Securitize selects RedStone as the primary blockchain oracle partner to fully connect tokenized assets to the DeFi ecosystem

Reprinted from panewslab

03/13/2025·1MAs a leader in real-world assets (RWA) tokenization, Securitize today announced a partnership with blockchain oracle service provider RedStone, which will provide data support for existing and future tokenized products including BlackRock USD Institution Digital Liquidity Fund (BUIDL), Apollo Diversified Credit Tokenization Fund (ACRED) and Hamilton Land Priority Credit Opportunity Branch Fund.

Promote the traditional financial chain through tokenization RWA

By 2025, the global securities market valuation is expected to reach US$300 trillion, in sharp contrast to the current scale of approximately US$90 billion in decentralized financial markets, and also highlights the huge growth potential of the on-chain economy. With the innate advantages of blockchain technology compared to traditional closed financial systems, traditional financial giants are increasingly interested in asset tokenization and access to the DeFi ecosystem. As a pioneer in RWA tokenization, Securities is joining hands with world-class asset management institutions such as BlackRock, Apollo, Hamilton Land and KKR to jointly promote the on-chain migration of the $300 trillion securities market.

"To fully unlock the potential of blockchain technology, tokenized securities must flourish on license-free public chains such as Ethereum, which are the most efficient settlement layers for value transfer. The partnership with RedStone not only allows us to trade tokenized securities on-chain, but also integrate them into existing DeFi infrastructure and develop new financial primitives to achieve the deep integration of traditional financial giants and crypto-native applications."

How Securitize leverages RedStone

New assets on-chain cannot be used directly in the DeFi protocol. They need to predict the establishment of a secure price flow through blockchain to reflect the token market value in real time to ensure that they can be safely integrated into DeFi applications. As the official oracle partner of Securities, RedStone will provide price data for tokenized RWAs such as BUIDL. Securitize chose RedStone as the first oracle service provider to create a price stream for its assets.

The initial cooperation will cover the net asset value (NAV) data flow (using push and pull dual modes) and daily interest rate data flow for networks such as Ethereum main network. These data flows will enhance the transparency and stability of funds and enhance investor attractiveness. RedStone's services will greatly expand the application scenarios of underlying assets, such as building a tokenized asset money market trading platform or as DeFi collateral, opening up new use cases for the DeFi market and attracting on-chain economic participants who focus on improving the effectiveness of RWA.

Why is RedStone the optimal solution for RWA

The Securitize and RWA fields require accurate, reliable and adaptable data infrastructure, and RedStone is the ideal choice. With the deepest price discovery capabilities and high-fidelity data, RedStone has maintained a record of zero pricing errors since its launch, ensuring unparalleled accuracy and credibility. Its modular architecture supports custom pricing solutions for RWA providers, providing the flexibility required for seamless integration.

RedStone provides secure and high-quality data flow, easily supports EVM and non-EVM chains, protecting Securitize's unlimited growth in the DeFi field. Users can gain a sense of trust, compliance and reliability under the endorsement of the highest security standards. Choosing RedStone, Securitize has gained the cornerstone of accelerating RWA adoption and reshaping the future of DeFi.

"Securitize has established its leadership in the tokenized assets field. After months of due diligence, we are honored to be the first oracle partner to support its expansion of the DeFi ecosystem. Relying on modular infrastructure, RedStone has become the fastest-growing blockchain oracle, and we will help Securitize products accelerate penetration into DeFi and on-chain finance."

On-chain finance is the future

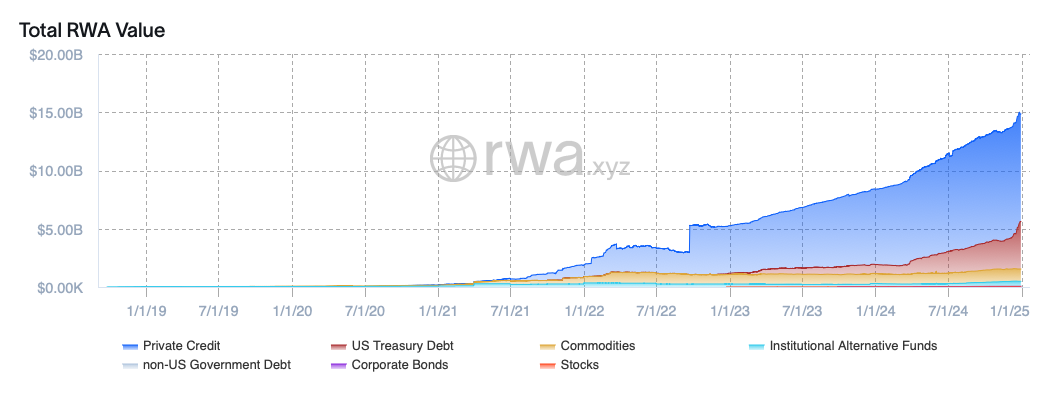

As an emerging sector of the on-chain economy (excluding stablecoins), RWA's current total market value is about US$15 billion. The demand for crypto assets is self-evident - Bitcoin ETFs are hailed as the most successful ETF issuance in history, while products such as BUIDL demonstrate the market's desire for tokenized assets, and these trends are strengthening the legitimacy of DeFi. (Data source: rwa.xyz)

As technology attention and DeFi potential energy rise, exponential growth may be seen in the next few years. With its unique positioning, Securitize has seized the trend of demand for tokenized assets, and RedStone is honored to be its oracle partner to promote the deep integration of traditional finance and DeFi in the unified chain financial environment.

About RedStone

RedStone is a modular oracle focusing on DeFi and on-chain financial interest-generating assets, especially serving value accumulation stablecoins, liquid pledges and re-pled tokens. It provides safe, reliable and customized data streams for more than 60 chains, and is trusted by institutions such as Ethena, Security, and Morpho.

About Security

As the leader in RWA tokenization, Securities uses tokenized funds to promote the global asset chain promotion through cooperation with top asset management institutions such as Apollo and BlackRock. Its subsidiary holds SEC registered broker, digital transfer agent, and fund administrative qualification, operates the SEC Regulatory Alternative Trading System (ATS), and is selected as the Forbes Top 50 Financial Technology Global 2025.

Compliance Statement

Securities are issued through FINRA/SIPC member broker Securities Markets, LLC. Security Markets and its affiliates Security Capital (Exemption Reporting Consultant) do not participate in the RWA tokenization Service. Digital assets are high-risk speculative assets, with poor liquidity and market manipulation risks. Securities, Inc. is a technology provider, and its affiliated company Securities, LLC is a SEC registered transfer agency, Securities Markets operates alternative trading systems, and Securities Capital is a Florida registration exemption consultant.

jinse

jinse