart below), Bitcoin has risen by 15% by the end of March, while gold has risen by 5%.

Indexed Performance of Bitcoin vs. Gold Over Past Year, Through April 2025.Source: JPMorgan.

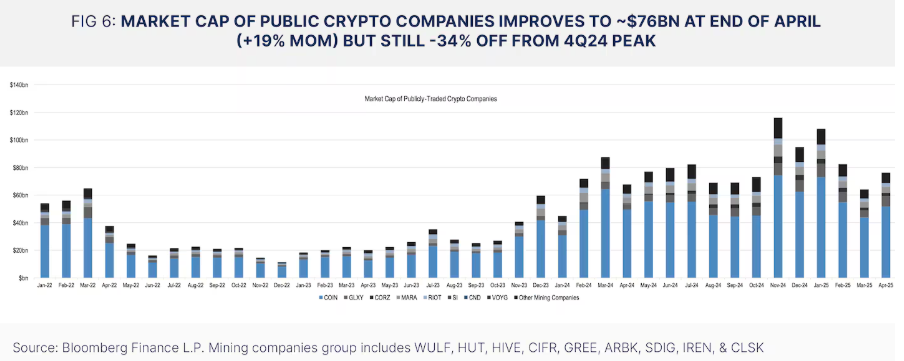

Cryptocurrency stocks soar

The total market value of listed crypto companies has contracted by 34% to $76 billion at the end of April from an all-time high of nearly $120 billion after the November 2024 election.

April brought a glimmer of hope, with a total market value achieving a month-on-month growth of 19%.

JPMorgan pointed out that Galaxy Digital announced plans to go public in the United States in April, becoming the biggest winner in market value growth that month, with an increase of 45%.

This week, it was reported that Coinbase will be included in the S&P 500 from May 19. The news drove its share price to soar 16%, and the company's total market value increased by 18% month-on-month, according to JPMorgan data.

Market Cap of Public Crypto Companies Improves to ~$76bn at End of April (+19% MoM) but Still -34% Off from 4Q24 Peak.Source: JPMorgan.

jinse

jinse